Econometrics Analysis of influences in ICT sector

advertisement

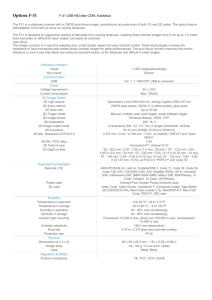

ČESKÁ ZEMĚDĚLSKÁ UNIVERZITA V PRAZE Provozně ekonomická fakulta Econometrics Analysis of influences in ICT sector Autor: Předmět: Obor: Ročník: Jakub Liška Ekonometrie – Úterý 12.15 Informatics 5. INTRODUCTION & OBJECTIVES Based on statistical data collected over the years 1996 – 2007 I've decided to analyse influences of several economical aspects on added value and revenues in ICT sector of Czech Republic. 1. One-equation model 1.1 Economic model and econometric model 1.1.1 Economic model definition Economic Value Added in ICT sector depends on : • quantity of enterprises • quantity of employees • expenses for labor in ICT sector • expenses for research & development in ICT sector • investments in ICT sector Expected relations : • from long-term point of view all of those 5 factors are supposed to increase added value in ICT sector 1.1.2 Econometric model definition Variables: Endogenous: y1 = added value in ICT sector (mil. CZ Crowns) Exogenous: x1 = unit vector x2 = quantity of enterprises x3 = quantity of employees x4 = expenses for labor in ICT sector (mil. CZ Crowns) x5 = expenses for research & development in ICT sector (mil. CZ Crowns) x6 = investments in ICT sector (mil. CZ Crowns) One-equation linear model: y1 = func (x1, x2, x3, x4, x5, x6) β11y1t = γ11 x1t + γ12 x2t + γ13 x3t + γ14 x4t + γ15 x5t + γ16 x6t + u1t 1. 1 Dataset Correlation matrix computation: added value (mil. CZK) quantity of enterprises y1 Variables 1995 39054 1996 48353 1997 55563 1998 65746 1999 73670 2000 84215 2001 100429 2002 112372 2003 120258 2004 130029 2005 131641 2006 149031 2007 163741 average 98008 variance 1488786191 standard deviation 38585 16531 17149 25102 20233 22362 24239 27768 28755 29052 29345 29108 29101 32654 25492 23832492 4882 YEARS x2 expenditures for research & development (mil. CZK) expenses for labor (mil. CZK) quantity of employees x3 x4 94782 97182 99005 96744 92690 102448 110605 108900 107036 110386 112316 122490 130936 106578 115935482 10767 x5 11204 15085 17035 18273 19557 23202 28002 30666 32971 36141 39487 45218 51238 28314 140253971 11843 investments (mil. CZK) x6 327 301 584 654 839 1002 1156 1411 2772 3031 4205 5282 5923 2114 3493820 1869 23769 38433 53683 44822 35136 56173 57304 33171 22771 24695 21637 26708 29074 35952 158387573 12585 Following results do not comply with acceptable levels of multi-collinearity except of investments. We can see strong dependence between all other variables. added value (mil. CZK) added value (mil. CZK) quantity of enterprises quantity of employees expenses for labor (mil. CZK) expenditures for research & development (mil. CZK) investments (mil. CZK) 1 0.92 0.92 0.99 0.93 -0.44 quantity of enterprises 0.92 1 0.84 0.9 0.78 -0.22 expenditures for research & investments development (mil. CZK) (mil. CZK) 0.99 0.93 -0.44 0.9 0.78 -0.22 0.95 0.92 -0.31 1 0.96 -0.44 expenses for labor (mil. CZK) quantity of employees 0.92 0.84 1 0.95 0.92 -0.31 0.96 -0.44 1 -0.55 -0.55 1 Therefore I expressed added value in year-to-year differences to decrease the level of mutual dependency, but there were still strong relations between the remaining 3 exogenous variables. After expressing all variables except investments as year-to-year differences the results seems satisfying. The only variable having unacceptable coefficient of correlation is labor costs in relation with quantity