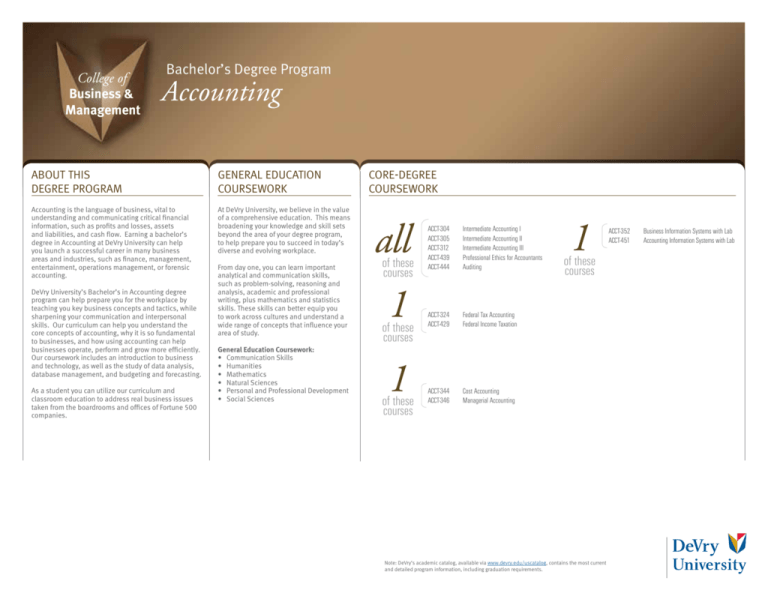

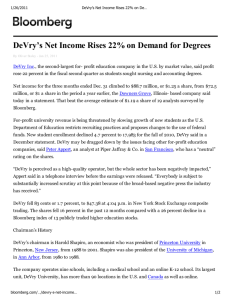

College of

Business &

Management

Bachelor’s Degree Program

Accounting

about this

degree program

general education

coursework

Accounting is the language of business, vital to

understanding and communicating critical financial

information, such as profits and losses, assets

and liabilities, and cash flow. Earning a bachelor’s

degree in Accounting at DeVry University can help

you launch a successful career in many business

areas and industries, such as finance, management,

entertainment, operations management, or forensic

accounting.

At DeVry University, we believe in the value

of a comprehensive education. This means

broadening your knowledge and skill sets

beyond the area of your degree program,

to help prepare you to succeed in today’s

diverse and evolving workplace.

DeVry University’s Bachelor’s in Accounting degree

program can help prepare you for the workplace by

teaching you key business concepts and tactics, while

sharpening your communication and interpersonal

skills. Our curriculum can help you understand the

core concepts of accounting, why it is so fundamental

to businesses, and how using accounting can help

businesses operate, perform and grow more efficiently.

Our coursework includes an introduction to business

and technology, as well as the study of data analysis,

database management, and budgeting and forecasting.

As a student you can utilize our curriculum and

classroom education to address real business issues

taken from the boardrooms and offices of Fortune 500

companies.

From day one, you can learn important

analytical and communication skills,

such as problem-solving, reasoning and

analysis, academic and professional

writing, plus mathematics and statistics

skills. These skills can better equip you

to work across cultures and understand a

wide range of concepts that influence your

area of study.

General Education Coursework:

• Communication Skills

• Humanities

• Mathematics

• Natural Sciences

• Personal and Professional Development

• Social Sciences

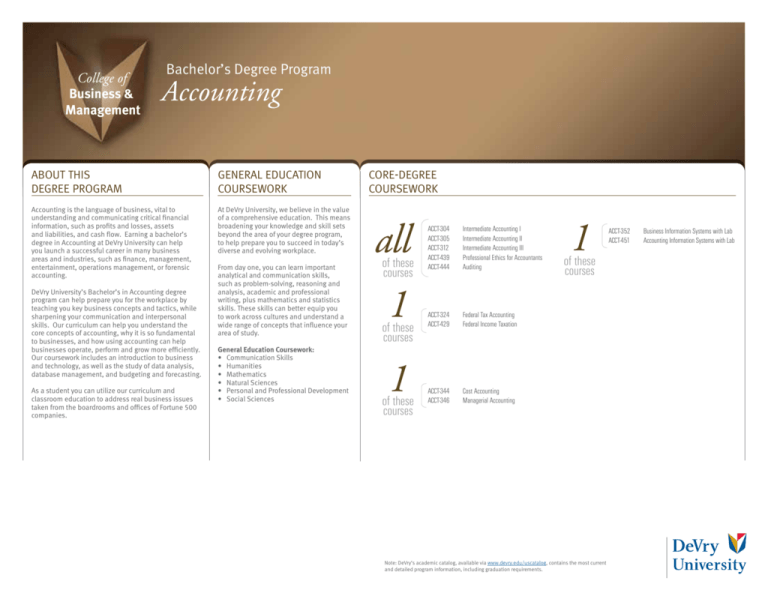

core-degree

coursework

all

of these courses

1

of these courses

1

of these courses

ACCT-304

ACCT-305

ACCT-312

ACCT-439

ACCT-444

Intermediate Accounting I

Intermediate Accounting II

Intermediate Accounting III

Professional Ethics for Accountants

Auditing

ACCT-324

ACCT-429

Federal Tax Accounting

Federal Income Taxation

ACCT-344

ACCT-346

Cost Accounting

Managerial Accounting

1

of these courses

Note: DeVry’s academic catalog, available via www.devry.edu/uscatalog, contains the most current

and detailed program information, including graduation requirements.

