Argus DeWitt

Benzene and Derivatives

Issue 15-32 Thursday 6 August 2015

Highlights

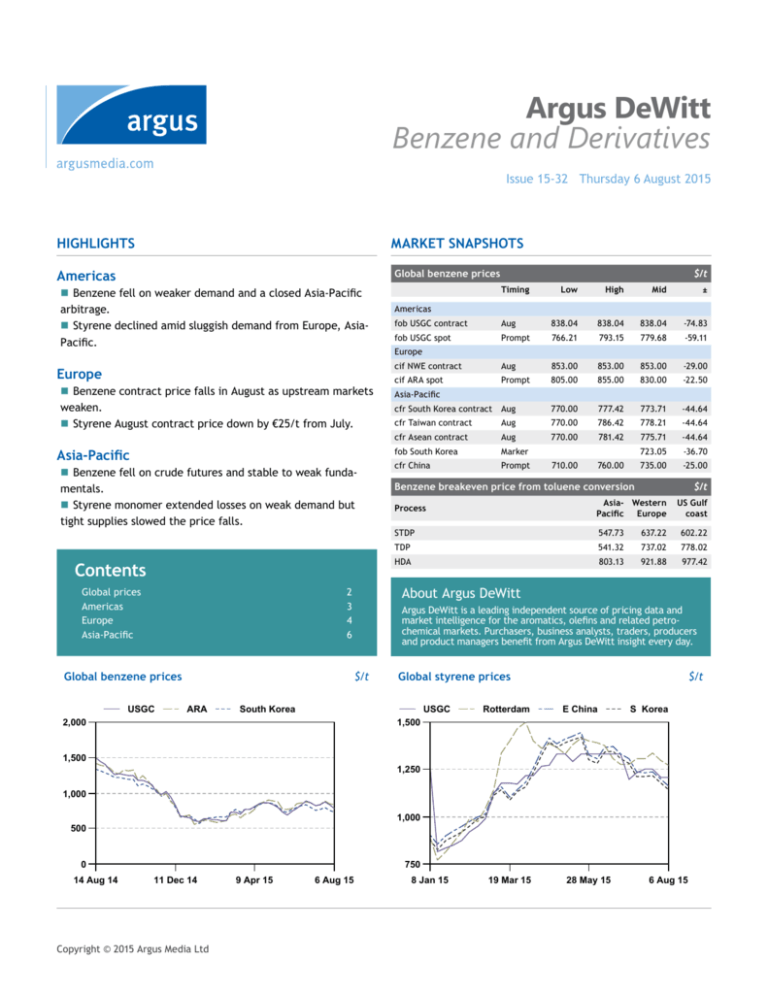

Market snapshots

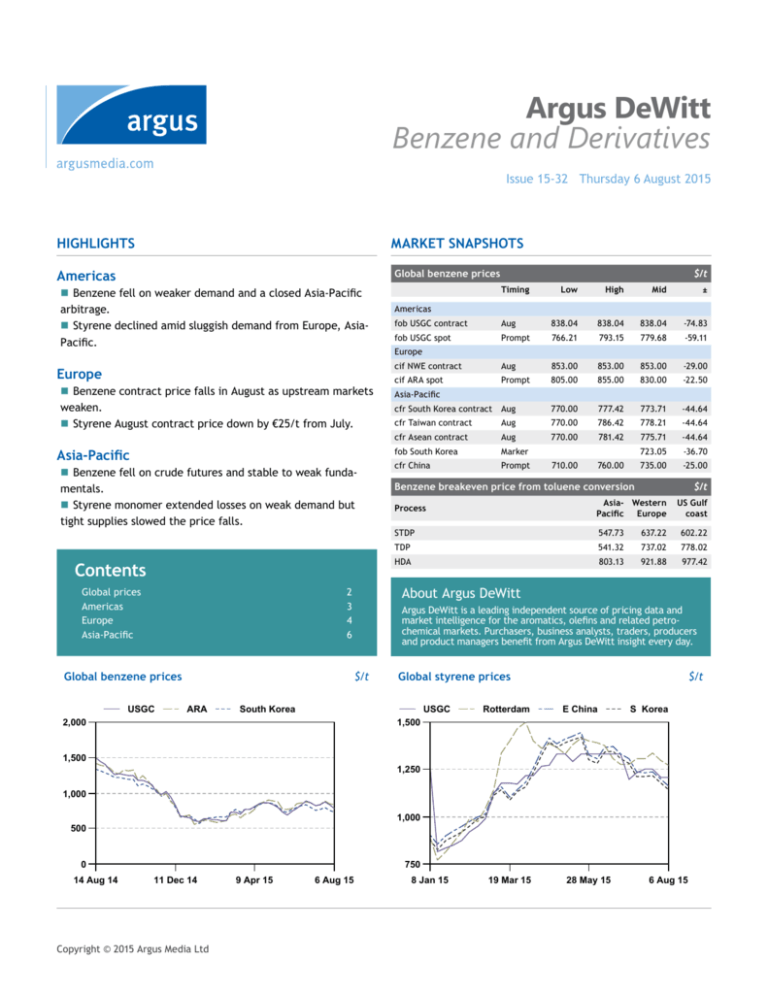

Global benzene prices

Americas

Benzene fell on weaker demand and a closed Asia-Pacific

arbitrage.

