BUS-49, Policy For Cash and Cash Equivalents Received

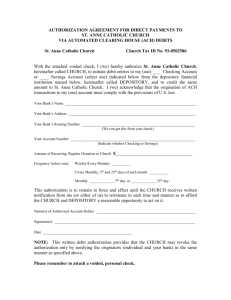

advertisement