Costco Wholesale Corp. - University of Oregon Investment Group

Costco Wholesale Corp

.

May 21, 2014

Consumer Goods

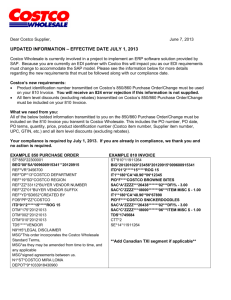

Ticker: COST

Current Price: $115.13

Recommendation: Sell

Price Target: $116.12

Key Statistics

52 Week Price Range

50-Day Moving Average

Estimated Beta

Dividend Yield

Market Capitalization

Trading Statistics

Diluted Shares Outstanding

Average Volume (3-Month)

Institutional Ownership

Insider Ownership

EV/EBITDA (LTM)

Margins and Ratios

Gross Margin (LTM)

EBITDA Margin (LTM)

Net Margin (LTM)

Debt to Enterprise Value

107.38-126.12

113.26

0.69

1.30%

50,454.76

436.92

2,348,420.00

76.00%

0.83%

11.52

13.55%

3.86%

1.97%

10.14%

Covering Analyst: Patrick Roy proy@uoregon.edu

Investment Thesis

International expansion plans will be the main catalyst for revenue growth into the terminal year.

Costco’s membership base isolates the retailer from extreme revenue swings and provides a solid platform for consistent growth.

Costco’s continued development of ancillary businesses will provide new revenue streams that will help to separate it from other warehouse store competitors.

Management’s advertisement of its international expansion plans has allowed for future revenue growth to be priced in, eliminating any discount in the share price.

Growth in e-commerce sites represents a direct threat to the retail store, increasing the risk of investing in the big box store model.

One-Year Stock Chart

$140.00

$120.00

$100.00

$80.00

$60.00

$40.00

$20.00

$0.00

May-13 Jul-13

Volume

Sep-13 Nov-13

Adjusted Close

Jan-14

50-Day Avg

4000000

3000000

Mar-14

200-Day Avg

May-14

0

2000000

1000000

10000000

9000000

8000000

7000000

6000000

5000000

1 University of Oregon Investment

Group

University of Oregon Investment Group

Figure 1: Costco Warehouse Store

Source: Google Images

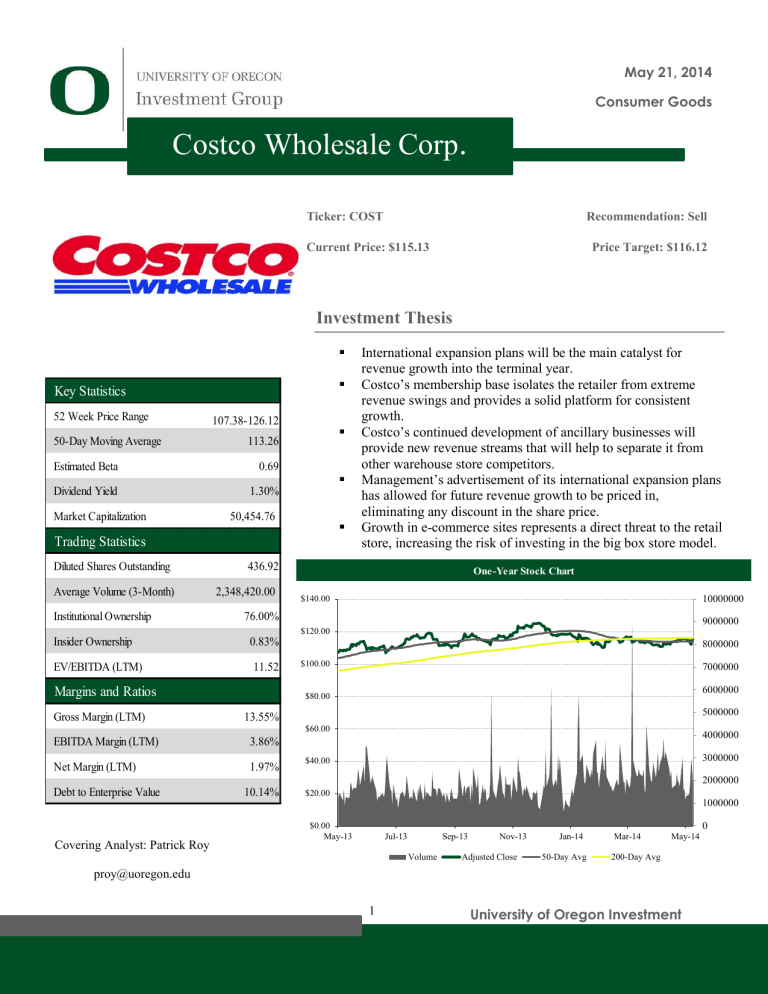

Figure 2: Product Dispersion as a percentage of revenue

CHART TITLE

Ancillary &

Other

17%

Fresh Food

13%

Softlines

11%

Food

21%

Sundries

22%

Source: UOIG Spreads

Hardlines

16%

May 21, 2014

Business Overview

Costco Wholesale Corporation operates 649 membership warehouses throughout

North America, the United Kingdom, Australia, and the Asia-Pacific Region that provide low prices on bulk household items as well as foodstuffs. The Costco business model is centered on large, utilitarian warehouse stores that offer a range of high quality merchandise at prices that are consistently lower than competitors.

Costco’s pricing model is a result of their direct relationship with suppliers as well as the warehouse-style layout of their stores, which allow for inventory to be stored on pallets directly above the sales floor, cutting down on handling, storage, and labor costs. The efficiency of their shipping and inventory process, combined with rapid product turnover and high sales volume, allows for Costco to thrive despite margins that are consistently lower than comparable retailers.

Costco’s membership program, which starts at an annual rate of $55, allows the company to reinforce loyalty amongst its customers as well as contribute to top line revenue. The membership renewal rate for fiscal year 2013 was 90% in the

US and Canada and 86% worldwide. A typical warehouse format is 143,000 square feet and contains approximately 3,700 stock keeping units (SKUs).

Sundries, 22%

Food and beverage products with exceptionally long shelf lives including candy, snack foods, alcoholic and non-alcoholic beverages. This category also includes tobacco products as well as cleaning and institutional supplies.

Hardlines, 16%

Non-food items such as electronics, appliances, office supplies, sporting goods, and toys. Seasonal items, garden supplies, and automotive supplies are also included in this category.

Food, 21%

All dry and institutionally packaged food items including frozen and canned goods.

Softlines, 11%

All apparel offerings as well as jewelry, home furnishings, media, and housewares. Many of these items are marketed through the Costco-owned

Kirkland brand, which manufactures the majority of the company’s apparel and domestic items.

Fresh Food, 13%

Perishable items such as meat and produce as well as all deli and bakery offerings.

Ancillary and Other, 17%

Affiliated businesses including gas stations, pharmacy, food court, optical, onehour photo, and travel. This category also includes all online business conducted through Costco.com. Online business accounted for 3% of total revenue in the most recent fiscal year.

UOIG 2

University of Oregon Investment Group

May 21, 2014

Strategic Positioning

900

800

700

600

500

400

300

200

100

0

Figure 3: Total Warehouse Growth

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Source: UOIG Spreads

Discount Prices

Costco stores are well known for having outstanding prices relative to other retailers. This is a result of management’s policy to never mark up an item more than 14% above cost. Costco does not offer special sales nor does it market itself as a follower of the “everyday low prices” model made famous by Wal-Mart.

