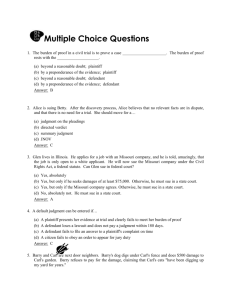

Contract Law

advertisement