ACCT-352

ACCT-451

Business Information Systems with Lab

Accounting Information Systems with Lab

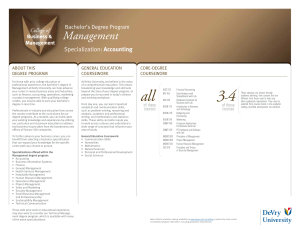

Bachelor’s Degree Program

College of

Business &

Management

Accounting

careers in

accounting

knowledge

and skills

A degree in accounting can be the gateway to a wide variety of careers in industries ranging from

technology and business to entertainment and hospitality. Accountants not only handle business

functions like bookkeeping, payroll and billing, they can also be involved in purchasing, forensic

analysis, financial management and can be an important part of the team guiding a company to

greater growth and success.

Financial Accounting 2 — Understand financial

foundations, including asset recognition and

measurement; external reporting; accounting for income

taxes, pensions and other post-retirement benefits;

shareholders’ equity, share-based compensation and

earnings per share; accounting changes and error

correction; and statements of cash flow.

By earning a bachelor’s degree in Accounting from DeVry University you can have a strong

foundation in accounting and economics, as well as a thorough understanding of business

technology, government laws and regulations, and even business administration and

management. This knowledge can help you handle the accounting needs of many different

types of both large and small businesses.

Graduates of DeVry University’s Bachelor’s in Accounting degree program may consider careers

including:

• Financial Examiner

• Budget Analyst

• Financial Manager

• Claim Examiner

• Purchasing Agent

• Cost Estimator

• Purchasing Manager

• Credit Analyst

According to the U.S. Department of Labor, employment of accountants and auditors is projected

to grow by 22 percent. “An increase in the number of businesses, changing financial laws and

corporate governance regulations, and increased accountability for protecting an organization’s

stakeholders will drive job growth.” Furthermore, growth in employment of financial analysts,

which is also a potential career option for someone with an accounting degree, is projected 20

percent during the 2008-18 decade, which is much faster than the average for all occupations.

“Primary factors for this growth are increasing complexity and global diversification of investments

and growth in the overall amount of assets under management.”1

Auditing 2 — Examine the principles, practices and

procedures used by public accountants for certifying

corporate financial statements.

Accounting Information Systems 2 —

Learn to design, install, operate and manage an

integrated, automated accounting system, including

ledgers, transaction process cycles, application controls,

information security requirements and business

information systems integration.

Federal Income Taxation 2 — Understand business

models such as sole proprietorships, s-corporations

and limited-partnerships, as well as the federal taxation

concepts that apply to them, including income inclusions

and exclusions; property transactions; capital gains and

losses; and tax credits.

Financial Advising 3 — Advise clients in areas such

as compensation, employee health care benefits, the

design of accounting or data processing systems, or longrange tax or estate planning.

did you know?

DeVry University, its Keller Graduate School of Management and Becker Professional Education can

provide you with a Fast Track to a career in Accounting. In as few as 5 years, you can earn a bachelor’s

degree, a master’s degree, and prepare to take the CPA Exam. This path can save you 2 years, 7 courses

and over $10,000 in tuition.

career-focused

coursework

3

of these

courses

all

of these

courses

2-3

of these courses

ACCT-349

ACCT-405

ACCT-424

ACCT-440

BUSN-420

Advanced Cost Accounting

Advanced Accounting

Federal Tax Accounting II

Accounting Research

Business Law

ACCT-461

Accounting Senior Project

Additional required courses: at least 6 semestercredit-hours from any course listed above, provided

prerequisites are satisfied. Some elective hours may

need to be used to meet specialized requirements,

to satisfy pre-requisites for courses in the core or

selection, and/or to meet specific state accountancy

board requirements.

Critical Thinking 3 — Use logic and reasoning

to identify the strengths and weaknesses of alternative

solutions, conclusions or approaches to problems.

Mathematical Reasoning 3 — Use mathematical

formulas to solve problems or project outcomes.

Judgment and Decision-Making 3 — Consider the

relative costs and benefits of potential actions to choose

the most appropriate one.

In New York, DeVry University operates as DeVry College of New York. DeVry

University is accredited by The Higher Learning Commission (HLC), www.ncahlc.org. DeVry is

certified to operate by the State Council of Higher Education for Virginia. DeVry University is

authorized for operation by the THEC. www.state.tn.us/thec. Nashville Campus – 3343 Perimeter

Hill Dr., Nashville, TN 37211. Program availability varies by location. AC0060. ©2014 DeVry

Educational Development Corp. All rights reserved. Version 7/7/14

For comprehensive consumer information, visit devry.edu/ba

Bureau of Labor Statistics, U.S. Department of Labor, Occupational Outlook Handbook, 2010-11 Edition, Accountants

and Auditors, on the Internet at www.bls.gov/oco/ocos001.htm (visited February 8, 2012).

DeVry University, on the internet at www.devry.edu/degree-programs/college-business-management/accounting-about.jsp.

3 O*NET OnLine, Accountants, on the Internet at www.online.onetcenter.org/link/summary/13-2011.01 (visited February 8, 2012).

1 2 Visit DeVry.edu or call 888.DEVRY.04