Fy 2012 - Xprimm publication

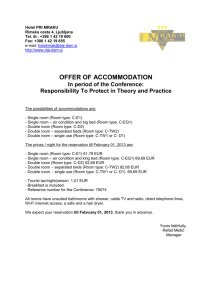

advertisement