UNCLE JULIO’S

ABSOLUTE NNN LEASE

LOMBARD, ILLINOIS

THE OFFERING

TH E O FFERI NG

Jones Lang LaSalle is pleased to offer for sale the fee simple interest in an Uncle Julio’s Mexican Restaurant (the “Property” or “Asset”), a

freestanding single-tenant, triple net (“NNN”) leased property located in Lombard, Illinois. Situated in DuPage County, one of the nation’s most

affluent counties, the Village of Lombard is located approximately 20 miles west of the City of Chicago and is convenient to both O’Hare and

Midway Airports. Developed for Uncle Julio’s (the “Company” or the “Tenant”) in 2003, the Property features a NNN lease with over eightyears of remaining lease term and two-five year renewal option periods with 8% rental escalations every five years during the primary term

and renewal option periods. In addition to being located on one of the area’s highest profile retail thoroughfares, the Property benefits from an

immediate surrounding area that is home to an abundance of residential neighborhoods and numerous national retailers as well as Yorktown

Center, a 1,300,000 square foot regional mall, containing over 150 stores, 20 restaurants and an 18-screen movie theatre. This offering

represents a unique opportunity to acquire an Uncle Julio’s Mexican Restaurant, a triple net leased property located in one of the most desirable

retail corridors in the Chicagoland area.

2

UNCLE JULIO’S - OFFERING MEMORANDUM

I N VEST M ENT HI GHLI GHTS

STRONG RETAIL LOCATION

The Property benefits from excellent access and visibility on a heavily

traveled thoroughfare with over 52,000 vehicles passing per day. In

addition to being surrounded by numerous national retailers, the

Property is proximate to Yorktown Center Mall, a regional shopping

destination that drives customer traffic to the area.

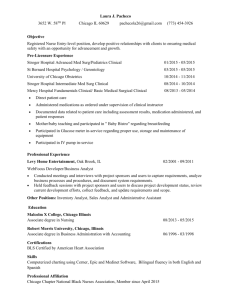

PROPERTY SUMMARY

Location:

2360 Fountain Square Drive

Lombard, IL 60148

Purchase Price

$7,875,000

Cap Rate

6.25%

Home to approximately 920,000 residents, DuPage County is the

second most populous county in Illinois after Cook County. The

affluent communities within the county boast an average household

income of $105,000.

NOI

$492,221

Building Size

10,682 SF

Year Built

2003

DESIRABLE LEASE STRUCTURE

Parking

+/- 200 spaces

Triple net lease structure with favorable rental escalations throughout

the primary term as well as the renewal option periods.

Type of Ownership

Fee-Simple

Tenant

Uncle Julio's of Illinois, Inc.

STRONG STORE PERFORMANCE

Guarantor

Uncle Julio's Corporation

Lease Type

NNN

Lease Term

20 years

Lease Expiration

3/31/2023

Renewal Options

Two, 5-Year Options

SURROUNDING DEMOGRAPHICS

The Property features attractive credit metrics as exemplified by

strong store sales year after year. In 2014, the Property had a rent to

sales ratio of approximately 8%.

STRONG RETAIL MARKET FUNDAMENTALS

The Property is situated within the East/West Corridor submarket,

a densely populated segment of the Chicago retail market with a

vacancy rate of 6.9% on approximately 31 million square feet of

general retail as of 4Q2014.

RENT ROLL

PERIOD

MONTHLY RENT

ANNUAL RENT

ANNUAL RENT PSF

4/1/03-3/31/08

$35,166.67

$422,000

$39.51

4/1/08-3/31/13

$37,980.00

$455,760

$42.67

4/1/13-3/31/18*

$41,018.42

$492,221

$46.08

4/1/18-3/31/23

$44,299.83

$531,598

$49.77

OPTION PERIODS

4/1/23-3/31/28

$47,843.83

$574,126

$53.75

4/1/28-3/31/33

$51,671.33

$620,056

$58.05

*Current Rent

UNCLE JULIO’S - OFFERING MEMORANDUM

3

MARKET OVERVIEW

CH IC A GO GENERAL RETA I L MA R K E T

The Property sits inside the Chicago retail market (“general retail”). The market is comprised of 11 submarkets totaling 30,866 buildings and

over 273 million square feet. Chicago retail market conditions remain strong and continue to thrive. The vacancy rate improved 40 basis points,

going from 7.0% in 3Q2014 to 6.6% in 4Q2014, the lowest it has been in the last 28 consecutive quarters. Year-to-date net absorption as of

4Q2014 was positive 3,541,000 square feet. 19 buildings totaling 240,000 square feet were delivered to the market in 4Q2014, with 43 buildings

totaling 668,000 square feet still under construction.

