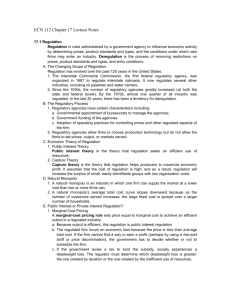

bottlenecks and bandwagons: access policy in the new

advertisement