From the Garage to the Information Superhighway

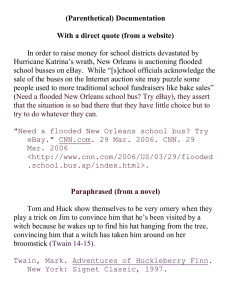

advertisement