Styrene declined amid sluggish demand from Europe, AsiaPacific.

Europe

Benzene contract price falls in August as upstream markets

weaken.

Styrene August contract price down by €25/t from July.

Asia-Pacific

Benzene fell on crude futures and stable to weak fundamentals.

Styrene monomer extended losses on weak demand but

tight supplies slowed the price falls.

Contents

Global prices

Americas

Europe

Asia-Pacific

USGC

Mid

±

Americas

fob USGC contract

Aug

838.04

838.04

838.04

-74.83

fob USGC spot

Prompt

766.21

793.15

779.68

-59.11

Europe

cif NWE contract

Aug

853.00

853.00

853.00

-29.00

cif ARA spot

Prompt

805.00

855.00

830.00

-22.50

cfr South Korea contract

Aug

770.00

777.42

773.71

-44.64

cfr Taiwan contract

Aug

770.00

786.42

778.21

-44.64

770.00

781.42

775.71

-44.64

Asia-Pacific

cfr Asean contract

Aug

fob South Korea

Marker

cfr China

Prompt

710.00

723.05

-36.70

735.00

-25.00

Asia- Western

Pacific

Europe

US Gulf

coast

760.00

Benzene breakeven price from toluene conversion

Process

$/t

STDP

547.73

637.22

602.22

TDP

541.32

737.02

778.02

HDA

803.13

921.88

977.42

Global styrene prices

South Korea

USGC

2,000

Rotterdam

$/t

E China

S Korea

1,500

1,500

1,250

hhh

1,000

hhh

1,000

500

0

14 Aug 14

High

Argus DeWitt is a leading independent source of pricing data and

market intelligence for the aromatics, olefins and related petrochemical markets. Purchasers, business analysts, traders, producers

and product managers benefit from Argus DeWitt insight every day.

$/t

ARA

Low

About Argus DeWitt

2

3

4

6

Global benzene prices

$/t

Timing

750

11 Dec 14

Copyright © 2015 Argus Media Ltd

9 Apr 15

6 Aug 15

8 Jan 15

19 Mar 15

28 May 15

6 Aug 15

Argus DeWitt Benzene and Derivatives

Issue 15-32 Thursday 6 August 2015

Global Prices

$/t

cif ARA spot

fob USGC spot

779.68

830.00

u

u

fob South Korea

USGC benzene premium to USGC gasoline

¢/USG

723.05

u

Global naphtha prices

250

600

200

550

$/t

500

150

hhh

100

450

hhh

400

50

87M gasoline = 0

350

21 May

0

4 Sep

25 Nov

19 Feb

14 May

6 Aug

ARA benzene premium to NWE naphtha

Singapore

$/t

800

600

600

hhh

200

Naphtha 65 Para NWE

6 Aug

USGC

400

$/t

hhh

200

NWE naphtha = 0

Benzene = 0

0

14 Aug 14

13 Jul

South Korea styrene premium to benzene

800

400

17 Jun

0

11 Dec 14

Copyright © 2015 Argus Media Ltd

9 Apr 15

6 Aug 15

4 Sep 14

Page 2 of 9

25 Nov 14

19 Feb 15

14 May 15

6 Aug 15

Argus DeWitt Benzene and Derivatives

Issue 15-32 Thursday 6 August 2015

Americas

Americas prices

Benzene

The August benzene contract price settled 25¢/USG lower at

280¢/USG on 31 July. After the contract settlement, spot prices weakened with very little volume traded. With many market participants away on summer holiday, and general negative

sentiment in energy markets, most remained sidelined for

much of the week. The price of August ddp barrels trended

lower with energy prices, falling from 265¢/USG on 3 August

down to 256¢/USG on 5 August. September barrels traded at a

very slight discount to August, but the level of backwardation

diminished. Lower Mississippi River discussions resumed at

the typical 2-3¢/USG premium to their ddp Houston/Texas City

counterparts for both the front and forward months.

Octane demand in the US has been extraordinary this year.

