16-23 1. Detail tie-in 2. Detail tie-in 3. a. Existence b. Accuracy c

16-23 1. Detail tie-in c. Realizable value (if cash receipts relate to older accounts) c. Realizable value (if cash receipts relate to older accounts)

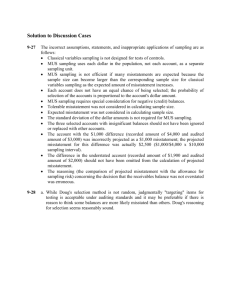

16-27 a. Ordinarily, a shipment is considered a sale when it is shipped, picked up, or delivered by a common carrier.

b.

INVOICE NO.

SHIPPING

DOCUMENT

NO.

MISSTATEMENT

IN SALES CUTOFF

OVERSTATEMENT OR

UNDERSTATEMENT OF

AUG. 31 SALES

August sales

4326

4329

4327

4328

4330

September sales

4332

4331

4333

4335

4334

2164

2169

2165

2168

2166

2163

2167

2170

2171

2172 none

1,914.30 none

620.22 none

2,534.52

4,641.31

106.39 none none none

4,747.70

2,213.18 overstatement overstatement understatement understatement

Adjusting entry

Accounts receivable

Sales

2213.18

2213.18

c. After making the type of cutoff adjustments shown in part b, current year sales would be overstated by:

2168

2169

2170

2171

2172

Amount of sale

620.22

1,914.30

852.06

1,250.50

646.58

5,283.66

The best way to discover the misstatement is to be on hand on the balance sheet date and record in the audit working papers the last shipping document issued in the current period. d. The following procedures are usually desirable to test for sales cutoff.

1. Determine the shipping document number for the last shipment made in the current year. Record that number in the working papers.

2. During year-end field work, select a sample of shipping documents preceding and succeeding those selected in procedure 1.

3. During year-end field work, select a sample of sales from the sales journal recorded in the last few days of the current period, and a sample of those recorded for the first few days in the subsequent period. e. The following are effective controls and related tests of controls to help prevent cutoff misstatements.

CONTROL

(1) Prenumbered shipping documents.

(2) Policy requiring the issuance of shipping documents sequentially.

(3) Record sales invoices in the same sequence as shipping documents.

(4) Policy requiring dating of shipping documents, immediate recording of sales, and dating sales on the same date as the shipment.

(5) Use of perpetual inventory records and reconciliation of differences between physical and perpetual records.

TEST OF CONTROL

Examine documents for prenumbering.

Observe issuance of documents, examine document numbers and inquiry.

Observe recording of documents, examine document numbers and inquiry.

Observe dating of shipping documents and sales invoices, and timing of recording.

Examine worksheets reconciling physical counts and perpetual records.

24-27 a. A contingent liability is a potential future obligation to an outside party for an unknown amount resulting from activities that have already taken place. The most important characteristic of a contingent liability is the uncertainty of the amount; if the amount were known it would be included in the financial statements as an actual liability rather than as a contingency. b. Audit procedures to learn about these items would be as follows:

The following procedures apply to all three items:

Discuss with management and obtain appropriate written representations.

Review the minutes of directors' and stockholders' meetings.

Analyze legal expense.

Obtain letters from all major attorneys.

The following are additional procedures for individual items:

Lawsuit Judgment - no additional procedures; see above list of procedures applicable to all three items.

Stock

Confirm details of stock transactions with registrar and transfer agent.

Review records for unusual journal entries subsequent to year- end.

Guarantee

Discuss, specifically, any related party transactions with management and include information in letter of representation.

Review financial statements of affiliate, and where related party transactions are apparent, make direct inquiries of affiliate management, and perhaps even examine records of affiliate if necessary. c. Nature of adjusting entries or disclosure, if any, would be as follows:

1. The lawsuit should be described in a footnote to the balance sheet. A current liability will be set up as soon as a final decision is rendered or if an agreement as to damages is reached.

2. The declaration of such a dividend does not create a liability that affects the aggregate net worth in any way. No entry is necessary, but an indication of the action taken, and that such a transfer will subsequently be made, should be shown as a footnote or as a memorandum to Retained Earnings and Common Stock in the balance sheet.

3. If payment by Newart is uncertain, the $3,750 interest liability for the period June 2 through December 1, 2007, could be reflected in the Marco Corporation's accounting records by the following entry:

Interest Payments for Newart Company $3,750

Accrued Interest Payable - Newart Bonds $3,750

The the balance sheet should be footnoted to the effect that the

Marco Corporation is contingently liable for future interest payments on Newart Company bonds in the amount of $60,000.

If the interest has been paid by the time the audit is completed , or if for other reasons it seems certain that the payment will be made by Newart on January 15, no entry should be made by

Marco. In this circumstance a footnote disclosing the contingent liability of $63,750 and the facts as to the $3,750 should be included with the statements.