of employees which is obvious even without correlation matrix anyway. I decided to remove this variable for the sake of explanatory variables parameters estimation accuracy. added value (mil. CZK) added value (mil.CZK) quantity of enterprises expenses for labor (mil. CZK) expenditures for research & development (mil CZK) investments (mil. CZK) 1 0.06 0.64 -0.16 0.22 quantity of enterprises 0.06 1 0.18 -0.11 0.38 expenditures for research investment & s (mil. development CZK) (mil. CZK) 0.64 -0.16 0.22 0.18 -0.11 0.38 1 0.25 -0.11 0.25 1 -0.67 -0.11 -0.67 1 expenses for labor (mil. CZK) First off, it seemed I chose inappropriate variables but the last correlation matrix is giving satisfying numbers so I decided not to change them. 1.3 Parameters’ estimation using OLSM I need a matrix X for parameter estimation with variables chosen according to the correlation matrix. For parameter estimation I'm using this equation: γ = (XTX)-1XTy So I transposed vector of my endogenous variable (added value) yT and XT yT 39054 48353 55563 65746 73670 84215 100429 112372 120258 130029 131641 149031 163741 Initial matrix X must be transposed as well: matrix X T 1 16531 11204 327 23769 1 17149 15085 301 38433 1 25102 17035 584 53683 1 20233 18273 654 44822 1 22362 19557 839 35136 1 24239 23202 1002 56173 1 27768 28002 1156 57304 1 28755 30666 1411 33171 1 29052 32971 2772 22771 1 29345 36141 3031 24695 1 29108 39487 4205 21637 matrix XT y The final econometric equation is then: y1t = -7329,14 x1t + 0,55x2t + 4,15x4t – 8,21x5t – 0,25 x6t + u1t 1 29101 45218 5282 26708 1 32654 51238 5923 29074 1274102 34733453346.23 41958997813.55 3561768902.49 43056478927.16 matrix (XT X)-1 XT y -7329.14 0.55 4.15 -8.21 -0.25 1.4. Economic verification To verify the model I'm going to evaluate influences of particular variables on the endogenous variable. -7329,14 +0,55 … Relatively far from average, which is good … positive value of quantity of enterprises variable conforms to expectations of added value growth with increasing number of enterprises on the market +4,15 … there are probably many angels of view for this fact. Let's say that the higher the expenses for labor in ICT sector are the more qualified and experienced specialists are being employed. The second explanation might be the fact that companies simply expand and increase such an amount of labor which produces more added value. One way or another, the positive value of this parameter is expected and matches economic expectations. -8,21 … expenditures for research are very long time oriented and economic returnability or projection into added value could last more then years. -0,25 … ICT sector in general differs from the others that investments of all kinds (equipment, technologies, know-how) come from abroad. For instance all kind of hardware which forms significant part of investments into ICT sector is part of import to Czech Republic. From this implies that added value grows abroad a lot. On the other hand in Czech Republic it does so only after the investments are reflected in production growth. 