Risk Management REVIEW

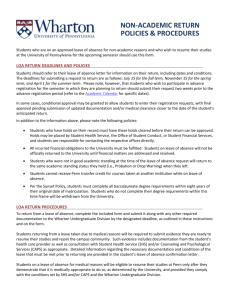

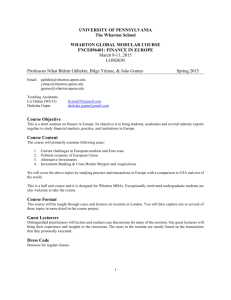

advertisement