According to the EIA, year-over-year gasoline demand is 3.2pc

higher, but still just 0.2pc above the ten-year average. Premium gasoline demand is 12.2pc higher and 14.5pc above its

10-year average. Premium gasoline now accounts for 10.8pc

of total gasoline supplied. Furthermore, an abundance of

low octane naphtha required additional octane to blend it

away into the motor gasoline pool. Light naphtha discounts to

gasoline widened to unprecedented levels, enabling blenders

to pay more for high octane blendstocks.

These trends boosted demand for high-octane reformate,

and, and one would expect supplies of co-product benzene

from reformate extraction as well. AFPM statistics released

last week partly disproved that theory. According to the AFPM’s report that published petrochemical production statistics

through June, year-over-year benzene production from reformate was just 2.6pc higher and total domestic benzene output

actually declined by 0.3pc, or -9,000t. High cost toluene led

to sharp reductions in conversion rates offset the increased

production from reformate extraction.

Meanwhile, benzene demand from styrene increased by

20,000 t or 1.1pc, cumene by 60,000t or 6.0pc and aniline by

29,000t or 7.8pc.

Imports balanced the market. An examination of trade on

a benzene equivalent, which measures traded volumes on a

contained benzene basis, the US imported 1.225mn t, which

represents a year-over-year increase of 209,000t. Over the

same period, the US exported 835,000t, which represents an

increase of 119,000t. Through May, the US increased its net

import position by 90,000t.

Roughly 70,000t of benzene was heard exported from

Copyright © 2015 Argus Media Ltd

Timing

Low

High

Mid

±

Benzene ¢/USG

fob USGC contract

Aug

280.00

280.00

280.00

-25.00

fob USGC spot

Prompt*

256.00

265.00

260.50

-19.75

+8.00

Styrene ¢/lb

fob USGC contract

Jul

64.50

66.00

65.25

fob USGC spot

Prompt*

54.43

55.11

54.77

0.00

fob USGC VWA

Jul

55.98

0.00

USGC large buyer index

Jul

53.64

-0.15

Cumene formula ¢/lb

fob USGC contract

Jul

36.67

36.67

36.67

+2.67

Aug

70.50

73.50

72.00

-3.00

fob USGC contract

Aug

273.00

273.00

273.00

-20.60

Marker with NG escalator

Aug

255.00

255.00

255.00

-20.90

Phenol ¢/lb

fob USGC contract

Cyclohexane ¢/USG

*Prompt refers to current month, but if the publication date is on or after the 15th

of a given month, then the spot posting will include current month and next month

trades

Benchmark margins

¢/USG

Margin

±

BTX US reformate extraction vs floor contract

63.41

-23.41

BTX US reformate extraction vs floor spot

60.63

-22.66

BT US reformate extraction vs floor contract

63.83

-22.17

BT US reformate extraction vs floor spot

58.95

-20.86

USGC styrene premium to benzene

$/t

700

600

500

400

hhh

300

200

Benzene = 0

100

22 Jan

26 Mar

28 May

30 Jul

South Korea to the US in July, with more South Korea supply heard shipped to Taiwan instead – about 90,000t. Traders

looked for alternative destinations for incremental barrels as

Page 3 of 9

Argus DeWitt Benzene and Derivatives

Issue 15-32 Thursday 6 August 2015

Americas

Chinese demand for imported benzene waned. Backwardation in the benzene and styrene markets discouraged more

volumes from being shipped to the US, even as cumene, aniline and polyurethane demand remains strong. In addition use

in phenol production, sizable quantities of cumene have also

been used as blendstock for gasoline this year.

Styrene

Styrene weakened in a thinly traded market as market players

eyed Europe for export opportunities as it remains the highest

netback. Traders and producers continued to monitor Asia-Pacific for consistent buying interest amid volatility in the China

stock market as inventory levels there were heard low.

Discussions were wide this week amid market volatility in

Europe and Asia-Pacific. September fob was reportedly offered

at 53.30¢/lb ($1,175/t). Bids were pegged in the low $1,100s/t

from Europe and in the sub-1,100s from Asia-Pacific. Traders

and producers were offering August volume, and producers

were also looking to move product for September lifting.

Most producers were last head running at high rates as domestic market demand remained supportive in spite of a quiet

export market. Shell Canada’s Scotford styrene unit was last

heard still under force majeure for supply out of its 450,000 t/

yr unit leading to reconfiguration of shipping patterns to serve

upper Midwest and west of Rockies consumers.

Downstream polystyrene (PS) demand is largely firm in

July, in line with the seasonal trend, but is ultimately expected to weaken compared to June – which rose 7.3pc – according

to revised statistics from the ACC Plastics Industry Statistics

Group as compiled by Veris Consulting. Sales are 0.4pc higher

year-to-date compared to 2014 levels. GPPS sales stood 2.4pc

higher, while HIPS fell 2.6pc compared to 2014.

