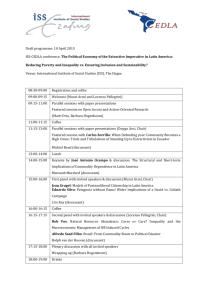

Program – Day 1 Sunday 16th December 2012

advertisement

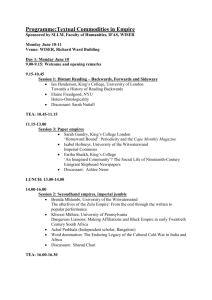

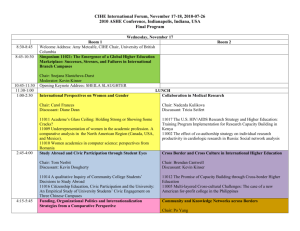

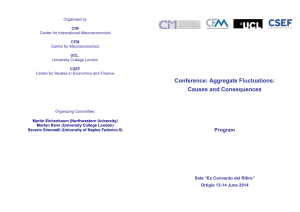

Sunday 16th December 2012 Program – Day 1 Registration 8:00 – 9:00 am Session 1 9:00am - 11:00 am Registration – Upper Ballroom Lobby Funds Management/ Mutual Funds 1 Capital Markets 1 Financial Institutions 1 Financial Economics 1 Financial Regulations 1 Corporate Finance 1 Lead session on Asset Pricing Chair: Luis Goncalves-Pinto Cambridge I & II Chair: Chunhua Lan Cambridge III Chair: Ranajoy Ray-Chaudhuri Cambridge IV Chair: Eliza Wu Chair: Andy Mullineux Essex II Chair: Jared Stanfield Bradfield lounge Chair: Jin-Chuan Duan Essex I Harlequin Morning Tea 11:00 - 11:30 am Morning Tea - Grand Ballroom Lobby Keynote Address Keynote Presentation 11:30 am – 12:30 pm Sovereign Debt, Government Myopia and the Financial Sector Professor Viral Acharya, New York University Grand Ballroom II Lunch 12:30- 1:15 pm Session 2 1:15 - 3:15 pm Lunch - Grand Ballroom I Corporate Finance 2 Funds Management/ Mutual Funds 2 Asset Pricing 1 Capital Markets 2 Financial Economics 2 Corporate Governance 1 Lead session on Behavioural Finance Chair: Christine Brown Cambridge I & II Chair: Gordon Alexander Cambridge III Chair: David Feldman Cambridge IV Chair: Dirk Schoenmaker Essex I Chair: John Elder Chair: Peter Pham Essex II Bradfield Lounge Chair: Terrance Odean Harlequin Afternoon Tea 3:15 - 3:45pm Session 3 3:45 – 5:45 pm Afternoon Tea – Grand Ballroom Lobby Corporate Finance 3 International Finance 1 Asset pricing 2 Special Issue: Systemic Risk 1 Financial Institutions 2 Corporate Governance 2 Quantitative Finance 1 Chair: Balbinder Singh Gill Cambridge I & II Chair: Pei Shao Chair: Qiang Kang Chair: Bodo Herzog Cambridge III Cambridge IV Essex I Chair: Necmi Avkiran Essex II Chair: Ronan Powell Bradfield Lounge Chair: David Colwell Harlequin Monday 17th December 2012 Program – Day 2 Session 4 8:45 – 10:45 am Derivative Instruments 1 Capital Markets 3 Asset Pricing 3 Special Issue: Systemic Risk 2 Financial Economics 3 Corporate Finance 4 Chair: Guang-Hua Lian Cambridge I & II Chair: Le Zhang Chair: Tony Berrada Cambridge IV Chair: Alireza Tourani Rad Essex I Chair: Vitor Leone Chair: Alexander Molchanov Bradfield Lounge Cambridge III Morning Tea 10:45 - 11:15 am Essex II Lead session on Financial Institutions Chair: Anthony Saunders Harlequin Morning Tea - Grand Ballroom Lobby Business Forum Regional Financial Stability: Systemic Risk, Liquidity Risk and Governance Nobel Laureate Professor Robert Engle, New York University Mr Jim Murphy, Deputy Federal Treasury Secretary (Executive Director, Markets) Dr Guy Debelle, Assistant Governor of the Reserve Bank of Australia Mr Curt Zuber, Treasurer of Westpac Banking Corporation Business Forum 11:15am - 1:00 pm Grand Ballroom II Lunch 1:00 - 2:00 pm Lunch - Grand Ballroom I Keynote Address Risk, Uncertainty, Monetary Policy and Asset Prices Professor Geert Bekaert, Columbia University Keynote 2:00- 3:00 pm Grand Ballroom II Afternoon Tea 3:00 - 3:30 pm Session 5 3:30 - 5:30 pm Afternoon Tea - Grand Ballroom Lobby Market Microstructure 1 Capital Markets 4 Emerging Markets 1 Chair: Petko Kalev Chair: Kingsley Fong Cambridge III Chair: Mark Humphery-Jenner Cambridge IV Cambridge I & II Women’s Forum 5:30 - 7:00 pm Pre- Dinner Drinks 7:00 - 7:30 pm Funds Management/ Mutual Funds 3 Chair: Ales Berk Financial Institutions 3 Corporate Finance 5 Lead Session on Asset Pricing 2 Chair: Wenling Lu Essex I Essex II Chair: Grzegorz Michalski Bradfield Lounge Chair: Bruno Solnik Harlequin Women’s Forum Cambridge III Pre- Dinner Drinks – Grand Ballroom Lobby Conference Dinner Presentations The Euro-zone crisis: Economics, Finance and Politics Professor Bruno Solnik, HKUST Dinner 7:30 pm The Implications and Costs of Basel 3 Professor Anthony Saunders, New York University Grand Ballroom I & II Tuesday 18th December 2012 Program – Day 3 Session 6 8:45 - 10:45 am Capital Markets 5 Financial Economics 4 Special Issue: Systemic Risk 3 Special Issue: Systemic Risk 4 Quantitative Finance/ Financial Mathematics Lead Session on Derivative Instruments Lead Session on Corporate Finance Chair: Saskia ter Ellen Cambridge I & II Chair: Leo Krippner Chair: Guangyao Zhu Chair: Claire Matthews Essex I Chair: Bruce Vanstone Essex II Chair: Chu Zhang Chair: Virkram Nanda Harlequin Cambridge III Bradfield Lounge Cambridge IV Morning Tea 10:45 - 11:15 am Morning Tea - Grand Ballroom Lobby Keynote Address Keynote 11:15 am - 12:15 pm Mergers that Matter: The Importance of Economic Links Among Firms Professor Jarrad Harford, University of Washington Grand Ballroom II Lunch 12:15 - 1:00 pm Session 7 1:00 - 3:00 pm Lunch - Grand Ballroom I Capital Markets 6 International Finance 2 Market Microstructure 2 Special Issue: Systemic Risk 5 Quantitative Finance 2 Corporate Finance 6 Asset Pricing 4 Chair: Fabian Irek Chair: Uzma Shahzad Cambridge III Chair: Peter Swan Chair: Qiongbing Wu Essex I Chair: Hayette Gatfaoui Essex II Chair: Christina Atanasova Bradfield Lounge Chair: Tze Chuan Ang Harlequin Cambridge I & II Cambridge IV Afternoon Tea 3:00 - 3:15 pm Session 8 3:15 - 5:15 pm Afternoon Tea - Grand Ballroom Lobby Corporate Finance 7 Corporate Governance 3 Asset Pricing 5 Markets and Financial Stability Emerging Markets 2 Chair: Sue Wright Chair: Michaela Rankin Chair: Jane Chau Chair: Rakesh Gupta Cambridge I & II Cambridge III Chair: Samuel Xin Liang Cambridge IV Essex I Essex II Sunday 16 December 9:00am – 11:00am Session 1 Cambridge I & II Funds Management/Mutual Funds 1 Sunday 16 December Session 1 Capital Markets 1 9:00am – 11:00am Cambridge III Costliness of Placement Agents Post-Earnings Announcement Bond Price Reaction Marko Rikato, PricewaterhouseCoopers Ales Berk, University of Ljubljana Discussant: Russell Gregory-Allen, Massey University Xiaoting Wei, Monash University Cameron Truong, Monash University Madhu Veeraraghavan, Monash University Discussant: Yaw-Huei Wang , National Taiwan University The Potential Effects of Mandatory Portfolio Holdings Disclosure in Australia and New Zealand The Informational Association between the S&P 500 Index and VIX Options Markets Kathleen Brown, Bancorp Treasury Russell Gregory-Allen, Massey University Discussant: Marko Rikato, PricewaterhouseCoopers Dian-Xuan Kao, National Taiwan University Wei-Che Tsai, National Sun Yat-Sen University Yaw-Huei Wang, National Taiwan University Discussant: Xiaoting Wei, Monash University Fund Analysis and Selection: An Approach Based on Distances and Similarities between Performance Measures The Response of Oil Prices to Macroeconomic News: An Analysis of Jumps Hery Razafitombo, University of Metz Discussant: Joonas Hamalainen, University of Turku John Elder, Colorado State University Hong Miao, Colorado State University Sanjay Ramchander, Colorado State University Discussant: Mohamed Ariff, Bond University The Efficiency of Mean-Variance Optimization with InDepth Covariance Matrix Estimation and Portfolio Rebalancing Money Supply, Interest Rate, Liquidity and Share Prices: A Test of Their Linkage Using Panel Data of G-7 Countries Joonas Hamalainen, University of Turku Discussant: Hery Razafitombo Tin-fah Chung, University Putra Malaysia Mohamed Ariff, Bond University Shamsher Mohamad, University Putra Malaysia Discussant: John Elder, Colorado