CH14_II

advertisement

Chapter 14

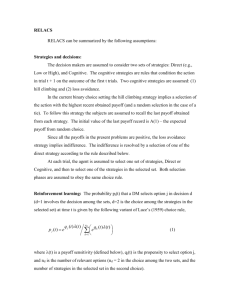

Option Market – Part II

Call Options Payoffs and Profits

at Expiration

Payoff to call holder (buyer)

max {ST – X, 0}

Payoff to call writer (seller)

- max {ST – X, 0}

Profit to call holder

max {ST – X, 0} - Premium

Profit to Call Writer

Premium - max {ST – X, 0}

5/9/2006

FIN3710 - Investment - Professor Rui Yao

2

1

Payoff Profiles for Calls

Profit

OTM

ITM

Call Holder

0

Stock Price

at time T

X

Call Writer

5/9/2006

FIN3710 - Investment - Professor Rui Yao

3

Profit/Loss Profiles for Calls

Profit

Call Holder

OTM

ITM

C

0

Stock Price

at time T

X

-C

Call Writer

Stock Price

5/9/2006

FIN3710 - Investment - Professor Rui Yao

4

2

Put Options Payoffs and Profits

at Expiration

Payoff to put holder (buyer)

max {X - ST, 0}

Payoff to put writer (seller)

- max {X - ST, 0}

Profit to put holder

max {X - ST, 0} - Premium

Profit to put Writer

Premium - max {X - ST, 0}

5/9/2006

FIN3710 - Investment - Professor Rui Yao

5

Payoff Profiles for Puts

Profits

ITM

OTM

Put Holder

0

X

Stock Price

at time T

Put Writer

5/9/2006

FIN3710 - Investment - Professor Rui Yao

6

3

Profit/Loss Profiles for Puts

Profits

ITM

OTM

Put Writer

P

0

Stock Price

at time T

X

-P

Put Holder

Stock Price

5/9/2006

FIN3710 - Investment - Professor Rui Yao

7

Put-Call Parity Relationship

ST < X

ST > X

0

ST - X

Payoff for

Holding a Call

Payoff for

Writing A Put

- (X - ST)

Total Payoff

ST - X

5/9/2006

FIN3710 - Investment - Professor Rui Yao

0

ST - X

8

4

Payoff of a Long Call and A Short Put

Payoff

Long Call

Combined Payoff

X

Stock Price

Short Put

-X

5/9/2006

FIN3710 - Investment - Professor Rui Yao

9

Payoff of a Leverage Equity

Payoff

Long Stock

Combined Payoff

X

-X

5/9/2006

Stock Price

Short Bond

FIN3710 - Investment - Professor Rui Yao

10

5

Put-Call Parity

We can replicate the payoff from a long call

and a short put by:

¾

¾

Long 1 share of stock today and hold it to T;

Borrow a margin loan in the amount of X / (1 + rf)T

Since the payoff on a long call and a short put

are equivalent to leveraged equity, the prices

must be equal today:

C - P = S0 - X / (1 + rf)T

If the prices are not equal, arbitrage will be

possible

5/9/2006

FIN3710 - Investment - Professor Rui Yao

11

An Example – Put Call Parity Arbitrage

Q:

A:

Stock Price = 110

Call Price = 17

Risk Free = 5%

Put Price = 5

Maturity

= 1 yr Strike Price = 105

Is there any arbitrage opportunity?

C - P > S0 - X / (1 + rf)T

17- 5 > 110 - (105/1.05)

12 > 10

Arbitrage opportunity:

¾

¾

The leveraged equity is less expensive

Buy (long) the low cost portfolio and sell (short) the high cost

alternative

5/9/2006

FIN3710 - Investment - Professor Rui Yao

12

6

An Example – Put-Call Parity Arbitrage

Position

Immediate

Cashflow

Buy Stock

-110

Cashflow in Six Months

ST <105

ST > 105

ST

ST

Borrow

X/(1+r)T = 100 +100

-105

-105

Sell Call

+17

0

Buy Put

-5

Total

2

-(ST - 105)

105 - ST

0

0

5/9/2006

0

FIN3710 - Investment - Professor Rui Yao

13

Option Strategy I – Protective Put

Long stock + Long (ATM) put

¾

Pay put premium for downside protection

Payoff from

A Protective put

Payoff from

Long a stock

X

P/L from

Holding stock

ST

P/L from

A Protective put

X

- S0

X

-P

X

Payoff from

Long a put

X

5/9/2006

ST

ST

FIN3710 - Investment - Professor Rui Yao

14

7

Option Strategy II – Covered Call

Long stock + short (sell / write) call

¾

Sacrifice upside potential for call premium

Covered Call

Write a call

Payoff at T

X

ST

payoff

X

profit

Payoff at T

X

Long a stock

C-S0

ST

X

5/9/2006

ST

FIN3710 - Investment - Professor Rui Yao

15

Option Strategy III - Straddle

Long call and put with same strike price

¾

Benefit from big jumps in stock prices

Payoff at T

Long Dec 160 call

X=160

ST

X

Straddle

X-P-C

Long Dec 160 Put

X

X

5/9/2006

X

ST

ST

FIN3710 - Investment - Professor Rui Yao

16

8

Wrap-up

Payout and P/L for holders and sellers of

put or call options

Put-call parity

Three option strategies

¾

¾

¾

Protective put

Covered call

Straddle

5/9/2006

FIN3710 - Investment - Professor Rui Yao

17

9