1 What Is a Contra Asset Account? The balance of contra asset

advertisement

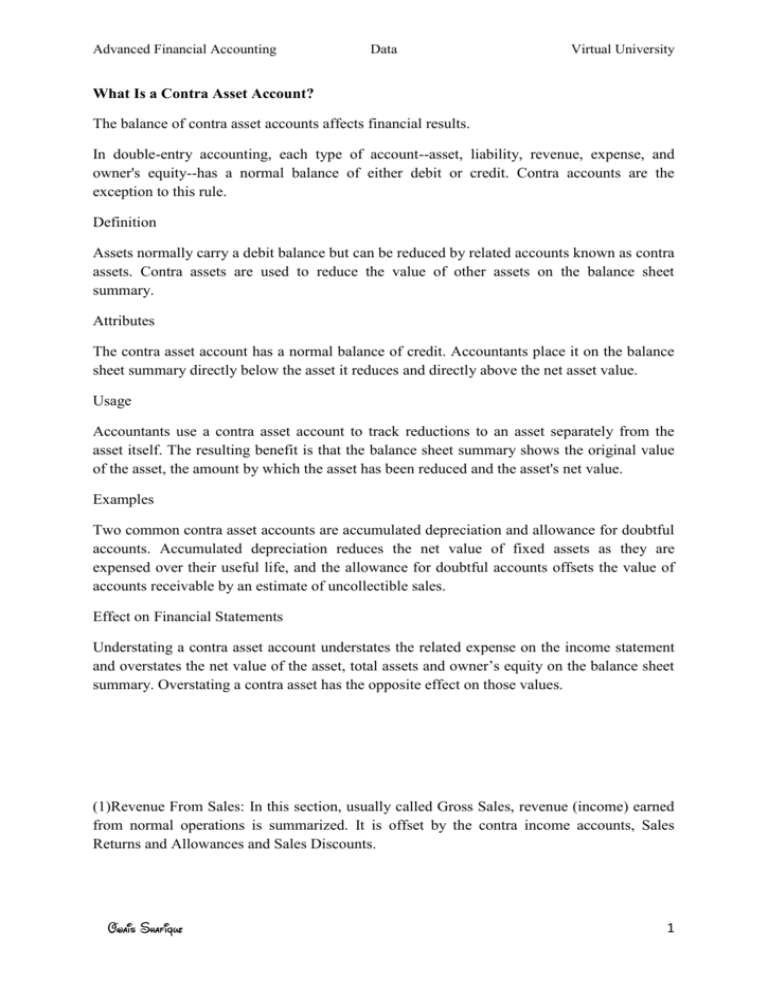

Advanced Financial Accounting Data Virtual University What Is a Contra Asset Account? The balance of contra asset accounts affects financial results. In double-entry accounting, each type of account--asset, liability, revenue, expense, and owner's equity--has a normal balance of either debit or credit. Contra accounts are the exception to this rule. Definition Assets normally carry a debit balance but can be reduced by related accounts known as contra assets. Contra assets are used to reduce the value of other assets on the balance sheet summary. Attributes The contra asset account has a normal balance of credit. Accountants place it on the balance sheet summary directly below the asset it reduces and directly above the net asset value. Usage Accountants use a contra asset account to track reductions to an asset separately from the asset itself. The resulting benefit is that the balance sheet summary shows the original value of the asset, the amount by which the asset has been reduced and the asset's net value. Examples Two common contra asset accounts are accumulated depreciation and allowance for doubtful accounts. Accumulated depreciation reduces the net value of fixed assets as they are expensed over their useful life, and the allowance for doubtful accounts offsets the value of accounts receivable by an estimate of uncollectible sales. Effect on Financial Statements Understating a contra asset account understates the related expense on the income statement and overstates the net value of the asset, total assets and owner’s equity on the balance sheet summary. Overstating a contra asset has the opposite effect on those values. (1)Revenue From Sales: In this section, usually called Gross Sales, revenue (income) earned from normal operations is summarized. It is offset by the contra income accounts, Sales Returns and Allowances and Sales Discounts. 1 Advanced Financial Accounting Data Virtual University Examples of the Contra Account Used with Assets and Liabilities Contra accounts are separate accounts reported on the balance sheet that reduce or increase the value of the main asset or liability account. The account listed with the main asset account is called a contra asset account. Similarly, the account listed with the main liability account is called a contra liability account. The contra account is not an asset or liability in itself, but an account used to adjust the carrying amount of the related asset or liability account. The word contra means contrariwise; or on or to the contrary. Since asset accounts are debit accounts, a contra asset account is a credit account used to offset the balance of the main debit account. Examples of Contra Accounts Examples of contra asset accounts are accumulated depreciation, used to report fixed assets at the book value (original cost – depreciation), and allowance for doubtful accounts, used to report the accounts receivable asset with the adjustment for bad debt estimates. Allowance for doubtful accounts is thus used to report accounts receivable at the net realizable value, or the amount of cash the company expects to receive for the asset. The balance sheet for Sunny Sunglasses Shop shows the following contra asset account reported with accounts receivable: Contra Asset Account: Allowance for Doubtful Accounts Accounts Receivable 21,900 Allowance for doubtful accounts (700) Receivables, net 21,200 Examples of contra liability accounts are discounts to notes and bonds payable, and the shortterm portion of long-term debt. Since a note or bond payable is a liability and a credit account, the contra liability account for the main account is a debit account used to offset the balance of its related liability account. The balance sheet for Sunny Sunglasses Shop shows the following contra liability account reported with the mortgage payable: Contra Liability Account: Short-term portion of mortgage payable Mortgage Payable 18,000 Short-term portion due (900) Mortgage Payable, long-term 17,100 In this case the $900 is a real short-term liability reported separately on the sample balance sheet as a current portion of long-term debt coming due. The adjustment to long-term debt, 2 Advanced Financial Accounting Data Virtual University on the other hand, is a contra liability account to mortgage payable that reduces the mortgage payable for long-term debt