Rather, Costco’s prices are a result of its devotion to providing the best deal to the customer while accepting lower margins relative to the rest of the industry.

Volume plays a crucial role in Costco’s pricing model. Warehouse layouts are completely devoid of signage, forcing customers to wander the aisles to find the items they are seeking and often resulting in the purchase of more goods. The success of this technique is reflected in Costco’s sales numbers, which indicate that an average member spends over $90 per visit and nearly $1600 annually, much higher than other wholesale club stores. High sales volume allows Costco to thrive on thinner margins and has contributed to its development as the preeminent membership warehouse store.

Limited Product Offerings

The average Costco store carries approximately 3,700 products on its sales floor.

This number is significantly lower than average grocery stores that can often feature in excess of 50,000 individual items. This inventory concept is predicated on the ideal that providing fewer options to the customer simplifies the shopping experience and guarantees consistent purchases. The limited product model allows Costco to save on inventory costs and contributes to its discount price offerings.

Business Growth Strategies

250

200

150

100

50

0

Figure 4: International Warehouse Growth

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Source: UOIG Spreads

Geographic Expansion

Management has been very outspoken about its intention to add over 100 international stores in the next ten years. This is reflected in the revenue model of this report that shows international operations as a percentage of total stores moving from 11% in 2013 to over 22% in the terminal year. Costco is scheduled to open its first store in Spain this year and plans to continue expansion efforts throughout Europe, Australia, and East Asia while simultaneously continuing to build in the mature markets of the US and Canada.

E-Commerce

Costco is currently working on growing its online presence through Costco.com.

Costco’s online sales increased by 24% in the first quarter of fiscal 2014, following growth rates of 20% and 15% in the last two quarters of fiscal 2013.

Although membership rules requiring customers to buy memberships to the warehouse store still apply online, expansion opportunities through the online marketplace remain promising.

Organic Growth

Costco believes it will continue to grow in the United States and Canada by providing high quality items at discount prices. By sticking to its fundamentals,

Costco will continue to increase its membership base and work towards a larger market share. The company’s reputation as an honest, fair corporation will gain it favor with consumers and assist in continued domestic growth.

UOIG 3

University of Oregon Investment Group

May 21, 2014

Industry

Competition

Concentration

Life Cycle Stage

Capital Intensity

Technology Change

Regulation & Policy

Industry Assistance

BJ's Wholesale

3%

Target

2%

Meijer, Inc

3%

Figure 5: Industry Structure

Source: IBIS World

Costco

16%

Other

11%

Wal-Mart

65%

Source: IBIS World

Medium

High

Mature

Medium

Medium

Light

None

Figure 6: Industry Market Share

Warehouse Clubs and Supercenters represent a unique subset of the department store industry. The industry comprises large stores that primarily offer a line of general grocery items along with apparel, appliances, and other general merchandise products. Warehouse clubs provide a wide selection of goods, often in bulk, at discounted prices offered as a result of membership fees paid by each customer.

Costco currently holds a 16.3% market share of the warehouse and super store industry, second only to Wal-Mart’s 64.4% share. The highly concentrated nature of the market place, with Costco and Wal-Mart accounting for over 80% of industry revenue, make it a very competitive industry with high barriers to entry.

Price stands as the most important basis for competition in the industry. The economic downturn put a premium on value and large stores have scrambled to maintain low prices in order to keep customers from leaving in favor of online ecommerce sites such as Amazon and Overstock.

Macro factors

Gross Domestic Product Growth

The performance of warehouse clubs and supercenters is historically tied to the general performance of the economy. This is evident when examining the midrecession numbers of 2009 where revenue growth fell sharply across the industry.

Stronger economic numbers in the last few years have positively impacted industry revenue growth.

Per Capita Disposable Income

Similar to its reliance on general economic growth, warehouse clubs rely heavily on the income of their customers. This makes per capita disposable income a strong indicator for the performance of the industry. Large stores remain attractive during periods of low income because of their typically lower prices, but consumers tend to spend less per trip.

Consumer Spending

Consumer spending also has a direct relation to revenue for the industry. Increases in consumer spending are typically reflected in the sales growth of the industry, with strong spending patterns often resulting in higher overall growth. This is especially true for Costco, which relies on customers to spend more money per trip than they would at comparable stores.

Competition

Competition in the industry is extremely high and is getting more intense as internet companies continue to eat into the superstore market share. The concentrated nature of the industry make it very difficult for new companies to come in, resulting in a few companies controlling a substantial market share. Big box stores are in a constant struggle to stock their shelves with the highest quality merchandise at the cheapest prices. Membership warehouses such as BJ’s and

Sam’s Wholesale Club are in direct competition with Costco’s business model while other large supercenters such as Wal-Mart and Target continue to provide outside pressure.

Costco’s inventory and supply chain efficiencies provide a significant advantage over their competition that has allowed them to seize a strong portion of the big box and superstore market share. Costco’s largest threat in the future will certainly be the emergence of e-commerce sites that will attempt to undercut prices and

UOIG 4

250000

200000

150000

100000

50000

University of Oregon Investment Group

Figure 7: Projected Total Revenue

0

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Source: UOIG Spreads

May 21, 2014 appeal to the next generation of millennial shoppers. Much of Costco’s future success will be dependent on its ability to adapt and restructure its operations in the face of evolving market preferences.

Management and Employee Relations

Costco maintains an outstanding reputation with respect to employee relations.

The average store employee earns over $17 per hour and is provided with a full range of benefits including healthcare and retirement. Much of these policies are a result of the policies put forth by the company’s management team.

Jeffrey H. Brotman, Chairman of the Board

Mr. Brotman is the co-founder and Chairman of the Board of Costco Wholesale

Corp. He founded the company along with Jim Sinegal in Seattle, Washington in

1983. He has served as Chairman since 1994 and director of the company since its founding. Mr. Brotman’s total compensation in fiscal 2013 was $5,385,475.

He is currently the largest executive shareholder with a total of 815,324 shares.

W. Craig Jelinek, President and CEO

Mr. Jelinek joined Costco Wholesale Corp. in April 1984 and has served as president since February 2010. He took over as CEO on January 1, 2012, replacing Jim Sinegal. Prior to his role as President he worked as Executive Vice

President and Chief Operating Officer. Mr. Jelinek’s total compensation in fiscal

2013 was $5,103,085.

Figure 8: COST Portfolio Statistics

Portfolio Shares Cost Basis Market Value Return

Tall Firs 100 11232.00

11249.00

0.15%

Svigals 35 3838.96

3937.15

2.50%

Management Guidance

The management team has a reputation in the industry for providing quality guidance to investors. Costco shows a historical trend of meeting or exceeding analyst expectations and a failure to meet numbers has often resulted in considerable stock price depreciation. Management expects to open 100 international stores in the next 10 years and believes that growth rates in the US and Canada will continue to steadily increase. They also expect the Kirkland brand and the e-commerce arena to continue to grow as a percentage of total revenue.

With regards to the 2014 fiscal year, management expects to open 30 additional stores with 17 coming in the United States, 3 in Canada, and 10 in the international market. Revenue is expected to fall somewhere between 113 and 116 billion.

Margins, accounting metrics, and other expenses are expected to remain in line with historical trends as a percentage of revenue.