E A ST /W EST CORRI DOR

Comprised of 3,210 buildings totaling nearly 31 million square feet, the East/West

Corridor retail submarket is one of Chicago’s largest and most stable submarkets.

With a vacancy rate of 6.9% and absorption of 430,000 square feet as of 4Q2014,

the submarket has continued to prosper in recent quarters.

Located on the highest profile retail corridor in the area along Butterfield Road

(Route 56), Uncle Julio’s is well positioned with high visibility from major roads.

The Property is adjacent to a major interchange for I-88 and less than one mile

from I-355, offering superior accessibility to customers. Lombard serves as a major

shopping and dining destination for DuPage County. The Property is proximate to

numerous national retailers and restaurants including, but not limited to Target,

Starbucks, Dick’s Sporting Goods, Weber Grill, P.F. Changs, McCormick and

Schmick’s Seafood, Arhaus Furniture, and DMK Burger Bar. In addition to the

numerous national retailers in the area, Yorktown Center Mall, a regional shopping

destination, offers over 150 stores, 20 restaurants and a movie theatre, driving

customer traffic to the area.

GENERAL RETAIL MARKET STATISTICS

(AS OF 4Q2014)

Total Inventory (SF)

Total Vacancy

YTD Net Absorption (SF)

Quated Rental Rate

MARKET

SUBMARKET

CHICAGO

EAST/WEST

CORRIDOR

273,000,000

31,000,000

6.60%

6.90%

3,541,000

430,000

$16.69

$13.64

Source: CoStar

Major corporations with corporate headquarters in the Easter East/West Corridor include: McDonald’s Corporation, Blistex, Inc., Advocate

Healthcare, Dominick’s, GTE Airfone, Swift-Eckridge Meats, Nalco Chemical, Ace Hardware, ServiceMaster, and Federal Signal.

4

UNCLE JULIO’S - OFFERING MEMORANDUM

22nd Street

South Highland Avenue

0

,50

52

rfi

e

utt

B

ve

I-88

Meyers Road

I-88

d

oa

R

eld

ute

o

-R

56

sp

le

hic

MALL

ay

d

er

UNCLE JULIO’S - OFFERING MEMORANDUM

5

LOCATION OVERVIEW

VILLAGE OF LOMBARD

OVERVIEW

Just a few miles from Chicago, the communities

of DuPage County combine the excitement of

one of the country’s top metropolitan areas with

the comfort, convenience and value of Chicago’s

western suburbs. Home to approximately 920,000

residents, DuPage County is the second most

populous county in Illinois after Cook County, which

borders it to the north and east. Together, DuPage

and Cook County account for half of the state’s

population. DuPage includes 39 municipalities, 20

of which lie entirely within county limits. One of

the nation’s most affluent counties, DuPage is rich

in many types of commerce and is second only to

Cook in tourism revenue.

6

UNCLE JULIO’S - OFFERING MEMORANDUM

LOCATION HIGHLIGHTS

• Situated approximately 20 miles west from the City of Chicago, the Property is located in DuPage County, the second most populous county

in Illinois after Cook County, which borders it to the north and east. DuPage County is one of the nation’s most affluent counties, boasting

an average household income of $105,000.

• Located on the highest profile retail corridor in the area, Butterfield Road (Route 56), Uncle Julio’s is well positioned with high visibility from

major roads and has nearly 53,000 cars passing by daily. The Property is adjacent to a major interchange for I-88 and less than one mile

from I-355, offering superior accessibility to customers.