only. Contra accounts are also called valuation allowances because they are used to adjust the carrying value of the related asset or liability. The Meaning of Contra Account (Valuation Allowance Account) Not all accounts work additively with each other on the primary financial accounting reports—especially on the income statement and balance sheet. There are many instances where one account works to offset the impact of another account. The so-called contra accounts "work against" other accounts in this way. In some situations, the contra accounts reverse the debit and credit rules from the table above. Contra-asset and contra-liability accounts are also called valuation allowance accounts, because they work to adjust the book value, or carrying value for assets or liabilities, as shown in the examples below. The balance sheet example running throughout this encyclopedia has several contra account examples, including these under "Assets:" Grande Corporation Figures in 1,000s Balance Sheet at 31 December 2011 Assets ... Current Assets ... Accounts receivable............... 1,969 Less allowance doubtful accounts.. 137 Net accounts receivable............... 1,832 ... Property, Plant & Equipment Factory mfr. equipment ........... 5,983 Less accumulated depreciation .. 2,782 Net factory mfr equipment. ........... 3,201 You may notice from the chart of accounts example below, that Accounts receivable (Account 110 from the chart) and Allowance for doubtful accounts (Account 120) are both asset accounts. Allowance for doubtful accounts, however, is a contra asset account that reduces the impact (carrying value) contributed by Accounts receivable. The balance sheet result is a "Net accounts receivable" less than the Accounts receivable value. 3 Advanced Financial Accounting Data Virtual University In the same way, Account 163, Factory Manufacturing equipment carries the value of these assets at historical cost—what was actually paid for these assets. This will not decrease as long as the company owns the assets. However, the asset's book value does change downward from year to year, as shown on the balance sheet. Contra Account 175, Accumulated depreciation, factory manufacturing equipment, is subtracted from the Account 163 value, to produce the balance sheet result Net factory manufacturing equipment. In each case above, incidentally there is also an expense category account involved, and those appear on the income statement, not the balance sheet. In the first example, the expense account is Bad debt expense and in the second case, the expense account is Depreciation expense, factory machinery. The offsetting debit and credit transactions might look like this way in the bookkeeper's journal (the chronological record of transactions) Grande Corporation Journal for Fiscal year 2011 Date Account Debit Credit DD-MMM-YY 630 Bad Debt Expense $137,000 DD-MMM-YY 120 Allowance for doubtful Accounts $137,000 DD-MMM-YY 770 Depreciation exp, factory manufacturing equipment $2,782,000 DD-MMM-YY 175 Accumulated depreciation expense, factory mfr equip $2,782,000 All four transactions add to the value of the accounts listed. Debiting each of the two expense accounts adds to account value, as you would expect from the table in the previous section. However notice here that crediting the two asset accounts adds to their value as well—just the opposite of what the same table prescribes for asset accounts. For contra accounts in this situation the rules are reversed, so that the fundamental equation Debits = Credits still holds for every pair of transactions. The examples also show why a contra asset account is said to hold a credit balance. The above examples show contra-asset accounts, but there are also examples of contraliability accounts that operate in the same way. For example, on the liabilities side of the balance sheet, a long term liability account Bonds payable may be accompanied by another liability account, a contra liability account called Discounts on bonds payable. The value in the contra account reduces the company's actual liability from the stated figure in the Bonds payable account. Contra liability accounts—like their contra asset account counterparts—also reverse the debit/credit "rules" from the table in the previous section. An addition to a liability account is normally a credit, but to a contra liability account, an addition is a debit. For this reason, contra liability accounts are said to carry a debit balance. 4