Balance sheet management

advertisement

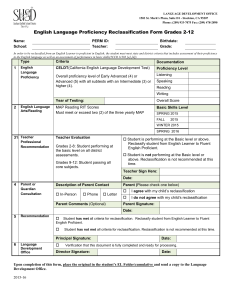

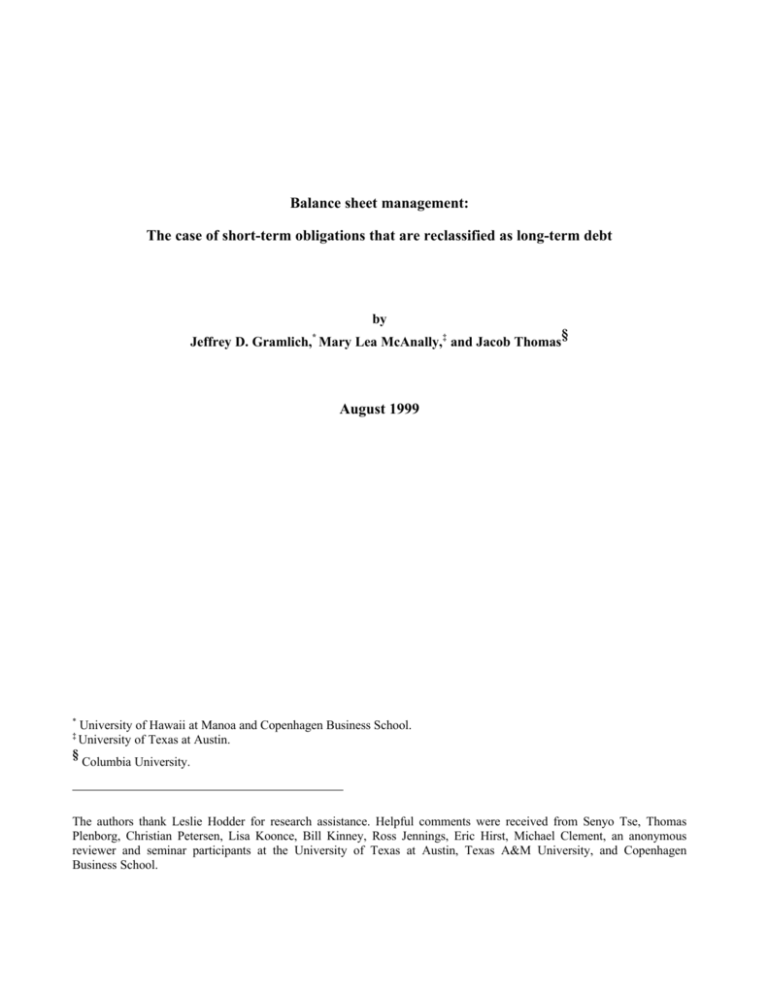

Balance sheet management: The case of short-term obligations that are reclassified as long-term debt by § Jeffrey D. Gramlich, Mary Lea McAnally,‡ and Jacob Thomas * August 1999 * University of Hawaii at Manoa and Copenhagen Business School. University of Texas at Austin. § Columbia University. ‡ The authors thank Leslie Hodder for research assistance. Helpful comments were received from Senyo Tse, Thomas Plenborg, Christian Petersen, Lisa Koonce, Bill Kinney, Ross Jennings, Eric Hirst, Michael Clement, an anonymous reviewer and seminar participants at the University of Texas at Austin, Texas A&M University, and Copenhagen Business School. 1. Introduction We examine a possible form of balance sheet management: the initial reclassification of certain short- term obligations, primarily commercial paper, as long-term debt, and the subsequent declassification of those items when they are returned to the current liability section of the balance sheet. (For this purpose, “reclassification” occurs when a firm includes some short-term obligations in the long-term liability section of the balance sheet; “declassification” occurs when a firm no longer reclassifies in a year when it did reclassify the year before.) Under Statement of Financial Accounting Standard No. 6 (SFAS 6) firms may reclassify part or all of their short-term obligations as long-term debt, provided the firm states its intent to roll over such obligations on a long-term basis and can demonstrate its ability to do so. Ability is in evidence when the firm secures from its bank a non-cancelable loan commitment that extends beyond the following fiscal year-end. The firm is then permitted to reclassify the short-term obligations as longterm debt.1 Why firms would undertake such a strategy is not immediately clear because reclassification has no impact on aggregate measures of assets, liabilities, or equity, although it increases both reported liquidity and reported leverage.2 While considerable research has examined why and how firms manage their income statements, 3 much less attention has been paid to balance sheet management.4 Even less is known about the incentives to manage liquidity and the classification of debt between current and long-term. Consequently, we do not present formal hypotheses in this paper. Rather, we report a previously undocumented financial reporting practice and propose two plausible explanations for the phenomenon. Perhaps further research will produce a theoretical understanding of this financial reporting practice. We examined a sample of 197 firms that reclassified short-term obligations to long-term during 1984 to 1994 and discovered that reported current ratios for reclassifying firms are increased to the extent that they are statistically indistinguishable from 1) the level in the year prior to the reclassification, and 2) the industry median current ratio.5 Long-term debt ratios are increased by reclassification, but not by enough to always make reclassifiers appear more leveraged than their industry peers. We also find that when firms subsequently declassify, their current ratios before the effects of reclassification are higher than in 1 the previous year and greater than for other firms in their industry. The declassification moves current ratios down to time-series and industry norms. Similar, but weaker, patterns exist for leverage levels in the years firms cease reclassifying. Additionally, we discovered that firms with current ratio or working capital debt covenants are more likely to reclassify. This holds even after controlling for profitability, liquidity, and leverage. Tests also show that reported covenant violations are less frequent among reclassifying firms than among other firms in the sample. The empirical regularities we document lead us to propose two explanations for reclassification. First, firms that reclassify are trying to meet inter-temporal and/or cross-sectional liquidity targets. In an environment characterized by exogenous shocks to liquidity and information asymmetry, a firm may choose to manage its reported level of liquidity to avoid reporting lows or highs that could be misconstrued by external constituents.6 Managers may perceive that some financial statement users rely on the balance sheet alone for an assessment of liquidity, perhaps because users perform analyses with quantitative electronic databases where contextual (i.e. footnote) information is not readily accessible. Such users include, for example, financial analysts who calculate time-series trends, make inter-company comparisons, and often use benchmarks in performing ratio analysis. Second, reclassifying firms may be close to violating a current ratio or working capital debt covenant. Duke and Hunt [1990] and Press and Weintrop [1990] document that working capital measured using balance sheet numbers is a construct often specified in debt contracts. Reclassification provides a means to move a critical covenant ratio thereby avoiding costly renegotiations or debt default. Conversations with audit partners revealed that they would not only approve reclassification as a means to effect balance sheet management, but would recommend it to clients facing debt-covenant violations. 