State University Session Chair: Luis Goncalves-Pinto, National University of Singapore Session Chair: Chunhua Lan, University of New South Wales Sunday 16 December Session 1 Financial Institutions 1 Sunday 16 December Session 1 Financial Economics 1 9:00am – 11:00am Cambridge IV The Diminishing Role of Banks in the U.S. Money Markets: Evidence from the GFC Jason Park, Curtin University of Technology Janice How, Queensland University of Technology Peter Verhoeven, Queensland University of Technology Discussant: Barry Williams , Bond University 9:00am – 11:00am Essex I Asset Prices and Google's Search Data Bodo Herzog, Reutlingen University Discussant: Necmi Avkiran, University of Queensland The Impact of Non Interest Income on Bank Risk in Australia Early Warning Indicators for the German Banking System: A Macroprudential Analysis Barry Williams, Bond University Discussant: Wenling Lu, Washington State University Nadya Jahn, University of Muenster Thomas Kick, Deutsche Bundesbank Discussant: Kyoo Kim, Bowling Green State University U.S. Bank Structure, Fragility, Bailout, and Failure during the U.S. Financial Crisis Moral Hazard and Banking Competition Wenling Lu, Washington State University David Whidbee, Washington State University Discussant: Sami Vähämaa, University of Vaasa Kyoo Kim, Bowling Green State University Young-Jin Kim, Seoul National University Discussant: Bodo Herzog, Reutlingen University Do Female CEOs and Chairs Constrain Bank Risk-Taking? Evidence from the Financial Crisis Does Collaboration in Finance Research in the 21st Century Produce Articles of Higher Impact? Ajay A. Palvia, Government of the United States of America Office of the Comptroller of the Currency Emilia Vähämaa, University of Vaasa Sami Vähämaa, University of Vaasa Discussant: Jason Park , Curtin University of Technology Necmi Avkiran, University of Queensland Discussant: Nadya Jahn, University of Muenster Session Chair: Ranajoy Ray-Chaudhuri, The Ohio State University Session Chair: Eliza Wu, University of Technology, Sydney Sunday 16 December Session 1 Financial Regulations 1 9:00am – 11:00am Essex II A Proclivity to Cheat: How Culture Influences Illegal Insider Trading Alireza Tourani Rad, Auckland University of Technology Bart Frijns, Auckland University of Technology Aaron Gilbert, Auckland University of Technology Discussant: Saikat Deb, Monash University Sunday 16 December Session 1 Corporate Finance 1 9:00am – 11:00am Bradfield Lounge Political Partisanship and Corporate Performance Alexander Molchanov, Massey University Art Durnev, University of Iowa Jon Garfinkel, University of Iowa Discussant: Liu Qigui, University of Wollongong Capacity Constraints and the Opening of New Hedge Funds Do Political Connections Help Firms’ Accessing the IPO Market? Sugato Chakravarty, Purdue University Saikat Deb, Monash University Discussant: Alireza Tourani-Rad, Auckland University of Technology Liu Qigui, University of Wollongong Gary Gang Tian, University of Wollongong Jinghua Tang Discussant: Alexander Molchanov, Massey University Optimal Bank and Regulatory Capital Reserve Strategies Under Loan-Loss Uncertainty Debt Maturity, Cash Holdings, Dividend Policy and Employee Characteristics Geoffrey Evatt, University of Manchester Paul Johnson, University of Manchester Mingliang Chen Kristoffer Glover, University of Technology, Sydney (UTS) Discussant: Axel Wieneke, La Trobe University Balbinder Singh Gill, Ghent University Discussant: Hitoshi Takehara, University of Tsukuba Size Matters: Bank Capital Regulation With Asymmetric Countries An Examination of the Relationship between Earnings Quality and Corporate Social Performance: Evidence from Japan Damien Sean Eldridge, La Trobe University Heidi Ryoo, La Trobe University Axel Wieneke, La Trobe University Discussant: Geoffrey Evatt, University of Manchester Session Chair: Andy Mullineux, University of Birmingham Sunday 16 December 9:00am – 11:00am Session 1 Harlequin Lead Session on Asset Pricing 1 Carbon Dioxide Emissions and Asset Pricing Zhuo Chen, Kellogg School of Management Andrea Lu, Northwestern University Discussant: Fabian Irek, Universite du Luxembourg Do Fund Investors Know that Risk is Sometimes Not Priced? Fabian Irek, Universite du Luxembourg Thorsten Lehnert, Universite du Luxembourg Discussant: Zhuo Chen, Kellogg School of Management Do Institutions Influence Corporate Behavior? An Analysis of Corporate Social Responsibility Chuan-Yang Hwang, Nanyang Technological University Sheridan Titman, University of Texas at Austin Ying Wang, Nanyang Technological University Discussant: Tony Berrada, University of Geneva Beta-Arbitrage Strategies: When Do They Work, and Why? Tony Berrada, University of Geneva Reda Jürg Messikh, Pictet Asset Management Gianluca Oderda, Ersel Asset Management Olivier Pictet, Pictet Asset Management Discussant: Ying Wang, Nanyang Technological University Session Chair: Jin-Chuan Duan, National University of Singapore Zhaoyang Gu, University of Minnesota Keiichi Kubota, Chuo University Hitoshi Takehara, University of Tsukuba Discussant: Balbinder Singh Gill, Ghent University Session Chair: Jared Stanfield, University of New South Wales Sunday 16 December Session 2 Corporate Finance 2 1:15pm – 3:15pm Cambridge I & II Sunday 16 December 1:15pm – 3:15pm Session 2 Cambridge III Funds Management/Mutual Funds 2 Cross-Border Mergers and Acquisitions: The Role of Private Equity Firms Enhanced Optimal Portfolios - A Controlled Integration of Quantitative Predictors Mark Humphery-Jenner, University of New South Wales Zacharias Sautner, University of Amsterdam Jo-Ann Suchard, University of New South Wales Discussant: Pang Caiji, Nanyang Technological University Lars Kaiser, Hochschule Liechtenstein Aron Veress, Hochschule Liechtenstein Marco Josef Menichetti Discussant: David Schumacher, INSEAD The Role of Severance Pay in CEO Turnover The Role of Domestic Industries in Foreign Portfolio Decisions Wei-Lin Liu, Nanyang Technological University Pang Caiji, Nanyang Technological University Discussant: Mark Humphery-Jenner, University of New South Wales David Schumacher, INSEAD Discussant: Lars Kaiser, Hochschule Liechtenstein CDS Spreads, ExecutivesPreferences, and Risk-Taking: Evidence from CEO Stock Grants Do Equity Mutual Funds Really Perform Less Poorly in Bad Times? Evidence from US and Australia Ingolf Dittmann, Erasmus University Rotterdam Lars Norden, Erasmus University Rotterdam Guangyao Zhu, Erasmus University Rotterdam Discussant: Renée Adams, University of New South Wales Tariq Haque, University of Adelaide Paskalis Glabadanidis, University of Adelaide Discussant: Melissa Porras Prado, Nova School of Business and Economics What Do Bankers Know? Equity Lending, Investment Restrictions and Fund Performance Renee Adams, University of New South Wales Qiaoqiao Zhu, Australian National University Yanhui Wu, Queensland University of Technology Discussant: Guangyao Zhu, Erasmus University Rotterdam Richard Evans, University of Virginia Miguel Ferreira, Nova School of Business and Economics Melissa Porras Prado, Nova School of Business and Economics Discussant: Tariq Haque, University of Adelaide Session Chair: Christine Brown, University of Melbourne Session Chair: Gordon Alexander, University of Minnesota Sunday 16 December Session 2 Asset Pricing 1 Sunday 16 December Session 2 Capital Markets 2 1:15pm – 3:15pm Cambridge IV 1:15pm – 3:15pm Essex I Individual Financial Risk Tolerance and