1.5. Statistical verification Statistical significance of parameters A matrix for statistical verification of parameters: matrix (X T X) -1 4.49 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Calculation of regulated residual variance Su2 Su2=∑(yt-ŷ)/(n-p)= 12776833.53 / 9 = 1 419 648,17 variance of estimated parameters quantity of enterprises unit vector 57349527.63 -3240.42 1370 -2976.67 -174.04 expenditures for research & development (mil. CZK) 1370 -2976.67 -0.29 0.97 0.33 -1.43 -1.43 7.32 0 0.09 expenses for labor (mil. CZK) -3240.42 0.39 -0.29 0.97 -0.01 investments (mil. CZK) -174.04 -0.01 0 0.09 0.01 Calculation of test criterion, errors and parameter significance errors test criterion ( α=0,05) t-value table ( α=0,05) paramater significance unit vector quantity of enterprises 7572.95 0.97 2.36 no 56.92 0.01 2.36 no expenses for labor (mil. CZK) 37.01 0.11 2.36 no expenditures for research & development (mil. CZK) 54.56 0.15 2.36 no (y 1 – y avg )2 Coefficient of multiple determination R2 • equation ◦ R2 = 1 – (Su2/Sy2) = = 1 - ( 8845500.13 / 1488786191.39 ) = 0,99 • from the value of R2 we can say that changes of endogenous variable are explained by exogenous variables from 99% sum Sy 2 Su2 Sŷ 2 R2 investments (mil. CZK) 13.19 0.02 2.36 no (ŷ 1 – y avg )2 3475601960.48 2465583884.66 1801558173.85 1040846719.7 592329781.89 190250604.96 5863245.01 206325755.61 495080026.31 1025354934.06 1131215271.65 2603315287.32 4320894842.56 19354220488.08 1488786191.39 8845500.13 3407587685.37 2059667632.08 1524729494.18 1221681195.67 759060480.29 323606105.33 5417048.39 319303639.3 361710753.65 883567661.46 1197894258.55 2330744084.81 4811831846.76 19206801885.84 1477446298.91 0.99 Residual auto-correlation with use of Durbin-Watson test DW • • equation ◦ DW = ∑ (ut-u(t-1))2/∑ut2= 1,69 from the result we can say that there is not so alarming presence of autocorrelation in the residuals. It's only 0,2 – 0,3 points under ideal level 1.6. Model application Coefficients of elasticity • • Labor expenses elasticity for year 2007 ◦ ∂y/∂x4*(x4/ŷ) = 4,15 * (51238 / 167375) = 1,27 ◦ if labor expanses increase about 1% in comparison with the last period of time, then added value increases about 1,27% in comparison with the last period of time Investments elasticity for year 2007 ◦ ∂y/∂x6*(x6/ŷ) = -0,25 * (29074 / 167375) = -0,04 ◦ if investments increase about 1% in comparison with the last period of time, then added value decreases about 0,04% in comparison with the last period of time Scenario simulations • • How much should expenses for labor increase for added value to increase to 1000 mil. CZK ? X4 = ?, y1 = 1000, 4,15x4 = 1000 = > x4 = 240,96 => expenses for labor would have to increase to 240,96 mil. CZK How high the quantity of enterprises should be for added value to increase to 4000 mil. CZK? x6 = ?; y1 = 4000; 0,55x2 = 4000 => x2 = 7 272,73 => quantity of enterprises must increase to 7272,73 for added value to be 4000 mil. CZK 2. Simultaneous model 2.1. • Economic model and econometric model I chose two-equations simultaneous model with two endogenous variables: Revenues and Added value y1 = economic Value Added in ICT sector (mil. CZ Crowns) y2 = revenues in ICT sector (mil. CZ Crowns) x1 = unit vector x2 = quantity of enterprises x3 = quantity of employees x4 = expenses for labor in ICT sector (mil. CZ Crowns) x5 = expenses for research & development in ICT sector (mil. CZ Crowns) x6 = investments in ICT sector (mil. CZ Crowns) Economic Model • expenses for labor and research are shared by both endogenous variables because both EAV and Revenues are very well explained by them. Investments and their cost explains EAV because it is basically part of calculation of EAV. Quantity of enterprises and employees influences primarily total revenues in ICT sector, but obviously it has relation with EAV as