Food-packaging and service sales rose 3.1pc compared to

2014, but consumer and institutional sales fell by 12.8pc as

product sales likely transferred to polypropylene given the more

competitive pricing. Additionally, electrical and electronic market sales fell 3.6pc, but compounders sales rose 3.5pc compared

to 2014. Sales to resellers increased 9.1pc, and prime sales

moved 6.8pc higher while off-grade sales rose 13.2pc.

Most other derivatives remain strong. Unsaturated Polyester Resins, or UPR, coatings and construction segments of

expandable polystyrene business remain particularly strong.

The carpet backing segment of styrene butadiene latex is

notably weak.

Europe

Europe prices

Benzene

The August contract price (CP) was settled at $853/t and

€779/t, a fall of $29/t and €13/t, respectively, from the July

CP. This was based on an exchange rate of $1.0955/€1 and was

broadly in line with the movement in spot prices, which were

weighed down by weaker crude and naphtha values. Spot

prices lost further momentum after the August CP settlement

as the upstream weakness persisted. August cargoes traded

down from $855/t on 31 July to $830/t on 3 August, then to

$805/t on 4 August. Product for first half of August shipment

was discussed at a $5-10/t premium to any August delivery.

The September market was tentative, and was mostly indicated at a $10-25/t discount to August. Overall trading was slow

as demand downstream eased because of seasonal factors and

plant turnarounds. Styrene plants in Germany and Belgium

will be down in September for planned maintenance, while

phenol units in Germany, France and Poland are off line for

some weeks in August and September for scheduled work.

Europe again outperformed the US and Asia and has been

Copyright © 2015 Argus Media Ltd

Timing

$/t

Low

€/t

High

Low

High

Benzene

cif NWE contract

Aug

853.00

853.00

779.00

779.00

cif ARA spot

Prompt*

805.00

855.00

738.00

783.00

1,325.00

1,325.00

Styrene

fca Rotterdam contract

Jul

1,446.21

1,446.21

fob Rotterdam contract

Aug

1,418.92

1,418.92 1,300.00 1,300.00

fca Rotterdam spot

Prompt*

1,298.86

1,320.69

1,190.00

1,210.00

fob Rotterdam spot

Prompt*

1,270.00

1,275.00

1,164.00

1,168.00

Aug

1,352.34

1,352.34

1,239.00

1,239.00

Aug

1,018.35

1,018.35

933.00

933.00

Phenol

delivered ARA contract

Cyclohexane

fob ARA contract

*Prompt refers to current month, but if the publication date is on or after the 15th

of a given month, then the spot posting will include current month and next month

trades

the highest priced benzene market globally so far in August.

Demand in the region has weakened but supply has also

Page 4 of 9

Argus DeWitt Benzene and Derivatives

Issue 15-32 Thursday 6 August 2015

Europe

fallen. Imports are limited as the arbitrage from the US to

Europe is closed. The arbitrage from Asia to Europe opened

briefly on paper and then shut as Asian prices regained some

ground following heavy losses. Cracker operations continue

to be impacted by persistent high temperatures and are losing volumes, particularly in southern Europe. Some crackers

in northern Europe, mainly in Germany, are also affected.

Operations at the Lavera cracker continue to improve, but

run rates remain reduced because of technical issues. A UK

cracker is down for planned maintenance. Ethylene supply in

Europe is tightly balanced. Production from hydrodealkylation

(HDA), which accounts for 10pc of European benzene capacity, remains lacking as the low benzene-toluene spread makes

HDA economics negative. Benzene supply from reformate

has increased as refineries run hard following the sharp fall in

crude prices. A 265,000 b/d refinery in Germany will be down

for maintenance from late-August or September.

North Sea Dated crude fell below $50/bl and traded around

$49/bl throughout the week, the lowest in six months, amid

escalating worries about the global oil supply glut ahead of the

potential return of Iranian exports and amid the slowdown in

the Chinese economy. Naphtha fell in line with crude, reaching $430/t on Wednesday, also a six-month low. Benzene’s

premium over feedstock naphtha remained healthy at above

$300/t despite the recent weakness in both products. The

euro weakened against the US dollar to $1.08-1.09/€1 after a

pick-up in US business activity and improved employment data

in July.

The latest monthly Purchasing Managers’ Index (PMI) in the

eurozone showed business growth accelerating in July from

June, exceeding market expectations, suggesting that the

recovery in the region is on track and has not been affected by

the Greek debt crisis.

Styrene

The August contract price was settled at €1,300/t ($1,417/t)

fob, down by €25/t from July, tracking the fall in feedstock

cost. Spot prices weakened in a thin and slow market.

