RCL- How to Pass the BIR COMPLIANCE TEST

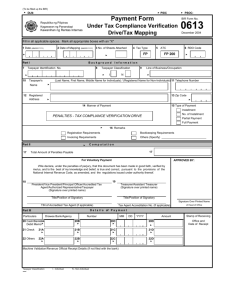

advertisement

HOW TO PASS THE BIR COMPLIANCE TEST ROGER C. LEE Group Supervisor Revenue District No. 82 Cebu City – South Distrct Objectives Taxpayers will be aware of the common violations and adhere to the requirements of OOKKEEPING NVOICING EGISTRATION Tax Mapping Operation Mission (Commissioner of Internal Revenue memo dated April 9, 2003) 1. To apprehend all business establishments not issuing proper receipts as well as for violation of all internal revenue laws, rules and regulations in the conduct of business; 2. To collect such penalties, fines and surcharges as are required under existing laws, regulations and memo orders; Tax Mapping Operation Mission (Commissioner of Internal Revenue memo dated April 9, 2003) 3. To insure that all the violations discovered are immediately corrected by business establishments concerned; and 4. Seize all unauthorized invoices/receipts found in the establishment including unregistered CRM or POS machines.In the meantime that these seized machines have not yet been released, nor duly authorized receipts printed and for a period of not less than two weeks, to require the use of BIR Authorized Temporary Receipt/Invoice. REGISTRATION VIOLATIONS Failure to register the business with BIR No RF annual/renewal payment No Certificate Of Registration displayed No ”Ask for Receipt” poster displayed Registration Requirement (Sec.236, NIRC) 1. Employees : Within 10 days from date of employment (BIR Form 1902- TRU) 2. Change of Status : Within 10 days from date of change (BIR Form 2305) 3. Business : Before commencement of business and payment of any tax due Individual - BIR Form 1901 Corporation - BIR Form 1903 Registration Requirement 3a. Sec. 248/249 – Failure to pay annual registration fee is subject to penalties of 25% surcharge, interest and compromise penalty. 3b. Sec. 258 – Unlawful pursuit of business. For each act or omission, be punished by a fine of not less than P5,000 but not more than P20,000 and imprisonment of not less than six (6) months but not more than 2 years. Registration Fee for Business P500 to be paid upon registration for new registrants and for old registrants, on or before Jan.31 of the year (BIR Form 0605) except: 1. Cooperatives 2. Employees 3. Individual Marginal Income Earners with annual sales/services of not more than P100,000 Registration Procedure Registration is required for every separate or distinct establishment or place of business including facility types where sales transactions occur and warehouse where inventory of goods for sale are kept before commencement of business and payment of any tax due. Registration Procedure The Certificate of Registration shall be issued to the applicant by the Revenue Office concerned upon compliance with the requirements for registration which shall be posted together with duly validated Registration Fee Return at a conspicuous place in the principal place of business and at each branch. Cancellation of Registration The required documents for submission: • • • • • • Formal letter of termination/Notice of Dissolution Duly accomplished BIR Form 1905 Unused Sales Invoice, ORs & other invoices VAT returns and Withholding Tax remittances Inventory of goods Audited Financial Statements Transfer of Registration Whenever a VAT-registered person changes his principal place of business from one revenue district to another, both revenue district offices should be notified by filing BIR Form 1905 within fifteen (15) days from the date of such change was made. If the change of address is within the revenue district, the notification shall be filed with the same revenue district office. Penalties for Registration Violation VIOLATION 1ST OFFENSE FAILURE TO REGISTER FAILURE TO PAY ANNUAL REGISTRATION FEE P 1,000.00 NO CERTIFICATE OF REGISTRATION DISPLAYED P 1,000.00 NO ”ASK FOR RECEIPTS” POSTER DISPLAYED P 1,000.00 2ND OFFENSE Invoicing Requirements All registered persons shall for every sale or lease of goods, properties or services, issue duly registered receipts or sales or commercial invoices which must show: • Name, TIN, address of seller • Date of transaction • Quantity, unit cost and description of merchandise or nature of service • The name,TIN, and address of the purchaser, customer or client for VAT registered taxpayers • Invoice or receipt number • Authority to print number & other receipt details INVOICING VIOLATIONS & PENALTIES VIOLATION 1STOFFENSE 2NDOFFENSE FAILURE TO ISSUE RECEIPTS/ INVOICES P 10,000.00 P 20,000.00 REFUSAL TO ISSUE RECEIPTS/ INVOICES P 25,000.00 P 50,000.00 DUPLICATE COPY OF RECEIPTS IS BLANK & USED ORIG COPY DETACHED P 10,000.00 P 20,000.00 USE OF UNREGISTERED RECEIPTS/ INVOICES P 10,000.00 P 20,000.00 INCOMPLETE INFORMATION IN THE RECEIPTS/INVOICES P 1,000.00 P 2,500.00 INVOICING VIOLATIONS & PENALTIES VIOLATION 1STOFFENSE 2NDOFFENSE USE OF unregistered