Defective Products and Product Warranty Claims in Minnesota

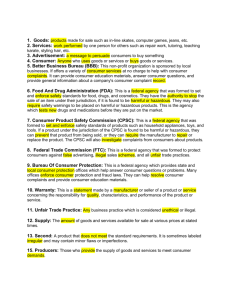

advertisement