China's Foreign Trade: Perspectives From the Past 150 Years

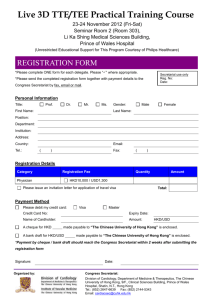

advertisement