JYD CHINA BENZENE MARKETSCAN MONTHLY REPORT

December 1, 2014

To request subscription, please email service@315.com.cn

Content

Summary of Hot Spots

Benzene Product Price

Feedstock Price

Market Overview

China Benzene Plants Turnaround

China Hydrogenation of Benzene Plants Turnaround

Supply Forecast

Downstream Consumption Structure

1

1

1

1

2

2

3

3

Downstream Profit and Loss

Derivatives Run Rate Contrast

Main Derivatives Trend Analysis

Domestic and Foreign Market Arbitrage of Benzene

Competition btw Hydrogenation of Benzene and Benzene

Downstream Overhaul & Benzene Consumption Forecast

Conclusion

Appendix

3

4

4

5

5

5

6

7

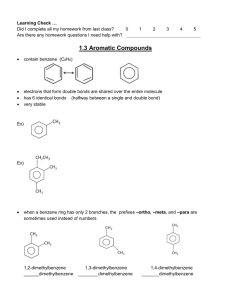

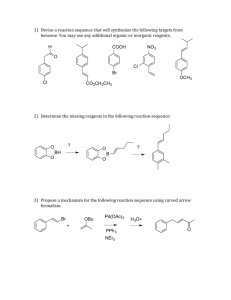

Summary of Hot Spots

I. Crude oil price plunges triggered a panic in China benzene market.

II. Benzene hydrogenation cost was still of weak support despite a slowdown in crude benzene prices.

III. With a large spread between prices for hydrogenation of benzene and those for benzene, traders were active in speculating. IV. The benzene industrial chain collapsed overall.

V. Cost tumbling to below supportive levels was the biggest drag on the benzene market.

VI. The styrene market, the most important downstream market for benzene, has kept hitting fresh lows.

Benzene Product Price

Benzene Product Price, 2014

Product

Naphtha

Benzene

Hydro-benzene

Styrene

Phenol

CYC

AA

Aniline

MA

Avg. Price in Oct

751

8,088

8,056

10,742

10,507

11,316

10,508

9,263

10,678

Avg. Price in Nov

674

7,223

7,042

9,472

9,830

10,145

10,043

8,458

9,411

Benzene Feedstock Price, 2014

Product

Crude Oil

Crude Benzene

Avg. Price in Oct

84.3

6,423.7

MoM Change

-77

-866

-1,014

-1,270

-677

-1,171

-465

-805

-1,267

Avg. Price in Nov

75.8

5,500

MoM Change Rate (%)

-10.2%

-10.7%

-12.6%

-11.8%

-6.4%

-10.3%

-4.4%

-8.7%

-11.9%

MoM Change

-8.5

-932.7

$/mt; CNY/mt

Delivery Terms

CFR Japan

Ex-stockpile, East China

Cash, delivered, East China

Cash, Ex-stockpile, East China

Cash, Ex-stockpile, East China

Acceptance, Ex-stockpile, East China

Cash, Ex-stockpile, East China

Acceptance, Ex-stockpile

Acceptance, Ex-stockpile, East China

MoM Change Rate (%)

-10.1%

-14.5%

$/bbl; CNY/mt

Delivery Terms

WTI

Cash, EXW, East China

Data Source: JYD Information Co., Ltd.

Market Overview

Benzene: China benzene market staged an obvious decline in November 2014 amid falling foreign quotes, fragile purchase

and producers’ constant cuts in their listing prices. Foreign quotes for benzene tumbled by $121/mt in the month to as low as

$943/mt FOB South Korea, the lowest level in three years. Meanwhile, domestic benzene producers cut their listing prices four

times this month by a total of CNY900/mt to CNY6,900-7,000/mt. Additionally, end users were lax in procuring, while traders

were slow in taking position, with some with stocks at hand being under relatively heavy sales pressures. Therefore, transactions

prices for benzene hit CNY6,800-6,900/mt at the end of November, slumping by CNY850/mt from the CNY7,600/mt at the

start of the month.

