EHC personal budgets via direct payments

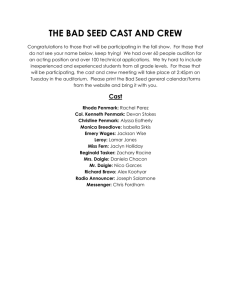

advertisement

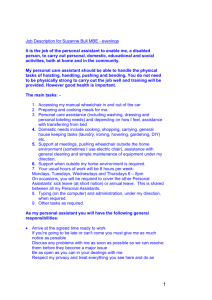

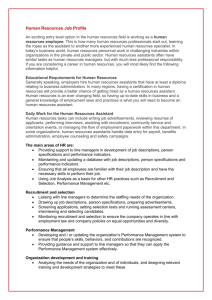

Responsibilities and Information EHC Personal Budgets via Direct Payment processes Sept 2015 version 3 Contents Page PAGE NO. CONTENT 1. What is a Personal Budget via a Direct Payment 3. Using the money 5. Keeping safe 9. Getting started 14. A young Person between 16 and 18 years old 15. Managed Bank Account 17. Employing family 20. Recruiting a Personal Assistant 38. Adult Social Care Assessment 40. Good record keeping Direct Payments Team - 01629 532023 What is a Personal Budget via a Direct Payment? The official guidelines state A Personal Budget is an amount of money identified by the Local Authority to deliver provision set out in an Education, Health and Care (EHC) plan where the parent or young person is involved in securing that provision. Personal Budgets should reflect the holistic nature of an EHC plan and can include funding for Special Education, Health and Social Care provision. They should be focused to secure the provision agreed in the EHC Plan (Named Outcomes). There are four ways in which the parents/young person can access a Personal Budget:1. Via a Direct Payment – where individuals receive cash to contract, purchase and manage services themselves 2. An arrangement – whereby the Local Authority, school or college holds funds and commissions the support specified in the EHC Plan (notional budget) 3. Third party – where funds (Personal Budget via Direct Payments) are paid to and managed by an individual or organisation on behalf of the child’s parent or young person. 4. A combination of the above. 1. NB. If there is a delay in the process of setting up an EHC Personal Budget then an interim provision would need to be sorted to meet immediate needs so the EHC plan can be completed within timescale of 20 weeks. These interim provisions will need to be written together with choice of how the payment to be accessed (1-4) and how the outcomes in the plan will be met via the Personal Budget. Please note that an Education Personal Budget cannot be granted unless the Head of setting (nursery, school, college or training facility) has given their approval where the provision takes place on school premises or the budget request is normally met by them. This is not the case with a Personal Health Budget or a Social Care Personal Budget. These budgets can stand alone without having an EHC - for further details of these Personal Budgets please ask key workers for these services. You will find a list of providers together with their costs listed on the Local Offer web site www.derbyshiresendlocaloffer.org these will be agencies accredited with Derbyshire County Council. 2. Using the money! Your child’s /your EHC plan gives detail of the Outcomes which will govern how you will use your child’s/your budget. They should have been set with your full participation and agreement. What is important is that your child/you achieve all the eligible outcomes within the assessed budget. When making decisions about how to spend the budget you also need to consider that the budget is finite. Although there is flexibility in how you meet your child's/your outcomes you need to balance your expenditure to meet all the allocated outcomes of the EHC plan. Your child/you should be involved in all the planning and decisions that need to be made. When budgeting, remember that everything has to come from their Personal Budget. For example, this includes reasonable administration costs, managed account costs and insurance/ payroll services if you are employing staff, etc. There is no additional funding for any of these items. Using the Money Legally you can use the money for anything that is safe, healthy and legal which achieves the outcomes agreed. This doesn’t mean that you cannot use the money flexibly, but your child’s/your EHC plan should outline the general way that you will use the money to achieve each of the outcomes. This should also detail costs. Anything you spend the Personal Budget on must be traceable. This means you cannot make cash payments from the Personal Budget direct payment. Everything you spend the Personal Budget on must be directly related to an agreed outcome of your child’s/your EHC plan. If you are not sure if something is agreed, talk to your child’s/your DCC worker. 3. Employing personal assistants (PA) If you choose to employ personal assistants, you need to employ and pay them properly, i.e. using a payroll service to work out tax, national insurance contributions, etc. There are also additional costs involved in employing staff which you need to budget for in your support plan. For further details re employing PA’s etc. please see page 20 What you cannot spend your Personal Budget direct payment on · Anything illegal · Employing a close family member living in the same house except in exceptional circumstances approved in writing · Anything which does not meet your child’s/your agreed outcomes in the EHC plan. · HMRC fines or costs · Bank charges if the Personal Budget direct payment account becomes over drawn or payments are rejected by the bank due to lack of funds in the account for example. 4. · Legal or tribunal costs should your personal assistant take action against you for any reason · Any costs awarded to your Personal Assistant by an employment tribunal · Any costs associated with any dispute with an agency or service provider 4. KEEPING SAFE! Personal Budgets allows extra control over your child/your care arrangements and means that you can identify personal carers. This may help your child/you feel safe from the risk of abuse or neglect. However there are times when this trust is misplaced. If at any time you as a parent/your child/you are concerned about a PA, agency or health professional’s behaviour please speak out. If your child has a Social Worker speak to her/him in the first instance, you can also ring Derbyshire County Council call centre on 01629 533190 during working hours or 01629 532600 out of hours service. Do not keep your worries and concerns to yourself. Whatever you do, make sure you talk to someone. Tell your DCC worker, a health professional, such as your GP, Health Visitor or Community Nurse. You could also talk to your teacher at school, your college tutor or welfare staff at college. You could tell a trusted family member, friend, neighbour, community leader or someone from your church, synagogue, mosque or other local religious centre. In an emergency you can dial 999 and ask for the police 5. All PA’s employed must have a current Disclosure and Barring Service (DBS) certificate. The DBS check can take several weeks to process (average of 4 weeks). If they hold a current CRB (Criminal Records Bureau) or current DBS checked through Derbyshire County Council they could start work straight away but you would need to see the documentation and discuss with your child or Young Person’s DCC worker. Please see page 8 for further details. It is important to talk to the person you intend to employ about their understanding of child protection issues and ensure that the job description clearly sets out the extent of the relationship with, and the degree of responsibility for, the child/young person with whom the person will have contact. It is important that they understand that their practice is conducive with child protection. If the Personal Assistant you intend to employ is unknown previously to you or is not a trusted family member, it would be safe practice to request both professional and character references, one of which should be from the applicant's current or most recent employer. Additional references may be sought where appropriate. Wherever possible references should be obtained prior to the interview, so that any issues of concern raised by the reference can be explored further with the referee and taken up with the candidate during interview. The referee should be asked to confirm whether the applicant has been the subject of any disciplinary action and whether the applicant has had any allegations made against him or her or had concerns risen which relate to either the safety or welfare of children and young people