the Global Financial Crisis The Cost of False Bravado: Management Overconfidence and Its Impact on Analysts' Views Paul Gerrans, University of Western Australia Robert Faff, University of Queensland Neil Hartnett, University of Newcastle Australia Discussant: Peter Swan, University of New South Wales Lisa Kramer, University of Toronto Chi Liao, University of Toronto Discussant: Mingxin Li, Simon Fraser University The Wisdom of Crowds: How the Hi-Tech Bubble Enriched Household Investors Hedge Funds as International Liquidity Providers: Evidence from Convertible Bond Arbitrage in Canada Peter Swan, University of New South Wales P. Joakim Westerholm, The University of Sydney Discussant: Robert Faff, University of Queensland Evan Gatev, Simon Fraser University Mingxin Li, Simon Fraser University Discussant: Lisa Kramer, University of Toronto Portfolio Choice with 2 Pass Estimation on Large Equity Data Sets Stock Price Informativeness, Analyst Coverage and Economic Growth: Evidence from Emerging Markets Tony Berrada, University of Geneva Sebastien Coupy, University of Geneva Discussant: Yuewen Xiao, University of New South Wales Fang-Chin Cheng, University of New South Wales Ferdinand Gul, Monash University Bin Srinidhi, University of Texas at Arlington Discussant: Meifen Qian, Jiangxi University of Finance and Economics Regime-Switching of Electricity Prices: Evidence from the PJM Market The Chinese Cash and Stock Dividend Puzzles: Evidence from Joint Earnings and Dividend Announcements Yuewen Xiao, University of New South Wales David B. Colwell, University of New South Wales Ramaprasad Bhar, University of New South Wales Discussant: Sebastien Coupy, University of Geneva John Powell, Massey University Meifen Qian, Jiangxi University of Finance and Economics Jing Shi, Australian National University Wu Yan, Jiangxi University of Finance and Economics Discussant: Fang-Chin Cheng, University of New South Wales Session Chair: David Feldman, University of New South Wales Session Chair: Dirk Schoenmaker, Duisenberg School of Finance Sunday 16 December Session 2 Financial Economics 2 1:15pm – 3:15pm Essex II Sunday 16 December Session 2 Corporate Governance 1 1:15pm – 3:15pm Bradfield Lounge Financial Literacy and Debt Literacy Amid the Poor Friendly Boards and Innovation Cherif Diagne, Audencia Nantes School of Management Christophe Villa, Audencia Nantes School of Management Discussant: Chi Feng Tzeng Jun-Koo Kang, Nanyang Technological University Wei-Lin Liu, Nanyang Technological University Angie Low, Nanyang Technological University Le Zhang, University of New South Wales Discussant: Emilia Vähämaa, University of Vaasa Bankruptcy Probabilities Inferred from Option Prices Gender Equality and Outside Representation on European Boards of Directors Stephen Taylor, Lancaster University Chi Feng Tzeng, National Tsing Hua University Martin Widdicks, Lancaster University Discussant: Cherif Diagne, Audencia Nantes School of Management Emilia Vähämaa, University of Vaasa Claire Crutchley, Auburn University Discussant: Le Zhang, University of New South Wales Credit Risk, Liquidity or Funding Access? ForeignExchange Forwards in a Post-2008 World Cross-Country Differences in the Effect of Political Connections on the Information Environment Justin Yap, University of New South Wales Discussant: Justinas Brazys, Erasmus University Rotterdam Yuanto Kusnadi, Hong Kong University of Science & Technology Bin Srinidhi, University of Texas at Arlington Discussant: Stephani Mason, Rutgers, The State University of New Jersey The Time-Varying Reaction of High Yield Currencies to Economic News Say on Pay: Is It Globally Value-Enhancing? Justinas Brazys, Erasmus University Rotterdam Martin Martens, Erasmus University Rotterdam Discussant: Justin Yap, University of New South Wales Session Chair: John Elder, Colorado State University Sunday 16 December 1:15pm – 3:15pm Session 2 Harlequin Lead session on Behavioural Finance The Liquidity and Volatility Impacts of Day Trading by Individuals in the Taiwan Index Futures Market Robin Chou, National Chengchi University George Wang, George Mason University Yun-Yi Wang, Feng Chia University Discussant: Thomas Ruf, University of New South Wales Limits to Market Making, Liquidation Risk and the Skewness Risk Premium in Options Markets Thomas Ruf, University of New South Wales Discussant: Robin Chou , National Chengchi University Dark Trading and Price Discovery Carole Comerton-Forde, Australian National University Talis Putnins, University of Technology, Sydney Discussant: Lee Smales, University of New South Wales Non-Scheduled News Arrival and High-Frequency Stock Market Dynamics: Evidence from the Australian Securities Exchange Lee Smales, University of New South Wales Discussant: Talis Putnins, University of Technology, Sydney Session Chair: Terrance Odean, University of California, Berkeley Stephani Mason, Rutgers, The State University of New Jersey Discussant: Yuanto Kusnadi, Hong Kong University of Science & Technology Session Chair: Peter Pham, University of New South Wales Sunday 16 December Session 3 Corporate Finance 3 3:45pm – 5:45pm Cambridge I & II Sunday 16 December Session 3 International Finance 1 3:45pm – 5:45pm Cambridge III Firm Financing Choices in a Thin, Capital Constrained Market A New Test of Financial Contagion with Application to the US Banking Sector David Smith, Massey University Jianguo Chen, Massey University Hamish Anderson, Massey University Discussant: Jared Stanfield, University of New South Wales Cody Yu-Ling Hsiao, Australian National University Discussant: Bronwyn McCredie, University of Newcastle Syndication, Networks, and Leveraged Buyout Exits The Impact of Monetary Policy Announcements on the Australian Foreign Exchange Market Jared Stanfield, University of New South Wales Discussant: David Smith, Massey University The Token Women Maria Strydom, Monash University Hue Hwa Au Yong, Monash University Discussant: Liangbo Ma, University of Wollongong Bronwyn McCredie, University of Newcastle Paul Docherty, University of Newcastle Stephen Andrew Easton, Newcastle University Katherine Uylangco, University of Newcastle Discussant: Celine Rochon, University of Oxford Optimal Maturity Structure of Sovereign Debt in Situation of Near Default Gabriel Desgranges, University of Cergy-Pontoise Celine Rochon, University of Oxford Discussant: Sudharshan Paramati, Griffith University Founding-Family Control, Information Opacity, and Cost of Debt: Evidence from China A Dynamic Analysis of the Integration of the Australian Stock Market with Those of Its Trading Partners Liangbo Ma, University of Wollongong Shiguang Ma, University of Wollongong Gary Tian Discussant: Maria Strydom, Monash University Sudharshan Paramati, Griffith University Rakesh Gupta, Griffith University Eduardo Roca, Griffith University Discussant: Cody Hsiao, Australian National University Session Chair: Balbinder Singh Gill, Ghent University Session Chair: Pei Shao, University of Lethbridge Sunday 16 December Session 3 Asset Pricing 2 Sunday 16 December 3:45pm – 5:45pm Session 3 Essex I Special Issue: Systemic Risk 1 3:45pm – 5:45pm Cambridge IV CAPM, Components of Beta and the Cross Section of Expected Returns Announcement Effects of Asset Securitization: The Case of Liquidity Facility Providers Tolga Cenesizoglu, HEC Montreal Jonathan Reeves, University of New South Wales Discussant: Philip Gharghori, Monash University Hilke Hollander, University