Trades for August were few and were concluded at $1,2701,275/t early in the week. September traded at $1,220/t and

$1,260/t. Prompt bids and offers that followed remained on

a downward path and were last discussed at around $1,2701,290/t and $1,300-1,320/t, respectively. Buying interest for

September product is sparse as consumers are reluctant to

Copyright © 2015 Argus Media Ltd

Premium of European styrene to benzene

$/t

900

720

540

360

180

0

Jan 15

Feb 15

Mar 15

Apr 15

May 15

Jul 15

Styrene raw material costs and pricing

Benzene mthly cont x.793

Styrene mthly contract

Aug 15

€/t

Ethylene cont x.293

Styrene spot fob

1,600

1,280

960

640

320

0

Aug 14

Oct 14

Dec 14

Feb 15

Apr 15

Jun 15

Aug 15

commit in a falling market. The backwardation into September narrowed to around $20-25/t, a range that could narrow

further ahead of turnarounds in Germany and Belgium.

Between 20,000t and 30,000t of styrene cargoes were fixed

in Houston for late-July and first half of August shipment to

the ARA region. Additional US imports are expected to arrive

in the second half of the month. Persistent high temperatures are impacting operations at production plants. Overall

availability is curbed but still sufficient to meet demand,

which is also falling seasonally as production down the chain

is traditionally either cut back or shut altogether for around

two to three weeks during August. Styrene units in Germany

and Belgium will be off line for turnarounds next month but

some downstream units could also be shut at the same time,

limiting the impact on availability. Low water levels on the

Rhine river, triggered by the hot and dry weather, are delaying

Page 5 of 9

Argus DeWitt Benzene and Derivatives

Issue 15-32 Thursday 6 August 2015

Europe

NWE styrene premium to benzene

$/t

1,000

cif ARA benzene premium to Eurobob

$/t

600

500

800

400

600

hhh

300

hhh

200

400

100

Benzene = 0

200

29 Jan

Eurobob = 0

0

2 Apr

4 Jun

6 Aug

14 Aug 14

deliveries in some areas and bolstering freight costs.

But styrene producers are aiming to run plants as hard

as they can. Styrene’s premium to feedstock benzene has

remained well above $400/t so far in August, levels that have

persisted since February.

Cyclohexane

The August contract price fell by €13/t to €920/t, in line with

the fall in benzene. Demand is slowing as expected at this

time of the year, while feedstock costs continued to falter,

weighing on CX prices.

11 Dec 14

9 Apr 15

6 Aug 15

Phenol

The contract reference price for phenol dropped by €13/t to

€1,239/t in August. Supply is sufficient despite turnarounds.

A German unit is expected to be back up in the first week of

August after a two-week planned shutdown. Units will be

shut in France and Poland for scheduled work in August and

September. The production unit in Finland that was affected

by issues recently is running normally. The acetone market is

weakening as a result of poor demand and ample supply, and

this could influence some producers to reduce output, curbing

phenol production in the process.

Asia-pacific

Benzene

A fall in crude futures influenced the downturn in Asian benzene

prices during the past week. Sentiment turned bearish with the

decline in wider energy values and underlying concerns resurfaced about weak regional demand. Discussions in the spot market were limited as most buyers were unsure of the short-term

direction, while sellers made efforts to maintain prices above

$700/t fob South Korea.

Trading for September and October-loading cargoes was

limited. A deal was done for September at $703/t on Tuesday

and again at $722/t on Thursday. Discussions for September fell

sharply to $703-709/t levels on Tuesday from $760-770/t seen last

Friday. Prices recovered some ground on Wednesday but by the

week’s close on Thursday prices again fell back as crude futures

remained on a downtrend. Discussions for September were in a

Copyright © 2015 Argus Media Ltd

$715-722/t range, while October prices were at $707-714/t. The

September-October intermonth spread remained at a backwardation ranging between $4.50-8/t. Some interest to buy secondhalf August loading cargoes remained in the market, with one

deal at $777/t on 31 July.

Benzene supplies in the region for August are balanced.

The overall supply availability was scheduled to rise in the third

quarter of the year as regional plants are running well and

Chinese demand is weak. But some of the excess in northeast

Asia has been absorbed by the strong demand from the styrene

monomer (SM) sector. Demand from SM producers has been on

the rise in the past month as SM plants resumed operations after

the turnaround season. SM margins have also been robust with

the benzene-SM spread remaining above $442/t in the past week.

Benzene supplies have also been absorbed by unexpected de-

Page 6 of 9

Argus DeWitt Benzene and Derivatives

Issue 15-32 Thursday 6 August 2015

Asia-pacific

mand from Taiwan because of continuing turnaround at Formosa’s

No.2 aromatics unit. The Mailiao plant, producing 470,000 t/yr of

benzene, is shut for maintenance since early July and is expected

to resume production in end August after about a 45-day turnaround.

