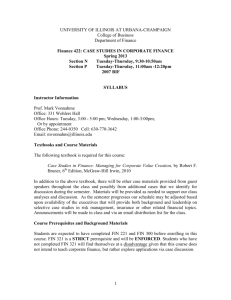

CASE STUDIES IN CORPORATE FI - University of Illinois at Urbana

advertisement

UNIVERSITY OF ILLINOIS AT URBANA-CHAMPAIGN College of Business Department of Finance Finance 422: CASE STUDIES IN CORPORATE FINANCE Spring 2011 Section N Tuesday-Thursday 9:30-10:50am 2007 BIF SYLLABUS Instructor Information Prof. Mark Vonnahme Office: 331 Wohlers Hall Office Hours: Tuesday and Wednesday, 3:00 - 5:00 pm or by appointment Office Phone: 244-0350 Cell: 630-770-3642 Email: mvonnahm@illinois.edu Textbooks and Course Materials I have assigned the following textbooks for this course: 1. Case Studies in Finance: Managing for Corporate Value Creation, by Robert F. Bruner, 6th Edition, McGraw-Hill Irwin, 2010 2. Applied Corporate Finance: A User’s Manual, by Aswath Damodaran, 2nd Edition, John Wiley, 2006 The first textbook is required while the second is strongly recommended. In addition to the above textbooks, there will be other case materials provided from guest speakers throughout the class. As the semester progresses our schedule may be adjusted based upon availability of the executives that will provide both background and leadership on selective case studies in risk management, insurance or other related financial topics. Announcements will be made in class and via an email distribution list for the class. Course Prerequisites and Background Materials Students are expected to have completed FIN 221 and FIN 300 before enrolling in this course. FIN 321 is a STRICT prerequisite and will be ENFORCED. Students who have not completed FIN 321 will find themselves at a disadvantage given that this course does not intend to teach corporate finance, but rather explore applications via case discussion. I assume that students in the course have a good knowledge of the material covered in FIN 221 and FIN 300. I will be introducing additional background material during the semester in the form of handouts. 1 In this course, I assume that you will be using your textbook from FIN 321 as a reference source for background reading. An alternative source is the recommended textbook by Damodaran. Recommended readings from that textbook related to the cases discussed in each class can be found on the course schedule in the last two pages of the syllabus. If you choose to use some other similar textbook, please refer to the background reading area related to each case and look it up in that text’s table of contents. If you have any questions, please feel free to check with me. Using a reference textbook is a very good practice of how you will be working in your professional career. Course Description This course helps students to bridge the gap between the theory of finance, covered in other courses, and the reality of decision-making as a financial manager through the use of real-world case studies. Students learn to analyze real-world problems and provide recommendations to upper management of the best course of action in a particular situation confronted by a business. Course Objectives The narrow objective of this course is to help students develop self-learning skills, writing skills, as well as encourage teamwork. The greater objective is to prepare students for making decisions within a business environment, a very valuable skill when you begin your career in the business world. To achieve these objectives, the course will use the “case study” method of teaching and learning. Case studies present real-world, complex problems faced by financial managers that require analysis and use of judgment to reach important business decisions. The use of case studies is a very effective learning method because it emphasizes student self-learning rather than a passive absorption of knowledge. Students learn to develop critical thinking skills and use their judgment to make decisions. Case studies do not always lead to the “right” or the “one” course of action for the decision maker. Rather, decisions are justified based upon sound financial assumptions and a thorough analysis of the situation at hand. Therefore, the analysis and discussion of cases is very valuable because it teaches students how to use principles of finance to define and analyze problems, work as a member of a team, and make recommendations for the best course of action. Class Format Case courses have a very different class format from other courses that you have taken thus far in your studies. In other courses, students are engaged in a passive form of learning and are expected to learn and practice skills through homework and exams. Courses that utilize the “case study” method assume an active form of learning on the part of students. The following four principles are ESSENTIAL components of each student’s success in a case course: 2 • • • • Participation: Learning in a case course takes place primarily through active class participation. Students are strongly encouraged and are responsible for sharing their understanding and views on each case with the rest of the class. As you can tell from the grade composition, class participation is very important and comprises half of your course grade. Preparation: To effectively participate in class discussion of cases, students MUST come to class well prepared. Students should study each