or about the applicant's behaviour towards children or 6. young people. Details about the outcome of any concerns or allegations should be sought. If the person you employ claims to have specific qualifications or experience relevant to working with children which may not be verified by a reference, the facts should be verified by making contact with the relevant body or previous employer and any discrepancy explored during the interview. Child Protection Training for Personal Assistants You can arrange for your PA to undertake Child protection training through Derbyshire County Council training section. Your PA will need paying as normal out of your child’s /your Personal Budget monies to attend the training. Child Protection training is considered essential. If there is not enough money in the PB direct payment account to pay the PA to attend the training you will need to talk to your child’s worker. A temporary increase in PB monies to cover the extra hours needed to enable your PA to go on the Child Protection Training. A certificate is awarded to attendees. DBS CHECKS The Criminal Records Bureau (CRB) and the Independent Safeguarding Authority (ISA) have merged to become the Disclosure and Barring Service (DBS). CRB checks are now called DBS checks. For work with children an ‘Enhanced with lists check’ is required, this will check whether someone’s included in the 2 DBS ‘barred lists’ (previously called ISA barred lists) of individuals who are unsuitable for working with children or adults. 7. A DBS check has no official expiry date. Any information included will be accurate at the time the check was carried out. It is up to an employer to decide if and when a new check is needed. As a guide Derbyshire County Council employees have afresh DBS check every 3 years. Derbyshire County Council will pay for all DBS checks carried out on Personal Assistants. Agencies are responsible for carrying out and paying for DBS checks on their own staff. You should check that all agency staff working with your child or young person has a valid and current DBS certificate. Applicants and employers can use the DBS update service (see DBS website - link below) to keep a certificate up to date or carry out checks on a potential employee’s certificate. You’re breaking the law if you don’t refer someone to DBS when you should. Employers must refer someone to DBS if they: · sacked them because they harmed someone · sacked them or removed them from working in regulated activity (See DBS Website) because they might have harmed someone. · were planning to sack them for either of these reasons, but they resigned first. Contact the barring helpline for help referring someone to DBS. Telephone: 01325 953795 (up to 9p per min land line, up to 40p per min mobile) DBS link: https://www.gov.uk/government/organisations/disclosure-andbarring-service 8. GETTING STARTED You will need to sign an agreement in which you will agree to use the money as set out in the EHC Plan/ Support Plan and to keep records about how you use the money. The agreement also sets out what you can expect from Derbyshire County Council. Basics to know about a Personal Budget direct payment Money is paid into the bank account or managed account. Clear instructions are needed of frequency of the payments to be made when setting up the Personal Budget via a Direct Payment as this should be quarterly (4 times per year) - it will default to every 4 weeks in advance unless stated otherwise. A record of how you have used the money is needed. If you choose to employ personal assistants you will be an employer and will have to follow employment law. Before a payment is made, you need to decide how you the parent/you will manage the Personal Budget direct payment and what account will be used? 9. PARENTS MANAGING THEIR CHILD’S PERSONAL BUDGET As a person with parental responsibility you will receive the Personal Budget on behalf of your disabled child. You are therefore considered to be the client receiving your child’s support as a direct payment. This means you are responsible for managing the payment, including providing DCC with paperwork to show how you have used the money. ‘With choice and control comes responsibility’ The responsibilities involved in receiving a Personal Budget via a direct payment are outlined in the “Direct Payments Agreement for Children with Assessed Needs”, which both you and your child’s worker sign. It is important that you understand what you are agreeing to by signing the agreement. If you will be employing staff you also need to understand your obligations as an employer. The direct payment agreement can be provided in different formats, if this is required, such as other languages or large print. If you need the agreement in another format, please discuss this with your child’s DCC worker. Your child’s DCC worker can also help you to understand the Personal Budget direct payment agreement. If you are unable to understand the agreement, your child’s worker will need to consider if you are able to have a Personal Budget on behalf of your child. If you are to manage the direct payment, you need to open a separate bank account. You will need a bank account which is just for direct payments and has no other money going in or paid out. Ideally you need a current account, which allows direct debits and transfers i.e. internet banking. If you can’t get a bank account, talk to your child’s DCC worker. They can support you with a letter which may 10. help you to get one. If you still can’t get a bank account, don’t worry, you could have a managed bank account. If you are going to employ personal assistants you don’t have to work out tax and national insurance yourself, you can use a payroll agency to do the calculations for you or Her Majesty’s Customs and Revenues (HMRC) free service. Your child’s DCC worker will have some forms they have to complete to get the Personal Budgets via a direct payment set up and will need to send these, along with the signed disabled children’s direct payment agreement and bank details, to the direct payment finance team. How long until I receive the payment? Payments cannot be made into the account until all the required paperwork has been received, including the bank account details. Your child’s DCC worker will give you a start date from when the Personal Budget amount will be paid. The finance team will write to you soon after receipt of the paperwork to confirm your Personal Budget. Payment can only be backdated for up to 28 days from when the completed paperwork has been received, so getting your paperwork completed as soon as possible is important. If there is a delay which is not your fault and you have completed your paperwork and given it to your DCC worker on time, then it may be possible for the direct payment to be backdated beyond the 28 days as long as the setting agrees. If your DCC worker has agreed you can start using the Personal Budget direct payment and you have already contracted with an 11. agency, or a personal assistant has already started working for you, you must keep records to be able to pay them from the direct payment account. Without these records your Personal Budget will not be backdated. Parent managing the direct payment on behalf of their child A child under 16 years of age cannot take responsibility for their Personal Budget direct payment nor sign the “Direct Payment Agreement for Children with Assessed Needs”. Only a person with parental responsibility can do this on their behalf. No other adult related to or known to the child can manage a Personal Budget direct payment on behalf of that child or sign the direct payment agreement. The person with parental responsibility becomes the Personal Budget direct payment recipient, with the responsibility to manage the Personal Budget to purchase support for the child to meet the outcomes in their EHC Plan/Support Plan. If there are two parents with parental responsibility only one can sign the direct payment agreement. This agreement sets out the responsibilities of the person with parental responsibility. The bank account can only be in the name of the parent who signed the Personal Budgets direct payment agreement. We cannot make payments into a joint account between both parents with parental responsibility. Neither can the signatory nominate a third party to manage the Personal Budget on their behalf. The account must be a current account. 