Deals concluded this month were mainly based on contracts, and traders were restocking on demand from the end users. In

spite of prices slumping to below the CNY7,000/mt price mark, traders expected them to slide further and that the market has

not yet notched the floor. The benzene market was weak throughout the month, with flat transactions.

P-1

December 1, 2014

JYD CHINA BENZENE MARKETSCAN MONTHLY REPORT

Hydrogenation of benzene: China hydrogenation of

benzene (hydro-benzene) market retreated to nearly a fouryear low with a decline range of up to CNY1,000-1,100/

mt in November 2014, owing to plunging crude oil prices,

continuously dropping foreign quotes and constant sharp

cuts for listing prices by domestic chemical producers. At

the end of the month, trading prices for hydro-benzene had

slipped to a low of CNY6,850/mt last seen in end-2010.

In early November, international crude price nosedives

weighed on the Chinese domestic benzene market. Supply

decreased as benzene hydrogenation plants in Hebei and

Shandong arranged massive production curtailment and

unit maintenance during the APEC meetings in the first

ten days of the month, albeit providing little strength to the

market. Petrochemical producers lowered their listing prices

four times this month by a margin of CNY1,000-1,100/mt.

East China Benzene & Hydrogenation of Benzene Price

CNY/mt

10,000

Benzene

Hydrogenation of benzene

9,500

9,000

8,500

8,000

7,500

7,000

6,500

6,000

Jan-14

Mar-14

May-14

Jul-14

Sep-14

Nov-14

Data Source: JYD Information Co., Ltd.

Supply and Demand Analysis

China Benzene Plants Turnaround, 2014

Region

Hebei

Hebei

Guangdong

Zhejiang

Producer

Xinqiyuan Energy

PetroChina (North China)