Demand for benzene from the US remains in place, although

a narrow arbitrage between the two regions has raised concerns

about loading too many cargoes. South Korea in July exported

about 60,000t of benzene to the US, while total exports from

Asia-Pacific were close to 100,000t. The arbitrage looks open on

paper, with the spread at $76/t, based on comparison between

prompt-month prices in both regions.

Demand for benzene from China has failed to pick up on

persistently high inventories in the east of the country and slower

downstream market conditions. It is unlikely that demand from

the largest market in this region will pick up in this quarter as

stocks are still estimated at about 170,000t in east China. Domestic market prices were at about $695-701/t in the past week,

much below fob South Korea prices and underscoring the lack of

intra-regional arbitrage opportunities. Sinopec also maintained

its listed prices for the fourth consecutive week at 5,200 yuan/t

ex-refinery or $701/t.

Chinese benzene import demand may remain weak heading

in the fourth quarter, with the expected start of production at

Zhongjin Petrochemicals’ Zhejiang province-based 500,000 t/

yr benzene unit from the end of August or September. The plant

is currently having trial runs but there were no clear updates on

whether on-specification benzene production has been achieved.

The start of production at this unit is expected to reduce import

demand from some key consumers in east China.

South Korea, which is the biggest exporter to China, is estimated to have exported a meagre 18,000t of benzene in July.

This is a sharp drop from the 121,000t shipped in April this year.

China has imported 895,000t of benzene in the first six months

of the year, more than double the 331,000t imported during

January-June 2014. This sharp increase in imports has come on

the back of downstream expansions in the phenol and MDI sectors. But all the new plants and expansions in these two sectors

has also created bearish pressures on these two markets. MDI

prices have fallen in recent weeks and market conditions are

currently weak. An oversupply in China’s phenol supplies because

of capacity additions has pushed prices lower and forced a cut in

operating rates at several units.

Benzene production in South Korea and Japan remains high

on steady production at most crackers and reformers. Margins for

Copyright © 2015 Argus Media Ltd

Asia-Pacific prices

$/t

Timing

Low

High

Mid

±

Benzene

cfr South Korea contract

Aug

770.00

777.42

773.71

-44.64

cfr Taiwan contract

Aug

770.00

786.42

778.21

-44.64

cfr Asean contract

Aug

770.00

781.42

775.71

-44.64

fob South Korea

Sep

705.00

770.00

737.50

-29.50

fob South Korea

Oct

700.00

765.00

732.50

-22.50

723.05

-36.70

710.00

760.00

735.00

-25.00

fob South Korea

Marker

cfr China spot

Prompt

cfr China month avg

Jul

747.50

761.82

754.66

na

fob southeast Asia

Prompt

695.00

760.00

727.50

-29.50

ex-tank E China Yn/t

Prompt

5,050

5,300

5,175

-150.00

ex-tank E China

Prompt

681.42

715.15

698.29

-20.30

ex-works Sinopec Yn/t

Prompt

5,200

0.00

ex-works Sinopec

Prompt

701.66

-0.05

Styrene

cfr Taiwan contract

Jul

1,224.00

1,224.00

1,224.00

-108.80

cfr China

Aug

1,145.00

1,205.00

1,175.00

-30.00

cfr China

Sep

1,130.00

1,175.00

1,152.50

-32.50

cfr China

Marker

fob South Korea

Aug

1,125.00

1,185.00

fob South Korea

Sep

1,110.00

1,155.00

fob South Korea

Marker

1,164.50

-30.10

1,155.00

-30.00

1,132.50

-32.50

1,144.50

-30.60

ex-tank China Yn/t

Prompt

8,650

9,050

8,850

-350.00

ex-tank China

Prompt

1,167.18

1,221.16

1,194.17

-47.33

South Korea benzene premium to Japan naphtha

$/t

500

400

300

hhh

200

100

Japan cfr naphtha = 0

0

07 Aug 14

04 Dec 14

09 Apr 15

06 Aug 15

aromatics producers continue to be strong with the naphtha-BTX

spread at $225/t in the past week. Toluene disproportionation

(TDP) margins have improved in the recent weeks as toluene

prices have fallen in the region and the toluene-benzene spread

has strengthened to $88/t, about $12/t which is below the breakeven $100/t mark for covering the variable cost of production.

Page 7 of 9

Argus DeWitt Benzene and Derivatives

Issue 15-32 Thursday 6 August 2015

Asia-pacific

Margins for selective TDP producers are positive and supported

by relatively steady and strong PX prices.

