NACHA Operating Rules:

What Do They Mean to You?

© 2015 NACHA — The Electronic Payments Association. All rights reserved.

No part of this material may be used without the prior written permission of NACHA. This material is not

intended to provide any warranties or legal advice and is intended for educational purposes only.

Agenda

• Who is NACHA and What is ACH?

• Originator Obligations for Authorization

and Authentication

• Authorization Requirements by SEC Code

• Resources

2

NACHA as Industry Association

• As a not-for-profit association, NACHA represents more than

10,000 financial institutions – some are Members directly, and

some are represented via 16 Regional Payments Associations

– Direct Financial Institution Members

– Regional Payments Associations

• Through its industry councils and forums, NACHA brings

together payments system stakeholders to foster dialogue

and innovation to strengthen the ACH Network

– Affiliate Program

– Risk Management Advisory Group

– Payments Innovation Alliance

– Government Relations Advisory

Group

– Communications & Marketing

Advisory Group

NACHA as Network Administrator

• ACH Logical Network

– ACH rules set, and associated

payment types and formats owned

by NACHA

– Allows counterparties to logically

and confidently pass transactions

to each other, knowing how they

will be recognized and dealt with

• NACHA holds the role of the

Network…

–

–

–

–

–

–

Administrator

Rules Creator

Rules Enforcer

Educator

Supporter

Protector

• ACH Physical Network

– The physical environment required to

move transactions

– The technology and communications

environment, and associated product

set, needed to initiate, clear and

settle ACH transactions between

counterparties

• ACH Operators take the role of…

– Processing and routing transactions

• Maintaining access to all sending and

receiving endpoints

• Inter-operator exchanges

– Services to help financial institutions

manage ACH volume and risk

management

– Interbank settlement

– Network reporting to NACHA

What is ACH?

AUTOMATED CLEARING HOUSE

Batch-oriented, store-and-forward

processing system

Safe, secure, electronic network

for consumer, business, and

government payments

Used by more than 11,000 participating FIs and millions of

businesses and consumers

What is ACH?

ACH Credit Payment: Entry and Funds Flow

Authorization

ACH Debit Payment: Entry and Funds Flow

Authorization

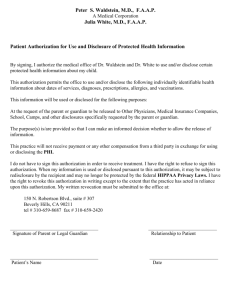

Authorizations

“An Originator must obtain authorization from

the Receiver to originate one or more Entries

to the Receiver’s account.”

2015 NACHA Operating Rules, Article Two, Subsection 2.3.1

9

Authorizations

• Authorization occurs when Originator and the

Receiver enter into an agreement to allow the

Originator to initiate a debit entry to the

Receiver’s account

• An authorization to debit an account is only valid

if the person who authorized the debit is an

owner on the account

• Requirements specified

in the Rules are

MINIMUM

requirements

10

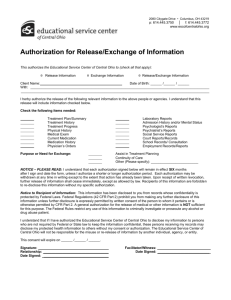

Electronic Authorizations

• Similarly authenticated standard allows signed, written

authorizations to be provided electronically

• Writing and signature requirements in the NACHA

Operating Rules can be satisfied by compliance with the

E-sign Act (Electronic Signatures and Global National

Commerce Act)

• To satisfy Reg E and NACHA Rules,

must evidence both the customer’s

identity and assent to authorization should provide the same assurance

as a signature in the physical world

11

• Electronic authorizations must be

visually displayed in a way that

allows the consumer to read it

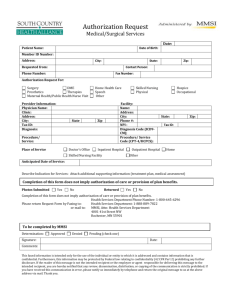

Corporate Authorizations

• Corporate Authorizations

– Business Receiver must authorize

all credits and debits

– Originator / Receiver must enter

into agreement with each

business receiver of ACH Entries

(other than ARC, BOC and POP

Entries to non-consumer

accounts)