CNOOC

Zhenhai Refinery

‘000mt/yr

Capacity

50

70

80

490

Start Time

Early October

Early October

November 7th

October 20th

China Hydrogenation of Benzene Plants Turnaround, 2014

End Time

November 11th

November 27th

November 23rd

November 30th

Remark

On schedule

On schedule

On schedule

On schedule

‘000mt/yr

Region

Plant

Capacity

Start Time

Ningxia

Inner Mongolia

Inner Mongolia

Shandong Zibo

Shanxi Changzhi

Shandong Heze

Shandong Zaozhaung

Shandong Heze

Shandong Laiwu

Hebei Tangshan

Hebei Tangshan

Hebei Tangshan

Hebei Handan

Hebei Handan

Hebei Handan

Hebei Handan

Hebei Handan

Hebei Shijiazhuang

Hebei Xingtai

Henan Anyang

Jiangsu Xuzhou

Ningxia Baofeng Energy

Inner Mongolia Jianyuan

Inner Mongolia Kingho

Shandong Haili Chemical

Shanxi Lubao Coking

Shandong Yuhuang Chemical

Tengzhou Shengyuan Hongda

Heze Derun Chemical

Shandong Laiwu Steel

Tangshan Baoshun Chemical

Tangshan Zhongrun

Tangshan Xuyang Chemical

Hebei Yulong Chemical

Hebei Jinruite Chemical

Hebei Yida Chemical

Hebei Rongte Chemical

Hebei Taojin Chemical

Hebei Minhai Chemical

Hebei Kingboard Chemical

Henan Yutian Chemical

Xuzhou Yongpeng

100

100

100

80+80+100

100

100

80+80

50+100

100

100+100

100+100

200

50+50

100

50+50

50

50

100

50

80+80

200

November 7th

November 1st

November 1st

November 6th

November 1st

November 8th

November 1st

November 18th

November 1st

November 21st

November 6th

November 6th

November 1st

November 6th

August 28th

November 6th

November 6th

November 6th

November 6th

August 28th

August 1st

End Time

November 30th

November 30th

November 30th

November 30th

November 12th

November 15th

November 30th

November 30th

November 12th

November 30th

November 7th

November 21st

November 30th

November 15th

August 31st

November 13th

November 13th

November 13th

November 13th

August 31st

August 31st

Days

Remarks

23

30

30

25

12

7

30

12

12

10

11

15

30

9

4

7

7

7

7

4

31

Insufficient gas

Long-term turnaround

Long-term turnaround

Two lines

planned

Planned

One line

One line

Long-term turnaround

One line

For APEC

For APEC

Long-term turnaround

Planned

Trouble shooting

For APEC

For APEC

For APEC

For APEC

Trouble shooting

Insufficient fund

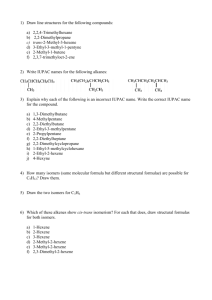

China Benzene Output, 2014

According to statistics, China’s benzene production

rose slightly from a month earlier to 670,000 mt in

November 2014, mainly as some units that shut down

previously resumed operation successively after midNovember.

According to JYD, in November hydrogenation of

benzene output fell 7,700 mt to 254,270 mt against

previous month, the sixth consecutive monthly cut,

which was because most companies in northern China

were in production-limiting or turnaround affected by

APEC in Beijing.

'000mt

2013

2014

1,400

1,200

1,000

800

600

400

200

0

Jan-Feb

Apr

Jun

Aug

Oct

Dec

Data Source: JYD Information Co., Ltd.

P-2

December 1, 2014

JYD CHINA BENZENE MARKETSCAN MONTHLY REPORT

Bezene & Hydrogenation of Benzene Demand Analysis

China Hydrogenation of Benzene Output

'000mt

350

2013

2014

6%

300

18%

Other

7%

Phenol

21%

250

10%

200

150

Aniline

8%

CYC

20%

24%

100

Styrene

46%

50

0

Jan

Feb Mar Apr May Jun

Jul

50%

Aug Sep Oct Nov Dec

30%

40%

10%

10%

Hydrogenation of Benzene

30%

Benzene

50%

Data Source: JYD Information Co., Ltd.

Supply Forecast

Benzene: In December benzene output will go up by 10% from November as downstream contract purchase was relatively

stable with lower offer price for stocking.

Hydrogenation of benzene: According to JYD, in December with the recovery growth in hydrogenation of benzene supply,

the run rate will be up by 7% considering restarting and seasonal factors.

Conclusion: As a whole, in December benzene and hydrogenation of benzene supply will increase sharply, especially benzene

supply, which was the principal part in supply.

Downstream Profit and Loss Analysis

Overall speaking, the profit and loss of benzene downstream industry products differentiate with each other, according to JYD

statistic, in November 2014, phenol was the only one made profit, which is above CNY800/mt. However, the other traditional

downstream products were still at a loss, such as styrene, aniline and CYC. Profits and losses of all downstream products since

the beginning of this year are shown as below, and Aniline suffered the most.

Benzene Derivatives Profit Margin

China Phenol Price and Profit Margin, 2014

CNY/mt

CNY/mt

Profit Margin

East China Phenol

13000

3000

Phenol

12000

2000

11000

1000

10000

0

Profit-Loss

Aniline

CYC

9000

Styrene

-1000

-500

0

Profit Margin

-1000

8000

500

-2000

27/Jan

1000

China Styrene Price and Profit Margin, 2014

CNY/mt

CNY/mt

MA

27/Mar

27/May

27/Jul

27/Sep

27/Nov

China CYC Price and Profit Margin, 2014

East China Styrene

13000

CNY/mt

1000

12000

500

11000

CNY/mt

13,000

Profit Margin

East China CYC

500

12,500

300

12,000

100

0

11,500

-100

10000

-500

11,000

-300

9000

-1000

10,500

-500

10,000

-700

8000

27/Jan

-1500

27/Mar

27/May

27/Jul

27/Sep

9,500

27/Nov

27/Jan

Data Source: JYD Information Co., Ltd.