12. The parent who signed the Personal Budget direct payment agreement is also the employer for any personal assistants and is responsible for being a good employer, i.e. taking out appropriate insurance, paying tax and national insurance. The parent would also be responsible for contracting with a service provider, including any contractual obligations. They are also responsible for meeting all the DCC financial monitoring requirements of a Personal Budget direct payment. The money belongs to Derbyshire County Council and is only to be used to provide support to the child with assessed needs as detailed in the outcomes of the EHC plan/Support Plan. 13. A Young Person between 16 and 18 years. As a young person between 16 and 18 years of age you can have a Personal Budget in your own right. Your DCC worker will need to talk to you in detail about the responsibilities of having a Personal Budget. This will include ensuring you fully understand the “Standard Direct Payment for a Young Person aged 16 to 18” before you sign it. This should be recorded in the outcomes of your child’s plan. There is a lot of support available to help you with your direct payments. There is a list of where you can get support on page 43 for some Useful Contacts. If you feel unable or wish to not take control of your Personal Budget then your DCC worker will elect an Authorised Person such as your parent to do so on your behalf. Even if you have signed the direct payment agreement, you can nominate someone else to support you to manage the Personal Budget. This is an agreement between you and someone willing to assist you with the Personal Budget. This person is called a Nominee. There is a place on the form for information about a nominee. You and the person you have chosen to support you, will both need to sign. You would still be responsible for the Personal Budget and you would be the employer if you use Personal Assistants. If you use a service provider or agency you would maintain contractual responsibilities. Your nominee can help you with administrative tasks, including sorting out timesheets, invoices, receipts from taxi’s, etc. You need to open a current bank account. If you use a nominee to help you with the Personal Budget direct payment you can have the nominees name added as a signatory or your nominee could have the account in their name if you are unable 14. to sign cheques. However this is your decision and you do not have to have a nominee. Managed Bank Account A managed bank account may be a good option if you feel the monitoring responsibilities would be something you would find difficult to manage. A managed account is not giving up control of the Personal Budget; a managed account provider works on your behalf and makes the payments you tell them to. The managed account provider will take on the administration responsibilities of a Personal Budget direct payment, leaving you with time to manage your support. However, you still retain all employer responsibilities. A managed account provider will pay any service provider invoices or wages to personal assistants, along with submitting your monitoring forms to DCC. You will still need to send timesheets or invoices to the managed account provider for them to make the payments. With a managed account DCC would make the payments to the managed bank account provider and they would make all payments on your behalf. You would retain control of the Personal Budget as employer and any contractual responsibilities. There are a number of managed account providers who can help you manage your direct payment. For details please contact your child’s DCC worker or the people listed on next page. The paperwork and Personal Budget direct payment agreements remain the same whether you are managing the Personal Budget yourself or you choose to contract with a managed account provider, other than the bank details. 15. DO NOT OPEN A BANK ACCOUNT IF YOU ARE CHOOSING TO USE A MANAGED BANK ACCOUNT Managed Account Providers Which managed account provider you choose is up to you, as long as they can meet the DCC monitoring requirements. Here are some providers but you can choose another. If you do have another service in mind, please contact the direct payment team on 01629 532023. The Rowan 02476 322860 Care in Finance 0845 241 0999 http://www.therowan.org/ www.careinfinance.co.uk Makes payments to personal assistants, agencies, provides telephone support, advice with setting PA rates and payroll issues plus 4 weekly statements Makes payments to personal assistants, agencies, provides telephone support, advice with setting PA rates and payroll issues plus 4 weekly statements. Enable Payroll 02031 374406 Paypacket 0800 848 8998 www.enable-payroll.co.uk http://paypacket.co.uk/ Makes payments to personal assistants, agencies, provides telephone support, advice with setting PA rates and payroll issues, provides 4 weekly statements and online accounts. Makes payments to personal assistants, agencies, provides telephone support, advice with setting PA rates and payroll issues, provides 4 weekly statements and online accounts. Penderels Trust 02476 511611 Ability Finance 01773 742 165 www.penderelstrust.org.uk www.dcil.org.uk Makes payments to personal assistants, agencies, provides initial home visit if required, provides 4 weekly statements. Makes payments to personal assistants, agencies, provides telephone support, advice with setting PA rates and payroll issues. 16. Employing Family While family can be employed via a Personal Budget, there are exclusions and considerations. Your child/you cannot have a Personal Budget specifically to employ a family member as you cannot employ a family member who lives in the same house as you or your child. The Direct Payments Guidance 2009 and Direct Payments Regulations 2009 prohibit anyone receiving a direct payment from employing family members living in the same household as the client. This includes the household in which the child lives, the household of the parent with parental responsibility (even if they live in a separate household) and any person nominated by a young person (16 to 25 years of age) to support them with the management of their direct payment unless there are exceptional circumstances. Exceptional Circumstances While the regulations are clear that close family members cannot be employed via a Personal Budget direct payment, they do allow us to make exceptions where required. An exceptional circumstance is one where we cannot meet your needs in any other way. Only a CAYA District Manager or if in education SENCO (or equivalent) can make the decision regarding whether or not your child’s/your situation warrants an exception. Usually exceptions are only made in circumstances such as a location being difficult for other personal assistants to get to, communication issues, cultural or religious needs, mental health or terminal illness. We will also need to consider how your child’s/your needs will be met when your family member is unwell or is taking a holiday. If as a parent you are the signatory on the children’s Personal Budget direct payment agreement, you are the Personal Budget recipient so 17. you cannot employ or contract with a family member living in your house in any way, whether as a personal assistant, self-employed personal assistant or as an agency carer in an agency in which you have a vested interest. Furthermore you cannot pay volunteer expenses to a family member living in your own house or living with the child who the Personal Budget is for. As the signatory you cannot also be the personal assistant or be paid for any role from the Personal Budget direct payment, such as payroll or accounting or for travel costs when taking your child out and about. Nominee Only a young person can arrange to have a nominee to support them with the management of their direct payments if the young person is the sole signatory on the direct payment agreement. As a Nominee you do not have the legal responsibility for the Personal Budget, this remains with the young person. Nevertheless as the Nominee, with the