Portfolio Strategy

Source: UOIG Annual Report

Costco Wholesale Corp. is currently held by the Oregon Investment Group in both the Tall Firs and Svigals Portfolios. As of March 26, 2014 COST represented

1.16% of Tall Firs and 2.37% of Svigals. A total of 135 shares were purchased in the spring of 2013 at a share price of $112.49 with 100 shares being allocated to

Tall Firs and the remaining 35 in Svigals. Since purchase, COST has earned a return on investment of 0.15% in Tall Firs and 2.5% in Svigals. It is worth noting that the covering analyst initially pitched Costco as a hold for all portfolios.

UOIG 5

University of Oregon Investment Group

May 21, 2014

Recent News

Figure 9: DCF Considerations

Considerations

Avg. Industry Debt / Equity

Avg. Industry Tax Rate

Current Reinvestment Rate

Reinvestment Rate in Year 2019E

Implied Return on Capital in Perpetuity

Terminal Value as a % of Total

Implied 2014E EBITDA Multiple

Implied Multiple in Year 2023E

Free Cash Flow Growth Rate in Year 2023E

Source: UOIG Spreads

30.48%

34.15%

52.54%

32.61%

9.20%

80.9%

13.1x

6.1x

11%

May 12, 2014 – “Costco kicks off European drive in Spain”

Costco took its first step onto the European mainland by opening a 145,000 square foot warehouse in Seville, Spain. Costco plans to expand its place in the Spanish market place by opening a store in Madrid later in the year. This marks an important step in the plan to greatly expand the company’s international operations. The article provides a preview of Costco’s future plans to expand in the European market. (The Seattle Times)

Implied Price

May 3, 2014 – “Costco store draws a crowd to pre-opening preview”

Terminal Growth Rate

Vehicles spilled out of the parking lot and into surrounding businesses as members arrived to get a sneak peak of a new Costco store opening in Baton

Rouge, Louisiana. The store invited new members to come tour the store prior to its opening, allowing new members to see the warehouse before they will be allowed to make purchases. The 148, 316 square foot store will include a tire shop and will employ 220 part-time and regular employees. The article shows the popularity of Costco stores in the United States. (Baton Rouge Advocate)

Catalysts

Upside

New ventures into Europe, Asia, and Australia will provide strong revenue growth

Strong fundamentals will encourage customer loyalty and bolster

Costco’s image as a reputable company in the superstore industry

Figure 10: Comparable Weightings

Multiple

EV/Revenue

EV/Gross Profit

EV/EBIT

EV/EBITDA

EV/(EBITDA-Capex)

Market Cap/Net Income = P/E

Price Target

Current Price

Overvalued

Implied Price Weight

192.02

0.00%

90.71

0.00%

98.10

20.00%

81.11

40.00%

51.82

0.00%

80.39

40.00%

$84.22

$115.13

(26.85%)

Source: UOIG Spreads

Downside

The movement of retail shopping into the online sphere will cut into Costco’s market share

The early pricing in of international expansion will slow stock price appreciation and hold the price in its current range

Analyst assumptions that the stock is currently fairly valued may trigger a sell off, resulting in price depreciation

Costco’s history of meeting analyst predictions opens it up to large sell offs if their projected numbers are not met

Comparable Analysis (35%)

Comparable companies include Wal-Mart, Target, Home Depot, and Kroger.

Finding strong comparables was a challenge because of Costco’s unique business model, high growth rates, and low net margins. The companies in the analysis were chosen because of their similarity in terms of product offerings and operations. Additionally, I paid special attention to revenue growth rates. None of the companies have market capitalizations in the same region as Costco, with

Wal-Mart and Home Depot both being larger while Kroger and Target are smaller.

However, of the four companies Kroger and Home Depot both offer growth rates most similar to Costco, with 2014 projected growth at 8.4% and 4.9% respectively. Because of the lack of strong comparable companies, the forward

UOIG 6

University of Oregon Investment Group

Figure 11: Kroger Logo

Source: Google Images

Figure 12: Home Depot Logo

Source: Google Images

Figure 13: Wal-Mart Logo

Source: Google Images

May 21, 2014 comparable analysis is weighed significantly less than the discounted cash flow model.

Forward Comparable Analysis

Kroger Co. 35%

Kroger along with its majority owned subsidiaries operate retail food and drug stores, multi-department stores, jewelry stores, and convenience stores. The company runs supermarkets as well as superstores under multiple banners including Kroger, Fred Meyer, Fry’s, and QFC. Kroger also operates fuel centers and fine jewelry stores in connection with its other retail centers. As of the last fiscal year there were 2,640 stores throughout the US and international markets.

Kroger was weighted the most out of the four comparables because of its similar growth rates as well as its significant exposure to the food market. The company’s revenue growth rate of 8.4% is the closest to Costco’s rate of 9.4%.

Home Depot, Inc. 25%

Home Depot, Inc. is a home improvement retailer based in Atlanta, Georgia that offers various building materials, home improvement and garden products through its large warehouse-style retail stores. The company also operates a number of ancillary businesses such as installation, lumber yards, and home improvement classes. Home Depot currently operates 2,263 retail stores in the

US, Canada, Puerto Rico, Guam, and Canada.

Home Depot was chosen because of similarities in growth rates and physical store footprints. While the company’s growth rates are lower than Costco’s they are still much closer than those of Wal-Mart or Target.

Wal-Mart Stores, Inc. 25%

Wal-Mart Stores Inc. operates discount stores, warehouse clubs, and supercenters throughout the world. The stores offer a full range of grocery products as well as household items, electronics, toys, and jewelry. The company also provides a full range of ancillary businesses including pharmacy, optical, automotive, and financial services. Wal-Mart also maintains a substantial online profile through

Walmart.com. As of the last fiscal year the company operated 11,302 stores in 27 countries with the US market accounting for just over 60% of total revenue.

Wal-Mart was chosen because of its position as Costco’s strongest competitor in the US market. Their wide product offering, production of ancillary business, and control of the membership wholesaler Sam’s Club made it the most similar to

Costco’s business model and was weighted accordingly.

UOIG 7

University of Oregon Investment Group

Figure 14: Target Logo

May 21, 2014

Target Corp. 15%

Target Corporation runs general merchandise stores throughout the US and

Canada. The company offers household essentials, electronics, apparel, and a small range of grocery items. Target also carries a number of decorative and furniture items as well as small appliances and seasonal merchandise. As of the last fiscal year the company operated 1,924 stores with over 90% of its revenue stemming from the US market.

Target was chosen because of its similar market capitalization as well as its supply chain similarities. Its small growth numbers and differences in product offerings caused it to be weighted the least of the 4 comparables.

Source: Google Images

Discounted Cash Flow Analysis (65%)

Figure 15: Beta Calculation

Five Year Weekly

Three Year Weekly

Three Year Daily

One year daily

Beta

0.62

0.65

0.67

0.74

Costco Wholesale Corp. Beta 0.69

SE Weighting

0.05

0.00%

0.07

0.03

0.07

0.00%

70.00%

30.00%

Source: UOIG Spreads

Revenue Model

Revenue was projected on a per store basis. Costco typically adds between 20 and

30 warehouse stores per year with little regard for how the stores appear as a percentage of growth. The revenue model is broken up into three geographic segments: United States, Canada, and International.