P-3

-900

27/Mar

27/May

27/Jul

27/Sep

27/Nov

December 1, 2014

JYD CHINA BENZENE MARKETSCAN MONTHLY REPORT

China Maleic Anhydride Price and Profit Margin, 2014

Profit Margin

CNY/mt

11500

China Aniline Price and Profit Margin, 2014

11000

0

10500

-500

10000

-1000

9500

-1500

9000

8500

27/Jan

27/Mar

27/May

27/Jul

CNY/mt

CNY/mt

500

East China Maleic Anhydride

27/Sep

Profit Margin

12000

CNY/mt

400

11000

0

10000

-400

9000

-800

-2000

8000

-1200

-2500

7000

27/Nov

-1600

27/Jan

27/Mar

27/May

27/Jul

27/Sep

27/Nov

Data Source: JYD Information Co., Ltd.

Main Derivatives Analysis

In November, the run rate of benzene downstream

companies were stable as a whole, of which phenol run rate

was as high as 92%, followed by CYC 85%, styrene 74%,

aniline 50% and MA 40%.

Downstream Run Rate, 2014

October

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Styrene: In November, as domestic styrene market

pointed downward, the price continued to decline by about

15%-18% within the month.

Phenol: November phenol market slipped amid negative

sentiment. Up to 28th, phenol traders in East China offered

between CNY9,400-9,450/mt, down by CNY600/mt against

the negotiation price of CNY10,000-10,050/mt at the

beginning of November.

Aniline: In November, domestic aniline price dropped

further by about CNY1,000/mt, as downstream traders

lacked purchasing enthusiasm.

CYC: This month, domestic CYC market remained weak

during the slack season and downstream traders only

purchased on demand amid inactive atmosphere. Benzene

price continued to go down steeply, CPL price hovered

around CNY15,000/mt, and AA price declined drastically.

MA: In November, MA price plunged due to continuous

crude price falling, weak demand and feedstock price

decline. At the end of November, MA in North China mainly

transacted at CNY 8,600-8,800/mt, down CNY1,2501,300/mt on month; MA in Shandong mainly transacted at

CNY8,800-8,900/mt, down CNY1,300/mt on month; MA

in Jiangsu and Zhejiang mainly transacted at CNY8,9009,000/mt, down CNY1,300/mt on month; MA in South

China mainly transacted at CNY8,900-9,000/mt , down

CNY1,300/mt on-month. (acceptance included )

styrene

November

phenol

aniline

cyclohexanone

malieic

anhydride

East China Styrene Price, 2014

CNY/mt

12500

12000

11500

11000

10500

10000

9500

9000

8500

8000

27/Jan

27/Mar

27/May

East China Phenol Price, 2014

East China Aniline Price, 2014

CNY/mt

13000

CNY/mt

12000

12500

11500

12000

11000

11500

10500

11000

10000

10500

9500

10000

9000

9500

8500

27/Jul

27/Sep

27/Nov

27/Jul

27/Sep

27/Nov

8000

9000

27/Jan

East China Aniline

27/Mar

27/May

27/Jul

27/Sep

27/Jan

27/Nov

Data Source: JYD Information Co., Ltd.

P-4

27/Mar

27/May

December 1, 2014

JYD CHINA BENZENE MARKETSCAN MONTHLY REPORT

East China Cyclohexanone Price, 2014

East China Maleic Anhydride Price, 2014

CNY/mt

13000

CNY/mt

11500

12500

11000

12000

11500

10500

11000

10000

10500

9500

10000

9000

9500

9000

8500

27/Jan

27/Mar

27/May

27/Jul

27/Sep

27/Nov

27/Jan

27/Mar

27/May

27/Jul

27/Sep

27/Nov

Arbitrage Analysis

According to JYD statistic, price inversion in both foreign and domestic markets was lessened due to crude price dip in

November, reflecting a resilient domestic market and may probably lead to arbitration between foreign market and domestic

market.