young person’s permission you can sign timesheets, invoices, etc and also be joint signature on the direct payment bank account, i.e. if the young person is unable to sign cheques, due to the nature of their disability. Therefore, the same exclusions apply to a Nominee as to the parent with parental responsibility. Employing family not living in the same house Family members not living in the same house can be employed via a Personal Budget. However, you still need to be a good employer and your family will have the same employment rights as any other employee. We recommend that you have a job description and by law you must give written terms and conditions of employment which is best given as a contract of employment. Having these will help you establish boundaries about what a family member does as 18. an employee and what they do as a family member. Family members employed must also pay tax and national insurance as any other employee. For further information regarding employing family members, please see the Direct Payments Guidance, Community Care, Services for Carers and Children’s (Direct Payments) Services 2009 which by found online at: http://webarchive.nationalarchives.gov.uk/+/www.dh.gov.uk/en/S ocialCare/Socialcarereform/Personalisation/Directpayments/DH_0 76522 19 Recruiting a Personal Assistant (PA) Finding the right personal assistant (PA) for your child is important and it can be difficult to know where to begin to find that person. If you wish to employ your own personal assistant, and do not have someone already in mind, you will need to recruit somebody to be employed by you. There are a number of ways of finding a PA. You can ask people you know who you think may be interested, i.e. Friends, neighbours, etc. You can advertise i.e. in a local shop window, job centre, local papers You can contact Disability Derbyshire for help with recruiting a personal assistant. You can use one of the many resources out there such as PA Pool - though there may be charges. Where should you start? You need to think about what you want your personal assistant to do. Use the outcomes of your child’s/your EHC Plan/Support Plan as a guide Any tasks your PA does need to enable your child/you to meet these outcomes Write down the tasks and use these in the Job Description. You also need to set an hourly rate you will pay your PA. How much you pay your PA is up to you, but you must pay minimum wage or more. Any Personal Assistant you consider will need to meet all the 20. relevant employment legislation. More information can be found on: https://www.gov.uk/browse/employing-people. You need to make sure you have enough money left over to pay other costs, i.e. insurance, payroll costs, holiday pay, relief hours, etc. The current rates of minimum wage can be found at https://www.gov.uk/national-minimum-wage-rates Advertising for a Personal Assistant To advertise for a personal assistant you need to think how best to let people know you are looking for someone to work with your child This can depend on where you live but you may consider placing an advertisement in the local shop or notice boards If you have internet access you could use the job centre website Reasonable costs for advertising can be funded from the Personal Budget but think carefully before placing very expensive advertisements in newspapers. It may be that they don’t reach local people. Please do not include personal details on any advertisement. Support with Recruiting a Personal Assistant If you are not sure what to do or what you are looking for you can contact Disability Derbyshire Coalition for Inclusive Living (DDCIL) on 01773 742165. Their support workers can help you with drafting job descriptions, advertising for staff, holding interviews and personalising contracts of employment. E-mail: direct.payments@dcil.org.uk Website: www.dcil.org.uk 21. References and Disclosure and Barring Service To safeguard your child, we recommend you obtain satisfactory written references for the personal assistant and a ‘satisfactory’ and current Disclosure and Barring Service (DBS) check. Any potential personal assistant will need a DBS check carried out and come back ‘satisfactory’ before they start work with your child. Derbyshire County Council insists you have an enhanced DBS disclosure carried out on any PA you wish to employ to work with your child even if this is a family member. DCC pay the cost of the disclosure. You will need to check with any PA you employ, or propose to employ, whether they have anything recorded on their DBS certificate. This is now your responsibility to do so, as Derbyshire County Council no longer has this information to help make a judgement about the suitability of the PA and potential risks involved in employing the PA concerned. Your child’s DCC worker can insist on seeing the DBS certificate of any potential PA as part of their child protection responsibilities. If you want a DBS check carried out on a potential PA please contact your DCC worker who will make the necessary arrangements. (Agencies are responsible for carrying out DBS checks on their own carers). Please note: DCC staff cannot become involved in employment matters nor support you as the employer should you experience any employment difficulties. This is because the contract between an employer and their staff, including those who consider themselves to be self-employed, is a private matter. You are 22. strongly advised to take out employer and public liability insurance and include the insurer’s legal employment helpline in the policy. Managing Personal Assistants Being a good employer is very important. To do this there are some tasks you must complete. These are: provide a contract of employment, follow health and safety regulations, purchase employers liability insurance and only dismiss your personal assistant after taking advice and following disciplinary procedures. Contract of Employment It is a legal requirement that all workers are provided with written terms and conditions of employment. These are best provided in a contract of employment. A sample contract can be found on DCC web pages: www.derbyshire.gov.uk/directpayments It is also useful to have a job description. If you need support to personalise this you can contact Disability Derbyshire on 01773 740246 or 01773 742165. Insurance All employers must have employer’s liability insurance in case of an accident or injury to a PA. This safeguard is important because you may not be able to meet any claims against you without this cover. It is also a legal requirement. Derbyshire County Council recommends you take out employer’s liability insurance with additional benefits to include tribunal expenses and 24 hour help lines for health and safety and employment matters. It is up to you which insurance provider you purchase this insurance from, but three organisations which provide this level of cover are: Fish Insurance can be contacted on 0800 088 3245 or at 23. https://www.fishinsurance.co.uk/independent-living-insurance.php Direct Care Insurance can be contacted on: 0800 458 3301 or at www.directcareinsurance.co.uk Premier Care can be contacted on: 01476 514478 www.home-employment-insurance.info/direct-payments-insurance This insurance does not cover your property from damage and you would need to check your buildings and contents insurance to see if you are covered. Your PA will also need to have business use on their car insurance if they are using their own car to transport your child/you. This is paid by the personal assistant privately. Health and Safety As an employer you are responsible for the health and safety of the people you employ while they are working for you. Please share any Moving and Handling Assessments, Specialist Intervention reports or risk assessments you have, with your PA. Your PAs are also responsible for taking care of themselves and following any instructions from you for their own safety. Home care safety is a shared responsibility. You and the person who is assisting your child/you are both responsible for making sure that you work safely to keep everyone free from harm. Take advice from your insurance provider about carrying out risk assessments. If a member of staff becomes pregnant, you will need to do a