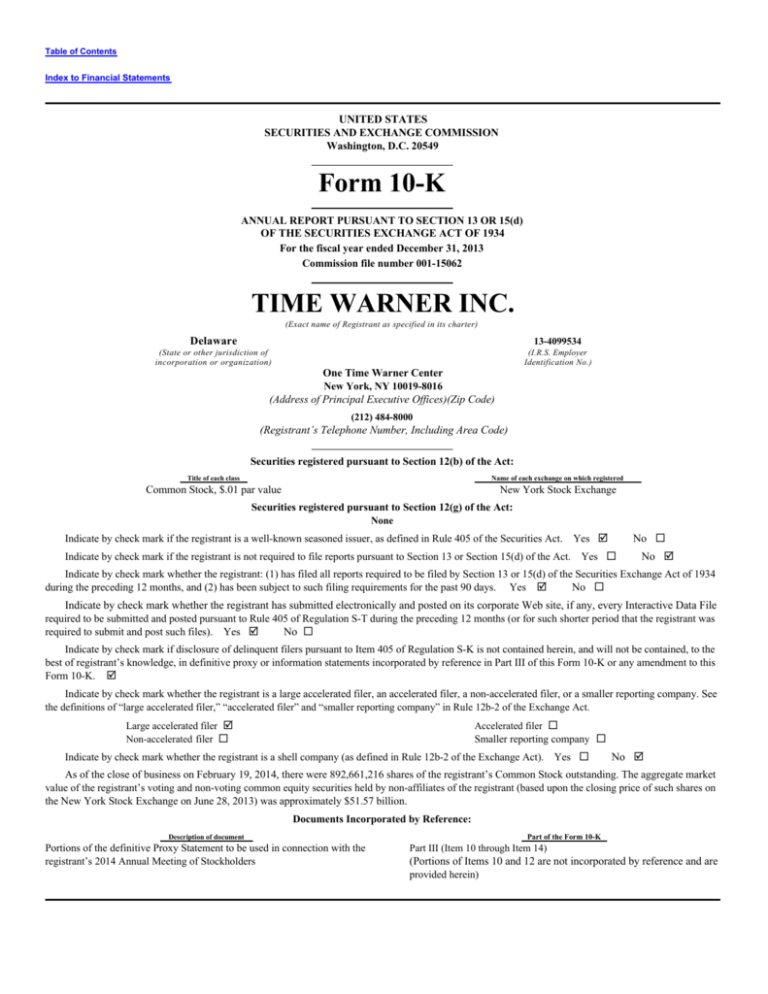

Form 10-K TIME WARNER INC. - Investor Relations Solutions

advertisement