2. Data Using the NAARS database, we identified 220 firms that reclassified short-term debt during the 1984 to 1994 period. If a firm had a reclassification at any point during the 11-year window, we collected short 2 and long-term debt footnotes for the entire period. We gathered other financial statement information from Compustat. Our final sample contains 197 firms (1765 firm-years). Debt footnotes were read and coded to obtain information on reclassification. We also searched for the terms associated with supporting loan commitments or lines of credit and debt covenant information, as well as violations thereof. A firm-year was coded as a reclassification if commercial paper, notes or other items of debt maturing within the following year were classified as long-term pursuant to the “intent and ability” paragraph of SFAS 6. A firm-year was coded as a declassification if the firm ceased reclassifying all amounts during the year. Interestingly, most declassifying firms continued to use shortterm obligations as financing after declassification, choosing, however, to include the short-term obligations in the current liability section of the balance sheet. Exhibit 1 provides an example of reclassification disclosure taken from Form 10K. Using Compustat data, we calculated industry benchmarks for liquidity and leverage measures. Each firm’s benchmark is the prior year’s median ratio for the size quartile and the 2-digit SIC group to which the firm belongs. Our use of industry benchmarks is motivated by recent empirical results that report increasing industry specialization among financial analysts, and the superior performance of those who specialize (Clement [1999]). Our design was also influenced by the result in Lev [1969] which suggests that firms’ financial ratios adjust across time toward the previous year’s industry averages. Among the six financial ratios Lev examines, the quick and current ratios exhibit the fastest and most significant adjustments toward industry averages. 3. Empirical Findings Over the 1984-94 sample period, half the firm-years have short-term obligations reclassified as long- term, and reclassification lasted five years on average. The size of reclassified liabilities is substantial for firms that reclassify: on average, 29.1 percent of long-term debt consists of reclassified current obligations and the amount reclassified averages $329 million. In the years they reclassify, reclassifying 3 firms are on average larger, more leveraged, less liquid, and more profitable than sample firms in their non-reclassifying years.7 3.1 UNIVARIATE COMPARISON AGAINST PRIOR YEARS Figure 1 shows the mean current ratio with and without the effects of SFAS 6 reclassification.8 Initial reclassifiers (Panel A) would have experienced a significant decline in their current ratio absent a reclassification. The mean current ratio is 1.20 before the effects of reclassification compared to a ratio of 1.50 after the reclassification. In fact, in the three years prior to initial reclassification, firms experience a steady decline in their current ratio. On the other hand, declassifiers’ current ratio strengthens considerably in the year of the declassification (Panel B). It is not empirically possible to estimate what the current ratio would have been had the firm not declassified so we compare the ratios for the current and prior year, absent reclassification. Before the effects of reclassification, the prior year’s current ratios averaged 1.21 and was increased to 1.53 by reclassification. In the declassification year, the current ratio is 1.47 without any benefits of reclassification. This suggests that declassification was strategically timed to occur when the current ratio was increasing. Tables 1 and 2 present annual statistics on the impact of reclassification and declassification.9 The “reported” ratios use the current liability number reported on the firm’s balance sheet, i.e. after the reclassification. The “adjusted” ratios are recalculated ratios, where the reclassified amounts are returned to the current debt section. These tables statistically compare: 1) the reported and adjusted ratios, 2) the change from the previous year in adjusted and reported ratios, and 3) the differences between the reported and adjusted ratios. In addition, Table 1 compares the changes in reported and adjusted ratios between reclassifying firms