well, so we'll see correlation matrix results Econometric Model • based on gained data I put two equations simultaneuos model together : β11y1t = β12y2t +γ11 x1t +γ14 x4t+γ15 x5t+γ16 x6t +u1t β22y2t = β21y1t +γ21 x1t +γ22 x2t +γ23 x3t+γ24 x4t + γ25 x5t + u2t 2.2. Dataset YEARS Variables 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 average variance standard deviation added value (mil. CZK) revenues (mil. quantity of CZK) enterprises quantity of employees expenses for labor (mil. CZK) expenses for research & development investments (mil. CZK) (mil. CZK) y1 y2 x2 x3 x4 x5 x6 39054 48353 55563 65746 73670 84215 100429 112372 120258 130029 131641 149031 163741 98008 1488786191 38585 85948.44 127345.57 143454.09 160911.29 181936.33 239037.5 291030.34 332608.39 374802.74 444216.35 445108.89 518919.95 598771.55 303392 24828489896 157571 16531 17149 25102 20233 22362 24239 27768 28755 29052 29345 29108 29101 32654 25492 23832492 4882 94782 97182 99005 96744 92690 102448 110605 108900 107036 110386 112316 122490 130936 106578 115935482 10767 11204 15085 17035 18273 19557 23202 28002 30666 32971 36141 39487 45218 51238 28314 140253971 11843 327 301 584 654 839 1002 1156 1411 2772 3031 4205 5282 5923 2114 3493820 1869 23769 38433 53683 44822 35136 56173 57304 33171 22771 24695 21637 26708 29074 35952 158387573 12585 Correlation matrix computation: • added value equation I managed to get these results after expressing the values of added value and expenses for labor and research in year-to-year differences. expenses for expenses for research & development investments added value labor (mil. (mil. CZK) CZK) (mil. CZK) (mil. CZK) added value (mil. CZK) expenses for labor (mil. CZK) expenses for research & development (mil. CZK) investments (mil. CZK) y1 x4 x5 x6 1 0.64 0.64 1 -0.16 0.25 0.22 -0.11 -0.16 0.22 0.25 -0.11 1 -0.67 -0.67 1 • revenues equation After I set up a correlation matrix for revenues equation there was high multiplicity all over the matrix in practically each relation between random two vectors. I reduced it by computing year-to-year differences for all vectors which was very satisfying but still there was only one strong relation between expenses for labor and quantity of employees. It makes sense to remove “quantity of employees “ vector from the model for the sake of explanatory variables parameters estimation accuracy. revenues (mil. CZK) quantity of enterprises expenses for labor (mil. CZK) expenses for research & development (mil. CZK) 1 0.09 0.74 0.09 1 0.18 0.74 0.18 1 0.03 -0.11 0.25 0.03 -0.11 0.25 1 2.3. Model identification : • • endogenous variables: g = 2 predeterminated variables k = 6 1.equation: β11y1t = β12y2t +γ11 x1t +γ14 x4t+γ15 x5t+γ16 x6t +u1t => k** = 2, g∆ = 1 => overidentified 2.equation β22y2t = β21y1t +γ21 x1t +γ22 x2t +γ23 x3t+γ24 x4t + γ25 x5t + u2t => k** = 1, g∆ = 1 => exactly identified 2.4. Parameters’ estimation using TSLSM and MMVR TSLSM 1. equation: Cii = K-1 K-1 0.00000007 0.00423637 0.00423637 253.58439781 -0.00000103 -0.06138426 0.00000072 0.04334294 0.00000005 0.00299251 -0.00000103 -0.06138426 0.00001497 -0.00001053 -0.00000074 0.00000072 0.04334294 -0.00001053 0.00000773 0.00000052 0.00000005 0.00299251 -0.00000074 0.00000052 0.00000004 Vector of estimated parameters: β2 γ1 γ4 γ5 γ6 1.09 61665.63 -11.14 1.42 0.54 ŷ1t = 1,09y2t + 61665,63 - 11,14 x4t + 1,42 x5t + 0,54 x6t 2. equation: Cii = K-1 K-1 0.00000007 -0.00430708 0.00000000 0.00000006 -0.00000033 