Internal Strategy: Resources, Capabilities, Value Chain

advertisement

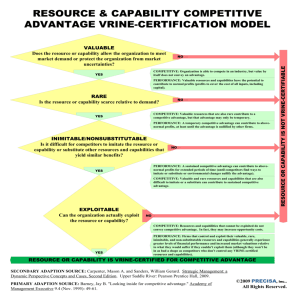

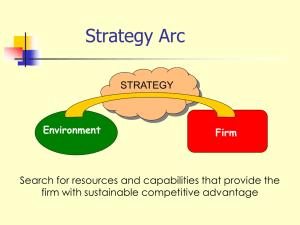

9/7/2007 OBJECTIVES Chapter 3 Examining the Internal Context of Strategy 1 Explain the internal context of strategy 2 Identify a firm’s resources and capabilities and explain their role in its performance 3 Define dynamic capabilities and explain their role in both strategic change and a firm’s performance 4 Explain how value-chain activities are related to firm performance and competitive advantage 5 Explain the role of managers with respect to resources, capabilities, and value-chain activities 1 TWO THEORIES FOR HOW AND WHY SOME FIRMS PERFORM BETTER THAN OTHERS COMPARATIVE PERFORMANCE WITHIN AN INDUSTRY ROA ROS Global Auto Semiconducto r A firm’s resources and capabilities determine performance A firm’s activities determine performance Success issues from fundamental differences in what firms own and what they can do Success is driven by a firm’s value chain activities: How it configures these activities to add more value than competitors Grocery Store How do such differences in profitability materialize? 2 3 RESOURCES AND CAPABILITIES: FUNDAMENTAL BUILDING BLOCKS OF STRATEGY RESOURCES, CAPABILITIES, AND MANAGERIAL DECISIONS Strategy Resources Managers Strategy Competitive advantage/ disadvantage Performance Management strategic decision making The inputs that firms use to create goods and services • Undifferentiated or firms-specific • Tangible or intangible • Easy to acquire or difficult Capabilities 4 BUSI 4940.004 – Fall 2007 A firm’s skill in using its resources to create goods and services. The combination of procedures and expertise that the firm relies on to engage in distinct activities in the process of producing goods and services 5 1 9/7/2007 EXAMPLES OF CAPABILITIES THE VRINE MODEL Test Company Capability Logistics -- distributing vast amounts of goods quickly and efficiently to remote locations 200,000-percent return to shareholders during first 30 years since IPO1 An extraordinarily frugal system for delivering the lowest cost structure in the mutual fund industry, using both technological leadership and economies of scale 25,000-percent return to share-holders during the 30-plus year tenure of CEO John Connelly.2 As for ongoing expenses expenses, share shareholders in Vanguard equity funds pay, on average, just $30 per $10,000, vs. a $159 industry average. With bond funds, the bite is just $17 per $10,000 Generating new ideas then turning those ideas into new, profitable products 30 percent of revenue from products introduced within the past four years 1: Stalk, Evans, and Shulman, 1992 2: Makadok, 2003 Definition Performance implication Valuable? Does the resource or capability allow the firm to meet a market demand or protect the firm from market uncertainties? If so, it satisfies the value requirement. Valuable resources are needed just to compete in the industry, but value by itself does not convey an advantage Valuable resources and capabilities convey the potential to achieve “normal profits” (i.e., profits which cover the cost of all inputs including the cost of capital) Rare? Assuming the resource or capability is valuable, is it scarce relative to demand? Or, is it widely possessed by most competitors? Valuable resources which are also rare convey a competitive advantage, but its relative permanence is not assured. The advantage is likely only temporary A temporary competitive advantage conveys the potential to achieve above normal profits, at least until the competitive advantage is nullified by other firms I i it bl Inimitable and nonsubstitutable? A Assuming i a valuable l bl and d rare resource, how difficult is it for com-petitors to either imitate the resource or capability or substitute for it with other resources and capabilities that accomplish similar benefits? Valuable V l bl resources and d capabilities biliti which are difficult to imitate or substitute provide the potential for sustained competitive advantage A sustained t i d competitive titi advantage d t conveys the potential to achieve above normal profits for extended periods of