of Oldenburg Jörg Prokop, University of Oldenburg Discussant: Alexandre Baptista, George Washington University The Performance of Socially Responsible Investments: An Examination under the ICAPM Framework On the Regulatory Responses to the Recent Crisis: An Assessment of the Basel Market Risk Framework and the Volcker Rule Yuchao Xiao, Monash University Robert Faff, University of Queensland Philip Gharghori, Monash University ByoungKyu Min, University of Neuchatel Discussant: Narelle Gordon, Macquarie University Information Asymmetry, Information Attributes and Industry Sector Returns Narelle Gordon, Macquarie University Edward Watts Qiongbing Wu, University of Western Sydney Discussant: Petko Kalev, University of South Australia Time-Varying Dynamics and Asymmetric Effects of the Fama-French Factor Betas Petko Kalev, University of South Australia Leon Zolotoy, Melbourne Business School Discussant: Jonathan Reeves, University of New South Wales Session Chair: Qiang Kang, Florida International University Gordon Alexander, University of Minnesota Alexandre Baptista, George Washington University Shu Yan, University of South Carolina Discussant: Hilke Hollander, University of Oldenburg Can European Bank Bailouts Work? Dirk Schoenmaker, Duisenberg School of Finance Arjen Siegmann, VU University Amsterdam Discussant: Andy Mullineux, University of Birmingham Banking for the Public Good Andy Mullineux, University of Birmingham Discussant: Dirk Schoenmaker, Duisenberg School of Finance Session Chair: Bodo Herzog, Reutlingen University Sunday 16 December Session 3 Financial Institutions 2 3:45pm – 5:45pm Essex II Sunday 16 December Session 3 Corporate Governance 2 3:45pm – 5:45pm Bradfield Lounge Did Local Lenders Forecast the Bust? Evidence from the Real Estate Market Industry Structure, Loan Contract Terms, and the Role of Firm-Level and Country-Level Corporate Governance Kristle Cortés, Federal Reserve Banks Discussant: Frank Packer, Bank for International Settlements Seul Koo, University of New South Wales Discussant: Chia-Feng Yu, Monash University Loan Loss Provisioning Practices of Asian Banks Hubris, CEO Compensation and Earnings Manipulation Frank Packer, Bank for International Settlements Haibin Zhu, Bank for International Settlements Discussant: Kristle Cortés, Federal Reserve Banks Chia-Feng Yu, Monash University Discussant: Seul Koo, University of New South Wales Liquidity Advantage of Domestic Banks: Evidence from Australian Syndicated Loans Tax Regimes, Regulatory Change and Corporate Income Tax Aggressiveness in China Christine Brown, University of Melbourne Viet Minh Do, Monash University Discussant: Shanty Noviantie, University of Verona Guodong Yuan, University of South Australia Ronald McIver, University of South Australia Michael Burrow, University of South Australia Discussant: Hyonok Kim, Tokyo Keizai University Extending Environmental Risk Management and Social Development to Commercial Banks: A Dealership Model Stock Option Awards: Effects on Firm Performance and Risk-Taking after Japan’s Corporate Governance Reforms Shanty Noviantie, University of Verona Discussant: Christine Brown, University of Melbourne Hyonok Kim, Tokyo Keizai University Yukihiro Yasuda, Tokyo Keizai Univeristy Nobuhisa Hasegawa, TKU-MFRC Discussant: Ronald McIver, University of South Australia Session Chair: Necmi Avkiran, University of Queensland Session Chair: Ronan Powell, University of New South Wales Oscar Trevarthen Sunday 16 December Session 3 Quantitative Finance 1 3:45pm – 5:45pm Harlequin Developing High-Frequency Foreign Exchange Trading Systems Bruce Vanstone, Bond University Tobias Hahn, Bond University Gavin Finnie, Bond University Discussant: Guang-Hua Lian, University of South Australia Firm Specific Risk and IPO Market Cycles Marie-Claude Beaulieu, Laval University Habiba Mrissa Bouden, Laval University Discussant: Eliza Wu, University of Technology, Sydney Modelling Sovereign Ratings Impacts on Stock Return Distributions within a Multivariate Regime Switching Long Memory Framework Hung Xuan Do, Monash University Robert Darren Brooks, Monash University Sirimon Treepongkaruna, University of Western Australia Eliza Wu, University of Technology, Sydney Discussant: Bruce Vanstone, Bond University Consistent Pricing of S&P500 and VIX Options in Gatheral's Model Robert Elliott Petko Kalev, University of South Australia Guang-Hua Lian, University of South Australia Discussant: Habiba Mrissa Bouden, Laval University Session Chair: David Colwell, University of New South Wales Monday 17 December Session 4 Derivative Instruments 1 8:45am – 10:45am Cambridge I & II The Price Sensitivity of Retail Warrant Investors Rainer Baule, University of Hagen Philip Blonski, FernUniversität in Hagen Discussant: Tim Krehbiel, Oklahoma State University All Risks Matter Weiping Li, Oklahoma State University Tim Krehbiel, Oklahoma State University Discussant: Philip Blonski, FernUniversität in Hagen Monday 17 December Session 4 Capital Markets 3 8:45am – 10:45am Cambridge III Price and Earnings Momentum, Transaction Costs and Financial Crisis Reza Tajaddini, University of Otago Timothy Falcon Crack, University of Otago Helen Roberts, University of Otago Discussant: Shaun McDowell, Waikato Institute of Technology Examining the Dynamic of Stock Prices with Evolving Computational Trading Models: The Value of Fundamental and Technical Analysis Laura Núñez-Letamendia, IE Business School Yiyi Jiang, Fundación Instituto de Empresa, S.L. Discussant: Ruichang Lu, National University of Singapore Contemporaneous Spill-Over Among Equity, Gold, and Exchange Rate Implied Volatility Indices The Benefits of International Diversification: Measuring the Risk-Adjusted Premium Ihsan Badshah, Auckland University of Technology Bart Frijns, Auckland University of Technology Alireza Tourani Rad, Auckland University of Technology Discussant: Godfrey Smith, The University of Queensland Shaun McDowell, Waikato Institute of Technology Discussant: Laura Núñez-Letamendia, IE Business School Testing Alternative Measure Changes in Nonparametric Pricing and Hedging of European Options Do Banks Monitor Corporate Decisions? - Evidence from Bank Financing of Mergers and Acquisitions Jamie Alcock, University of Cambridge Godfrey Smith, The University of Queensland Discussant: Ihsan Badshah, Auckland University of Technology Sheng Huang, Singapore Management University Ruichang Lu, National University of Singapore Anand Srinivasan, National University of Singapore Discussant: Reza Tajaddini, University of Otago Session Chair: Guang-Hua Lian, University of South Australia Session Chair: Le Zhang, University of New South Wales Monday 17 December Session 4 Asset Pricing 3 Monday 17 December 8:45am – 10:45am Session 4 Essex I Special Issue: Systemic Risk 2 8:45am – 10:45am Cambridge IV Cross-Sectional PEG Ratios, Market Equity Premium, and Macroeconomic Activity Xiaoquan Jiang, Florida International University Qiang Kang, Florida International University Discussant: Helen Lu, Massey University Predictability in the Short and Long Legs of Carry Trades Helen Lu, Massey University Ben Jacobsen, Massey University Discussant: Qiang Kang, Florida International University Is the Accruals Quality Premium Really Only a January Effect? International Evidence Lijuan Zhang, Australian National University Mark David Wilson, University of Canberra Discussant: Mirela Malin, Griffith University Using Volatility