and their industry benchmark measures. For the moment, we focus on the time-series comparison, saving the industry comparison for later. In this regard, annual changes in reported current ratios are insignificant for most years whereas changes in adjusted current ratios are large and negative 4 (see Table 1, Panel A, test 2). Thus, the effects shown in Figure 1 appear consistently in each year of the sample period. By definition, reclassification increases both the current ratio and the long-term debt ratio and over the sample period, these increases are statistically significant (p<.001). The effect of reclassification is to increase mean current ratio by 0.32 and increase mean long-term debt ratio by 0.06.10 After considering the effect of reclassification, reported current ratios are not significantly different from the prior year when no reclassification occurred. Without the reclassification, however, current ratios would have declined on average, by 0.34 (p<.001). In contrast, while reported long-term debt ratios increase in the initial year of reclassification, after undoing the effects of the reclassification, less long-term debt was indicated than the year before. Thus, the leverage effect of initial reclassification is mitigated by a real decline in long-term debt (see Table 1, Panel B, test 2). Similar to reclassification, declassification appears to be driven by a desire to smooth the current ratio and the long-term debt ratio. Table 2, Panel A shows that in the year of declassification, reported current ratios are not statistically different from the prior year, although adjusted current ratios increase by a mean of 0.26 (p<.001). In the declassification year, adjusted long-term debt ratios increased by mean of 0.03 (p<.001) and reported long-term debt ratios decreased by a mean of 0.03 (p<.001). (See Table 2, Panel B.) Indeed, if smoothing ratios is an objective, declassification also appears to be driven by firms smoothing the current ratio, not the long-term debt ratio, and fundamental increases in the long-term debt ratio absorb some of the decrease caused by declassification. 3.2 UNIVARIATE COMPARISON AGAINST INDUSTRY PEERS Table 1, Panel A (test 3) reports the mean difference between a firm’s current ratio and its industry benchmark. Reclassifiers’ reported current ratio is statistically equivalent to the industry benchmark in every year except 1990. Thus, from a comparison of the firms’ balance sheets, reclassifiers are at the industry norm. But when the reclassifiers’ adjusted current ratios are compared to the industry benchmark, big differences emerge. In eight of the 10 years studied, the reclassifiers’ adjusted current 5 ratios were lower than the industry benchmarks by a significant amount. We conclude that reclassifiers are comparatively less liquid, as indicated by lower current ratios, in their initial year of reclassification but that reclassification obscures the difference. The fourth test on Table 1, Panel A, shows that these lower current ratios arise from fundamental declines in adjusted current ratios during the year prior to initial reclassification (see test 2), but that these fundamental declines did not occur for the industry benchmark firms. The effects of initial reclassification on long-term debt are summarized in Table 1, Panel B. Test 1 shows that reclassification significantly impacted long-term debt ratios (p<.001). Test 2 indicates that reported long-term debt ratios increased relative to the previous year as a result of reclassification (p<.001) while adjusted long-term debt ratios decreased (p<.05). Apparently, a fundamental decline in long-term debt ratios helped reclassifiers absorb the increased reported leverage arising from reclassification. Test 3 shows that, prior to the reclassification, reclassifying firms were less leveraged overall than their industry benchmarks, and test 4 reveals that this lower leverage arose, at least in part, from declines in the long-term debt ratio in the year preceding initial reclassification. The subsequent declassification decision appears to be timed to coincide with strengthening liquidity. Without considering the reclassification in the prior year, the current ratio would have increased in every year except 1990 (see Table 2, Panel A). Shifting short-term obligations back to the current liability section of the balance sheet decreased the current ratio (relative to what would have been reported if the firm continued to reclassify), but the decrease is not significant (see test 1) nor is it endemic to the industry (see test 3). From Table 2, Panel B we see that adjusted long-term debt ratios were increasing among declassifiers (test 1, column 3) and that declassification gives the opposite impression (test 1, column 2). After declassification, reported long-term debt ratios are not statistically different from the industry benchmarks (Table 2, Panel B, test 2). However, test 3 reveals that declassifiers’ reported longterm debt ratios declined slightly; the non-parametric test of medians is significant, but the parametric test of means is not. If declassifying firms had not reclassified in the previous year, their long-term debt ratios would have increased (p<.01). 