Assignment 3

advertisement

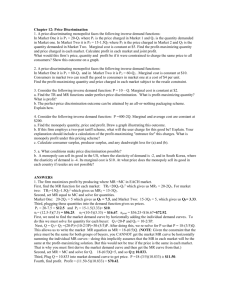

CARLETON UNIVERSITY Department of Economics Introduction to Economics: Microeconomics Assignment 3 Professor: Amir Kia ________________________________________________________________________ Note: Students are not required to hand in this assignment. However, this assignment will help in the preparation of all examinations, including the final examination. 1. Define consumer surplus and producer surplus. Use graphs to explain very carefully. 2. Suppose you are willing to pay $65,000 for your favorite car, but being one of the best economists in the world, you could get a good deal at $50,000. Do you think you gain an extra benefit in the transaction? If your answer is yes, how much is your surplus? Answer: $15,000 3. Your hourly fee as a consultant is $500. Yo ur production cost is $200 per hour. You work 8 hours a day. Calculate your daily producer surplus. Answer: Revenue = $4,000; Cost = $1,600; Producer surplus = $2,400 4. Suppose the equilibrium price for a commodity is $10. What is the marginal benefit to consumers if the equilibrium quantity is $10,000? Answer: $10 5. Providing a brief explanation, indicate if the following is true or false: (i) (ii) (iii) (iv) (v) When market price increases, producer surplus increases because (1) producer surplus received by existing seller increases, and (2) new sellers enter the market because they can receive producer surplus at the higher price. Total surplus in a market is consumer surplus minus producer surplus. Total surplus in a market is the value to buyers of the goods minus the costs to sellers of providing those goods. Free markets allocate the supply of goods to the buyers who value them most highly, and free markets allocate the demand for goods to the sellers who can produce them at least cost. Willingness to pay measures how much a buyer values a good. 2 6. If a consumer is willing and able to pay $200 for a certain quantity of a particular good but only has to pay $140. Calculate the consumer surplus. Answer: $60 7. Suppose you are willing to pay $1000 for a man’s suit, but are able to buy the suit for $600. (a) How much do you value the suit? (b) What is your consumer surplus? Answer: (a) $1000, and (b) $400 8. Suppose there are only 5 individuals in the market for a car. Their willingness to pay for a car is respectively $8,500; $7,000; $5,500; $4,000 and $3,500. (i) (ii) (iii) (iv) In a graph, show the demand in the market for cars. Suppose the market price is $5,500. Calculate the consumer surplus if there are only 3 cars available for sale. Answer = $4,500 At price = $3,500, which individual is the marginal buyer? First, second, third, fourth or the last one? At price = $3,500, do you expect each individual to have a consumer surplus? 9. Start from the equilibrium point. Now assume the supply curve shifts to the left. Do you expect the consumer surplus to increase, decrease or remain the same. 10. Define cost and producer surplus and using graphs explain both very carefully. Show when demand for a commodity goes up the producer surplus will increase. 11. The cost of production for a commodity is the following: Seller 1 $100 2 80 3 70 4 50 5 30 (i) Suppose the market price is $70. Calculate the producer surplus. Answer: $60 (ii) What is the total cost of the product at price $70. Answer: $150 3 12. We know that the marginal seller is the seller who would leave the market first if the price were any lower, then explain what the height of the surplus curve at a particular output rate represents. 13. Define total surplus to society in a market. Explain how the allocation of resources is efficient. 14. The following table shows market supply and demand for good X. Price $12 10 8 6 4 2 0 (i) (ii) Quantity Demanded 0 4 8 12 16 20 24 Quantity Supplied 24 20 16 12 8 4 0 What price would result from market-clearing? Answer: $6 At the equilibrium price, what is the total surplus? Answer: $36 15. Define deadweight of tax. In a graph show the deadweight loss of a tax and carefully demonstrate that both buyers and sellers are worse off after the tax. Explain how the losses of consumer surplus and producer surplus as a result of a tax exceed the revenue raised by the government. 16. Demonstrate and explain how the deadweight loss from a given tax, ceteris paribus, will be larger the more elastic is the supply or demand. Use graphs in your explanation. 17. By using graphs, demonstrate and explain on whom falls the burden of the tax on land. 18. Start from equilibrium and show on your graph the total welfare gain at the equilibrium. Explain carefully. Now show the quantity and price effect of a tax. Show on your graph the welfare loss of the tax. 19. Draw a supply-demand diagram for chocolate. On the diagram, show the equilibrium before and after the imposition of a tax. Now identify areas corresponding to each of the following. a. consumer surplus before the tax b. producer surplus before the tax c. total surplus before the tax d. consumer surplus after the tax e. producer surplus after the tax 4 f. total surplus after the tax g. tax revenue h. deadweight loss 20. Craig has been in the habit of mowing Alice's lawn each week for $20. Craig's opportunity cost is $15, and Alice would be willing to pay $25 to have her lawn mowed. What is the maximum tax the government can impose on lawn mowing without discouraging Craig and Alice from continuing their mutually beneficia l arrangement? Answer: If the tax is less than $10, there will exist a price at which both Craig and Alice will benefit from the lawn- mowing arrangement. If the tax is $10, a price can be set that will leave Craig and Alice neither better off nor worse off from the lawn- mowing arrangement. If the tax is greater than $10, all possible prices will leave at least one of the parties worse off from the lawn- mowing arrangement. 