Futures as Extreme Downside Hedges Bernard Lee, Hedge Funds and Sophisticated Products Advisors Discussant: Jinjuan Ren, University of Macau Pricing Deviation, Misvaluation Comovement, and Macroeconomic Conditions Eric Chang, University of Hong Kong Yan Luo, University of Hong Kong Jinjuan Ren, University of Macau Discussant: Bernard Lee, Hedge Funds and Sophisticated Products Advisors Banking Risk and Macroeconomic Fluctuations Yi Jin, Monash University Zhixiong Zeng, Monash University Discussant: Yan Luo, Harvard Law School Long-Term Return Reversal: Evidence from International Market Indices Costly and Unprofitable Speculation: Evidence from Trend-Chasing Chinese Short-Sellers and Margin-Traders Mirela Malin, Griffith University Graham Bornholt, Griffith University Discussant: Lijuan Zhang, Australian National University Eric Chang, University of Hong Kong Yan Luo, University of Hong Kong Jinjuan Ren, University of Macau Discussant: Yi Jin, Monash University Session Chair: Tony Berrada, University of Geneva Session Chair: Alireza Tourani Rad, Auckland University of Technology Monday 17 December Session 4 Financial Economics 3 8:45am – 10:45am Essex II Monday 17 December Session 4 Corporate Finance 4 8:45am – 10:45am Bradfield Lounge Higher-Moment Asset Pricing and Allocation in a Heterogeneous Market Equilibrium Market Microstructure and Ex-Dividend Day Pricing Anomaly: Evidence from a Unique Environment Qunzi Zhang, Swiss Finance Institute Discussant: Sajid Chaudhry, Maastricht University Khamis Al-Yahyaee, Sultan Qaboos University Discussant: Aymen Turki, Université Lille Nord de France Tail Risks and Systemic Risks for U.S. and Eurozone Financial Institutions in the Wake of the Global Financial Crisis The Informational Role of Acquirer Dividend Policy in Corporate Takeovers Stefan Straetmans, Maastricht University Sajid Chaudhry, Maastricht University Discussant: Qunzi Zhang, Swiss Finance Institute Aymen Turki, Université Lille Nord de France Sebastien Dereeper, Université Lille Nord de France Discussant: Khamis Al-Yahyaee, Sultan Qaboos University Throwing in the Towel: Optimal Voluntary Liquidation of Distressed Assets The Fukushima Nuclear Accident, Damage Compensation Resolution and Energy Stock Returns James Brotchie, University of Queensland Jamie Alcock, University of Cambridge Stephen Gray, University of Queensland Discussant: Andrea Lu, Northwestern University Peng Xu, Hosei University Discussant: Grzegorz Michalski, Wroclaw University of Economics International Instability and Asset Pricing After-Crisis Relation between General Economic Condition and Liquidity Management: Financial Liquidity Investment Efficiency Model (FLIEM) Use to Diagnose Polish Economics Standing Zhuo Chen, Kellogg School of Management Andrea Lu, Northwestern University Zhuqing Yang, Northwestern University Discussant: James Brotchie, University of Queensland Session Chair: Vitor Leone, Nottingham Business School Monday 17 December 8:45am – 10:45am Session 4 Harlequin Lead Session on Financial Institutions Funding Advantage and Market Discipline in the Canadian Banking Sector Mehdi Beyhaghi, York University Chris D'Souza, Government of Canada Adi Mordel Gordon Roberts, York University Discussant: Ranajoy Ray-Chaudhuri, The Ohio State University How Banking Deregulation Affects Growth: Evidence from a Panel of U.S. States Ranajoy Ray-Chaudhuri, The Ohio State University Discussant: Amine Tarazi, University of Limoges Ultimate Ownership Structure and Bank Regulatory Capital Adjustment: Evidence from European Commercial Banks Laetitia Lepetit, University of Limoges Amine Tarazi, University of Limoges Nadia Zedek, University of Limoges Discussant: Pei Shao, University of Lethbridge How Important is the Informational Advantage of Relationship Lenders?: The Impact of Regulation Fair Disclosure Yutao Li, University of Waterloo Anthony Saunders, New York University Pei Shao, University of Lethbridge Discussant: Gordon Roberts , York University Session Chair: Anthony Saunders, New York University Grzegorz Marek Michalski, Wroclaw University of Economics Discussant: Peng Xu, Hosei University Session Chair: Alexander Molchanov, Massey University Monday 17 December Session 5 Market Microstructure 1 3:30pm – 5:30pm Cambridge I & II Market Liquidity, Private Information, and the Cost of Capital: Microstructure Studies on Family Firms in Japan Takashi Ebihara, Musashi University Keiichi Kubota, Chuo University Hitoshi Takehara, University of Tsukuba Eri Yokota, Keio University Discussant: PeiLin Billy Hsieh, Cornell University Volatility Uncertainty, Time Decay, and Option Bid-Ask Spreads Monday 17 December Session 5 Capital Markets 4 3:30pm – 5:30pm Cambridge III Media and Market Quality Terrance Fung, Hong Kong University of Science & Technology Discussant: Jaehoon Lee , University of New South Wales Funding Liquidity and Its Risk Premiums PeiLin Billy Hsieh, Cornell University Discussant: Keiichi Kubota, Chuo University Jaehoon Lee, University of New South Wales Discussant: Terrance Fung, Hong Kong University of Science & Technology Impact of Anonymity on Liquidity in Limit Order Books: Evidence from Cross-listed Stocks Excess Stock Return Comovements and the Role of Investor Sentiment Jane Chau, University of Wollongong Alex Frino, University of Sydney Gary Gang Tian, University of Wollongong Shiguang Ma, University of Wollongong Discussant: Keng-Yu Ho, National Taiwan University Bart Frijns, Auckland University of Technology Willem Verschoor, Erasmus University Rotterdam Remco Zwinkels, Erasmus University Rotterdam Discussant: Daniel Schmidt, INSEAD Market Efficiency and Foreign Institutional Trading: Evidence from the Taiwan Futures Market Investors' Attention and Stock Covariation: Evidence from Google Sport Searches Robin Chou, National Chengchi University Keng-Yu Ho, National Taiwan University Pei-Shih (Pace) Weng, National Central University at Taiwan Discussant: Jane Chau, University of Wollongong Daniel Schmidt, INSEAD Discussant: Remco Zwinkels, Erasmus University Rotterdam Session Chair: Petko Kalev, University of South Australia Session Chair: Kingsley Fong, University of New South Wales Monday 17 December Session 5 Emerging Markets 1 Monday 17 December 3:30pm – 5:30pm Session 5 Essex I Funds Management/Mutual Funds 3 3:30pm – 5:30pm Cambridge IV Oil Price Shocks and Stock Market Performance: Do Nature of Shocks and Economies Matter? Ha Le, Nanyang Technological University Youngho Chang, Nanyang Technological University Discussant: Vanja Piljak, University of Vaasa Bond Markets Co-Movement Dynamics and Macroeconomic Factors: Evidence from Emerging and Frontier Markets Vanja Piljak, University of Vaasa Discussant: Ha Le, Nanyang Technological University Practice What You Preach: Microfinance Business Models and Operational Efficiency Jaap Bos, Maastricht University Matteo Millone, Maastricht University Discussant: Zaghum Umar, University of Groningen The Informational Advantage of Local Investors: Evidence from Fund Managers’ Trades Around Credit Events Natalie Oh, University of New South Wales Jerry Parwada, University of New South Wales Kian Tan, University of New South Wales Discussant: Scott Weisbenner, University of Illinois at UrbanaChampaign The Investment Behavior of State Pension Plans Jeffrey Brown, University of Illinois at Urbana-Champaign Joshua Matthew Pollet, Michigan State University Scott Weisbenner, University of Illinois at