assigned case in advance, identify the main participants and the problem faced, and prepare to ask and answer questions. It is very important that you work to analyze the case before it is discussed in class. You must be prepared to offer your judgment and recommendation for the situation presented in each case. You should feel free to visit me during office hours or set up an appointment, if you need help with preparing for a case. In addition, you should read all assigned background readings. Again, I emphasize that students must prepare well before arriving to class. Presence: The only way to learn and succeed in this course is to be present and participate in each and every class. Reading a text or copying notes from your fellow students CANNOT substitute for the insight and knowledge that you will acquire through participation in class discussions. Promptness: Students must make sure that they arrive before the beginning of each class. Students who arrive to class late disrupt the discussion and impose a burden on their fellow students’ learning experience. If, for some reason, you happen to arrive to class late, please enter quietly and do not disturb your fellow students. It is clear from the above that students must make a commitment to prepare for each class and actively participate in class discussions. This point cannot be emphasized enough! Students must also be prepared to be called upon to answer questions or offer their views on the case under discussion. I also strongly encourage you to take a stand and offer your recommendation for action by management based upon your analysis. Remember, case studies describe real-world business situations. There is typically more than one course of action that can be taken. It is not important to discover which particular action will eventually be taken as it is to learn to provide a recommendation based on financial principles and solid analysis. I strongly encourage you to read the section “Note to the Student: How to Study and Discuss Cases” in the textbook “Cases in Finance: Managing for Corporate Value Creation” by Robert F. Bruner (pages xxv-xxxi). Equally useful is the author’s note on “Ethics in Finance” (pages xxxii-xlvii). 3 Grading Procedures and Policies • Course Grade: The course grade will be determined by your class participation, two written case examinations, and a case presentation. The grade composition is as follows: Class Participation Case Examinations Case Presentation 45% 40% 15% Case examinations: Each case examination will comprise 20% of your total grade. These will be take-home examinations and the examination cases will be made available in the Business Library at appropriate times during the semester, or in the alternative through the Finance or MSF office. A completed case analysis shall be no more than five double-spaced typewritten pages. Exhibits are not included in the five-page limit. Students who speak English as their native language will have 7 (or more) hours to complete the examination, beginning from the time they pick up the case. Non-native English speakers will have 8 (or more) hours Detailed instructions on how to take the case examinations will be discussed in class. The Business Library’s hours for the spring 2011 semester are: M-Th 8:30am-9pm Fr 8:30am-5pm Sa Closed Su 1pm-9pm Upon completing the case exam, students must print the following pledge on the back of their case analysis: “On my honor as a University of Illinois student I have neither given nor received unauthorized aid on this exam, and I have limited the time spent on this case to seven (eight) hours”. Please print your name and date the pledge was made and sign your name below the pledge, which affirms the credibility of your pledge. Your name should NOT appear elsewhere on the paper. Please do not miss other classes when you are writing the exam. The first case examination will be taken on an individual basis. The second case examination will be taken on a team basis with each team composed of four students. If there aren’t enough students in the course for each team to have four members, then I will facilitate the formation of teams as the situation develops. I would like you to form teams of four and inform me of each team’s members by February 3. In the second case examination, each team member will receive the grade assigned to the submitted team report. In addition, each of you will be 4 asked to rank your fellow team members in terms of their effort and contribution to the case analysis. Participation grades: The quality of your class participation will be graded each day on a scale of zero to three points. Participation grades will be based on the following criteria: o 0 points: No participation or observations o 1 point: Contributes relevant information or facts, asks critical questions concerning the discussion in class, reading assignments and responses to comments of classmates o 2 points: Provides an interpretation of relevant information and/or facts that is based on analysis and, in turn, advances the discussion to other related topics o 3 points: Provides contributions that leads the discussion to a significantly higher level of thought; or presents an analysis and interpretation of the relevant information that results in a solution