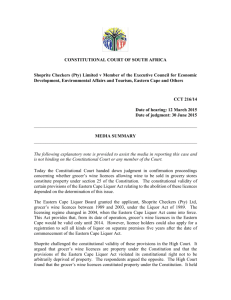

Shoprite – “Reasons to be proud?”

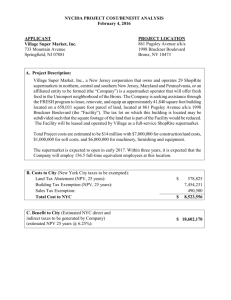

advertisement