0.00000045 -0.00430708 337.34334335 -0.00032868 -0.00449718 0.02246964 -0.03010631 0.00000000 -0.00032868 0.00000003 0.00000000 -0.00000002 0.00000007 0.00000006 -0.00449718 0.00000000 0.00000006 -0.00000031 0.00000041 -0.00000033 0.02246964 -0.00000002 -0.00000031 0.00000172 -0.00000240 Vector of estimated parameters: β1 γ1 γ2 γ3 γ4 γ5 5.52 -335348.51 -0.59 3.79 -12.84 34.43 ŷ2t = 5,52y1t - 335348,51 - 0,59 x2t + 3,79 x3t - 12,84 x4t + 34,43 x5t 0.00000045 -0.03010631 0.00000007 0.00000041 -0.00000240 0.00000363 MMVR 1. equation: • matrix (W* - kW) Matrix (W*-kW) • 56936289.4 14161469.41 14161469.63 3522309.25 roots k D eterm inant of m atrix (W *-k W ) 7.48E + 016 dis c rim inant k1 k2 k2 -2.26E + 017 5.74E + 033 2.02 1.01 k • vector of parameters β • vector of parameters γ Y1 = 4,02Y2 + 235694,64 - 53,6X4 + 31,17X5 + 2,62X6 1.52E + 017 β22=1 Β21=4,02 x1 x4 -235694.64 x5 x6 -31.17 53.6 -2.62 2. equation: • matrix (W* - kW) Matrix (W*-kW) 458243572.64 83009578.96 83009579.09 15036959.86 • roots k Determinant of matrix (W*-kW) 7.48E+016 discriminant k1 k2 k2 8.35E+032 1.39 1 -1.79E+017 k 1.04E+017 • vector of parameters β Β22= 1 Β21= 5,52 • vector of parameters γ Y2 = 5,52Y1 - 335348,51 - 0,59X2 + 3,79X3 - 12,84X4 + 34,43x5 x1 x2 335348.51 x3 0.59 x4 -3.79 x5 12.84 -34.43 control calculations: 1. equation: • TSLSM ŷ1t = 1,09y2t + 61665,63 - 11,14 x4t + 1,42 x5t + 0,54 x6t 98007,85 = 1,09*303391,65 + 61665,63 – 11,14*28313,78 + 1,42*2114,45 +0,54*35952 • MMVR Y1 = 4,02Y2 + 235694,64 - 53,6X4 + 31,17X5 + 2,62X6 Verification v variable averages average y1 y2 x1 x2 x3 x4 x5 x6 98007.85 303391.65 1 25492.23 106578.38 28313.78 2114.45 35952 98007.85 = 98007.85 2. equation: • TSLSM ŷ2t = 5,52y1t - 335348,51 - 0,59 x2t + 3,79 x3t - 12,84 x4t + 34,43 x5t 303391,65 = 5,52*98007,85 + 335348,51 – 0,59*25492,23 + 3,79*106578,38 – - 12,84*28313,78 + 34,43*2114,45 • MMVR Y2 = 5,52Y1 - 335348,51 - 0,59X2 + 3,79X3 - 12,84X4 + 34,43x5 V erific ation v v ariable av erages y 1 y2 x1 x2 x3 x4 x5 x6 av erage 98007.85303391.65 1 25492.23106578.3828313.78 2114.45 35952 303391.65 = 303391.65 2.5. Economic verification 1. equation: parameters of variables of the model expenses for expenses for research & investments labor (mil. development (mil. CZK) CZK) (mil. CZK) 61665.630 -11.138 1.420 0.537 235694.638 -53.604 31.171 2.624 added value revenues (mil. 1.equation Param eters Constant (mil. CZK) CZK) TSLSM MMVR 1.000 1.000 1.086 4.021 1.086 / 4.021 …confirms, that if revenues increase added value increases as well 61665.63 / 235694.638 … both positive values in proper distance from an average -11.138 / -53.604 … when expenses for labor increase, added value should increase !! 1.42 / 31.171 … increasing added value with increasing expenses for research is supposed to be right 0.537 / 2.624 … correct 2. equation: parameters of variables of the model 2.equation Parameters TSLSM MMVR • revenues (mil. CZK) added value (mil. CZK) Constant 1.000000000 5.520369788 -335348.514093023 1.000000000 5.520369790 -335348.514168253 expenses for research & development (mil. CZK) -0.591965655 3.785323428 -12.836305711 34.430551000 -0.591965655 3.785323429 -12.836305717 34.430551008 quantity of enterprises quantity of employees expenses for labor (mil. CZK) parameters of explanatory variables estimated by both methods are almost identical -335348 … negative constant value seems a bit invalid • anyway the rest of the parameters seems perfectly valid and well founded • expenses for labor behave the same way as they do in the previous equation in relation with added value. It could be the case, that enterprises might spend more funds for labor and narrow their budget down so that added value is produced by additional labor force but potential added value is not produced by the other means then 2.6. Statistical verification statistical significance of estimated parameters: 1. equation: y1t = 1,09y2t + 61665,63 - 11,14 x4t + 1,42 x5t + 0,54 x6t sy2 su2 cor su2 1606937339.21 111763156.19 161435670.05 0.93 0.87 R2 kor R2 • a value of R tends to be a little higher and expresses higher dependency between explanatory variables Sii Sbi T-value t-value table (α=0,1) t-value table (α=0,05) paramater significance y2 11.53 3.4 0.3197 1.83 2.62 no x1 40937567175 202330.34 0.3048 1.83 2.62 no x4 2416.08 49.15 -0.2266 1.83 2.62 no x5 1247.34 35.32 0.0402 1.83 2.62 no x6 5.96 2.44 0.2199 1.83 2.62 no 2. equation: y2t = 5,52y1t - 335348,51 - 0,59 x2t + 3,79 x3t - 12,84 x4t + 34,43 x5t sy 2 su2 cor su2 R2 cor R2 • 24878872137.18 147848672.81 240254093.31 0.99 0.99 a value of R is high and expresses strong dependency between explanatory variables Sii Sbi T-value t-value table (α=0,1) t-value table (α=0,05) paramater significance y2 15.98 4 1.38 1.86 2.31 no x1 81048119090.64 284689.51 1.18 1.86 2.31 no 2.7. Matrix B, Γ and matrix M x2 7.33 2.71 0.22 1.86 2.31 no x3 14.64 3.83 0.99 1.86 2.31 no x4 412.53 20.31 0.19 1.86 2.31 no x5 872.29 29.53 1.17 1.86 2.31 no matrix Β matrix Γ matrix M 1 -5.52 x1 -61665.63 335348.51 -1.09 1 x2 60563.6 -1015.03 matrix -Β −1 0.2 1.11 0.22 0.2 matrix -Β -1 5.52 1.09 -1 x3 x4 x5 x6 0 0.59 0 -3.79 11.14 12.84 -1.42 -34.43 -0.54 0 0.13 0.12 -0.82 -0.76 5.02 14.88 -7.77 -8.47 -0.11 -0.59 reduced form y1 = 60563,6x1 + 0,13x2 – 0,82x3 + 5,02x4 - 7,77x5 – 0,11x6 y2 = -1015,03x1 + 0,12x2 – 0,76x3 + 14,88x4 - 8,47x5 – 0,59x6 • • differences between structural and reduced form models in reduced form express dependencies of endogenous only on predetermined variables, while in structural form endogenous variables are being influenced by predetermined variables and the others explanatory variables in the multiplicator matrix of mine we can see that those predetermined variables, which haven't been part of original equations, have reduced form as a result of mediation between explanatory variables 2.8. Model application coefficients of elasticity for 1.equation • expense elasticity for the last year expenses for labor ∂y/∂x4*(x4/ŷ) = -11,138 * (51238/165080,3) = -3,46 => increase of expenses for labor causes decrease of added value about 3,46% in comparison with the last one expenses for research ∂y/∂x5*(x5/ŷ) = 1420 * (5923/165080,3) = 0,05 => increase of expenses for research causes increase of added value about 0,05% in comparison with the last one • investments elasticity for the last year ∂y/∂x6*(x6/ŷ) = 0,537 * (29074/165080,3) = 0,09 => increase of investments causes increase of added value about 0,05% in comparison with the last one 3. Conclusion I suppose this analysis fulfilled the objectives well except of the fact that testing showed that most of the variables are statistically insignificant which might be influenced by many factors. For instance it is good to say that the amount of variables I used to explain the dependencies is not enough to cover this huge sector of market. References: http://czso.cz/csu/redakce.nsf/i/ict_sektor – Category “ICT sektor - celkem”