Management’s dedication to international expansion explains the reasoning behind the projections. International warehouse growth is expected to peak in

2016 at 10.93% and will then trend down to 2.36% in the terminal year. The number of warehouses was projected first; then the last year’s revenue/warehouse number was used to project revenue for the new year while simultaneously accounting for new growth. The revenue/warehouse number for the most recently projected year would then be calculated by taking revenue divided by the number of warehouses.

Expansion into the international market acts as the main catalyst for revenue growth throughout the model with the US and Canadian sectors providing steady growth in line with historical trends.

Beta

121

0.59

0.64

0.69

0.74

0.79

Figure 16: Beta Sensitivity Analysis

Analysis

2.0%

Implied Price

Terminal Growth Rate

2.5% 3.0% 3.5%

111.54

102.46

94.53

87.55

81.36

127.53

115.94

106.02

97.42

89.91

149.56

134.06

121.12

110.17

100.78

181.84

159.69

141.88

127.26

115.05

4.0%

233.69

198.74

172.21

151.39

134.62

Source: UOIG Spreads

The beta was calculated with a 70% weighting for the three-year daily regression accurately reflects the risk associated with Costco.

Cost of Goods Sold

Cost of Goods Sold includes the purchase price of inventory sold, inbound and outbound shipping charges, as well as all costs from Costco’s depot operations.

COGS for Costco have remained very consistent over time and typically range between 86.25% and 86.66%. COGS were projected as a percent of revenue and are expected to remain in line with historical trends.

UOIG 8

University of Oregon Investment Group

Figure 17: Cost of Debt Sensitivity Analysis

May 21, 2014

Selling, General, & Administrative

SG&A costs consist primarily of salaries and benefits as well as administrative expenses including utilities, bank charges, and rent. These costs have remained remarkably consistent over the last 5 years as a percentage of revenue ranging from 9.60% to 10.16%. SG&A was projected as a percent of revenue and is not expected to deviate significantly from previous years.

Depreciation and Amortization

121

2.15%

2.65%

3.15%

3.65%

4.15%

Implied Price

Terminal Growth Rate

2.0% 2.5% 3.0% 3.5% 4.0%

96.33

108.24

124.00

145.79

177.92

95.42

107.12

122.54

143.81

175.02

94.53

106.02

121.12

141.88

172.21

93.66

104.93

119.73

140.00

169.48

92.80

103.86

118.36

138.16

166.82

projected into the future as a percentage of Plant, Property, & Equipment.

Net Working Capital

Costco’s net working capital has historically been negative and is expected to remain that way going forward. Net working capital includes accounts receivable, inventory for current assets, accounts payable, income tax payable, and other liabilities while excluding cash, short term investments, and short-term debt.

Source: UOIG Spreads

It should be noted that the negative working capital numbers do not reflect an inability to meet its payables. Costco does not have a cash shortage and has not taken out debt to cover a short cash position. Costco’s ability to rapidly turn over its inventory before it is required to pay vendors allows it to finance a greater percentage of inventory through payment terms provided by suppliers rather than by working capital.

Figure 18: Tax Rate Sensitivity Analysis

Cost of Debt

Calculating a realistic cost of debt proved to be very challenging for Costco. The company has historically been able to borrow money at rates below the US

Government’s risk free rate of 2.62%. This could be a result of Costco’s outstanding credit rating, which is stronger than any other company in the

121

31.50%

32.50%

33.50%

34.50%

35.50%

2.0%

94.37

94.45

Implied Price

Terminal Growth Rate

2.5%

105.81

105.91

3.0%

120.85

120.99

3.5%

141.52

141.70

94.53

94.62

94.70

106.02

106.12

106.22

121.12

121.25

121.39

141.88

142.06

142.24

Source: UOIG Spreads

4.0%

171.69

171.95

172.21

172.47

172.74

Costco’s historic borrowing rates. I believe a cost of debt of 3.15% is an accurate estimate of Costco’s future costs.

Tax Rate

The tax rate has historically been in the 35% range. However, with international business taking up a greater portion of revenue I am predicting the tax rate to settle at 33.5% and remain consistent into the terminal year.

UOIG 9

University of Oregon Investment Group

May 21, 2014

Terminal Growth Rate

Free cash flow was growing at 11% going into the model’s terminal year. To remedy this I used an intermediate growth rate to trend it down to the standard

3% in compliance with group standards.

Figure 19: Final Implied Price

Recommendation

Method

Comparable Analysis

DCF Asssumptions

Price Target

Current Price

Undervalued

Implied Price

Source: UOIG Spreads

84.22

Weight

35.00%

133.30

116.12

115.13

0.86%

I recommend a sell for the Svigals and Tall Firs Portfolios. Based on

Discounted Cash Flow and Forward Comparable analysis, Costco is currently trading slightly below fair market value. International expansion plans have been priced into the market for a substantial period, eliminating the discount in Costco’s share price and resulting in limited potential appreciation. The stock price has been relatively flat for over a year and I do not predict any substantial movement in the near future.

Additionally, the group currently holds positions in other large retailers such as Target and Home Depot, making it unnecessary to maintain a position in Costco. There is no doubt that Costco possesses strong fundamentals, but there are other companies that will provide stronger potential gains at the same level of risk.

UOIG 10

University of Oregon Investment Group

Appendix 1 – Comparable Analysis

Comparables Analysis

($ in millions)

Max

115.13

0.85

Stock Characteristics

Current Price

Beta

Size

Short-Term Debt

Long-Term Debt

Cash and Cash Equivalent

Non-Controlling Interest

Preferred Stock

Diluted Basic Shares

Market Capitalization

Enterprise Value

Growth Expectations

% Revenue Growth 2014E

% Revenue Growth 2015E

% EBITDA Growth 2014E

% EBITDA Growth 2015E

% EPS Growth 2014E

% EPS Growth 2015E

Profitability Margins

Gross Margin

EBIT Margin

EBITDA Margin

Net Margin

Credit Metrics

Interest Expense

Debt/EV

Leverage Ratio

Interest Coverage Ratio

Operating Results

Revenue

Gross Profit

EBIT

EBITDA

Net Income

Capital Expenditures

Multiples

EV/Revenue

EV/Gross Profit

EV/EBIT

EV/EBITDA

EV/(EBITDA-Capex)

Market Cap/Net Income = P/E

11,040.00

44,560.00

7,280.00

6,580.00

-

3,229.18

248,678.77

303,578.77

9.4%

7.8%

11.8%

8.6%

25.1%

18.7%

34.82%

11.47%

14.49%

7.25%

2,386.00

0.32

2.30

38.96

490,434.00

119,005.00

26,331.00

37,876.00

17,055.00

13,082.00

1.45x

4.17x

15.08x

11.52x

30.47x

22.23x

Min

46.99

0.47

9.00

5,000.00

401.00

-

-

438.91

24,613.63

35,533.63

3.0%

3.5%

3.1%

3.1%

3.5%

8.5%

13.55%

2.39%

3.86%

1.54%

114.00

0.10

1.17

6.60

Median

77.01

0.68

Weight Avg.

63.84

0.66

1,657.00

12,622.00

1,900.00

11.00

-

650.00

50,454.76

51,179.76

4.9%

4.3%

10.9%

7.8%

12.7%

11.7%

24.27%

5.34%

7.72%

3.41%

763.00

0.18

1.47

15.71

3,638.30

20,084.60

2,539.60

1,648.85

-

1,441.28

103,222.32

126,054.47

5.4%

4.1%

8.8%

5.9%

13.6%

12.6%

26.48%

5.85%

8.57%

3.73%

1,103.50

0.23

1.79

12.70

COST

Costco

Wholesale Corp.