time (until competitors eventually find ways to imitate or substitute or the environment changes in ways that nullify the value of the resources) Exploitable? For each step of the preceding steps of the VRINE test, can the firm actually exploit the resources and capabilities that it owns or controls? Resources and capabilities that satisfy the VRINE requirements but which the firm is unable to exploit actually result in significant opportunity costs (other firms would likely pay large sums to purchase the VRINE resources and capabilities). Alternatively, exploitability unlocks the potential competitive and performance implications of the resource or capability Firms which control unexploited VRINE resources and capabilities generally suffer from lower levels of financial performance and depressed market valuations relative to what they would otherwise enjoy (though not as depressed as firms lacking resources and capabilities which do satisfy VRINE) 6 THE VRINE MODEL: VALUE Value: A resource or capability p y is valuable if it allows a firm to take advantage of opportunities or to fend off threats in its environment Competitive implication Result 7 THE VRINE MODEL: RARITY Example Example Union Pacific Railroad’s rail system is a tangible resource that allows UP to compete with other carriers in the long-haul transportation of a variety of goods When McDonald’s signs an agreement to build a restaurant inside a Wal-Mart store, it has an intangible advantage over Burger King that is valuable and rare Definition • Maintain an extensive network of rail-line property and equipment on the U.S. Gulf cost A useful resource or capability p y that is scarce relative to demand. • Operates in the western two-third of the United States serving 23 states, linking every major West Coast and Gulf Coast port, and reaching east through major gateways in Chicago, St.Louis, Memphis, and New Orleans Valuable resources that are available to most competitors (i.e., that are not rare) simply allow firms to achieve parity • Also operates in key north-south corridors • The only U.S. railroad serving all six gateways to Mexico • Interchanges traffic with Canadian rail systems 8 THE VRINE MODEL: INIMITABILITY AND NON-SUBSTITUTABILITY THE VRINE MODEL: EXPLOITABLITY Example Example Barnes & Noble’s large store network gave it access to customers and purchasing power that was inimitable … Novell: “I walk down Novell hallways and marvel at the incredible potential for innovation here, but Novell has had a difficult time in the past turning innovation into product in the market place” - CEO Eric Schmidt Definition • A resource or capability is inimitable if competitors cannot acquire the valuable and rare resource quickly, or face a disadvantage in doing so • It is non-substitutable if a competitor cannot achieve the same benefit using different combinations of resources and capabilities Definition … but Amazon.com found a substitute A resource or capability that the organization has the capability to exploit (i.e., the capability to generate value from) 10 BUSI 4940.004 – Fall 2007 9 Xerox: Xerox invented the laser printer, Ethernet, graphical-interface graphical interface software and computer mouse but could not capitalize on these 11 2 9/7/2007 VRINE IMPLICATIONS STOCK AND FLOW OF CAPABILITIES – THE NEED TO BE DYNAMIC Capability Valuable Rare Costly to Imitate Nonsub-Nonsub stitutable NO NO NO NO Competitive Disadvantage Below Average Returns YES NO NO YES/NO Competitive Parity Average Returns YES YES NO YES/NO Temporary Competitive Advantage Aver./Above Average Returns Sustainable Competitive Advantage Above Average Returns YES YES YES Competitive Performance Consequences Implications YES Flow Stock 12 TWO THEORIES FOR HOW AND WHY SOME FIRMS PERFORM BETTER THAN OTHERS DYNAMIC CAPABILITIES Start-up plans 13 Mail Boxes Etc. franchise People Brand Value Location Processes Dynamic capability: how we integrate reconfigure, acquire, or divest resources for competitive advantage A firm’s resources and capabilities determine performance A firm’s activities determine performance Success issues from fundamental differences in what firms own and what they can do Success