to the case You are encouraged to work independently in preparing the case. However, it will be very helpful to form a study group in order to discuss your analysis and interpretation of each case, which will help you to more effectively prepare for class. Each student is permitted to have NO MORE THAN TWO excused absences throughout the semester. Please notify me of your absence before the specific date either in person or by email. Case Presentation: In addition to working together on the second case examination, each team will be asked to present one of the cases listed on the syllabus. The purpose of this presentation is to enable you to practice your presentation skills. This presentation should be treated as taking place in front of the firm’s board of directors (or senior management). You will be asked to present one of the cases covered during the period February 24 – April 7. Those of you not presenting on a specific day will play the role of a member of the board of directors (or senior manager) and are expected to participate through questions and during the case discussion. Thus, your participation in those discussions will be graded as in any other class. Teams must select the case that they would like to present by February 10. More information on the selection process will be provided later. Teams will prepare their presentations in consultation with me. I will provide guidelines and suggestions to help you with the preparation of your presentation. • Office Hours: My office hours are listed on the first page of the syllabus. These hours are especially allocated for the benefit of the students in this course. Please 5 feel free to come to my office without an appointment during these hours. If you cannot stop by my office during these hours, please feel free to ask me for an appointment for another time, either by talking to me after class or by sending me an email. I also encourage you to come to my office hours with questions, comments or suggestions related to the course that you might have. Academic Integrity From the University statement on your obligation to maintain academic integrity: “If you engage in an act of academic dishonesty, you become liable to severe disciplinary action. Such acts include cheating; falsification or invention of any information or citation in an academic endeavor; helping or attempting to help others commit academic infractions; plagiarism; offering bribes, favors or threats; academic interference; computerrelated infractions; and failure to comply with such regulations” Rule 33 of the Code of Policies and Regulations Applying to All Students gives complete details of rules governing academic integrity for all students. Students are responsible for knowing and abiding by these rules. Disability Accommodation To ensure that disability-related concerns are properly addressed from the beginning, students with disabilities who require reasonable accommodations to participate in this class are asked to see me as soon as possible. 6 COURSE SCHEDULE (Background reading material is from the textbook “Applied Corporate Finance” by Aswath Damodaran. As needed, additional relevant background material will be distributed in the form of class notes.) DATE CASE ASSIGNMENT Jan. 18 TOPIC BACKGROUND READING Course Introduction Jan. 20 FEDEX vs. UPS Value creation and economic profit Ch. 2 Financial Statement Analysis Jan. 25 Krispy Kreme Doughnuts, Inc. Financial statement analysis Financial Statement Analysis Jan. 27 Deutsche Brauerei (part I) Financial forecasting and growth Financial Statement Analysis and Financing Growth Feb. 1 Deutsche Brauerei (part II) Financial forecasting and growth Financial Statement Analysis and Financing Growth Feb. 3 The Boeing 7E7 (part I) Submit Team Names Corporate capital costs Ch. 3, 4 Case 13 from text Feb. 8 The Boeing 7E7 (part II) Corporate capital costs Ch. 3, 4 Case 13 from text Feb. 10 Teletech Corporation, 2005 Select Case to be Presented Business segments and risk-return trade-offs Ch. 3,4 Feb. 14-21 First Case Examination Feb. 22 Discuss First Case Examination Feb. 24 Target Corporation Multifaceted capital investment decisions Ch. 5 Mar. 1 Victoria Chemicals (A) Relevant cash flows Ch. 5, 6 7 Mar. 3 Victoria Chemicals (B) Mutually exclusive investment opportunities Ch. 5, 6 Mar. 8 Euroland Foods S.A. Strategic Resource Allocation Ch. 6 Mar. 10 JetBlue Airways IPO Valuation Initial public offering for a young firm Ch. 7 Mar. 15 Purinex, Inc. Financing the earlystage high-growth firm Ch. 7 Mar. 17 California Pizza Kitchen Optimal leverage Ch. 7, 8 Case 31 from text March.19-March 26th Spring Break Mar. 29 Deluxe Corporation Financial flexibility Ch. 7, 8 Case 31 from text Mar. 31 Gainesboro Machine Tools Dividend and stock buyback decisions Ch. 10, 11 Apr. 5 The Wm. Wrigley Jr. Company Leveraged restructuring Ch. 7, 8 Apr. 7 Flinder Valves and Controls Inc. Valuing the enterprise for sale Ch. 12 Case 41 from text Apr. 12 TBA ERM or other topic Class Notes Apr. 14 TBA ERM or other topic Class Notes Apr. 19 Hostile Takeovers: A Primer for the Decision Maker Contests for control Apr. 21 April 25-May 2 General Electric’s Evaluating an Proposed Acquisition of arbitrage position Honeywell Second Case Examination 8 Case 48 from text 9