115.13

0.69

190.00

5,000.00

4,644.00

179.00

-

438.91

50,454.76

51,179.76

9.4%

7.8%

11.1%

7.8%

3.5%

11.7%

13.55%

2.95%

3.86%

1.97%

114.00

0.10

1.17

38.96

KR

Kroger Co.

35.00%

46.99

0.68

1,657.00

9,653.00

401.00

11.00

-

536.17

24,613.63

35,533.63

8.4%

4.3%

10.9%

4.8%

12.7%

10.5%

20.67%

2.39%

4.61%

1.54%

451.00

0.32

2.30

10.91

74,880.00

15,590.54

2,550.00

4,441.29

1,646.00

1,506.00

0.33x

1.61x

11.53x

7.22x

11.46x

14.58x

106,608.00

22,347.00

3,999.00

6,971.00

2,555.00

2,761.42

0.62x

2.55x

12.67x

8.02x

12.24x

14.95x

191,836.55

48,017.95

10,447.10

15,233.80

6,722.10

5,058.00

0

0.74x

2.59x

12.85x

8.14x

13.87x

15.54x

115,059.31

15,590.54

3,394.25

4,441.29

2,269.78

2,761.42

0.44

3.28

15.08

11.52

30.47

22.23

Multiple

EV/Revenue

EV/Gross Profit

EV/EBIT

EV/EBITDA

EV/(EBITDA-Capex)

Market Cap/Net Income = P/E

Price Target

Current Price

Overvalued

Implied Price

191.98

Weight

0.00%

90.71

98.10

81.11

0.00%

20.00%

51.82

80.39

$84.22

$115.13

(26.85%)

40.00%

0.00%

40.00%

106,608.00

22,039.00

2,550.00

4,919.00

1,646.00

2,903.00

0.33

1.61

13.93

7.22

17.63

14.95

WMT

Wal-Mart

Stores, Inc.

25.00%

77.01

0.47

11,040.00

44,560.00

7,280.00

6,580.00

-

3,229.18

248,678.77

303,578.77

490,434.00

119,005.00

26,331.00

37,876.00

17,055.00

13,082.00

UOIG 11

3.0%

3.9%

3.1%

3.1%

3.9%

8.5%

24.27%

5.37%

7.72%

3.48%

2,386.00

0.18

1.47

15.87

0.62

2.55

11.53

8.02

12.24

14.58

HD

Home Depot,

Inc.

25.00%

77.36

0.85

9.00

14,691.00

1,900.00

-

-

1,395.31

107,393.07

120,193.07

4.9%

4.4%

9.7%

8.6%

17.6%

15.9%

34.82%

11.47%

14.49%

7.25%

763.00

0.12

1.23

15.71

82,733.00

28,804.00

9,488.00

11,990.00

5,996.00

1,506.00

1.45

4.17

12.67

10.02

11.46

17.91

May 21, 2014

TGT

Target Corp.

15.00%

58.64

0.61

1,974.00

12,622.00

695.00

-

-

650.00

37,263.92

51,164.92

3.1%

3.5%

11.8%

8.4%

25.1%

18.7%

29.84%

5.34%

9.31%

3.41%

1,056.00

0.29

2.09

6.60

74,880.00

22,347.00

3,999.00

6,971.00

2,555.00

2,633.00

0.68

2.29

12.79

7.34

11.79

14.58

University of Oregon Investment Group

Appendix 2 – Discounted Cash Flows Valuation

Discounted Cash Flow Analysis

($ in millions)

Total Revenue

% YoY Growth

Cost of Goods Sold

% Revenue

Gross Profit

Gross Margin

Selling General and Administrative Expense

% Revenue

Depreciation and Amortization

% Plant, Property, & Equipment

Preopening Expenses

% Revenue

Earnings Before Interest & Taxes

% Revenue

Interest Expense

% Revenue

Net Interest (Income)

% Revenue

Earnings Before Taxes

% Revenue

Less Taxes (Benefits)

Tax Rate

Net Income

Net Margin

Add Back: Depreciation and Amortization

Add Back: Interest Expense*(1-Tax Rate)

Operating Cash Flow

% Revenue

Current Assets

% Revenue

Current Liabilities

% Revenue

Net Working Capital

% Revenue

Change in Working Capital

Capital Expenditures

% Revenue

Acquisitions

% Revenue

Unlevered Free Cash Flow

Discounted Free Cash Flow

2009A

71,422.00

(1.46%)

61,607.00

86.26%

9,815.00

13.74%

7,252.00

10.15%

728.00

7.03%

41.00

0.06%

1,794.00

2.51%

-

-

3,117.05

2010A

77,946.00

9.13%

67,200.00

86.21%

10,746.00

13.79%

7,840.00

10.06%

795.00

7.29%

26.00

0.03%

2,085.00

2.67%

-

-

2,380.65

2011A

88,915.00

14.07%

76,884.00

86.47%

12,031.00

13.53%

8,691.00

9.77%

855.00

7.56%

46.00

0.05%

2,439.00

2.74%

-

-

2,345.06

2012A

99,137.00

11.50%

85,915.00

86.66%

13,222.00

13.34%

9,518.00

9.60%

908.00

7.30%

37.00

0.04%

2,759.00

2.78%

-

-

380.67

2013A

105,156.00

6.07%

91,002.00

86.54%

14,154.00

13.46%

10,104.00

9.61%

946.00

7.30%

51.00

0.05%

3,053.00

2.90%

-

-

978.88

2014E

115,059.31

9.42%

99,468.77

86.45%

15,590.54

13.55%

11,091.72

9.64%

1,047.04

7.54%

57.53

0.05%

3,394.25

2.95%

108.00

0.15%

111.00

0.14%

(58.00)

0.08%

1,744.00

(88.00)

0.11%

2,062.00

2.44%

629.00

36.07%

2.65%

731.00

35.45%

116.00

0.13%

(60.00)

0.07%

2,383.00

2.68%

841.00

35.29%

95.00

0.10%

99.00

0.09%

(103.00)

0.10%

2,767.00

(97.00)

0.09%

3,051.00

2.79%

1,000.00

36.14%

2.90%

990.00

32.45%

53.00

0.05%

(48.00)