pregnant worker risk assessment and make adjustments to their work if necessary. Any worker who is 16 or 17 years of age will also need a risk assessment carrying out. For support with Health and Safety contact your insurance provider. The HSE website www.hse.gov.uk may also contain information 24. useful to you. Training for Personal Assistants Personal assistants can access Derbyshire County Council training free of charge. Derbyshire can provide funding for cover required where the training is essential to the job, for example; child protection courses, moving and transferring training where your PA assists your child to move. To arrange training please contact Derbyshire County Council training on 01629 531415. PAs can also access New Level 2 and 3 Diplomas in Health and Social Care. You can contact the Vocational Qualification Team Unit on 01629 531915. The direct payment team can provide you with a guide and application form for PA training, which will help you decide if the training is essential. Contact us on 01629 532023. You should keep a record of what training what your PAs have completed or your insurance could be invalid. Managing staff We recommend you talk to your child’s/your personal assistant on a regular basis, to discuss the role and hopefully resolve any issues before they arise. This should include giving them positive feedback about how they are doing. Sometimes it may be necessary to discipline your staff. If you have any concerns about the conduct of your staff, you MUST take advice before taking any action. No matter what your member of staff has done, do not dismiss them without advice, even if you feel what they have done amounts to gross misconduct. If you don’t feel able to continue working with 25. them, it is acceptable to inform them you don’t need them further that day, on their usual pay, and immediately take advice. Where you have insurance provided by FISH, Direct Care Insurance or Premier Care, ensure you contact them for advice, and follow any advice given, or your insurance could be invalid. Keep a record of what you are advised and by whom. They all operate a 24 hours legal employment helpline. Disability Derbyshire can provide emotional support with disciplining your child’s/your PA with practical support such as note taking. You can contact them on 01773 740246 or 01773 742165. Setting the Hourly Rate When setting the hourly rate for your child’s personal assistant, it is very important to think about the costs of being an employer and make sure you have enough to cover both the employees wage and the associated employer costs. What you pay your personal assistant is up to you, as long as it is above the minimum wage 1 October 2014 it is £6.50 per hour for adults 21 years and over. Payroll Options You are responsible as an employer to register with HM Revenue and Customs and pay tax and National Insurance on behalf of your personal assistant. Tel: Employers helpline 0300 200 3211 or 0300 200 3200 for advice and to register. Or visit www.hmrc.gov.uk HM Revenue and Customs now requires monthly returns as part of Real Time Information (RTi) and if you choose to manage your own payroll, you will need to make online returns every time you make a 26 payment to a personal assistant. Alternatively you can use a payroll agency, which will register you as an employer and calculate tax and national insurance for you. Payroll agencies who can calculate your tax and national insurance: Ability Finance payroll - 01773 740246 - www.dcil.org.uk Paypacket payroll - 0800 848 8998 - www.paypacket.org.uk Rowan Organisation – 02476 322860 - www.therowan.org.uk These agencies can also provide managed account services. Help in choosing the right provider for you can be found by contacting your DCC worker or the DP social work team. Other payroll providers are available and you can use your own payroll provider as long as their charges are reasonable. When planning your budget you need to make sure you have enough money in your contingency to pay for: Employers Liability Insurance (approximately £135.00 per year) Cover for personal assistant holidays (5.6 x your weekly PA hours) 27. You may also need to pay for: Payroll costs Employers National Insurance (For staff earning over £144 per week) We recommend paying personal assistants around £8.50 gross. If you have been given a personal budget, you need to consider these costs when planning how many hours you wish to use and what hourly rate to pay. Please note that Tax and Employee’s National insurance contributions are deducted from the PAs hourly rate. Timesheets You and your child’s personal assistants need to have a record of what hours they have worked, so your PA should complete a timesheet. A timesheet can be any form that shows what hours someone has worked. The timesheet should be signed by you both. Derbyshire County Council will provide you with sample timesheets to use if you prefer. If you are using a payroll provider or have a managed bank account, the timesheet must be sent to the organisation providing payroll. The payroll will use the timesheet to calculate what wages to pay your personal assistant and what tax and national insurance is required to be deducted. Your payroll provider will also inform you how much your Employer’s National Insurance contributions are. Personal assistant expenses If your outcomes include accessing social events and activities, you need to discuss with your DCC worker if there is enough in the budget to pay for personal assistant expenses. Your child’s/your 28. personal assistant must be paid for their time in the normal manner when supporting your child/you in the community. You cannot just pay their expenses or give them a gift in lieu of their salary. Whilst out, you are expected to pay for your child’s/your own refreshments, travel costs and entrance fees. If your child/you are being transported in their PA’s vehicle you would normally be expected to fund this from your personal money or from your child’s/your mobility allowance. If you feel there is an exceptional reason why your child’s/your transport costs should be included in their support plan, talk to your DCC worker. You may agree with your DCC worker for costs to be named as an Outcome in your child’s/your EHC Plan for a proportion of your child’s/your Personal Budget. However these expenses need to be reasonable and within HMRC guidelines, otherwise they could be taxable income. This also ensures that there is responsible use of public monies. HMRC rates are: Daytime social activity, Refreshment limit - £5.00 Evening social activity which lasts until after 8pm Refreshment limit - £15.00 Full day and evening social activity, Refreshment limit - £20.00 (2 meals) Mileage rates up to 45p per mile. We usually recommend 40p per mile but it is your decision. The direct payment finance team will query any costs above this and you may be required to pay the additional costs back. 29. Public Transport You can reimburse ‘no more than the necessary costs of business travel’ and only for journey’s forming ‘part of an employee’s employment duties’. A reasonable limit, i.e. coach fare or 2nd rail class fare. If your child/you wishes to go 1st class with their PA then you must pay the difference privately. Please note 1st class travel is seen as an employee’s taxable benefit and you will need to declare the cost when sending the PA timesheet to your payroll service. Derbyshire County Council does not recommend contracting with self-employed individual’s for personal assistant tasks. In law there are certain conditions that must be met for someone to be classed as working in a self-employed capacity. A personal assistant may not meet these conditions. If you have a self-employed worker you could be found liable for all the tax and national insurance. HM Revenue and Customs are the only people who can decide a workers status. If HMRC decide after your personal assistant has been working for you that they are not self-employed, you could be liable for the full tax bill and any costs and fines. If you do decide you want to go ahead and contract a self-employed personal assistant, then we would advise you to take the following steps. 