Benzene & Hydrogenation of Benzene Competition, 2014

Arbitrage, 2014

Benzene FOB Korea-FOB China Arbitrage,2014

CNY/mt

12000

Spread

FOB East China

FOB Korea

CNY/mt

600

CNY/mt

3000

11000

2500

500

10000

2000

400

9000

1500

300

8000

1000

200

7000

500

6000

0

5000

-500

4000

27/Jan

27/May

27/Jul

27/Sep

Trend of Replacement

100

0

-100

-1000

27/Mar

Spread

-200

27/Nov

25/Jul 8/Aug 22/Aug 5/Sep 19/Sep 3/Oct 17/Oct 31/Oct 14/Nov 28/Nov

Competition between Hydrogenation of Benzene and Benzene

Hydrogenation of benzene has a competitive advantage over benzene due to low feedstock price and will certainly lead to

active speculations.

Downstream Overhaul & Benzene Consumption Forecast

Stepping into November, the systematic risk of crude oil started to release, resulting in an overall price crash of nearly all

downstream products. As the prices for downstream products slid sharply while that for domestic benzene decreased slowly,

most downstream products of benzene suffered a severe loss. Though phenol was profitable to some extent, the general

profitability was cut down. Benzene consumption is predicted to drop due to unit maintenance.

China Benzene Downstream Plants Turnaround, November 2015

Product

Company

Styrene

Dawang Huaxing

Styrene

Styrene

Styrene

Styrene

Styrene

Phenol

Phenol

Phenol

Phenol

Phenol

Phenol

Aniline

Aniline

Aniline

Aniline

CYC

Total

Yanshan Petrochemical

Dawang Huaxing

Anqing Petrochemical

Tianjin Dagu

Liaotong Chemical

Gaoqiao Petrochemical

Gaoqiao Petrochemical

Yangzhou Shiyou

Yanshan Petrochemical

Zhongsha Tianjin

Huizhou Zhongxin

Shandong Jinling

Shandong Jinling

Cornell

Shanxi Tianji

Neijiang Tianke

Start Time

Jun 16th

Nov 23rd

Jul 21st

Oct 8th

Nov 15th

Nov 6th

Jun 16th

Sep 15th

Sep 11th

Nov 23rd

Nov 6th

Nov 6th

Nov 11th

Oct 25th

Oct 25th

Oct 1st

Oct 1st

Oct 1st

End Time

Pending

Nov 28th

Pending

Pending

Dec 5th

Nov 30th

Pending

Nov 5th

Nov 10th

Pending

Nov 13th

Nov 13th

Pending

Pending

Pending

Oct 31st

Pending

Pending

Capacity

75

150

80

80

100

500

75

62.5

37.5

200

187.5

220

187.5

260

260

360

250

20

Benzene Demand Cut

5

12

5

5

3

13

8

1

1

2

1

1

2

11

11

16

12

2

111

‘000mt/yr

Remarks

On Schedule

On Schedule

On Schedule

On Schedule

On Schedule

Operation rate down to 50%-60%

On Schedule

N/A

N/A

Operation rate down to 60%-70%

Operation rate down to 80%

Operation rate down to 80%

Maintenance

Narrow profit

Narrow profit

Narrow profit

Narrow profit

Cost of feedstock

Data Source: JYD Information Co., Ltd.

P-5

JYD CHINA BENZENE MARKETSCAN MONTHLY REPORT

China Benzene Downstream Plants Turnaround, December 2015

Product

Styrene

Styrene

Styrene

Aniline

Company

Liaotong Chemical

Yanshan Petrochemical

SP Chemical

Shandong Jinling

Capacity

75

80

320

260

Shutdown Time

June 16th, 2014

July 21st, 2014

Late December

October 25th, 2014

Benzene Demand Cut

5

5

11

11

Aniline

Connell Chemical

360

October, 2014

16

Aniline

CYC

Aniline

Total

Tianji Group

Neijiang Tianke

Shandong Jinling

250

20

260

October, 2014

October, 2014

October 25th, 2014

12

2

11

73

December 1, 2014

‘000mt/yr

Remark

Stopped production

Stopped production

Changed catalyst

Insufficient profit

Only one plant was operating due to low

profit

Insufficient profit

Maintenance & feedstock cost

Insufficient profit

Data Source: JYD Information Co., Ltd.