0.04%

3,389.25

2.95%

1,119.47

33.03%

1,115.00

1.56%

728.00

69.05

795.00

71.65

855.00

75.06

1,912.05

2.68%

1,331.00

1.71%

2,197.65

2.82%

1,542.00

1.73%

2,472.06

2.78%

1,767.00

1.78%

908.00

60.67

2,735.67

2.76%

2,061.00

1.96%

946.00

66.88

3,073.88

2.92%

2,269.78

1.97%

1,047.04

35.49

3,352.31

2.91%

-

-

1,223.07

575.99

2015E

124,075.73

7.84%

107,275.87

86.46%

16,799.85

13.54%

11,936.09

9.62%

1,116.68

7.41%

74.45

0.06%

3,672.64

2.96%

-

-

-

-

3,672.64

2.96%

1,230.33

33.50%

2,442.31

1.97%

1,116.68

-

3,558.99

2.87%

-

-

1,087.07

964.39

2016E

133,117.52

7.29%

115,133.35

86.49%

17,984.18

13.51%

12,792.59

9.61%

1,211.37

7.43%

93.18

0.07%

3,887.03

2.92%

-

-

-

-

3,887.03

2.92%

1,302.16

33.50%

2,584.88

1.94%

1,211.37

-

-

3,796.25

2.85%

-

1,300.26

1,086.48

2017E

141,558.50

6.34%

122,462.26

86.51%

19,096.24

13.49%

13,660.40

9.65%

1,302.34

7.38%

99.09

0.07%

4,034.42

2.85%

-

-

-

-

4,034.42

2.85%

1,351.53

33.50%

2,682.89

1.90%

1,302.34

-

-

3,985.23

2.82%

-

1,493.12

1,175.12

2018E

150,297.62

6.17%

130,052.53

86.53%

20,245.09

13.47%

14,488.69

9.64%

1,412.80

7.38%

105.21

0.07%

4,238.39

2.82%

-

-

-

-

4,238.39

2.82%

1,419.86

33.50%

2,818.53

1.88%

1,412.80

-

-

4,231.33

2.82%

-

1,434.78

1,063.58

2019E

160,175.91

6.57%

138,664.29

86.57%

21,511.63

13.43%

15,408.92

9.62%

1,537.69

7.70%

96.11

0.06%

4,468.91

2.79%

-

-

-

-

4,468.91

2.79%

1,497.08

33.50%

2,971.82

1.86%

1,537.69

-

-

4,509.51

2.82%

-

1,408.22

983.22

2020E

170,301.34

6.32%

147,429.87

86.57%

22,871.47

13.43%

16,417.05

9.64%

1,583.80

7.59%

85.15

0.05%

4,785.47

2.81%

-

-

-

-

4,785.47

2.81%

1,603.13

33.50%

3,182.34

1.87%

1,583.80

-

4,766.14

2.80%

-

-

1,914.90

1,259.28

May 21, 2014

2021E

181,191.20

6.39%

156,802.86

86.54%

24,388.33

13.46%

17,448.71

9.63%

1,666.96

7.52%

72.48

0.04%

5,200.19

2.87%

-

-

-

-

5,200.19

2.87%

1,742.06

33.50%

3,458.12

1.91%

1,666.96

-

5,125.08

2.83%

6,610.00

9.25%

9,653.00

13.52%

(3043.00)

4.26%

6,959.00

8.93%

11,240.00

14.42%

(4281.00)

5.49%

8,093.00

9.10%

13,537.00

15.22%

(5444.00)

6.12%

8,672.00

8.75%

13,241.00

13.36%

(4569.00)

4.61%

(2,455.00)

1,250.00

1.75%

(1,238.00)

1,055.00

1.35%

(1,163.00)

1,290.00

1.45%

875.00

1,480.00

1.49%

9,716.00

9.24%

14,273.00

13.57%

(4557.00)

4.33%

12.00

2,083.00

1.98%

10,550.94

9.17%

15,740.11

13.68%

(5189.17)

4.51%

11,439.78

9.22%

17,010.78

13.71%

(5571.00)

4.49%

(632.17)

2,761.42

2.40%

(381.83)

2,853.74

2.30%

12,127.01

9.11%

18,143.92

13.63%

(6016.91)

4.52%

13,037.54

9.21%

19,351.05

13.67%

(6313.51)

4.46%

13,857.44

9.22%

20,530.65

13.66%

(6673.21)

4.44%

14,752.20

9.21%

21,912.07

13.68%

(7159.86)

4.47%

(445.91)

2,941.90

2.21%

(296.60)

2,788.70

1.97%

(359.71)

3,156.25

2.10%

(486.65)

3,587.94

2.24%

15,616.63

9.17%

23,246.13

13.65%

(7629.50)

4.48%

16,669.59

9.20%

24,551.41

13.55%

(7881.82)

4.35%

(469.64)

3,320.88

1.95%

(252.32)

3,424.51

1.89%

-

-

1,952.89

1,209.63

-

-

2,344.27

1,367.66

2022E

190,722.88

5.26%

164,994.36

86.51%

25,728.52

13.49%

18,328.47

9.61%

1,716.51

7.45%

57.22

0.03%

5,626.32

2.95%

-

-

-

-

5,626.32

2.95%

1,884.82

33.50%

3,741.51

1.96%

1,716.51

-

5,458.01

2.86%

3,924.29

1.97%

1,794.28

-

5,718.58

2.87%

17,546.51

9.20%

25,823.88

13.54%

(8277.37)

4.34%

18,321.61

9.19%

26,993.97

13.54%

(8672.36)

4.35%

(395.56) (394.99)

3,509.30

1.84%

3,468.94

1.74%

-

-

2,644.62

1,453.22

2023E

199,364.64

4.53%

172,430.48

86.49%

26,934.16

13.51%

19,178.88

9.62%

1,794.28

7.51%

59.81

0.03%

5,901.19

2.96%

-

-

-

-

5,901.19

2.96%

1,976.90

33.50%

UOIG 12

University of Oregon Investment Group

Appendix 3 – Revenue Model

May 21, 2014

Revenue Model

($ in millions)

United States Operations

Warehouses

% Growth

% of Total Warehouses

Revenue / Warehouse

% Growth

Revenue

% Growth

% of Total Revenue

2009A 2010A 2011A 2012A

439 406

2.01%

77.04%

139.28

(2.58%)

56,548.00

(0.62%)

79.17%

416

2.46%

77.04%

143.33

2.91%

59,624.00

5.44%

76.49%

429

3.13%

72.47%

151.29

5.56%

64,904.00

8.86%

73.00%

2.33%

72.20%

163.50

8.07%

71,776.00

10.59%

72.40%

2013A

451

2.73%

71.14%

167.39

2.38%

75,493.00

5.18%

71.79%

2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E

468

3.77%

70.48%

175.93

5.10%

82,333.90

9.06%

71.56%

479

2.35%

69.52%

184.72

5.00%

88,482.19

7.47%

71.31%

488

1.88%

68.35%

193.77

4.90%

94,562.79

6.87%

71.04%

497

1.85%

67.34%

202.11

4.30%

100,448.70

6.22%

70.96%

505

1.61%

66.45%

211.81

4.80%

106,965.08

6.49%

71.17%

514

1.78%

65.73%

222.40

5.00%

114,312.52

6.87%

71.37%

520

1.24%

64.94%

233.07

4.80%

121,285.03

6.10%

71.22%

527

1.22%

64.41%

244.82

5.04%

128,952.05

6.32%

71.17%

532

1.01%

64.02%

254.86

4.10%

135,594.90

5.15%

71.10%

537

0.93%

63.89%

264.44

3.76%

142,005.93

4.73%

71.23%

Canada Operations

Warehouses

% Growth

% of Total Warehouses

Revenue / Warehouse

% Growth

Revenue

% Growth

% of Total Revenue

Total Operations

Warehouses

% Growth

Revenue / Warehouse

% Growth

Revenue

% Growth

2.67%

14.61%

126.45

(9.92%)

9,737.00

(7.51%)

13.63%

Other International Operations

Warehouses

% Growth

% of Total Warehouses

Revenue / Warehouse

% Growth

Revenue

% Growth

% of Total Revenue

44

12.82%

8.35%

116.75

(9.87%)

5,137.00

1.68%

77

2.60%

14.63%

152.54

79

3.80%

13.85%

170.98

82 82

0.00%

13.49%

191.67

202.11

85

3.66%

13.41%

7.19%

527

2.93%

135.53

(4.27%)