Urbana Discussant: Kian Tan, University of New South Wales Co-Insurance in Mutual Fund Families Luis Goncalves-Pinto, National University of Singapore Breno Schmidt, Emory University Discussant: Mark Kamstra, York University The Myopic and Intertemporal Demand for Equities: Evidence from Emerging Markets Seasonal Asset Allocation: Evidence from Mutual Fund Flows Zaghum Umar, University of Groningen Laura Spierdijk, University of Groningen Discussant: Matteo Millone, Maastricht University Mark Kamstra, York University Lisa Kramer, University of Toronto Maurice Levi, University of British Columbia Russ Wermers, University of Maryland Discussant: Luis Goncalves-Pinto, National University of Singapore Session Chair: Mark Humphery-Jenner, University of New South Wales Session Chair: Ales Berk, University of Ljubljana Monday 17 December Session 5 Financial Institutions 3 3:30pm – 5:30pm Essex II Monday 17 December Session 5 Corporate Finance 5 3:30pm – 5:30pm Bradfield Lounge Market Discipline and Bank Risk CEO Overconfidence and Corporate Financial Distress Mamiza Haq, University of Queensland Robert Faff, University of Queensland Khoa Hoang, University of Queensland Discussant: Jiakai Chen, University of California, Berkeley Chao Rung Ho, Taiwan Academy of Banking and Finance Yuanchen Chang, National Chengchi University Discussant: Ed Vos, University of Waikato Libor's Poker: Tacit Collusion and Signaling Effect The Happy Story Told by SME Capital Structure Jiakai Chen, University of California, Berkeley Discussant: Khoa Hoang, University of Queensland Ed Vos, University of Waikato Kenny Bell Discussant: Chao Rung Ho, Taiwan Academy of Banking and Finance Government Guarantees of Loans to Small Businesses: Effects on Risk-Taking and Non-Guaranteed Lending Institutional Investor Horizons, Information Environment, and Firm Financing Decisions James Wilcox, University of California, Berkeley Yukihiro Yasuda, Tokyo Keizai Univeristy Discussant: Yongjia Lin, University of Macau Xin Chang, Nanyang Technological University Yangyang Chen, Monash University Sudipto Dasgupta, Hong Kong University of Science & Technology Discussant: Juan Luo, Nanyang Technological University Bank Competition and Financial Stability in Asia Pacific Maggie Fu, University of Macau Yongjia Lin, University of Macau Philip Molyneux, University of Wales System Discussant: Yukihiro Yasuda, Tokyo Keizai Univeristy Session Chair: Wenling Lu, Washington State University Monday 17 December 3:30pm – 5:30pm Session 5 Harlequin Lead Session on Asset Pricing 2 The Systematic Pricing of Market Psychology Shock Samuel Xin Liang, Hong Kong University of Science & Technology Discussant: Jae Kim, La Trobe University Predictive Regression: An Improved Augmented Regression Method Jae Kim, La Trobe University Discussant: Samuel Xin Liang, Hong Kong University of Science & Technology It is the Short-Run Idiosyncratic Risk that May Matter: Evidence from Multiresolution Analysis Pei Pei Tan Don (Tissa) Galagedera, Monash University Elizabeth Ann Maharaj, Monash University Discussant: Marie Lambert, University of Liege Comoment Risk and Stock Return Marie Lambert, University of Liege Georges Hubner, University of Liege Discussant: Don (Tissa) Galagedera, Monash University Session Chair: Bruno Solnik, HKUST Information Spillover Across Firms in Institutional Investor’s Blockholding Network: Evidence from Seasoned Equity Offerings Juan Luo, Nanyang Technological University Discussant: Yangyang Chen, Monash University Session Chair: Grzegorz Michalski, Wroclaw University of Economics Tuesday 18 December Session 6 Capital Markets 5 8:45am – 10:45am Cambridge I & II Tuesday 18 December Session 6 Financial Economics 4 8:45am – 10:45am Cambridge III Multiple Changes in Persistence vs. Explosive Behaviour: The Dotcom Bubble Is Increasing Financial Integration Related to Improved International Risk Sharing? Otavio Ribeiro de Medeiros, University of Brasília Vitor Leone, Nottingham Business School Discussant: Cameron Truong, Monash University Hans-Peter Burghof, University of Hohenheim Helena Kleinert, University of Hohenheim Discussant: Yin Liao, Queensland University of Technology Options Trading Volume and Stock Price Response to Earnings Announcements Contingent Liabilities and Sovereign Risk: Evidence from Banking Sectors Cameron Truong, Monash University Discussant: Vitor Leone, Nottingham Business School Serkan Arslanalp, International Monetary Fund Yin Liao, Queensland University of Technology Discussant: Helena Kleinert, University of Hohenheim Does Income Smoothing Affect the Cost of Bank Loans? Bank Risk Within and Across Equilibria Yusuke Takasu, Hitotsubashi University Discussant: Mario Bersem, Copenhagen Business School Itai Agur, International Monetary Fund Discussant: Rose Lai, University of Macau Incentive-Compatible Sovereign Debt Liquidity, Fragility and the Credit Crunch: A Theoretical Explanation and the Introduction of Contingent Convertible Bonds Mario Bersem, Copenhagen Business School Discussant: Yusuke Takasu, Hitotsubashi University Robert Van Order, George Washington University Rose Lai, University of Macau Discussant: Itai Agur, International Monetary Fund Session Chair: Saskia ter Ellen, Erasmus University Rotterdam Session Chair: Leo Krippner, Reserve Bank of New Zealand Tuesday 18 December 8:45am – 10:45am Session 6 Cambridge IV Special Issue: Systemic Risk 3 Tuesday 18 December 8:45am – 10:45am Session 6 Essex I Special Issue: Systemic Risk 4 Corporate Governance and the Dynamics of Capital Structure: New Evidence Market Perceptions of US and European Policy Actions Around the Subprime Crisis Robin Chou, National Chengchi University Yakai Chang, National Chengchi University Tai-Hsin Huang, National Chengchi University Discussant: Baeho Kim, Korea University Theoharry Grammatikos, Universite du Luxembourg Thorsten Lehnert, Universite du Luxembourg Yoichi Otsubo, Universite du Luxembourg Discussant: Katsutoshi Shimizu, Nagoya University Suppliers, Investors, and Equity Market Liberalizations The Impact of IRB Approach on the Credit Risk Exposure Under Basel II Martin Strieborny, University of Michigan at Ann Arbor Discussant: Yakai Chang, National Chengchi University How to Evaluate the Share Price Performance During CEO Tenure: The Case of Josef Ackermann’s Stewardship at Deutsche Bank Stephan Späthe, Center for Financial Studies Discussant: Martin Strieborny, University of Michigan at Ann Arbor A Systematic Diagnosis of Systemic Risk: The Role of Leading and Lagging Indicators Myeong Hyeon Kim, Korea University Business School (KUBS) Baeho Kim, Korea University Discussant: Stephan Späthe, Center for Financial Studies Session Chair: Guangyao Zhu, Erasmus University Rotterdam Katsutoshi Shimizu, Nagoya University Discussant: Yoichi Otsubo, Universite du Luxembourg Banking Systemic Vulnerabilities: A Tail-Risk Dynamic CIMDO Approach Xisong Jin, McGill University Francisco Nadal De Simone, Banque Centrale du Luxembourg Discussant: Simone Giansante, University of Bath Liquidity and Solvency Shocks in Interbank Lending and the Prediction of Bank Failures: Analysis of a Network Model of Systemic Risk Andreas Krause, University of Bath Simone Giansante, University of Bath Discussant: Xisong Jin, McGill University Session Chair: Claire Matthews, Massey University Tuesday 18 December 8:45am – 10:45am Session 6 Essex II Quantitative Finance/Financial Mathematics Tuesday 18 December 