Conclusion

Benzene: Concerns for the next month focused on whether China and oversea benzene market price will continue to go down,

whether listing prices of companies will be cut down, whether bottom price will appear in December, as well as the speculation of

traders. Most downstream users and traders purchased upon rigid demand, which limited the amount of trading. The declining

listing price also pared down domestic trade. Additionally, the oversea market price was easy to fall down with the slumping

crude price. Based on an atmosphere with unfavorable factors, benzene price will continue its weak trend early next month. As

traders considered cutting down inventory and some of them worried about the risk of stocking up, a bottom price would appear

in China benzene market in December.

Hydrogenation of benzene: As the fundamentals turned well in December, China hydrogenation of benzene market slowed

down its sharp plummet. Affected by new-built capacities and the maintenance termination of a few plants, the downstream

demand was in a moderate upturn. Further, based on the fade-in of cost support and the strong rigid demand, crude benzene

price rebounded after a sharp decrease in the end of this month and several new peaks appeared in auction price. The market

was shored up by short supply. However, as the expectation of production reduction at OPEC conference failed to realize, crude

price will fluctuate weakly in a downstream channel. This will bring a huge burden to the staple commodity market, which faces

relatively high systematic risks. It is suggested that transactions of hydrogenation of benzene in December should be made

cautiously.

JYD China Benzene Marketscan Monthly Report

Director

Yang Li

yangli@315.com.cn

Editor

Susie Li

+86-10-84428754

liyumeng@315.com.cn

Editorial director

Tobey Li

Wang Zhenxian

+86-10-84428620

wangzhenxian@315.com.cn litingting1@315.com.cn

Li Hong

Chief Editor

lihong@315.com.cn

Bian Cuijing

Jing Changting

biancuijing@315.com.cn

jingchangting@315.com.cn

Amanda Zhao

Xue Jing

+86-10-84428984

xuejing@315.com.cn

zhaolei@315.com.cn

JYD Information Co., Ltd is recognized as the leading information provider in

China. We specialized in providing the transparent, high-value, authoritative

market intelligence and professional analysis in commodity market. Our

expertise covers oil, gas, coal, chemical, plastic, rubber, fertilizer and metal

industry, etc.

JYD China Petroleum Marketscan Weekly is published by JYD Information Co.,

Ltd. every week on China crude oil, oil products and fuel oil market review, price

trend refiners output figures, teapots run rate, refiners turnaround schedule and

so on. The report provides full-scale & concise insight into China oil products

market.

All rights reserved. No portion of this publication may be photocopied,

reproduced, retransmitted, put into a computer system or otherwise

redistributed without prior authorization from JYD Information Co., Ltd.

P-6

JYD CHINA BENZENE MARKETSCAN MONTHLY REPORT

December 1, 2014

Appendix

China Petrochemical Companies' Naphtha Monthly Settlement Price, 2014

Month

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Internal Supply

6,811

6,640

6,650

6,720

6,830

6,910

6,960

6,570

6,320

5,490

4,870

Sinopec

Tahe Branch’s Supply to Eastern Chemical Plants

5,811

5,640

5,650

5,720

5,830

5,910

5,960

5,570

5,320

4,490

3,870

Datuhe Crude Benzene Auction Price, 2014

Date

Nov 4th

Nov 11th

Nov 18th

Nov 25th

Starting Price

5,200

5,150

4,800

4,600

Closing Price

5,200

Auction Fail

4,800

4,770

Change

-350

-50

-350

-30

Data Source: JYD Information Co., Ltd.

P-7

CNY/mt

Internal Supply

6,312

6,209

6,016

6,028

6,125

6,236

6,292

6,570

6,320

5,490

4,870

PetroChina

Cross-regional Internal Supply

6,454

6,351

6,158

6,169

6,267

6,378

6,434

6,476

6,049

5,789

4,978

WoW Change Rate (%)

-6.73%

-0.97%

-7.29%

-0.63%

CNY/mt

Volume (mt)

300

300

300

300