30. Ensure the individual is registered as Self Employed Firstly, remember, the decision whether someone is self-employed rests with Her Majesty’s Revenues and Customs (HMRC). HMRC could decide that they are not self-employed, and that you are liable for any tax and national insurance owed to them. Make sure that the personal assistant provides you with a Unique Tax Reference number (UTR). You can also contact HMRC on 0300 200 3600 to check if they are self-employed. More information about if someone is selfemployed can be found at: http://www.hmrc.gov.uk/employment-status/index.htm#1 Ask the self-employed worker for a contract Your self-employed worker should provide you with a contract which details terms and conditions, important issues it should cover, for example, are: They are responsible for their own tax and national insurance contributions Notice period to terminate Notice to change arrangements Tasks that can be included Hourly Rate They are responsible for budgeting for holidays and sickness They have their own insurance You need to consider your cover arrangements, as a self-employed personal assistant must NOT send someone in their place or arrange cover for you, as this requires registration with Care Quality Commission and without this they would be acting illegally. 31. Employer and Public Liability Insurance It is a good idea to take out your own Employer and Public Liability Insurance, even if the self-employed personal assistant says they have their own. In the event of a dispute it is advisable to be able to seek legal employment advice particularly if there is a question over the personal assistants employment advice. Ask for a four weekly invoice The invoice should contain sufficient details to enable you to check it is accurate, i.e. number of hours worked and when, amount charged, tasks carried out, etc. The invoice should also contain the name and address of the selfemployed personal assistant The self-employed personal assistant should give you their invoice. It is up to you to authorise payment Ask the personal assistant to sign the invoice to say they have received payment If you have a managed bank account it would be best if you sign and date the invoice before sending it for payment. This will help reduce the risk of misunderstandings in the event of a query over payment Never use a timesheet for a self-employed worker Each self-employed worker must produce their own invoice for the work they have done. A self-employed worker cannot invoice for any work someone else has done. 32. Hourly Rate for self-employed workers A self-employed worker should set their own rate, however you need to ensure that your child’s/your personal budget can afford to contract with them. Before calculating how many hours you can request at their rate, you need to deduct costs such as; Employers Liability Insurance, Managed Bank Account costs, relief personal assistant salary, etc. Employers liability insurance You need to find money to pay employers liability insurance from the budget. Although you are contracting with a self-employed worker, the recommendation is you take out insurance in case of a dispute. This insurance needs to be paid for from the Personal Budget. Managed bank account costs If you have a managed bank account you need to deduct the cost of the managed account from your budget (don’t forget to also budget for their fee for paying the Invoice) Parents - Keeping your child safe Even when you contract with a self-employed personal assistant they will need a valid DBS (Disclosure and Barring Service) check. This is mandatory as your child is the client and is under the age of 18 years old. Please see page 25 for further details 33. Advantages to choosing to use a service provider Contracting with a service provider, you will have different responsibilities. You will agree with the service provider what you want them to do with your child/you and when. a payment into your Personal Budget direct payment account for the amount that has been agreed for you. You pay the service provider when they invoice you. A service provider will take care of the following: Recruitment of support workers Provision of support workers and cover for holidays/sickness Paying wages/tax and insurance/sick pay and holiday pay Insuring staff against accidents Training staff Supervision and discipline of staff. DBS checks on their staff Some other factors to think about You may not always be able to choose which support worker your child has. A service provider will try to work within your child’s preferences but they may not always be able to A service provider may be more flexible and able to help out in emergencies The price of the service provider needs to be checked, to ensure your child’s direct payment money will cover the cost. Some service providers charge higher rates than those set by DCC. Always ask their hourly rate and the rate for travel, The Local Offer lists out some of these. If you choose to use a more expensive service provider, calculate the cost incurred and check that you 34 can afford to pay the extra, keep within your child’s/your Personal Budget and still meet the outcomes of your child’s/your EHC Plan. The service provider should provide you with a contract, detailing what they charge per hour, what happens if their worker is sick, how much notice to cancel a visit without being charged, training and experience staff have had, DBS (Disclosure and Barring Service) checks, notice period to terminate their services, etc. Check this contract and ask for support if you do not understand it. The service provider must be registered with The Care Quality Commission if their workers carry out personal care tasks. What information do I need to give to the service provider? You may wish to give the service provider a copy of your child’s /your most recent Assessment and/or EHC Plan detailing the outcomes to be met and any risk assessments. You need to discuss with the provider what information they require to be able to meet your child’s /your needs. Check that the service provider can meet your child’s/your needs in the way your child/you wants and at the times wanted. What if I want a Service Provider to employ and manage staff on my behalf? Some service providers may be prepared to employ and manage staff on your behalf. If you decide to follow this option it may be worth considering the following: Check how much the service provider charges for this service, 35. what the ongoing costs are and what they cover. For example; training. (DCC provide relevant training free of charge to personal assistants so there would be no need for the service provider to charge you for training although the PA would still need paying for their time as usual). Ensure you are involved in the recruitment process, including reading the references and ensuring there are current DBS certificates on all potential PA. You know best. A young person may wish to be involved in the recruitment process and every effort should be made to accommodate their involvement. Make sure the staff are contracted to provide support for your child and can only undertake other work for the Service Provider outside your child’s requirements. Check how much say you have in what the staff do to meet the outcomes of your child’s /your EHC Plan. As with other providers, make sure you include points such as the notice period for changes in their charges, notice period for staff leaving, etc in your contract with them. Don’t forget to give them a copy of your child’s EHC Support Plan and any risk assessments. Finding a provider You will find a list of providers together with their costs listed on the Local Offer web site www.derbyshiresendlocaloffer.org these will be agencies accredited with Derbyshire County Council. As a Personal Budget holder you can choose to use an agency not accredited with DCC. If you would like some support with contracting with a service provider, DCIL support workers should be able to help. They can be 36. contacted on 01773 742165. Another option is to involve someone you trust whether it is a family member, friend or member of your local community. Please note: As said before unfortunately your DCC worker cannot become involved in recruiting Personal Assistants, including ‘self-employed Personal Assistants, or choosing a