Fy 2012 - Xprimm publication

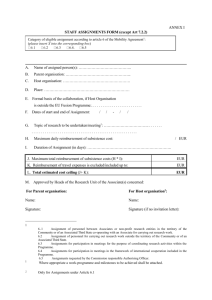

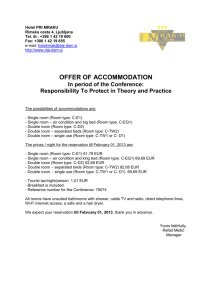

advertisement