Acquiring IT Competencies through Focused Technology Acquisitions

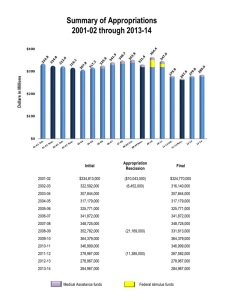

advertisement