8.05%

540

2.47%

144.34

6.51%

11.24%

592

9.63%

150.19

4.05%

11.75%

608

2.70%

163.05

8.56%

11.87%

634

4.28%

165.86

1.72%

71,422.00

(1.46%)

20.63%

12,051.00

23.77%

15.46%

45

2.27%

12.08%

14,020.00

16.34%

15.77%

81

80.00%

8.33%

139.36

13.68%

123.35

19.36% (11.49%)

6,271.00

9,991.00

22.08% 59.32%

77,946.00

9.13%

88,915.00

14.07%

12.10%

15,717.00

12.10%

15.85%

87

7.41%

14.31%

133.84

8.51%

11,644.00

16.54%

99,137.00

11.50%

5.44%

17,179.00

9.30%

16.34%

98

12.64%

15.46%

127.39

(4.82%)

12,484.00

7.21%

105,156.00

6.07%

88

3.53%

13.25%

212.41

91

3.40%

13.21%

219.21

94

3.30%

13.16%

226.53

97

3.20%

13.14%

234.23

99

2.06%

13.03%

242.78

101

2.02%

12.92%

252.08

5.10%

18,692.37

8.81%

16.25%

3.20%

19,946.40

6.71%

16.08%

3.34%

21,292.83

6.75%

16.00%

3.40%

22,721.32

6.71%

16.05%

3.65%

24,035.79

5.79%

15.99%

3.83%

25,460.48

5.93%

15.90%

103

1.98%

12.85%

264.26

105

1.94%

12.84%

276.55

106

0.95%

12.75%

288.49

4.83%

27,218.69

6.91%

15.98%

4.65%

29,036.96

6.68%

16.03%

4.32%

30,579.12

5.31%

16.03%

106

0.00%

12.61%

299.02

3.65%

31,695.26

3.65%

15.90%

108

10.20%

16.27%

129.94

2.00%

14,033.04

12.41%

12.20%

119

10.18%

17.27%

131.49

1.20%

15,647.14

11.50%

12.61%

132

10.93%

18.49%

130.77

(0.55%)

17,261.90

10.32%

12.97%

144

9.09%

19.51%

127.70

(2.35%)

18,388.48

6.53%

12.99%

156

8.33%

20.53%

123.70

(3.13%)

19,296.74

4.94%

12.84%

167

7.06%

21.36%

122.17

(1.24%)

20,402.92

5.73%

12.74%

178

6.58%

22.21%

122.46

0.24%

21,797.62

6.84%

12.80%

186

4.50%

22.75%

124.74

1.86%

23,202.19

6.44%

12.81%

193

3.76%

23.22%

127.20

1.97%

24,548.86

5.80%

12.87%

198

2.36%

23.50%

129.91

2.13%

25,663.45

4.54%

12.87%

664

4.73%

173.28

4.47%

115,059.31

9.42%

689

3.76%

180.08

3.93%

124,075.73

7.84%

714

3.63%

186.44

3.53%

133,117.52

7.29%

738

3.36%

191.81

2.88%

141,558.50

6.34%

760

2.98%

197.76

3.10%

150,297.62

6.17%

782

2.90%

204.83

3.57%

160,175.91

6.57%

801

2.48%

212.51

3.75%

170,301.34

6.32%

818

2.04%

221.58

4.27%

181,191.20

6.39%

831

1.63%

229.50

3.57%

190,722.88

5.26%

841

1.15%

237.18

3.35%

199,364.64

4.53%

UOIG 13

University of Oregon Investment Group

Appendix 4 – Working Capital Model

Working Capital Model

($ in millions)