Southeast Asian benzene supplies are slightly less abundant

and more balanced compared with demand. The force majeure

on benzene and PX supplies by Thailand’s PTTGC last week, along

with the disruption at one of its aromatics units, is expected to

keep supplies better balanced during August and maybe even

September. PTTGC declared the force majeure on supplies from

its No.2 aromatics plant that can produce up to 655,000 t/yr of

paraxylene and 355,000 t/yr of benzene for an estimated 40-45

days following a disruption at an upstream feedstock unit. The

producer may bring forward its planned maintenance scheduled

for later this year, which in turn is expected to push the restart

of production. Discussions on a fob southeast Asia basis have

been at about a $8-10/t discount to fob South Korea prices in the

past week compared with the $15/t discount seen in the past few

months.

Phenol

Offers on a cfr southeast Asia basis were at about $1,050/t this

week amid a lack of buying interest. Phenol supplies in southeast

Asia are expected to rise heading into the last quarter of this

year, as PTT Phenol starts production at its new Mab Ta Phutbased 250,000 t/yr unit. The No.2 unit is due to start production

from the mid-November, doubling the producer’s capacity.

PTT is operating its No.1 plant, producing another 250,000

t/yr of phenol, at full rates at present with it unaffected by the

disruption at the upstream aromatics unit at the same complex.

The producer has secured sufficient stocks of cumene to tide it

by part of the affected period and will get benzene supplies from

the No.1 aromatics unit that is running normally.

Mitsui Phenols Singapore is considering a 10pc reduction in its

operating rates from October because of reduced demand from

a key derivatives producer that is planning a turnaround from

November. The Singapore-based plant can produce 310,000 t/yr

of phenol and 186,000 t/yr of acetone.

Styrene

The styrene monomer market extended losses during this latest

assessment week, as crude values hit a fresh five-month low

and demand from derivative markets remained weak. Volatile

stock markets also had a dampening psychological impact on the

styrene market. But the gradient of the price fall was gentle,

as the pace was slowed down by short covering on Wednesday

amid still tight supplies. A further reduction in supplies is likely as

Copyright © 2015 Argus Media Ltd

SM enters the fall turnaround season and imports from overseas

remain limited.

The lack of market conviction and soft buying interest

prompted sellers to reduce their offers amid falling prices.

August cfr China offers were lowered from above $1,200/t and

some deals were seen done at $1,175-1,185/t late on Wednesday

as trading firms sought to cover back their short positions after

prices fell. But sentiment continued to worsen and discussions

finished the week at $1,140-1,150/t.

Many trading firms also sought to unwind their short positions

in August cargoes by concluding the August-September intermonth spread deals at a backwardation of $33-35/t. This spread

fell back to $30/t at the end of the week and looks set to narrow

further as demand is expected to remain weak.

The lack of market confidence also prompted more interest in

concluding forward-month September cargoes on a floating basis.

These cargoes were traded based on September cfr China basis

at premiums of $9-15/t. Fixed price discussions finished the week

at $1,130-1,140/t cfr China.

Weak demand, together with a loss of market direction, caused

prices of SM to lose almost $100/t within two weeks. But production profits remain protected as feedstock prices fell faster. Cash

margins for standalone producers after accounting for operating

costs remain above $90/t this week. For integrated producers, the

production spread between naphtha and SM is about $608-700/t

and the benzene-SM production spread remains above $400/t. This

spreads will continue to support robust SM production.

Despite high operating rates, supplies in northeast Asia

remain tight. Although Japan’s Idemitsu Kosan raised operating

rates to full production at its two SM units located in Tokuyama,

which are able to produce 340,000 t/yr, the company is still unable to bring on line its 210,000 t/yr unit located in Chiba after

it was shut almost two weeks ago. Apart from strong demand

from its domestic derivative polystyrene (PS) sector, a weaker

Japanese yen has also made it more expensive for Japanese

industries to import PS. Japan continues to maintain high PS operating rates. Stocks of SM remain at historical lows, limiting the

country’s ability to export SM to key market South Korea.

Taiwanese producer Formosa will reduce its SM production

by half as its No.1 and No.2 SM units, with a total capacity of

600,000t/yr, are scheduled for 40 days of maintenance starting

in September. The company may need to buy up to 20,000t of

SM with September or October delivery to Taiwan from the spot

market as a result. But the company has little impetus to stock

up now because of falling prices, unstable crude and softening

Page 8 of 9

Argus DeWitt Benzene and Derivatives

Issue 15-32 Thursday 6 August 2015

Asia-pacific

derivative demand. Prices of Taiwan’s key derivative, acrylonitrile

butadiene styrene (ABS), continue to slide with soft demand and

production margins have turned negative. ABS producers remain

reluctant to raise operating rates after lowering production a few

weeks ago.