24-28 a. 3 - c. 1 - d. 2 - g. 4 - h. 2 -

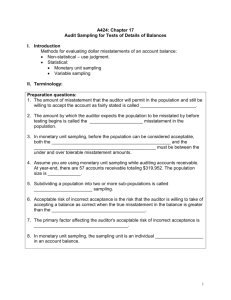

17-28 a.

Excel command: =RANDBETWEEN(1,207295)

NOTE: Random dollar items are matched with population item numbers where the cumulative book value of the population includes the random dollar selected. b.

Interval = Number of items selected

=

10

Using 1857 as a starting point, we have:

SYSTEMATIC

DOLLAR

1

2

3

4

5

6

7

8

9

10

1,857

22,586

43,315

64,044

84,773

105,502

126,231

146,960

167,689

188,481

POPULATION

ITEM NO.

2

6

8

8

15

20

26

30

30

35

NOTE: Systematic dollar items are related to population item numbers in the same manner as for part a above.

c. All items larger than the interval will be automatically included.

The same is not necessarily true for random number selection, but the probability is high. d. There is no significant difference in ease of selection between computer generation of random numbers and systematic selection. e. Monetary unit sampling would be used because (1) it is efficient and (2) it focuses on large dollar items.

17-29 a.

Items 2 and 7 are not misstatements, but only timing differences.

ITEM

RECORDED

VALUE

AUDITED

VALUE

1

3

4

5

$2,728.00

3,890.00

791.00

548.00

$2,498.00

1,190.00

815.00

1,037.00

6 3,115.00 3,190.00

Upper misstatement bound before adjustment:

NO. OF

MISSTATE-

MENTS

RECORDED

VALUE x CUER

PORTION x

MISSTATE-MENT

$ 230.00

2,700.00

(24.00)

(489.00)

(75.00)

MISSTATE-

MENT %

ASSUMPTION

MISSTATE-MENT/

RECORDED VALUE

.084

.694

(.030)

(.892)

(.024)

=

MIS-STATE-MENT

BOUND

1.000

.694

.084

$45,425

21,930

2,323

$69,678

0

1

$1,975,000

1,975,000

.023

.016

2 1,975,000 .014

.053

Lower misstatement bound before adjustment:

NO. OF

MISSTATE-

MENTS

RECORDED

VALUE x CUER

PORTION x

0

1

2

3

$1,975,000

1,975,000

1,975,000

1,975,000

.023

.016

.014

.013

.066

MISSTATE-

MENT %

ASSUMPTION

1.000

.892

.030

.024

=

MIS-

STATE-MENT

BOUND

$45,425

28,187

830

616

$75,058

Adjustment of upper misstatement bound:

Point estimate for understatement amounts =

sum of misstatement percents x recorded value / sample size

= (.892 + .030 + .024) x (1,975,000 / 100)

= .946 x 19,750

Adjusted bound = initial bound - point estimate for understatement amounts

= 69,678 - 18,684

Adjustment of lower misstatement bound:

Point estimate for overstatement amounts = sum of misstatement percents x recorded value/sample size

= (.694 + .084) x (1,975,000 / 100)

= .778 x 19,750

Adjusted bound = initial bound - point estimate for overstatements

= 75,058 - 15,366

b. The population is not acceptable as stated because both the lower misstatement bound and upper misstatement bound exceed materiality.

In this situation, the auditor has the following options:

Segregate specific type of misstatement and test it separately (for the entire population). The sample would then not include the specified type of misstatement since it is being tested separately.

2. Increase the sample size.

3. Adjust the account balance (i.e., propose an adjustment).

4. Request the client to review and correct the population. refuses to correct the problem.

6. Consider the criteria used in the test, possibly in connection with additional audit work in areas outside of accounts receivable.

Segregating these items, testing cutoff more extensively, and eliminating them from the sample would result in the following bounds

:

Upper misstatement bound:

NO. OF

MISSTATE-

MENTS

RECORDED VALUE x CUER

PORTION x

MISSTATE-

MENT %

ASSUMPTION

=

MIS-

STATE-

MENT

BOUND

0

1

$1,975,000

1,975,000

.023 1.000

.016

.039

.084

Less adjustment [(.030 + .024) (19,750)]

$45,425

2,654

$48,079

(1,067)

$47,012

Lower misstatement bound:

NO. OF

MISSTATE-

MENTS

RECORDED VALUE X CUER

PORTION x

MISSTATE-

MENT %

ASSUMPTION

0

1

2

$1,975,000

1,975,000

1,975,000

.023 1.000

.016

.014

.053

.030

.024

Less adjustment [(.084) (19,750)]

=

MIS-

STATE-

MENT

BOUND

$45,425

948

664

$47,037

(1,659)

$45,378