Total Revenue

Current Assets

Accounts Receivable

Days Sales Outstanding A/R

% of Revenue

Merchandise Inventory

Days Inventory Outstanding

% of Revenue

Deferred Income Taxes & Other Assets

% of Revenue

Total Current Assets

% of Revenue

Long Term Assets

Net PP&E Beginning

Capital Expenditures

Acquisitions

Depreciation and Amortization

Net PP&E Ending

Total Current Assets & Net PP&E

% of Revenue

Current Liabilities

Accounts Payable

Days Payable Outstanding

% of Revenue

Accrued Charges

% of Revenue

Deferred Income Taxes

% of Revenue

Deferred Membership Fees

% of Revenue

Current Portion of Long Term Debt

% of Revenue

Other Liabilities

% of Revenue

Total Current Liabilities

% of Revenue

May 21, 2014

2009A

71,422.00

2010A

77,946.00

2011A

88,915.00

2012A

99,137.00

2013A

105,156.00

2014E

115,059.31

2015E

124,075.73

2016E

133,117.52

2017E

141,558.50

2018E

150,297.62

2019E

160,175.91

2020E

170,301.34

2021E

181,191.20

2022E

190,722.88

2023E

199,364.64

834.00

4.26

1.17%

5,405.00

32.02

7.57%

371.00

0.52%

6,610.00

9.25%

884.00

4.14

1.13%

5,638.00

30.62

7.23%

437.00

0.56%

6,959.00

8.93%

965.00

3.96

1.09%

6,638.00

31.51

7.47%

490.00

0.55%

8,093.00

9.10%

1,026.00

3.79

1.03%

7,096.00

30.23

7.16%

550.00

0.55%

8,672.00

8.75%

1,201.00

3.84

1.14%

7,894.00

29.15

7.51%

621.00

0.59%

9,716.00

9.24%

1,323.18

4.20

1.15%

8,583.42

31.50

7.46%

644.33

0.56%

10,550.94

9.17%

1,439.28

4.25

1.16%

9,330.49

31.83

7.52%

670.01

0.54%

11,439.78

9.22%

1,530.85

4.20

1.15%

9,864.01

31.27

7.41%

732.15

0.55%

12,127.01

9.11%

1,585.46

4.09

1.12%

10,701.82

31.90

7.56%

750.26

0.53%

13,037.54

9.21%

1,698.36

4.12

1.13%

11,302.38

31.72

7.52%

856.70

0.57%

13,857.44

9.22%

1,858.04

4.25

1.16%

12,029.21

31.75

7.51%

864.95

0.54%

14,752.20

9.21%

1,907.37

4.09

1.12%

12,755.57

31.58

7.49%

953.69

0.56%

15,616.63

9.17%

2,065.58

4.16

1.14%

13,643.70

31.76

7.53%

960.31

0.53%

16,669.59

9.20%

2,212.39

4.23

1.16%

14,266.07

31.56

7.48%

1,068.05

0.56%

17,546.51

9.20%

2,332.57

4.28

1.17%

14,932.41

31.70

7.49%

1,056.63

0.53%

18,321.61

9.19%

10,355.00

1,250.00

-

728.00

10,877.00

17,487.00

24.48%

10,900.00

1,055.00

-

795.00

11,160.00

18,119.00

23.25%

11,314.00

1,290.00

-

855.00

11,749.00

19,842.00

22.32%

12,432.00

1,480.00

-

908.00

13,004.00

21,676.00

21.86%

12,961.00

2,083.00

-

946.00

14,098.00

23,814.00

22.65%

13,881.00

2,761.42

-

1,093.06

15,549.36

26,100.30

22.68%

15,062.79

2,853.74

-

1,134.05

16,782.48

28,222.27

22.75%

16,293.58

2,941.90

-

1,206.04

18,029.44

30,156.44

22.65%

17,638.19

2,788.70

-

1,337.73

19,089.16

32,126.70

22.70%

19,147.92

3,156.25

-

1,453.38

20,850.79

34,708.23

23.09%

19,957.92

3,587.94

-

1,601.76

21,944.10

36,696.30

22.91%

20,878.94

3,320.88

-

1,703.01

22,496.81

38,113.44

22.38%

22,177.80

3,424.51

-

1,753.93

23,848.39

40,517.98

22.36%

23,039.32

3,509.30

-

1,861.46

24,687.17

42,233.67

22.14%

23,983.57

3,468.94

-

1,945.80

25,506.71

43,828.32

21.98%

5,450.00

32.29

7.63%

1,720.00

2.41%

388.00

0.54%

824.00

1.15%

81.00

0.11%

1,190.00

1.67%

9,653.00

13.52%

5,947.00

32.30

7.63%

2,415.00

3.10%

681.00

0.87%

869.00

1.11%

-

-

1,328.00

1.70%

11,240.00

14.42%

6,544.00

31.07

7.36%

2,695.00

3.03%

885.00

1.00%

973.00

1.09%

900.00

1.01%

1,540.00

1.73%

13,537.00

15.22%

7,303.00

31.11

7.37%

2,890.00

2.92%

981.00

0.99%

1,101.00

1.11%

-

-

966.00

0.97%

13,241.00

13.36%

7,872.00

29.07

7.49%

3,129.00

2.98%

1,016.00

0.97%

1,167.00

1.11%

-

-

1,089.00

1.04%

14,273.00

13.57%

8,698.48

31.92

7.56%

3,463.29

3.01%

1,150.59

1.00%

1,265.65

1.10%

-

-

1,162.10

1.01%

15,740.11

13.68%

9,318.09

31.79

7.51%

3,759.49

3.03%

1,253.16

1.01%

1,389.65

1.12%

-

-

1,290.39

1.04%

17,010.78

13.71%

9,957.19

31.57

7.48%

4,020.15

3.02%

1,317.86

0.99%

1,490.92

1.12%

-

-

1,357.80

1.02%

18,143.92

13.63%

10,673.51

31.81

7.54%

4,260.91

3.01%

1,387.27

0.98%

1,599.61

1.13%

-

-

1,429.74

1.01%

19,351.05

13.67%

11,362.50

31.89

7.56%

4,493.90

2.99%

1,487.95

0.99%

1,683.33

1.12%

-

-

1,502.98

1.00%

20,530.65

13.66%

12,109.30

31.96

7.56%

4,821.30

3.01%

1,601.76

1.00%

1,761.94

1.10%

-

-

1,617.78

1.01%

21,912.07

13.68%

12,806.66

31.71

7.52%

5,160.13

3.03%

1,685.98

0.99%

1,856.28

1.09%

-

-

1,737.07

1.02%

23,246.13

13.65%

13,571.22

31.59

7.49%

5,399.50

2.98%

1,757.55

0.97%

1,993.10

1.10%

-

-

1,830.03

1.01%

24,551.41

13.55%

14,266.07

31.56

7.48%

5,702.61

2.99%

1,888.16

0.99%

2,078.88

1.09%

-

-

1,888.16

0.99%

25,823.88

13.54%

14,912.47

31.65

7.48%

5,941.07

2.98%

1,973.71

0.99%

2,193.01

1.10%

-

-

1,973.71

0.99%

26,993.97

13.54%

UOIG 14

University of Oregon Investment Group

Appendix 5 – Discounted Cash Flows Valuation Assumptions

Tax Rate

Risk Free Rate

Beta

Market Risk Premium

% Equity

% Debt

Cost of Debt

CAPM

WACC

Discounted Free Cash Flow Assumptions

3.00%

103,243.05

48,119.39

15,579.19

63,698.58

5,190.00

58,508.58

439

33.50% Terminal Growth Rate

2.62% Terminal Value

0.69 PV of Terminal Value

5.75% Sum of PV Free Cash Flows

90.69% Firm Value

9.31% Total Debt

3.15% Market Capitalization

6.59% Fully Diluted Shares

Avg. Industry Debt / Equity

Avg. Industry Tax Rate

Current Reinvestment Rate

Reinvestment Rate in Year 2019E

Implied Return on Capital in Perpetuity

Terminal Value as a % of Total

Implied 2014E EBITDA Multiple

6.17% Implied Price 133.30

Implied Multiple in Year 2023E

Current Price

Undervalued

Intermediate Growth Rate

2024E

2,882.64

1,491.95

9%

115.13

15.79%

2025E

3,055.59

1,489.56

6%

3,177.82

1,459.11

Free Cash Flow Growth Rate in Year 2023E

2026E

4%

UOIG 15

May 21, 2014

30.48%

34.15%

52.54%

32.61%

9.20%

80.9%

13.1x

6.1x

11%

Implied Price

Terminal Growth Rate

University of Oregon Investment Group

Appendix 6 – Betas

Company

Wal-Mart Stores, Inc.

Target Corp.

Home Depot, Inc.

Kroger Co.

Weight Average Unlevered Beta

0.68

Costco Wholesale Corp.

Levered Costco Wholesale Corp. Beta0.58

3 Year Daily Hamada Beta

Beta

0.47

Weighting

35.00%

D/E Tax Rate Unlevered Beta

21.88% 33.47% 0.41

0.61

0.85

15.00%

25.00%

39.39% 36.83%

13.74% 35.90%

0.49

0.78

25.00% 46.91% 30.41%

10.16% 35.23%

0.52

0.54

Company

Blended Comp

COST

Beta

Variance

Weight

Unlevered Vasicek

Levered Vasicek

Company

IYC

COST

Beta

Variance

Weight

Unlevered Vasicek

Levered Vasicek

Beta

Vasicek Comp Beta

D/E Tax Rate Unlevered Beta

0.64

28.70% 33.81% 0.54

0.67

Industry

0.54

0.0001

70.00%

10.16%

COST

0.63

0.0009

35.20%

30.00%

0.57

0.6

Vasicek ETF Beta- IYC v. COST

0.63

Beta

0.94

0.67

Industry

0.56

0.0001

87.00%

D/E Tax Rate Unlevered Beta

74.30%

10.16%

COST

10.30%

35.20%

0.56

0.63

0.63

0.0009

13.00%

0.57

0.60

May 21, 2014

Company

Wal-Mart Stores, Inc.

Target Corp.

Home Depot, Inc.

Kroger Co.

0.96

0.63

Weight Average Unlevered Beta

Costco Wholesale Corp.

Levered Costco Wholesale Corp. Beta0.58

3 Year Daily Hamada Beta

Beta Weighting

0.44

0.60

35.00%

15.00%

D/E Tax Rate Unlevered Beta

21.88% 33.47%

39.39% 36.83%

0.38

0.48

25.00%

25.00%

13.74% 35.90%

46.91% 30.41%

0.88

0.48

0.55

10.16% 35.23%

SE

0.0197

0.0302

SE

0.0115

0.0302

Variance

0.000389

0.000914

Variance

0.000133

0.000914

UOIG 16

University of Oregon Investment Group

Appendix 8 – Sources

Costco Wholesale Corp. 10K

Costco Quarterly Filings

Costco Earnings Call transcripts

FactSet

IBIS World

Costco Investor Relations

Finviz.com

Yahoo! Finance

UOIG Training Slides

May 21, 2014

UOIG 17