8:45am – 10:45am Session 6 Bradfield Lounge Lead Session on Derivative Instruments Risk and Dependence Analysis of Australian Stock Market - The Case of Extreme Value Theory The Option-Implied Density of the S&P500: What Drives Market Uncertainty and Prediction? Abhay Singh, Edith Cowan University David Allen, Edith Cowan University Robert Powell, Edith Cowan University Discussant: Magdalena Pisa, Maastricht University Yi Ling Low, University of Melbourne Discussant: David Allen, Edith Cowan University Modeling Default Correlation in a US Retail Loan Portfolio A Non-Parametric and Entropy Based Analysis of the Relationship between the VIX and S&P 500 Dennis Bams, Maastricht University Magdalena Pisa, Maastricht University Christian Wolff, Universite du Luxembourg Discussant: Abhay Singh, Edith Cowan University David Allen, Edith Cowan University Michael McAleer, Erasmus University Rotterdam Robert Powell, Edith Cowan University Abhay Kumar-Singh, Edith Cowan University Discussant: Yi Ling Low, University of Melbourne Optimal Hedging When the Underlying Asset Follows a Regime-Switching Markov Process CEO Compensation and Credit Default Swaps: Evidence from the U.S. And Germany Pascal Francois, HEC Montreal Genevieve Gauthier, HEC Montreal Frédéric Godin, HEC Montreal Discussant: John Peter Chateau, University of Macau Hsin-Hui Chiu, California State University, Northridge Eva Wagner, Johannes Kepler University Linz Discussant: Hayette Gatfaoui, Rouen Business School Gram-Charlier Processes and Equity-Indexed Annuities Investigating the Linkages between U.S. CDS Spreads and Both the Equity Market Price and Equity Market Volatility Channels: A Quantile Regression Approach John Peter Chateau, University of Macau Daniel Dufresne, University of Melbourne Discussant: Genevieve Gauthier, HEC Montreal Session Chair: Bruce Vanstone, Bond University Tuesday 18 December 8:45am – 10:45am Session 6 Harlequin Lead Session on Corporate Finance The Impact of the 2007 Reforms on the Information Environment in the Chinese A-Share Market Rong Gong Alastair Marsden, University of Auckland Russell Poskitt, University of Auckland Discussant: Chander Shekhar, University of Melbourne Institutional Shareholder Response to Antitakeover Laws Chander Shekhar , University of Melbourne Murat Aydogdu, Bryant University Discussant: Alastair Marsden, University of Auckland Auctions of Real Options: Security Bids, Moral Hazard and Strategic Timing Lin Cong, Stanford Graduate School of Business Discussant: Michaela Rankin, Monash University Promotion Incentives, CEO Appointments and Firm Performance Maria Strydom, Monash University Michaela Rankin, Monash University Discussant: Lin Cong, Stanford Graduate School of Business Session Chair: Vikram Nanda, Georgia Institute of Technology Hayette Gatfaoui, Rouen Business School Discussant: Eva Wagner, Johannes Kepler University Linz Session Chair: Chu Zhang, HKUST Tuesday 18 December Session 7 Capital Markets 6 1:00pm – 3:00pm Cambridge I & II Effect of Regret Prachi Deuskar, University of Illinois at Urbana-Champaign Pan Deng, Fudan University Scott Weisbenner, University of Illinois at Urbana-Champaign Fei Wu, Massey University Discussant: Paskalis Glabadanidis, University of Adelaide Market Timing with Moving Averages Paskalis Glabadanidis, University of Adelaide Discussant: Eben van Wyk, Royal Bank of Scotland Short Selling and Over-Optimism: Do Short Sellers Profit on the Australian Stock Exchange? David Gallagher, Macquarie Graduate School of Management Petko Kalev, University of South Australia Eben van Wyk, Royal Bank of Scotland Discussant: Fei Wu, Massey University Tuesday 18 December Session 7 International Finance 2 1:00pm – 3:00pm Cambridge III Measuring Financial Integration Across European Stock Markets Using the Implied Cost of Capital Katja Muehlhaeuser, Technische Universität München Discussant: Liang Li, University of Western Australia How Much are Resource Projects Worth? A Capital Market Perspective Liang Li, University of Western Australia Discussant: Katja Muehlhaeuser, Technische Universität München Kiwisaver Member Behaviour: A Quantitative Analysis Callum David Thomas Claire Matthews, Massey University Discussant: Scott Pappas, Griffith University Risk-Factor Diversification and Portfolio Selection Scott Pappas, Griffith University Robert Bianchi, Griffith University Michael Drew, Griffith University Rakesh Gupta, Griffith University Discussant: Claire Matthews, Massey University Session Chair: Fabian Irek, Universite du Luxembourg Session Chair: Uzma Shahzad, Massey University Tuesday 18 December Session 7 Market Microstructure 2 Tuesday 18 December 1:00pm – 3:00pm Session 7 Essex I Special Issue: Systemic Risk 5 1:00pm – 3:00pm Cambridge IV The Information Content of Price Movements for Intraday Liquidity Estimation Paolo Mazza, Louvain School of Management Mikael Petitjean, Louvain School of Management Discussant: Kathleen Walsh , Australian National University Rehypothecation Dilemma: Impact of Collateral Rehypothecation on Derivative Prices Under Bilateral Counterparty Credit Risk Yuji Sakurai, University of California, Los Angeles Yoshihiko Uchida, Bank of Japan Discussant: Masayasu Kanno, Kanagawa University Diminishing Price Impact in Asian Limit Order Book Markets Forecasting of Credit Migration Considering Correlation between Business and Credit Cycles Wang Chun Wei, University of Sydney Quan Gan, University of Sydney Discussant: Detollenaere Benoit, Louvain School of Management Masayasu Kanno, Kanagawa University Discussant: Yuji Sakurai, University of California, Los Angeles Do Japanese Candlesticks Help Solving the Trader's Dilemma? The Knock-On Effect in Business Group: Evidence from Korean Chaebols Credit Rating Changes Detollenaere Benoit, Louvain School of Management Paolo Mazza, Louvain School of Management Discussant: Wang Chun Wei, University of Sydney Seung Hun Han, Korea Advanced Institute of Science and Technology Yonghyun Kwon, Korea Advanced Institute of Science and Technology Eunjin Jo Discussant: Igor Loncarski, University of Ljubljana The Corporate Governance and Performance Relation: A Small Firm Perspective Quality of Bank Capital and Credit Growth in the Global Financial Crisis David Tan, Australian National University Lauren Wade Kathleen Walsh, Australian National University Discussant: Paolo Mazza, Louvain School of Management Marko Kosak, University of Ljubljana Shaofang Li, University of Ljubljana Igor Loncarski, University of Ljubljana Matej Marinc, University of Ljubljana Discussant: Yonghyun Kwon, Korea Advanced Institute of Science and Technology Session Chair: Peter Swan, University of New South Wales Session Chair: Qiongbing Wu, University of Western Sydney Tuesday 18 December Session 7 Quantitive Finance 2 1:00pm – 3:00pm Essex II Tuesday 18 December Session 7 Corporate Finance 6 1:00pm – 3:00pm Bradfield Lounge Measuring the Stance of Monetary Policy in Zero Lower Bound Environments Crash Risk, Corporate Reporting Environment, and Speed of Leverage Adjustment Leo Krippner, Reserve Bank of New Zealand Discussant: Yingshan Chen, National University of Singapore Zhe An, University of New South Wales Donghui Li, University of New South Wales Jin Yu, University of New South Wales Discussant: Huizhong Zhang, University of Adelaide Incomplete Information, Trend Following, and Liquidity Premia Extraordinary Acquirers: Top Management Team Talent and Bidding Behavior Luis