Talking Numbers - Department of Finance

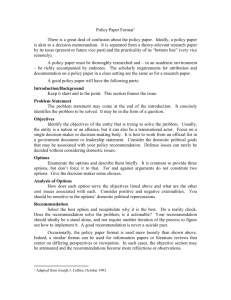

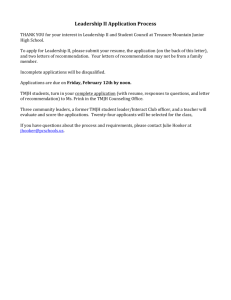

advertisement