Tight supplies will continue to support prices. Market participants expect lower than normal overseas volumes for August arrivals. Availability from Japan and South Korea will continue to be

limited, and while stocks in east China coastal ports may slowly

build up because of high operating rates, it will take some time

before stocks can return to normal levels. Asahi, Formosa, GPPC

and TSMC all have shutdowns scheduled from the second half of

August until the end of the year. Supplies from southeast Asia

will still be suppressed as well, especially after SMI shuts both SM

lines with a total capacity of 350,000 t/yr for three months, in

line with a corresponding shutdown at its cracker. The shutdown

at its cracker has been postponed from the end of August to midSeptember but SMI has not confirmed any changes to its shutdown schedule for styrene.

Shandong Yuhuang has stopped production at its 200,000 t/yr

line because of a technical fault, while New Solar has decided on

a month-long turnaround at its 250,000 t/yr SM unit at the end of

August. This facility is currently operating at 70-80pc in preparation for the maintenance.

Stocks at coastal tanks in east China dipped by 3,300t to

32,600t this week. If consumers’ stocks are included, this figure

rises to 69,900t, which is below the July average volume of about

70,000-71,000t and is only 28pc of levels a year ago. China has

been unable to build stocks despite relatively high operating rates

as imports have been sliding. The recent dip in import might also

be attributable to the slight pick-up in downstream operating

rates across all three key derivatives, namely expandable polystyrene (EPS), PS and ABS.

Production of EPS, which constitutes about 40pc of SM

demand in China and is usually in its peak demand season in summer, picked up from 48pc a week ago to 52pc earlier this week.

EPS producers had to raise operating rates to fulfil orders because

of low stocks after they reduced operating rates to 40pc a month

ago because of production losses. These margins started improving since two weeks ago to cover production costs but there

is little to no profits. Although EPS prices fell by 350 yuan/t to

Yn9,800/t this week, production margins remained stable. Prices

of prompt SM cargoes fell from Yn9,000/t last Friday to trade at

Yn8,650/t towards the end of the assessment week. EPS producers typically require about Yn1,000/t to cover production costs.

Towards the end of the week, market participants said that EPS

producers slowed down production again after completing their

orders as demand had slowed once more.

Argus DeWitt Benzene and Derivatives is published by Argus Media Ltd.

Registered office

Argus House, 175 St John St, London, EC1V 4LW

Tel: +44 20 7780 4200 Fax: +44 870 868 4338

email: sales@argusmedia.com

ISSN: 2053-6259

Copyright notice

Copyright © 2015 Argus Media Inc. All rights reserved.

All intellectual property rights in this publication and

the information published herein are the exclusive

property of Argus and/or its licensors and may only

be used under licence from Argus. Without limiting

the foregoing, by reading this publication you agree

that you will not copy or reproduce any part of its

contents (including, but not limited to, single prices

or any other individual items of data) in any form or

for any purpose whatsoever without the prior written

consent of Argus.

Trademark notice

ARGUS, ARGUS MEDIA, ARGUS DEWITT, the ARGUS

logo, ARGUS DEWITT BENZENE and Derivatives,

other ARGUS publication titles and ARGUS index

names are trademarks of Argus Media Inc.

Visit www.argusmedia.com/trademarks for more

information.

Disclaimer

The data and other information published herein

(the “Data”) are provided on an “as is” basis. Argus

makes no warranties, express or implied, as to the

accuracy, adequacy, timeliness, or completeness of

the Data or fitness for any particular purpose. Argus

shall not be liable for any loss or damage arising

from any party’s reliance on the Data and disclaims

any and all liability related to or arising out of use

of the Data to the full extent permissible by law.

Petrochemicals

illuminating the markets

Publisher

Adrian Binks

Chief executive

Neil Bradford

CEO Americas

Euan Craik

Global compliance officer

Jeffrey Amos

Commercial manager

Karen Johnson

Editor in chief

Ian Bourne

Managing editor, Americas

Jim Kennett

Contact: Chuck Venezia

Tel: +1 713 360 7569

benzenedaily@argusmedia.com

Customer support and sales

Technical queries

technicalsupport@argusmedia.com

All other queries

support@argusmedia.com

Houston, US

Tel: +1 713 968 0000

New York. US

Tel: +1 646 376 6130

Washington DC, US Tel: + 1 202 775 0240

London, UK Tel: +44 20 7780 4200

Astana, Kazakhstan Tel: +7 7172 54 04 60

Beijing Tel: +86 10 6515 6512

Dubai Tel: +971 4434 5112

Moscow, Russia Tel: +7 495 933 757

Rio de Janeiro, Brazil

Tel: +55 21 3514 1402

Singapore Tel: +65 6496 9966

Tokyo, Japan Tel: +81 3 3561 1805