FAE 2013 Mock Exam - the Chartered Grind School

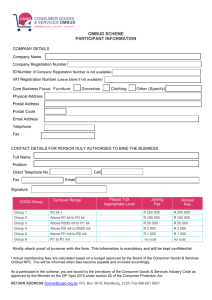

advertisement

FAE 2013 Mock Exam Primary Indicators • Prepare a comprehensive and motivating one page summary of MIL’s mission strategy • Prove that the group do not see the full value of MIL • Prepare an assessment of what impact the possible sale of 30% of MIL may have on the share price of the Mayflower Group • Calculate the impact of the sale of the 30% stake of MIL will have on the group financial statements including journal entries Primary Indicators • Classify the Internal Audit findings and explain your logic for each • Consider the issue with regard to the staff who have a moral dilemma (three step approach; identify the issue; clarify and evaluate; action and review) • Consider the position of the MIL board • Provide advice on which MIS we should go for True economic performance of MIL • PBT per forecast results €600 • Reverse the allocation of R&D – there’s a strong argument for reversing all of the €2,100 as we’re told on page 10 that the group don’t do any R&D for MIL • Group administration costs should be allocated based on something like turnover rather than employee numbers as we don’t subcontract out staff costs – therefore add back approx €1,500 True economic performance of MIL • Transfer pricing – 50% of consulting sales is intercompany priced at VC + 10% (€2,420 *50% * 110*) = €1,331 – Total sales = €3,993 meaning that the other half of sales are charged out at (3,993-1,331) €2,662 – As a result we’re undercharging the intercompany sales by €1,300 Economic value of MIL • • • • • Profit per management accounts Group R&D Administration costs Transfer pricing True profitability €600 €2,100 €1,500 €1,300 €5,500 Impact on the share price of a 30% disposal of MIL • Current market value of MIL (using PE of 8) – €600*.8*8 = €3,840 (pre tax profit 600, tax rate 20%) • Realistic value of MIL (based on AME and a PE of 22); – (€5,500)*.8*22 = €96,800 • Current value of MG equity = 400m shares at €1 = €400,000 – Take out the €3,840 – Increase it by the cash we receive on selling 30% of MIL (30% * 96,800) = €29,040 less 20% CGT = €23,232 – Add back the value of the remaining 70% of MIL (96,800*.70) = €67,760 – Total = €487,152 (or €1.22 per share) – (error in solution, uses 400 as current earnings instead of 600) Mission Statement • Not excessive in length! (one page summary MAX – as per the case) – Part of a plc – Aim to be leading RCV manufacturer in Europe – Will invest in R&D – Will attract best people – Will invest as necessary – Link with manufacturing – Importance of consulting Internal Audit considerations Point No Disaster Recovery plan in place Significant Routine Urgent x Non urgent x Automatic reversing journals are not retrospectively reviewed x x FAR does not record purchase invoice number x x Reconcile all major supplier statements monthly x x GRNI account balances older than one year x x Register of Directors x x Staff mapping by department x x Balances with group companies to be reconciled on a monthly basis x x Misstated bills of materials x x Customers payments in advance x x Accounting for disposal • IFRS 10 – didn’t lose control, continue to consolidate • Based on my earlier valuation (ignoring tax charge) €32,208 – – – – Dr Bank (less transaction costs of 200) 32,008 Cr Payables 200 Cr NCI (net asset value * 30%) 900 Cr equity 30,908 • No impact on earnings • Transaction costs go to equity • Disclosures re NCI on face of SOCI and SOFP