– Agreement must bind the Receiver to the NACHA

Rules

12

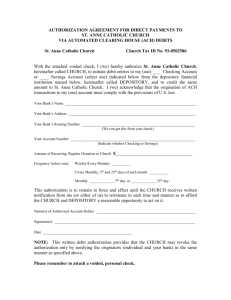

Consumer Debit Authorizations

• Authorization must:

– Be readily identifiable

– Have clear and readily understandable terms

– Provide for revocation (for recurring payments or

payments scheduled in advance)

• Authorization should contain:

–

–

–

–

Express authorization language

Amount of transaction

The date(s) and/or frequency of the transaction(s)

The consumer’s account number and financial

institution’s routing number

– Account Type

• Authorization of a debit entry must be in writing and signed

or similarly authenticated, except where expressly provided

in the Rules for specific types of Entries

13

Consumer Debit Authorizations

Originators must:

• Provide the Receiver with electronic or hard copy of

Receiver’s authorization

• Retain the original or a copy for two years from

termination or revocation of authorization

• At the request of the ODFI, provide original or copy to

ODFI in such time and manner as to allow the ODFI to

deliver it to the RDFI within 10 banking days of the

RDFI’s request for a copy of the authorization

14

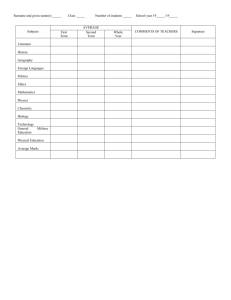

Consumer Debit Authorizations

• Notice of Change of

Amount

• Written notification of

amount and date

• No notice required for

change within agreed

upon range

• Notice of Change to

Scheduled Date

• Written notification of

new date

15

10 CALENDAR

DAYS

prior to debit date

7 CALENDAR

DAYS

prior to debit date

Authorization Requirements by SEC Code

PPD

Prearranged Payment or Deposit Entry

Written Authorization Credit or Debit

• Writing that is signed OR Receiver may similarly

authenticate the written authorization previously

delivered by Originator

• Example of similarly authenticated:

– Originator delivers written terms of authorization.

– Receiver authenticates agreement to terms of

authorization by key entering into a VRU or speaking to

a recorded line a PIN provided with the authorization

that identifies the consumer

• Proof of authorization would be a copy of the

written authorization and the consumer’s use of

the authorization code provided by the

Originator.

16

credit

debit

PPD

PPD

Authorization Requirements by SEC Code

TEL

Telephone Initiated Entry

Electronic Authorization (Similarly Authenticated) Debit Only

• Oral Authorization only

• Single Entry or recurring consumer

debits

• If no relationship exists, the

consumer must initiate the phone

call

• Record authorization and/or provide

written notice before settlement

17

TEL

Authorization Requirements by SEC Code

TEL

Telephone Initiated Entry

Electronic Authorization (Similarly Authenticated), Debit Only

• Minimum Authorization Information

– Date on or after which debit will occur (single) or timing –

including start date – number and/or frequency (recurring)

– Amount of the transaction(s) or method of determining amount

– Receiver’s Name and account to be debited

– Telephone number for Receiver inquiries

– Revocation method

– Date of oral authorization

– Statement by Originator that authorization is for single entry ACH

debit (single only)

• REMEMBER: Key entry on a VRU to input data and

respond to questions does not qualify as oral

authorization. Actual authorization must be oral.