is driven by a firm’s value chain activities: How it configures these activities to add more value than competitors Mail boxes, etc., has developed the ability to combine resources better than the competition 14 VALUE CHAIN ANALYSIS 15 VALUE CHAIN: INTERNET STARTUP EXAMPLE Firm Infrastructure Firm Infrastructure – e.g., Financing, legal support, accounting Support Activities Human Resources – e.g., Recruiting, training, incentive system, employee feedback Support Activities Financing, legal support, accounting Human Resources Recruiting, training, incentive system, employee feedback Technology Development Technology Development Inventory system Site software Procurement Procurement CDs Shipping Computers Telecom lines Inbound shipment of top titles Server operations Inbound Logistics Operations Outbound Logistics Marketing & Sales Warehousing After-Sales Service Collections Inbound Logistics Primary Activities Operations Shipping services Picking and shipment of top titles from warehouse Shipment of other titles from thirdparty distributors Site look & feel Return Customer research procedures Media Pricing Promotions Advertising Returned items Customer feedback Product information and reviews Affiliations with other websites Outbound Logistics Marketing & Sales After-Sales Service Primary Activities 16 BUSI 4940.004 – Fall 2007 Billing Pick & pack procedures 17 3 9/7/2007 USING VALUE CHAINS TO GAIN COMPETITIVE ADVANTAGE TRADE OFF PROTECTION - YOUR RIVALS CHOOSE NOT TO COPY YOU Selected differences between Southwest and large Airlines Identical Differentiated Find a different way to perform activities Longer-lasting advantage Southwest Major Airlines Technology and design • Single aircraft • Multiple types of Operations • Short segment flights • Smaller markets and secondar secondary airports in major markets Find a better way to perform the same activities • • • • Shorter-term advantage (competitors catch up) Marketing Southwest made choices so that competitors did not copy because copying would require them to abandon activities essential to their strategies aircrafts No baggage transfers to others airlines No meals Single class of service No seat assignments • Limited use of travel agents • Word of mouth • Hub and spoke system • Meals • Seat assignments • Multiple classes of service • Baggage transfer to other airlines • Extensive use of travel agents 18 RESULTS OF TRADE OFF PROTECTION Airline 2004 Revenue ($000,000) AirTran Alaska American INNOVATION AND INTEGRATION OF THE VALUE CHAIN 2004 Cost of Available Seat Miles (CASM) 279 8.42 656 10.03 4,541 9.72 579 7.81 AmericaWest Continental 2,397 9.49 Delta 3,641 10.23 JetBlue 19 334 6.03 Northwest 2,753 10.31 Southwest 1,655 7.77 United 3,988 10.16 US Air 1,660 11.34 Area of innovation IKEA Transferred assembly and delivery to the consumer Dell Chose an entirely direct distribution model (rather than through retailers) and outsourced component manufacturing 20 STRATEGIC LEADERSHIP 21 SENIOR VS. MIDDLE MANAGERS Senior Decide how to use other resources and capabilities, configure their firm’s value-chain activities, and set the context which determines how front-line and middle managers can add value Middle Are better positioned than senior managers to contribute to competitive advantage and firm success in four areas • Entrepreneurship • Communications • Psychoanalyst • Tightrope walker “Companies that overlook the role of leadership in the early phases of strategic planning often find themselves scrambling when it’s it s time to execute execute. No matter how thorough the plan, with-out the right leaders it is unlikely to succeed” – McKinsey & Company Source: Quy Nguyen Huy 22 BUSI 4940.004 – Fall 2007 23 4 9/7/2007 SUMMARY 1 Explain the internal context of strategy 2 Identify a firm’s resources and capabilities and explain their role in its performance 3 Define dynamic capabilities and explain their role in both strategic change and a firm’s performance 4 Understand how value-chain activities are related to firm performance and competitive advantage 5 Explain the role of managers with respect to resources, capabilities, and value-chain activities 24 BUSI 4940.004 – Fall 2007 5