Goncalves-Pinto, National University of Singapore Min Dai, National University of Singapore Yingshan Chen, National University of Singapore Discussant: Leo Krippner, Reserve Bank of New Zealand Alfred Yawson, University of Adelaide Huizhong Zhang, University of Adelaide Discussant: Zhe An, University of New South Wales Liquidity Premia and Dynamic Flows in Money Management Spillover Effects of Intra-Industry Bankruptcy Filings on Firms' Cash Holding Policy Luis Goncalves-Pinto, National University of Singapore (NUS) Department of Finance Min Dai, National University of Singapore Jing Xu, National University of Singapore Discussant: Xin Xu, University of New South Wales Nhan Le, University of Mannheim Discussant: Davin Wang Equilibrium-Based Volatility Models of the Market Portfolio Rate of Return David Feldman, University of New South Wales Xin Xu, University of New South Wales Discussant: Jing Xu, National University of Singapore Session Chair: Hayette Gatfaoui, Rouen Business School Tuesday 18 December Session 7 Asset Pricing 4 1:00pm – 3:00pm Harlequin The Term Structure of Equity Returns: Risk or Mispricing? Michael Weber, University of California, Berkeley Discussant: Saskia ter Ellen, Erasmus University Rotterdam Risk and Uncertainty in the Foreign Exchange Market Saskia ter Ellen, Erasmus University Rotterdam Willem Verschoor, Erasmus University Rotterdam Remco Zwinkels, Erasmus University Rotterdam Discussant: Michael Weber, University of California, Berkeley Durable Matters? An Alternative Measure of Consumption Risk Rui Cui, University of Chicago Discussant: Thomas Lejeune, University of Liege Risk Horizon and Equilibrium Asset Prices Georges Hubner, University of Liege Thomas Lejeune, University of Liege Discussant: Rui Cui, University of Chicago Session Chair: Tze Chuan Ang, University of Melbourne Do Diversified and Focused Firms Have Different Growth Options? Evidence from Total Asset Growth Davin Wang, Monash University Discussant: Nhan Le, University of Mannheim Session Chair: Christina Atanasova, University of York Tuesday 18 December Session 8 Corporate Finance 7 3:15pm – 5:15pm Cambridge I & II Incentive Alignment, Monitoring Mechanism and Going Private in Australia Mamunur Rashid, Curtin University of Technology Subhrendu Rath, Curtin University of Technology Discussant: Helen Higgs, Griffith University Disinterested, Disinclined, or Discouraged? Determinants of Finance Seeking Among Australian Small and Medium-Sized Enterprises Dong Xiang, Griffith University Andrew Worthington, Griffith University Helen Higgs, Griffith University Discussant: Mamunur Rashid, Curtin University of Technology Tuesday 18 December Session 8 Corporate Governance 3 3:15pm – 5:15pm Cambridge III Corporate Governance and Small Firm Financing Christina Atanasova, University of York Evan Gatev, Simon Fraser University Daniel Shapiro, Simon Fraser University Discussant: Andy Lardon, University of Antwerp The Value of Stable Ownership before and during the Global Financial Crisis Andy Lardon, University of Antwerp Marc Deloof, University of Antwerp Christof Beuselinck, Catholic University of Lille Discussant: Christina Atanasova, University of York Overcoming Fraud in Junior Equity Markets Block Trade Targets in China J. Ari Pandes, York University Michael Robinson, University of Calgary Discussant: Dong Xiang, Griffith University Liping Dong, Kyushu University Konari Uchida, Kyushu University Xiaohong Hou Discussant: Reza Yaghoubi, University of Waikato Family Ownership, Organisational Control and Agency Costs in Australian Small and Medium-Sized Enterprises Net Present Value of Acquisitions Dong Xiang, Griffith University Andrew Worthington, Griffith University Helen Higgs, Griffith University Discussant: Michael Robinson, University of Calgary Reza Yaghoubi, University of Waikato Stuart Locke, University of Waikato Jenny Gibb, University of Waikato Discussant: Konari Uchida, Kyushu University Session Chair: Sue Wright, Macquarie University Session Chair: Michaela Rankin, Monash University Tuesday 18 December Session 8 Asset Pricing 5 Tuesday 18 December 3:15pm – 5:15pm Session 8 Essex I Markets and Financial Stability 3:15pm – 5:15pm Cambridge IV An Evolutionary CAPM Under Heterogeneous Beliefs Liquidation Discount Carl Chiarella, University of Technology, Sydney Roberto Dieci, University of Bologna Xuezhong He, University of Technology, Sydney Kai Li, University of Technology, Sydney Discussant: Grant Cullen, Murdoch University Marie Fung Hing, Curtin University of Technology John Gould, Curtin University of Technology Wei Hu, Curtin University of Technology Joey Wenling Yang, University of Western Australia Discussant: My Nguyen, Monash University Mutual Fund Trades: Timing Sentiment and Managing Tracking Error Variance Bank Market Power and Liquidity: Evidence from 113 Developed and Developing Countries Dominic Gasbarro, Murdoch University Grant Cullen, Murdoch University Gary Monroe, University of New South Wales J. Kenton Zumwalt, Colorado State University Discussant: Kai Li, University of Technology, Sydney My Nguyen, Monash University Michael Skully, Monash University Shrimal Perera, Monash University Discussant: John Gould , Curtin University of Technology Distress Risk and Stock Returns: Evidence from Earnings Announcements Would Australia-New Zealand Be a Viable Currency Union? Evidence from Interstate Risk Sharing Performances Tze Chuan Ang, University of Melbourne Discussant: Graham Bornholt, Griffith University Individualism, Trading Volume, and Momentum around the World Graham Bornholt, Griffith University Yiwen (Paul) Dou, Macquarie University Mirela Malin, Griffith University Cameron Truong, Monash University Madhu Veeraraghavan, Monash University Discussant: Tze Chuan Ang, University of Melbourne Session Chair: Samuel Xin Liang, Hong Kong University of Science & Technology Faisal Rana, Massey University Faruk Balli, Massey University Discussant: Andrew Worthington, Griffith University Financial Risk Attitudes in Australian Households: A Comparative Analysis of the Impact of Demographic and Socioeconomic Factors and Macroeconomic Conditions Tracey West, Griffith University Andrew Worthington, Griffith University Discussant: Faisal Rana, Massey University Session Chair: Jane Chau, University of Wollongong Tuesday 18 December Session 8 Emerging Markets 2 3:15pm – 5:15pm Essex II Stability of Money Demand in Vietnam: Application of the Bounds Testing Approach on 1999-2011 Ngoc-Anh Lai, University of Paris 1 Pantheon-Sorbonne Discussant: Anil Perera, Monash University Off-Balance Sheet Banking and Bank Lending Channel of Monetary Transmission: Evidence from South Asia Anil Perera, Monash University Deborah Ralston, University of the Sunshine Coast J. Wickramanayake, Monash University Discussant: Ngoc-Anh Lai, University of Paris 1 PantheonSorbonne Performance Through Financial Ratios of South Asian Microfinance Institutions Uzma Shahzad, Massey University David Tripe, Massey University Claire Matthews, Massey University Hatice Ozer Balli, Massey University Discussant: Nurjannah Nurjannah, Monash University Performance of Time-Varying Risk in Cross-Sectional Tests of Aset Pricing Models: Evidence from Quantile Regression Nurjannah Nurjannah, Monash University Don (Tissa) Galagedera, Monash University Robert Darren Brooks, Monash University Discussant: Uzma Shahzad , Massey University Session Chair: Rakesh Gupta, Griffith University