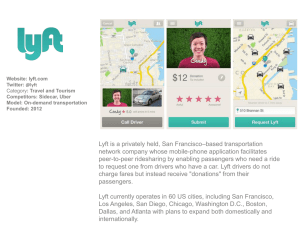

within

advertisement