columbia variable portfolio – income opportunities fund

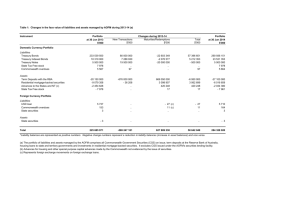

advertisement