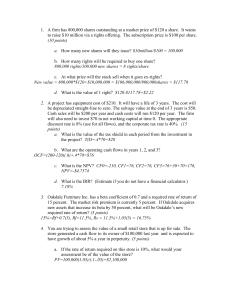

RHP - Sebi

advertisement