6 To summarize, declassification resulted in smoothing the current ratio across time and relative to industry benchmark firms. Further, declassification, which has the effect of decreasing long-term debt ratios, appears to have been timed to occur in years when long-term debt ratios were increasing. 3.3 MULTIVARIATE ANALYSES To explore what factors jointly affect the reclassification decision, we estimated multivariate logistic regressions. Independent variables included levels and year-over-year changes in liquidity, leverage, and profitability where all the variables are defined to exclude the effects of reclassification. Our findings, not presented in detail here, are significant: the models correctly predict between 74 and 90 percent of the reclassification and declassification decisions represented by the sample firm-years. Estimated coefficients reveal that the smaller a firm’s current ratio and the larger the decrease in the current ratio before the effects of reclassification, the more likely the firm is to reclassify. In addition, firms are more likely to reclassify when current liabilities are high but long-term liabilities are low. Profitability is not associated with either the reclassification or the declassification decisions. When liquidity and leverage variables are defined relative to industry benchmarks (to test for crosssectional smoothing), current ratio and changes in current ratio remain the most significant factors in the reclassification and declassification decisions. Interestingly, leverage becomes much more significant for declassifiers, consistent with the notion that these firms smooth to industry norms but not to time-series targets. We estimated ordinary least squares regressions and determined that the dollar amount of reclassified short-term obligations is negatively related to liquidity, leverage, and profitability. We tested both the time-series and the cross-sectional smoothing models and the results were largely the same. Measures of R2 range from .25 to .35, and the coefficients of interest are highly significant. Firms appear to make considered choices in both the reclassification decision as well as the dollar amount reclassified. 7 3.4 DEBT COVENANTS AND RECLASSIFICATION Although 36 percent of the firm-years in our sample disclosed current ratio or working capital covenants, few of these were quantified. Tests of means showed that reported and adjusted current ratios of firms disclosing working capital or current ratio covenants were significantly higher than those of firms that did not disclose such covenants. Frequency tables revealed that a higher proportion of these firms reclassified than statistically expected. We performed logistic and OLS regressions and included dummy variables for the existence of liquidity based constraints, and find that firms with such covenants are significantly more likely to reclassify (and reclassify greater dollar amounts) after controlling for profitability, liquidity and leverage. We also included in the regressions a dummy variable to capture debt covenant violations reported in the debt footnote. In the logit and OLS regressions, the violations variable was not significant. However, when the OLS regressions were re-run on the sub-sample of firms whose footnotes mentioned current ratio or working capital covenants, we found a strong negative association of violation with the amount reclassified. Thus, firms whose footnotes reported liquidity-based covenants, but not covenant violations, reclassified more short-term obligations as long-term debt. One possibility is that these firms effectively used reclassification to avoid covenant violations. 4. Conclusion We find that both reclassification and declassification have the effect of smoothing liquidity and leverage measures reported on the balance sheet. Short-term obligations reclassified as long-term debt smooth liquidity measures in a time-series and cross-sectional sense. Initial reclassifications are associated with deteriorating current ratios when measured against last year’s level or against an industry benchmark. Repeat reclassifiers report smooth, but low, liquidity ratios during the term of their reclassification. It appears that firms time their declassification to coincide with strengthened liquidity ratios: declassifying firms’ current ratios are improving prior to the declassification and the declassification smoothes liquidity measures in a time-series sense. 