CRM,POS or SIMILAR DEVICES IN LIEU OF INVOICES/RECEIPTS P 25,000.00 P 50,000.00 USE OF Computerized Accting System (CAS) &/or components w/o PERMIT P 25,000.00 P 50,000.00 FAILURE TO INFORM ANY ENHANCEMENTS/MODIFICATIONS/ CHANGES IN PREVIOUSLY ISSUED PERMIT to use CAS P 25,000.00 P 50,000.00 Use of POS in TRAINING MODE IN THEIR SALES TRANSACTION P 25,000.00 P50,000.00 INVOICING VIOLATIONS & PENALTIES VIOLATION FAILURE to register CRM as CASH DEPOSITORY ONLY 1STOFFENSE 2NDOFFENSE P 25,000.00 P 50,000.00 CASH depository CRM is USED FOR P 25,000.00 ISSUING SALES RECEIPTS/INVOICES P 50,000.00 FAILURE to ATTACH/PASTE ORIGINAL STICKER in the machine authorizing the USE of CRM/POS or similar device P 1,000.00 FAILURE to ATTACH/PASTE ORIGINAL STICKER in the machine authorizing the USE of CRM for CASH DEPOSITORY ONLY P 1,000.00 INVOICING VIOLATIONS & PENALTIES VIOLATION 1STOFFENSE FAILURE to DISPLAY PERMIT issued by the RDO for CRM/POS/or similar device P 1,000.00 FAILURE TO PROVIDE CRM with two (2) ROLLER TAPES P 1,000.00 2NDOFFENSE FAILURE TO NOTIFY THE REVENUE P 1,000.00 DISTRICT OFFICE that the CRM/POS or similar device is DEFECTIVE and has been PULLED-OUT for REPAIR prior to the TRANSFER of CRM/POS to OTHER BUSINESS LOCATION USE of CRM/POS or similar device in a PLACE OTHER THAN SPECIFIED IN THE PERMIT. P 25,000.00 P 50,000.00 BOOKKEEPING VIOLATIONS Failure to register Books of Accounts Failure to keep Books of Accounts at the place of business Failure to record daily entries in the registered Books of Accounts Books of Accounts (Sec. 232, NIRC) 1. New Business – must be registered before commencement of the business or upon registration. 2. Existing Business – must be registered on or before Dec. 31 of the current year. 3. Late registration – shall be subject to a minimum penalty of: Individual (Non-VAT P500; VAT P1,000) Corporation (Non-Vat P1,000; VAT P2,000) BOOKKEEPING VIOLATIONS & PENALTIES VIOLATION FAILURE to register BOOKS OF ACCOUNTS/CASH REGISTER MACHINE´S SALES BOOKS AMOUNT Subject to graduated rates (P200-P50,000) based on gross sales FAILURE TO KEEP BOOKS OF ACCOUNTS AT THE PLACE OF BUSINESS FAILURE TO MAKE ENTRIES IN THE REGISTERED BOOKS OF ACCOUNTS OTHERS (refer to Section 275 of NIRC) P 1,000.00 for each act or ommission File & Pay your taxes on time KIND OF TAX FREQUENCY BIR FORM 1. Monthly Quarterly 2550M 2550Q 20th day of the following month 25th day of the following month 2551M 20th day of the following month 1601C 10th day of the following month except for the month of DEC remittable not later than JAN.15 of the following year -do- VAT 2. Non-VAT Monthly (Percentage) 3. Withholding Tax Compensation Monthly Expanded 4. 5. Income Tax (Individual Income Tax (Corp/Part) Monthly 1601E Quarterly 1701Q Yearly Quarterly Yearly 1701 1702Q 1702 DEADLINE 1ST Qtr – Apr 15 2nd Qtr - Aug 15 3rd Qtr - Nov 15 Apr 15 of the following year 60 days after the end of the quarter 15 days after the 4th month of every calendar year or fiscal year Schedule of Submission of Annual Information & Reports Kind of Report Deadline • List of Inventories January 30 • Annual Information return of taxes withheld from Income (Expanded and Final) Form 1604C – Compensation January 31 Form 1604E – Expanded March 1 Form 1604F – Final January 31 BIR Compliance Test Questions 1. Is your main business establishment or branch registered with the BIR? 2. Do you display the Certificate of Registration & ”Ask for Receipt” Poster? 3. Have you paid the annual Registration Fee or renewed your business? 4. Are your receipts/invoices registered with the BIR? 5. Do you issue receipts for every sale of goods or services? 6.Does your receipt contain the necessary & prescribed information? 7.Are your Point Of Sale/Cash Register Machines registered with the BIR? 8.Do your POS/CR machines have the authority to use sticker? 9.Do you display the permit to use POS/CR Machines issued by the BIR? 10.Do you inform the BIR if your defective POS/CR Machines are replaced? 11.Do you have a Permit to use Computerized Accounting System? 12.Are your Books of Accounts/CRM sales books registered with the BIR? 13.Do you keep the Books of Accounts at the place of business? 14.Do you make entries in the registered Books of Accounts? Y N HOW YOU CAN HELP INCREASE TAX COLLECTION For Corporations and Enterprises: 1. Pay correct taxes regularly and on time 2. Encourage officers and employees to pay correct taxes 3. Organize tax forum/briefings for officers & employees 4. Produce & disseminate tax information, education and communication materials to workforce and the public 5. Issue receipts for every business transaction HOW YOU CAN HELP INCREASE TAX COLLECTION 6. Include tax information in company newsletters and other publications 7. Sponsor broadcast infomercials or developmental plugs include tax duties and obligations in the company code of conduct 8. Integrate tax-related topics in the company’s regular training programs