18

Authorization Requirements by SEC Code

WEB

Internet/Mobile Initiated Entry

Electronic Authorization (Similarly Authenticated)

• Single or Recurring consumer debit and credit

entries

• Use when authorization was given via the

internet or entry was initiated via wireless

device

• Use for P2P – Credit WEB only for payments

exchanged between consumers

• Example of records of authorization

– Screen shot of authorization language and

date/time stamp of the Receiver log-in and the

authorization process that evidenced both the

consumer’s identity and assent to the authorization

19

WEB

Authorization Requirements by SEC Code

CIE

•

•

•

•

Consumer Initiated Entry

Electronic Authorization (Similarly Authenticated) Credit Only

Consumer is Originator

Used primarily for bill payment

Credits only (except for reversal)

Individual payments only

CIE

Authorization Requirements by SEC Code

RCK

Re-Presented Check Entry

Notice = Authorization, Debit Only

• Single entry debit initially presented as a paper check

• Consumer check must have been returned insufficient

or uncollected funds and be less than $2,500

• Limited to a combination of three presentments (paper

and ACH)

• Notice must be provided

RCK

21

Authorization Requirements by SEC Code

CCD

Corporate Credit or Debit

Written Authorization (recommended), Credit or Debit

• Single or recurring payments

• Agreement between trading

parties

• One addenda record

• Used for the distribution or

consolidation of funds intracompany or between two

corporate entities

CCD

Authorization Requirements by SEC Code

CTX

Corporate Trade Exchange Entry

Written Authorization (recommended) Credit or Debit

• Debit or credit transfer

between trading

partners, single or recurring

• Agreement between trading

parties

• May contain up to 9,999

addenda records

CTX

Authorization Requirements by SEC Code

ARC

Accounts Receivable Entry

Authorization = Notice + Receipt of Source Document, Debit Only

• Regular lockbox check converted into an

ACH transaction

• Must have been received through the mail

or at a drop-box or in-person for bill payment

• “When you provide a check as payment, you

authorize us either to use information from your

check to make a one-time electronic fund

transfer from your account or to process the

payment as a check transaction”

• Must post/place in prominent and conspicuous

location

24

CHECK

RECEIVED AT

LOCKBOX

ARC

Authorization Requirements by SEC Code

BOC

Back Office Conversion Entry

Authorization = Notice + Receipt of Source Document, Debit Only

• Requires written notice to Receiver prior to

receipt of each source document

• “When you provide a check as payment, you

authorize us either to use information from

your check to make a one-time electronic fund

transfer from your account or to process the

payment as a check transaction. For inquiries,

please call (retailer phone number).”

• Must post in prominent and conspicuous

location and provide copy of notice at the time

of transaction

25

CHECK IS RECEIVED AT

POINT OF SALE, BUT

CONVERTED

AT A LATER TIME

BOC

Authorization Requirements by SEC Code

BOC

Back Office Conversion Entry

Authorization = Notice + Receipt of Source Document, Debit Only

• Verification of Receiver’s Identity

– Must use commercially reasonable procedure to

verify the Receiver’s identity

– Examples include:

• Photo identification

• Retailer preferred card

• Check verification services

26

Authorization Requirements by SEC Code

POP

Point-of-Purchase Entry

Authorization = Notice + Receipt of Source Document AND

Written Authorization, Debit Only

• Merchant must provide notice and

consumer signs

authorization at point of purchase

• Check is scanned by merchant to capture

account information, voided, and returned

to the customer

• Must post in prominent and conspicuous

location and provide copy of notice at the

time of transaction

27

POP

Resources

• NACHA Operating Rules

– Board Policy Statements

– Formal Rules Interpretations

– Summary of Revisions from

previous year and any Supplements

– Operating Rules

• NACHA Operating Guidelines

– do not supersede the Rules but provide

additional information

Resources

1. Online Rules access

With full-featured search, bookmarking,

save search, and a host of FAQs!

www.achrulesonline.org

2. NACHA’s Website

–

–

–

–

Upcoming amendments

Proposed changes

eStore

News and education

www.nacha.org

QUESTIONS?

Danita Tyrrell, AAP

Director, Network Rules

NACHA-The Electronic

Payments Association

dtyrrell@nacha.org