8 Leverage is increasing prior to declassification. Long-term debt ratios are increasing in the year of declassification even after the short-term obligations are taken out of long-term debt and declassification smoothes long-term debt ratios toward industry benchmarks. We also find that reported violations of restrictive current ratio or working capital-based debt covenants are negatively associated with reclassification. Reclassification may have been successfully used to avoid violations of such covenants. Our study provides further evidence of management's tendency to intervene in the financial reporting process but more study is required to understand the underlying motivations for such intervention. We do not know why firms reclassify debt, but they do engage in this behavior, it is not random, and the dollar amounts are substantial. The use of reclassification does not preclude other forms of balance sheet or income statement management. In this vein, further research is needed to understand the interplay between reclassification and other management techniques, including accrual manipulation and accounting policy shifts. Future research might also address issues such as why managers are motivated to reclassify, what other forms of financial statement management substitute or complement reclassification, how users perceive the reclassification and whether those perceptions have economic impact on equity prices and or bond ratings. 9 REFERENCES AMIR, E., AND A. ZIV. “Recognition, Disclosure, or Delay: Timing the Adoption of SFAS No. 106.” Journal of Accounting Research. (Spring 1997): 61-81. CLEMENT, M., “Analyst Forecast Accuracy: Do Ability, Resources, and Portfolio Complexity Matter?” Journal of Accounting and Economics. (forthcoming). DUKE, J.C., AND H.G. HUNT. “An Empirical Examination of Debt Covenant Restrictions and Accounting-Related Debt Proxies.” Journal of Accounting and Economics. (January 1990): 45-63. FINANCIAL ACCOUNTING STANDARDS BOARD. “Statement of Financial Accounting Standards No. 6: Classification of Short-term obligations Expected to be Refinanced.” (1975). HEALY, P. “The Effects of Bonus Schemes on Accounting Decisions.” Journal of Accounting and Economics. (April 1985): 85-107. HOPKINS, P.E. “The Effect of Financial Statement Classification of Hybrid Financial Instruments on Financial Analysts' Stock Price Judgments.” Journal of Accounting Research. (Supplement 1996): 33-50. IMHOFF, E., AND J.K. THOMAS. “Economic Consequences of Accounting Standards: The Lease Disclosure Rule Change.” Journal of Accounting and Economics. (December 1988): 277-310. JONES, J.J. “Earnings Management During Import Relief Investigations.” Journal of Accounting Research. (Autumn 1991): 193-228. LEV, B. “Industry Averages as Targets for Financial Ratios.” Journal of Accounting Research. (Autumn 1969): 290-299. MOHR, R.M. “Unconsolidated Finance Subsidiaries: Characteristics and Debt/Equity Effects.” Accounting Horizons. (March 1988): 27-34. PRESS, E.G. AND J. WEINTROP “Accounting-based constraints in public and private debt agreements: Their association with leverage and impact on accounting choice.” Journal of Accounting and Economics. (1990): 65-95. SCHIPPER, K. “Commentary on Earnings Management.” Accounting Horizons. (1989) 91-102. WATTS, R.L. AND J.L. ZIMMERMAN. “Positive Accounting Theory: A Ten Year Perspective.” The Accounting Review. (January 1990): 131-156. WEISS, I. “Earnings Management in Response to an Exogenous Non-Recurring Item.” Working paper, University of Chicago, 1999. 10 Exhibit 1 Except from a 10K Financial Statement Footnote That Reports Declassification of Amounts Previously Reclassified H J HEINZ COMPANY APR 29, 1992 6. Long-Term Debt Range of Interest Maturity (Fiscal Year) Commercial paper Variable Eurodollar bonds 7½% Revenue bonds 4 - 11¾% Promissory notes 6½ - 12% Other 7¼ - 8¾% 1992 1997 1993-2016 1993-2003 1993-1998 1992 1991 75,000 34,584 31,085 9,231 149,900 $ 437,696 75,000 67,428 24,188 6,889 611,201 144,258 294,158 115,770 $ 178,388 234,329 845,530 128,593 $ 716,937 United States dollars: (in thousands) $ Foreign Currencies Total long-term debt Less portion due within one year In 1992, the company modified its domestic commercial paper backup credit lines. At year-end 1992, such credit lines totaled $ 1,180 million and expire nine to twelve months after year-end unless otherwise extended. At the end of 1991, such credit lines totaled $ 590 million and were cancellable only after 390 days written notice. The effect of the modification to the credit lines is that commercial paper supported by such credit lines, which was classified as long-term debt at year-end 1991, is now classified as short-term debt. Consequently, as of April 29, 1992, the company had $1,064.2 million of domestic commercial paper classified as short-term debt, whereas, as of May 1, 1991, the company had $ 437.7 million of domestic commercial paper classified as long-term debt. 11 Figure 1 Effects of Reclassification and Declassification on Mean Current Ratios Panel A: Effect of initial reclassification on mean current ratio reported across time for 128 firms that reclassified in the current year and did not reclassify in the three prior years. 