• The Property is situated in a prime retail center,

comprised of national retail tenants including Dick’s

Sporting Goods, Starbucks, P.F. Changs, Weber Grill

and a Hyatt Place Hotel consisting of 150 rooms.

• The Asset is adjacent to Yorktown Center Mall, a regional

shopping destination, which offers over 150 stores, 20

restaurants and a movie theatre, driving customer traffic

to the area. Furthermore, the Property is adjacent to The

Westin Lombard Yorktown Center, a 20- story, 500 room

full service, green certified hotel.

DEMOGRAPHICS

1-MILE RADIUS

3-MILE RADIUS

5-MILE RADIUS

2019 Projection

9,080

87,109

261,987

2014 Estimate

8,774

85,867

257,820

2014 Number of Households

3,985

34,958

99,437

2014-2019 Projected Growth

3.5%

1.4%

1.6%

Age 0 - 14

15.4%

16.7%

19.2%

Age 15 - 24

9.9%

11.2%

12.2%

Age 25 - 44

29.3%

25.3%

23.6%

Age 45 - 64

26.3%

27.8%

29.2%

Age 65+

19.1%

19.0%

15.9%

Less than $35,000

22.8%

21.7%

20.7%

$35,000 - $49,999

14.8%

11.1%

10.3%

$50,000 - $74,999

20.4%

18.0%

15.9%

$75,000 - $99,999

9.9%

13.5%

12.8%

More than $100,000

32.2%

35.6%

40.3%

Average Estimated HH Income

$89,772

$96,187

$108,582

Median HH Income

$62,839

$73,239

$79,976

POPULATION

ESTIMATED HH INCOME

UNCLE JULIO’S - OFFERING MEMORANDUM

7

LOCATION OVERVIEW

CH IC A GO OVER VI EW

Often considered the capital of the Midwest, Chicago is the third largest city in the United States with a population of approximately 9.8

million people in the metropolitan area, a population that has grown by nearly 10 percent since 2000. Approximately 84 million people,

equivalent to 27 percent of the total population of the United States, live within 500 miles of Chicago. With its central location, diverse

economy, cultural and entertainment attractions, top institutions of higher education, professional and amateur sports, and numerous

recreational activities, Chicago is one of the most important and influential cities in the world.

In many ways Chicago is a microcosm of the Unites States, offering everything that one looks for in cosmopolitan living, along with a

hardworking, diverse population in a variety of culture-rich communities. The beautiful city’s economic base is broad, home to more

than 400 corporate headquarters, Chicago’s

abundance of well-educated human capital

EMPLOYMENT BY SECTOR

and quality of labor set it apart. The city and

its surrounding metro area benefits from the

second largest labor pool in the United States

2%

24.8%

with approximately 4.3 million workers. It

Information

Finance/Insurance/

is this dominant and highly educated labor

Real Estate

15.2%

force that has attracted businesses and

Trade

fueled the growth of many of Chicago’s

leading industries, such as manufacturing,

4.8%

29.4%

technology, transportation, health care,

Transportation/Utilities

Services

education and telecommunications to name

8.4%

Manufacturing

a few. Chicago is a known center for business

12.3%

3.2%

and finance, ranked by FORBES as #6 on

Government

Construction/Mining

the list of world’s top financial centers.

8

UNCLE JULIO’S - OFFERING MEMORANDUM

CH IC A GO E CONOMY

The city of Chicago has one of the world’s largest, most diversified economies, with 4.3 million employees and a gross regional product

of nearly $500 billion. The city is widely recognized as one of the most important industrial, financial and cultural centers in the United

States, with a strong economic base ranging from capital goods to consumer nondurables to business services. Chicago is home to over

400 major corporate headquarters, including 28 FORTUNE 500 companies and two major global financial exchanges, second only to

New York. The city’s extensive urban infrastructure and proximity to suppliers and customers make for an ideal business environment.

Chicago has one of the most diverse economies in the United States, which insulates the local markets from economic downturns in

any one sector. The city is considered the industrial capital of the Midwest, with a well-established manufacturing sector. Chicago banks

hold 40 percent of the total assets in the Midwest, making Chicago the financial center for the central region of the United States.