service provider. This is because contractual arrangements are a private matter between yourself (on behalf of your child) and the Personal Assistants (regardless of their employment status) and or the service provider. When a young person reaches 16, time and attention is required to consider the transition to adulthood. This may be earlier if there are complex needs. This can mean life planning and the young person deciding what they want to do once they reach adulthood. This is also a time to look at the transition from Children’s Social Care Services to Adult Care. Social Care Children’s workers at this time should be making contact with Adult Care to begin the process early to ensure appropriate services are in place and the transition is smooth. The EHC Support plan will reflect the changes as they happen and work to be coordinated between the three services. Once a young person reaches the age of 16, the Personal Budget direct payment can no longer be paid to a parent on their behalf, unless they are appointed as a suitable person. At this stage your DCC worker will need to fill in a “Standard Direct Payments Agreement for a Young Person aged 16 to 18” agreement form to establish whether the Young Person/Nominee or Suitable Person takes overall control of the Personal Budget. 37. Adult Social Care Assessment The transition to adulthood process should be started early, thought through and work clearly named as Outcomes in the EHC plan, though a young person does have the option not to continue with an EHC plan opting to leave education/training post 18. The Health/Social Services elements of the EHC support plan will probably continue post 18. An adult care worker will complete an ‘assessment of needs’. This assessment will take into account what the young person’s needs are, what outcomes they would like to achieve and also what support they have available from families and friends, these should already be listed within the EHC support plan as part of the present and future Outcomes that have evolved as the young person grew into adult hood. These outcomes could include what the young person needs in their life, such as achieving activities of daily living. If a young person is going to college or University. If they are planning to move to independent or supported living etc.. Capacity Whether a young person once they reach adulthood has capacity or not to manage and take responsibility for their Personal Budgets is an important decision and subject to the legal framework of the Mental Capacity Act 2005. The Mental Capacity Act's main purpose is to provide a legal framework for acting and making decisions on behalf of adults who lack the capacity to make particular decisions for them – selves. A person must be assumed to have capacity unless it is established they don't. 38. In many circumstances it is clear whether a young person can or cannot manage their own Personal Budget. For example, a young person with severe learning difficulty is unlikely to have capacity to manage their own Personal Budget. Nevertheless a young person with Asperger’s Syndrome may well have capacity, but needs support to complete the relevant forms, etc. If the young person has no impairment of mind or brain, then capacity must be assumed and the Personal Budget direct payment would be transferred to them at 18. They can nominate someone to help them manage the Personal Budget direct payment, such as a parent. The young person would sign a standard adult direct payment agreement. The young person would normally open a bank account in their name for the Personal Budget monies or they can choose to have a managed account. The young person is fully responsible for their own Personal Budget. If the young person has an impairment of mind or brain, such as a learning disability, then their capacity to make the decision to receive their Personal Budget direct payment must be considered. An adult worker would carry out a ‘capacity assessment’. This would involve communicating with the young person in an appropriate format to explore what their understandings of the responsibilities involved with a Personal Budget direct payment are. If the capacity assessment finds that they do not have capacity they would need a ‘suitable person’ to manage the budget on their behalf. Anyone involved in the young person’s care can be appointed as a ‘Suitable Person’. It is usually the person who has the most involvement. There are guidelines to who we should look to as a ‘suitable person’. The ‘suitable person’ signs the ‘suitable person direct payment agreement’. The Personal Budget monies would be 39. made into the suitable person’s bank account via a direct payment. The Suitable Person is fully responsible for the young person’s Personal Budget. The rules around use of the Personal Budget via a direct payment and employment law remain the same for adults and children’s services. Good Record Keeping Everyone is required to keep financial record of things such as wages, benefits, mortgage statement; a Personal Budget is no different. We recommend you use your initial administration payment of £5.00 to purchase a file for you to keep all your child’s/your paperwork in. It is best to keep the paperwork up to date as you go, but there may be times when your child/you are not well enough to do this. As long as you make sure all letters, statements, invoices, receipts go in this one file then it is easier to sort out when you are well enough again. The essential documents to show how you have used your Personal Budget monies is the expenditure summary and the bank statement. Four Weekly Monitoring Derbyshire Direct Payments Office ask that you send in copies of your Personal Budget payment records every four weeks. What you need to send to us will be dependent on whether you employ a personal assistant or if you are using and agency or other service. Four Weekly monitoring to be sent to Direct Payments Finance Team if: Employing a Personal Assistant Expenditure summary 40. Bank Statement Copy of timesheet for each personal assistant Receipts or invoices for any other service or expenditure. Contracting with a service provider or self-employed personal assistant Expenditure summary Bank Statement Invoice for work carried out, including hours worked, hourly rate and any other expenditure Receipts for any other expenditure Address to send your documentation is: Direct Payments Finance Section Adult Care County Hall Matlock DE4 3AG 01629 532119 You can send your documentation via email to the direct payment finance team. However please remember the documentation will contain sensitive and confidential information, i.e. your child’s Personal Assistants name, pay details, your Personal Budget bank account details, etc. therefore we strongly advise that you password protect any information you send and send the password to the DP Finance Team in a separate email. Emails 41. Direct Payment Finance Team email address: direct.payments@derbyshire.gov.uk For additional timesheets and expenditure sheets please telephone the Direct Payment Finance Team on 01629 532448 or email direct.payments@derbyshire.gov.uk If you are not sure how to complete the timesheets please ring the Direct Payment Finance Team on 01629 532448 for advice or contact Disability Derbyshire (DDCIL) on 01773 740165. Where do I keep my records and for how long? It is important to keep your child’s/your Personal Budgets Direct Payments documents, letters and paperwork in a safe place. They contain important information about your child/you, your personal assistants and agencies (if you use them). The Data Protection Act says that employee’s personal data should be kept safe, secure and up to date. Most of this information will be on the personal assistants application form, contract of employment, payslips, correspondence and DBS Certificate, for example. Therefore it is important to keep these safe. It is a good idea to have a separate file for each personal assistant so the information does not get mixed up. It is best if you have somewhere to lock this information. If you do not have anywhere to lock it, think about keeping the information in a safe place where only you have access. It is advisable to keep your Personal Budget direct payment