2.0 Effect of SFAS 6 adjustment 1.5 Current ratio 1.0 Current ratio before SFAS 6 adjustment 0.5 0.0 Three years prior Two years prior Prior year Current year 0 0 0 0.30 1.63 1.62 1.52 1.20 Effect of SFAS 6 adjustment Current ratio before SFAS 6 adjustment Panel B: Effect of declassification on mean current ratio reported across time for 47 firms that declassified in the current year and reclassified in the three prior years. 2.0 Current ratio 1.5 Effect of SFAS 6 adjustment 1.0 Current ratio before SFAS 6 adjustment 0.5 0.0 Three years prior Two years prior Prior year Current year Effect of SFAS 6 adjustment 0.47 0.43 0.32 0 Current ratio before SFAS 6 adjustment 1.20 1.11 1.21 1.47 12 Table 1 Univariate Tests of Reclassification Effect on Balance Sheet Ratios Panel A - Current Ratio Tests (1) (2) (3) (4) Effects of Reclassification on Current Ratio, Year-to-Year Changes in Reported and Adjusted Current Ratios, Differences in Current Ratios Between Reclassification Firms and Industry Benchmarks, and Differences in Year-to-Year Changes in Current Ratios Between Reclassification Firms and Industry Benchmarks Test: ——————(1)—————— ————(2)———— —————(3)————— Difference in Current Initial-Year Reclassification Firms Year N 1985 22 1986 19 Reported Adjusted Current Current b c Ratio Ratio 1.75 1.41 1.34 1.09 Reclass d Effect *** 0.41 *** 0.32 -0.02 -0.35 *** -0.14 ** 0.23 1.54 1.29 0.25 1988 13 1.50 1.25 0.25 1989 18 1.65 1.26 0.39 ** Change from Previous Year in Adjusted Current f Ratio *** -0.43 * -0.67 Reclass Firms’ Reported And Industry gh Benchmark 0.05 -0.18 Current Ratio Between: Reclass Firms’ Adjusted And Industry gi Benchmark ** -0.37 -0.01 Reclass Firms’ Adjusted And Industry gk Benchmark *** -0.43 *** -0.29 -0.61 *** -0.01 -0.27 ** -0.02 -0.26 ** * -0.50 *** -0.15 -0.42 -0.39 *** -0.20 -0.45 -0.16 0.04 -0.31 -0.32 Reclass Firms’ Reported And Industry gj Benchmark * ** ** 0.24 -0.12 ** 0.11 -0.31 0.20 -0.20 0.12 -0.26 ** 0.00 -0.22 1990 18 1.67 1.25 0.42 1991 10 1.50 1.29 0.22 ** -0.16 0.11 -0.13 0.12 -0.21 0.00 -0.34 ** -0.17 -0.36 ** 0.02 -0.17 * 0.23 -0.01 *** 0.02 -0.30 *** 0.02 -0.19 -0.29 *** -0.03 -0.22 1.57 1.24 0.33 1993 13 1.30 1.11 0.19 1.37 1.13 0.24 1985-94 149 1.56 1.23 0.32 medians 1.36 1.11 0.24 * ** 0.09 0.04 16 * * *** 1992 5 Change from Previous Year in Reported Current e Ratio -0.07 15 Differences in Changes of Ratios Between: *** 1987 1994 a ————— (4) ————— 0.21 -0.03 -0.09 -0.32 *** -0.02 -0.34 *** -0.02 -0.34 *** -0.03 -0.24 *** -0.09 ** -0.32 ** * *** *** Means are reported for each year. Both means and medians are reported for the overall sample period. * ** *** , , and denote statistically significant differences from zero at the .05, .01, and .001 levels, respectively (two-tailed t-test for means and Wilcoxon sign-rank test for medians). (See notes following Panel B of this table.) 13 Table 1 Continued Univariate Tests of Reclassification Effect on Balance Sheet Ratios Panel B - Long-Term (LT) Debt Ratio Tests (1) (2) (3) (4) Effects of Reclassification on Long-Term Debt Ratios, Year-to-Year Changes in Reported and Adjusted Long-Term Debt Ratios, Differences in Long-Term Debt Ratios Between Reclassification Firms and Industry Benchmarks, and Differences in Year-to-Year Changes in Long-Term Debt Ratios Between Reclassification Firms and Industry Benchmarks Test: ——————(1)—————— ————(2)———— —————(3)————— ————— (4) ————— Difference in Long-Term Initial-Year Reclassification Firms Reported Adjusted LT Debt LT Debt b c Ratio Ratio Reclass d Effect Year N 1985 22 0.22 0.14 0.08 1986 19 0.30 0.23 0.07 0.07 ** -0.00 * -0.01 * -0.02 * -0.01 ** 0.04 -0.02 0.04 *** 0.07 ** 0.08 0.01 0.04 -0.03 0.06 0.05 -0.02 0.03 -0.03 0.09 -0.03 ** 0.03 -0.02 0.02 -0.03 0.03 -0.03 ** 0.03 -0.03 0.01 -0.06 *** 0.01 -0.02 -0.02 -0.06 0.06 16 0.21 0.14 0.07 1993 13 0.20 0.16 0.04 0.23 0.18 0.06 0.25 0.18 0.06 *** *** 0.05 ** *** *** 1992 0.18 -0.01 * -0.04 -0.06 0.05 0.23 * Reclass Firms’ Adjusted And Industry gk Benchmark ** 0.04 0.17 medians 0.05 -0.00 0.22 1985-94 149 -0.04 0.00 10 5 0.06 * -0.01 1991 1994 0.01 ** * Reclass Firms’ Reported And Industry gj Benchmark 0.05 0.06 0.18 ** Reclass Firms’ Adjusted And Industry gi Benchmark 0.05 0.05 0.20 0.24 0.04 LT Debt Ratio Between: ** 0.19 0.26 18 -0.02 0.08 0.24 1990 ** Difference in Changes of ** 13 0.22 Reclass Firms’ Reported And Industry gh Benchmark *** 15 0.29 Debt Ratios Between: Change from Previous Year in Adjusted LT Debt f Ratio 0.06 1988 18 Change from Previous Year in Reported LT Debt e Ratio *** 1987 1989 a ** 0.05 *** 0.05 *** 0.04 ** -0.01 * -0.01 *** -0.02 0.03 *** 0.03 ** 0.01 * 0.05 ** 0.03 -0.03 *** -0.04 *** -0.04 * ** -0.03 * -0.01 * -0.01 *** -0.01 *** -0.02 0.05 0.05 0.03 * *** Means are reported for each year. Both means and medians are reported for the overall sample period. * ** *** , , and denote statistically significant differences from zero at the .05, .01, and .001 levels, respectively (two-tailed t-test for means and Wilcoxon sign-rank test for medians). a Reclassification firm years occur when a firm reclassifies short-term obligations to long-term in the current year but does not do so in the previous year. b Current (long-term debt) ratio is the ratio of current assets to current liabilities (long-term debt to total assets). c Adjusted current (long-term debt) ratio is reported current (long-term debt) ratio, without the effect of reclassification of short-term obligations to long-term. d Reported current (long-term debt) ratio less adjusted current (long-term debt) ratio. e Reported current (long-term debt) ratio for the current year, less reported current (long-term debt) ratio for the previous year. f Adjusted current (long-term debt) ratio for the current year, less adjusted current (long-term debt) ratio for the previous year. g Industry benchmarks are the median current (long-term debt) ratios of the firms in the respective two-digit SIC industry classification. h Reclassification firms’ reported current (long-term debt) ratio, less the respective reported industry benchmark current (long-term debt) ratio. i Reclassification firms’ adjusted current (long-term debt) ratio, less the respective reported industry benchmark current (long-term debt) ratio. j Reclassification firms’ change from previous year’s reported current (long-term debt) ratio, less the respective change in reported industry benchmark current (long-term debt) ratio. k Reclassification firms’ change from previous year’s adjusted current (long-term debt) ratio, less the respective change in reported industry benchmark current (long-term debt) ratio. 14 Table 2 Univariate Tests of Declassification Effect on Balance Sheet Ratios Panel A - Current Ratio Tests (1) (2) (3) Effect of Current-Year Declassification on the Year-to-Year Change in Current Ratio, Differences in Current Ratios Between Declassification Firms and Industry Benchmarks, and Differences in Year-to-Year Changes in Current Ratios Between Declassification Firms and Industry Benchmarks (1) Test: Declassification Firms Change from Previous Year in Reported Reported Current Current b c Ratio Ratio (2) Differences in Current Ratios Between: a Change From Previous Year in Adjusted Current d Ratio Year N 1985 14 1.81 0.12 0.48 1986 9 1.84 0.27 0.66 Declass Firms’ Reported And Industry ef Benchmark (3) Differences in Changes of Current Ratios Between: Declass Firms’ Reported And Industry eg Benchmark Declass Firms’ Adjusted And Industry eh Benchmark ** -0.07 0.12 0.47 * 0.20 0.25 0.60 * ** * * 1987 12 1.60 -0.08 0.22 -0.20 -0.03 0.25 1988 13 1.43 0.00 0.25 -0.11 0.07 0.31 1989 11 1.76 -0.12 0.31 -0.09 0.06 0.47 1990 11 1.37 -0.32 -0.10 -0.20 -0.23 -0.02 -0.02 0.20 * * *** ** ** *** 1991 18 1.41 -0.03 0.20 -0.19 1992 13 1.26 -0.27 0.05 -0.25 -0.38 -0.04 * -0.13 -0.02 0.26 * -0.12 0.05 0.25 *** -0.11 ** -0.12 1993 12 1.50 0.06 0.38 1994 11 1.56 0.02 0.25 1985-94 124 1.54 1.37 -0.03 -0.02 medians * ** 0.26 *** 0.21 * -0.01 -0.01 * * *** 0.27 *** 0.21 Means are reported for each year. Both means and medians are reported for the overall sample period. * ** *** , , and denote statistically significant differences from zero at the .05, .01, and .001 levels, respectively (two-tailed t-test for means and Wilcoxon sign-rank test for medians). (See notes following Panel B of this table.) 15 Table 2 Continued Univariate Tests of Declassification Effect on Balance Sheet Ratios Panel B - Long-Term Debt Ratio Tests (1) Effect of Current-Year Declassification on the Year-to-Year Change in Long-Term Debt Ratio, (2) Differences in Long-Term Debt Ratios Between Declassification Firms and Industry Benchmarks, and (3) Differences in Year-to-Year Changes in Long-Term Debt Ratios for Declassification Firms and for Industry Benchmarks (1) Test: (2) Differences in Long-Term Debt Ratios Between: a Year Initial-Year Declassification Firms Change Change from From Previous Previous Reported Year in Year’s Long-Term Reported Adjusted Debt L-T Debt L-T Debt b c d N Ratio Ratio Ratio 1985 14 1986 1987 9 12 0.19 0.24 0.20 * -0.03 0.00 * -0.04 * Declass Firms’ Reported And Industry ef Benchmark 0.03 0.02 * 0.07 0.02 0.01 -0.04 (3) Differences in Changes of Long-Term Debt Ratios Between: Declass Firms’ Reported And Industry eg Benchmark Declass Firms’ Adjusted And Industry eh Benchmark * 0.01 * 0.03 * -0.02 -0.05 -0.04 -0.06 1988 13 0.20 -0.02 0.02 0.10 0.10 0.15 1989 11 0.25 -0.04 0.02 0.01 -0.02 0.04 1990 11 0.24 0.00 0.04 * 0.04 0.00 0.04 