Much of the world’s commodity trade takes place at the multiple exchanges in Chicago. With the merger of the Chicago Board of Trade

(CBOT) and the Chicago Mercantile Exchange (CME), the City is home to the most diverse and extensive global derivatives exchange

in the world. Chicago is the global capital of futures trading, illustrating the city’s position as an integral link to international capital

markets. Chicago’s economy thrives on a combination of mature and emerging industries.

The city consistently ranks in the top five for gross regional product among 350+ U.S. metro areas in the following industries: Business

& Financial Services, Manufacturing and Transportation & Distribution. Chicago is also a leader in a number of emerging industries

including Biotech, Information Technology and Green Energy.

TR AN SP O R TATI ON & ACCE SS

The Chicago metropolitan area has a variety of transportation options that allow

residents, workers, and visitors to come and go with ease. The Chicago Transit

Authority, or CTA, operates the second largest public transportation system in the

United States (to New York’s Metropolitan Transportation Authority) and covers the

City of Chicago and 40 surrounding suburbs. The CTA operates 24 hours a day and

on an average weekday has over 1.6 million riders. When traveling by car, Chicago

has a vast system of major highways that connect all suburban communities with

downtown Chicago and the surrounding region. Chicago’s train lines, neighborhood

bus stops, convenient local roadways, and easy access to major highways provides

for an exceptional travel experience throughout the region.

QU ALIT Y OF LI FE

Chicago is a smart, dynamic city that offers a quality of life unparalleled by any

other major metropolis, providing a true community with world class amenities for

businesses and people. Described as an “urban value,” Chicago’s cost of living

is lower than leading cities including New York, San Francisco, Los Angeles,

Washington, D.C., Boston and Philadelphia. Chicago’s wide variety of places to live

— from downtown high-rise condos, to traditional bungalows, to row homes — are

conveniently linked to business opportunities by a 3,700-square mile public transit

system serving over 700 million passengers annually. The city’s unique character

can be attributed to its people, its location/infrastructure, its collaborative business

and government community and an unprecedented array of cultural activities and

destinations.

TOP EMPLOYERS

COMPANY

EMPLOYEES

Advocate Health Care System

16,710

JPMorgan Chase & Co.

15,103

University of Chicago

15,029

Walgreen Co.

14,528

AT&T

14,000

Abbot Laboratories

13,000

United Continental Holdings, Inc.

13,000

Wal-Mart Stores, Inc.

12,500

Presence Health

12,159

University of Illinois

9,800

American Airlines

9,264

Northwestern University

9,122

Chicago Transit Authority

8,900

Jewel-Osco Stores

8,900

Archdiocese of Chicago

7,900

Allstate Insurance Co.

7,826

Source: Moody’s

UNCLE JULIO’S - OFFERING MEMORANDUM

9

COMPANY OVERVIEW

INVESTMENT MODEL

J . H . WH IT NEY & CO. OVER VI E W

Uncle Julio’s is a current portfolio company of J.H. Whitney and Co. (“JHW”).

Established in 1946, J.H. Whitney & Co. was one of the first U.S. firms to

pioneer the development of the private equity industry. Today, J.H. Whitney

remains privately owned and its main activity is to provide private equity capital

for small and middle market companies. J.H. Whitney is currently investing its

seventh private equity fund, whose investors include major endowments, leading

foundations, pension funds, and high net-worth families. Investment activities are

focused on small and middle market buyouts of market leading companies that

are poised for growth in a number of industries including consumer products and

retail, healthcare services, specialty manufacturing and business services.

I N VEST M ENTS

JHW invests principally in small and middle market buyouts and recapitalizations

of growth-oriented companies based in the U.S. Primarily, JHW seeks companies

that have attractive long term growth and profitability characteristics. This

investment focus has guided their activities for decades, and JHW believes their

dedication to this market niche enhances their ability to generate superior riskadjusted returns for their investors.

Target Company Revenue:

$50 - $100 million

Target Transaction Size:

$40 - $500 million

Target Equity Investment:

$20 - $125 million

JHW’s investments include,

but are not limited to the following:

CONSUMER

CAbi

Igloo Products

Ignite Restaurant Group

Pure Fishing

SPECIALTY MANUFACTURING

Arrowcast, Inc.

