RHP - Sebi

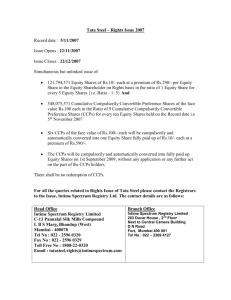

advertisement