1991 18 0.21 -0.03 * -0.01 -0.03 0.03 * * -0.01 -0.07 -0.06 * 0.06 0.04 -0.03 0.03 * -0.01 0.02 -0.02 0.01 0.01 0.00 -0.02 *** -0.03 0.03 *** 0.02 1992 13 0.16 -0.06 1993 12 0.21 -0.04 1994 11 0.21 -0.04 1985-94 124 0.21 0.21 -0.03 *** -0.02 medians 0.03 *** * *** 0.03 *** 0.02 *** * * -0.01 ** Means are reported for each year. Both means and medians are reported for the overall sample period. * ** *** , , and denote statistically significant differences from zero at the .05, .01, and .001 levels, respectively (two-tailed t-test for means and Wilcoxon sign-rank test for medians). a Declassification firm-years occur when a firm reclassifies short-term obligations to long-term in the previous year but does not do so in the current year. b Current (long-term debt) ratio is the ratio of current assets to current liabilities (long-term debt to total assets). c Mean reported current (long-term debt) ratio for the current year, less mean reported current (long-term debt) ratio for the previous year. d Mean reported current (long-term debt) ratio for the current year, less mean reported “adjusted” current (long-term debt) ratio for the previous year. (Adjusted current and long-term debt ratios for the previous year are computed without the effect of that year’s reclassification of short-term obligations to long-term.) e Industry benchmarks are the median current (long-term debt) ratios of the firms in the respective two-digit SIC industry classification. f Declassification firms’ reported current (long-term debt) ratio, less the respective reported industry benchmark current (long-term debt) ratio. g Declassification firms’ change from previous year’s reported current (long-term debt) ratio, less the respective change in reported industry benchmark current (long-term debt) ratio. h Declassification firms’ change from previous year’s adjusted current (long-term debt) ratio, less the respective change in reported industry benchmark current (long-term debt) ratio. 16 1 Based on discussions with auditors and CFOs, we assume that firms have considerable freedom when choosing to reclassify and declassify; i.e., they can elect to either pass or fail the ability requirements, and their expressed intent is hard to contest. 2 For discussion purposes, we define liquidity measures as relating to current assets and current liabilities either as a ratio or as a difference. We use the term leverage to mean the ratio of long-term debt to total assets. 3 For example, see Healy [1985], Jones [1991], Schrand and Walther [1997], and Weiss [1999]. For reviews, see Schipper [1989] and Watts and Zimmerman [1990]. 4 Prior research has shown that firms seek to keep long-term debt off the balance sheet, either because it affects financial statement users’ perceptions of how risky the firm is or because contractual obligations are specified in terms of book leverage; for example, Amir and Ziv [1997] consider SFAS 106 OPEB obligations, Imhoff and Thomas [1988] consider capitalization of leases, and Mohr [1988] considers consolidation of finance subsidiaries. 5 As noted later, our test sample was matched with a control sample on the basis of both firm size and industry membership. 6 Recent empirical evidence shows that balance sheet classifications within the debt section can have real effects on financial analysis and valuation judgments (Hopkins [1996]). 7 Total assets average $5.1 billion for reclassifying firm-years versus $3.8 billion for non-reclassifying firm-years, the mean ratio of debt-to-total assets is 0.27 for reclassifiers and 0.22 for non-reclassifiers, and current ratio averages 1.46 for reclassifiers and 1.59 for non-reclassifiers. Complete descriptive statistics for the sample are available from the authors. 8 Figure1, Panel A (Panel B) represents the three-year pattern in current ratios for firms that reclassify (declassify) in the current year and that also did not (did) reclassify in the prior three years. Because of the requirement for three consecutive years of non-reclassification (reclassification), Figure 1 reflects fewer observations than in the subsequent Tables. 9 Annual statistics are reported to demonstrate that both reclassification and declassification effects are relatively evenly distributed across the entire sample period, and that in each case the directions of the differences are the same as the overall sample differences. Medians are reported in order to demonstrate that the mean effects are not driven by outliers;. exceptions are noted when they occur. 10 Current ratios are generally larger than long-term debt ratios. Consequently, reclassification appears to have a larger impact on the current ratio than on the long-term debt ratio. In other words, one should not compare the magnitudes of the current ratio effects of reclassification and declassification with the size of long-term debt ratio effects. 17