and employment information for 6 years, plus the current year’s records. This does not mean you cannot get rid of the information when it reaches the 6 year period. But please remember you will need to get 42. rid of it safely as it will contain confidential information about your child/you and any staff employed. It is a good idea to use a shredder preferably one which cuts the paper into very small pieces. Please do not put the information straight into the bin, even if you have torn it up by hand or cut it with a pair of scissors. Don’t forget your personal assistant has the right to request to see their records. It is your responsibility to keep your child’s/your personal assistants records secure. If you keep your records on your computer or any other electronic devise, i.e. laptop, iPhone, etc., please remember you are still subject to the Data Protection Act. If you need to pass on confidential information to a third party, i.e. to your payroll service, managed bank account provider, Direct Payment Finance Team, etc; please use a password to protect the data. Again, when deleting the information please ensure you erase it from all sources, i.e. desk top files, hard drive, external storage facilities, memory sticks, e-mails, etc. Derbyshire County Council Contacts Direct Payments Team 01629 532023 Can provide general direct payment advice Direct Payments Finance Team 01629 532119 They can help you with your direct payment monitoring Paperwork Timesheets and Expenditure Summaries 01629 532448 43 If you want more timesheets and expenditure summaries ring the Direct Payment Finance Team Address: Direct Payment Teams, Adult Care, Derbyshire County Council, Matlock, Derbyshire. DE4 3AG E-mail: directpayments@derbyshire.gov.uk Website: www.derbyshire.gov.uk/directpayments Direct payments paperwork can be accessed via the link on The Local Offer www.derbyshiresendlocaloffer.org Employment matters Employer and Public Liability Insurance Take advice from your Insurer’s legal employment helpline. ACAS (Advisory, Conciliation and Arbitration Service)- 0845747 4747 ACAS can help with employment matters providing independent free advice to employers and employees to solve problems. There is also a question and answer section on Personal Budgets (direct payments) employment matters in the Advice A – Z topics on their website. www.acas.org.uk Citizens Advice Bureaux (CAB) - 0844 848 9800 CAB offices can provide advice and support with employment matters. They have offices situated in various locations around Derbyshire. Many have drop in sessions or you can make an appointment. www.adviceguide.org.uk Disability Derbyshire Coalition for Inclusive Living (DDCIL) - 01773 742165 44. Their direct payment support workers can help with recruitment and general employment matters. They will also provide advice if you decide to contract with a Service Provider. www.dcil.org.uk Gov.UK Website This is the official UK government website. There is a lot of advice on employment matters. There is a section headed ‘Employing Staff for the First Time’ listing 6 things you need to know when employing staff for the first time. You may find this information particularly helpful. https://www.gov.uk/employing-staff Health and Safety Employer and Public Liability Insurance Take advice from your Insurers legal employment helpline. Please remember to follow the advice given or your insurance may become invalid. Gov.UK website There is a section on Health and Safety at Work on the Gov.UK website: https://www.gov.uk/browse/employing-people/health-safety Health and Safety Executive There is comprehensive health and safety information on this website. www.hse.gov.uk 45. To recap - Tips and advice Always take advice before dismissing staff This has to be at the top of the list. Even if someone has done something which you feel is gross misconduct, please don’t dismiss staff without taking and following advice. Your insurance provider will have a helpline which you must contact. You need to follow the advice they give or your insurance could be void. Keep every bit of paperwork Even if you are not great at organising paperwork, have a box or file where you keep everything .Then no matter what happens you will have the information in that box or file. Keep a record of every shift staff do, even if you use an agency. Don’t forget to keep the paperwork in a safe place, secured in a locked drawer or cupboard, as it has confidential information about your child’s personal assistants or service providers. Ask for Help Whatever the issue, staffs at Derbyshire County Council CAYA want to help you get the most from a Personal Budget with as little inconvenience to you as possible. We want your child to enjoy the benefits of having a Personal Budget. So if you need any advice, help or information just ask us but in the first instance contact your child’s/your DCC worker. 46. Make sure you plan your budget You need to make sure you try to plan for every cost to be met from your child’s/your Personal Budget. This is especially important when setting your hourly rate. If you employ personal assistants you need to account for their salary, 5.6 weeks holiday pay, up to 2 weeks sick pay, relief staff to cover when your PA is off, employers liability insurance, payroll costs, managed bank account costs (if applicable) and maybe employers national insurance. If you need help to plan your budget, talk to your child’s/your DCC worker. We recommend you don’t use self-employed workers HM Revenue and Customs say that personal assistants are not selfemployed and this can mean you could be liable for a large tax bill. Although not recommended, if you do have self-employed workers, please ensure they give you a unique tax reference number to show their self-employed status, ask them to invoice you for their hours and do not complete timesheets, and ensure you have a service contract with them. Do not forget they will need a satisfactory DBS check before they start working with your child. Everyone Keep on top of your Personal Budget, it is a lot easier to do your paperwork once or twice a week than once every four weeks Make sure you know what you will do if your personal assistant or the agency can’t make it one day. Make sure you have a plan for sickness and unexpected emergencies If you Employ Personal Assistants Always take up references and new DBS checks for personal 47. assistants (a DBS check is essential) Always have a contract of employment with a probationary period Write up a job description so you are clear what you want staff to do Take out employer’s liability insurance if you employ staff You may choose to use a payroll agency if you struggle with calculations or if you also struggle to keep records organised Ask for support with recruiting staff and any other issues with your Personal Budget. If you use an agency or other services If you choose to use an agency ask for a contract and check it over to make sure it is fair before signing it. Check for things like the notice you need to give to cancel the visit or the service and charges if you do, have the agency staff all got an up to date satisfactory DBS certificate. Don’t be afraid to tell the agency what you want and request which worker you prefer. The agency may not be able to provide exactly what you want but you may be able to negotiate Ask the agency to invoice you four weekly. It can be very confusing for you if they invoice you monthly. Contingency Planning Where you receive a Personal Budget direct payment it is essential that you plan for the future. 48. Ensure you have planned should you need to ‘bank’ money to cover extra support during your child’s school holidays or planned respite for example. This would be included as part of the Outcomes of your child’s/your EHC Plan. Ensure you have a plan of what you will do if your employee is unable to attend work Check you know what to do if your child’s/your service provider lets you down Make a plan about how your child’s/your Personal Budget will be managed or ended if you are unable to do it anymore, such as through other commitments, ill health or death. ABOVE ALL ENJOY THE FREEDOM OF PLANNING YOUR OWN LIFE, PROVISION AND ACTIVITIES THAT HAVING A PERSONAL BUDGET BRINGS! 49. NOTES NOTES