CJ Foods

Stevens Manufacturing

Wellman Plastics Manufacturing

HEALTHCARE

TIDI Products

Precision for Medicine

United BioSource

U.S. Bioservices Corporation

BUSINESS SERVICES

Authentix

FNF Construction

EMC Holdings

Stauber Performance Ingredients

10 UNCLE JULIO’S - OFFERING MEMORANDUM

U N C LE JU LI O’S

OV ER V IEW

Founded in 1986, Uncle Julio’s is a polished casual dining concept offering high quality

border-style Mexican food made from scratch with fresh ingredients. The popularity of

Uncle Julio’s grew rapidly, and with it came an instant craze for a drink Uncle Julio’s

named The Swirl, a frozen concoction of margarita layered with home-made sangria.

Uncle Julio’s is committed to providing the freshest and highest-quality, border-style

Mexican food. Using a distinctive hacienda decorating style, Uncle Julio’s created

a unique restaurant concept around original recipes that demand only the freshest

ingredients.

Since its founding, Uncle Julio’s has grown to 21 locations in seven states, positioned

around major metropolitan areas including Dallas, Atlanta, Austin, Chicago, Dallas and

Washington D.C. The Chicago locations include Chicago (Lincoln Park neighborhood),

Lombard/Oakbrook, Skokie (Westfield Old Orchard) and Orland Park.

Uncle Julio’s is led by Tom Vogel, who has served as President and CEO since 2013.

Vogel, former CEO of Logan’s Roadhouse, has more than 25 years of restaurant

industry experience. Under Vogel’s lead, Logan’s Roadhouse expanded from 96

locations to 228, growing the company’s revenues from $275 million to $648 million

(source: Dallas Business Journal). Vogel also worked for Orlando-based Darden

restaurants for 12 years, serving several senior positions, including senior vice

president of operations and vice president of food and beverage.

COMPANY INFORMATION

Founded in 1986

Headquartered in Irving, TX

21 Restaurants in seven states:

Texas, Georgia, Illinois, Maryland,

Virginia, Florida and Pennsylvania

UNCLE JULIO’S - OFFERING MEMORANDUM 11

PRIMARY SALES CONTACTS:

Matthew Berres

+1 213 239 6174

matthew.berres@am.jll.com

Dwight Stephenson

+1 312 228 2014

dwight.stephenson@am.jll.com

Daniel Ahlering

+1 312 228 3762

daniel.ahlering@am.jll.com

FINANCING CONTACTS:

Brion Haist

+1 212 812 6492

brion.haist@am.jll.com

JONES LANG LASALLE AMERICAS, INC.

515 South Flower Street

Suite 1300

Los Angeles, CA 90071

Your Resource for NNN Lease Investment Offerings

http://www.jllexchange.com/property/uncle-julios

Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. The material in this Offering Memorandum is confidential, furnished

solely for the purpose of considering the “AS IS” acquisition of Uncle Julio’s (the “Property” or “Asset”) located in the State of Illinois. The information is not to be used for any other purpose or to be made available to any other person without the express written

consent of Agent on behalf of Owner. The material is based, in part, upon information supplied by Owner and, in part, upon information obtained by Agent from sources they deem to be reliable. Summaries contained herein of any legal documents are not

intended to be comprehensive statements of the terms of such documents, but rather only outlines of some of the principal provisions contained therein. No warranty or representation, expressed or implied, is made by Owner, Agent or any of their respective

related agents or entities as to the accuracy or completeness of the information contained herein. Prospective investors should make their own investigations, projections and conclusions regarding the Asset. It is expected that prospective investors will conduct

their own independent due diligence concerning the Property, including such engineering and environmental inspections as they deem necessary to determine the condition of the Asset and the existence or absence of any potentially hazardous materials used

in the construction or maintenance of the Property. No representations, expressed or implied, are made as to the foregoing matters by the Owner, Agent or any of their respective officers, employees, affiliates and/or agents. Jones Lang LaSalle America, Inc.