21. Suppose that a tax is imposed on the coal market, and is left in place for several years. What would you predict about (a) the size of the deadweight loss of the tax in the short run relative to the long run, and (b) the amount of revenue collected from the tax in the short run relative to the long run? Assume that the economy doesn't grow during the period in question. Answer: Because both demand and supply tend to be more elastic in the long run than in the short run, we would predict that (a) the deadweight loss of the tax would be larger in the long run than in the short run, and (b) the tax revenue would be smaller in the long run than in the short run. 22. Define budget constraint and show: (i) The slope of a budget constraint reflects the rate of exchange between commodities. (ii) An increase in income does not change the slope of the budget constraint. 23. (i) In a graph explain how indifference curves can be used to rank all possible bundles of two commodities. (ii) Do you expect bundles of goods on higher indifference curves always contain more of two goods than bundles on lower indifference curves? Explain your answer very carefully. (iii) Explain what does the slope of an indifference curve reflect? Do you expect indifference curves to cross? Explain your answer. In a graph show indifference curves, which are consistent with perfect substitutes and perfect complements in consumption. 24. Assume an individual has a budget of $100 for groceries and she is interested to spend all her money on good x and good y. The price of good x is $2 and the price of good y is $4. (i) Show the individual’s budget line. (ii) Now suppose the individual receives a phone call indicating that some friends want to visit her. She adds another $100 to her grocery budget. Show the new budget line. (iii) When she goes to the grocery store she will notice that the price of good x has gone up 5 to $4. Show her new budget line in a graph. Calculate the slope of the budget line after the change in the price of x. 25. Define utility and explain the Law of Diminishing Returns. Explain how a family of indifference curves can be derived from an individual utility function. 26. In a figure show how an optimizing consumer selects a consumption bundle. Explain your answer very carefully. Keep one price constant and derive the demand curve for the other commodity for which the price changes. 27. Assume that a consumer has an income of $100, and faces prices Px= $10, and Py= $20. If this consumer chooses a consumption bundle which maximizes his utility function what is the marginal rate of substitution at the optimized point. Show your answer in a graph. 28. Explain carefully substitution and income effects. Use graphs in your explanation. 29. Define the following: (i) Implicit and explicit costs of production (ii) Economic and accounting profits (iii) Firm (iv) Production function, marginal product of labor (v) Fixed cost, variable cost, sunk cost, total cost, average cost and marginal cost 30. Assume labor is the only factor of production. Use graphs to explain the following : (i) Total product of labor (ii) Average product of labor (iii) Marginal product of labor 31. Explain carefully short run and long run in economics. 32. Explain constant, increasing and decreasing returns to scale. 33. Define economies of scale and compare it with increasing returns to scale. 34. Define profit. Is profit the same as producer surplus? Explain your answer. 35. Use graphs and carefully explain total, average and marginal products of a factor of production. Be sure you relate the total product with the average and the marginal products of the factor of production. You also need to describe clearly the area of the production function that is subject to the Law of Diminishing returns. 6 36. What is the difference between fixed costs and variable costs? Can fixed costs ever be considered variable? Exp lain. 37. Explain the relationship between a firm's production function and its total cost. Answer: The production function defines the input combinations that can be used to produce output. As such, it defines technical possibilities, and when input prices are attached to various input combinations it helps determine the firm's cost structure. 38. Graphically depict a typical U-shaped long-run average cost curve. On your graph, identify the regions associated with economies of scale, diseconomies of scale, and constant returns to scale. Describe the circumstances that are related to each of these regions on the long-run average cost curve. 39. Complete the following table. Measures of Cost for Fred's Fritter Factory Quantity Fixed Cost 4 5 6 7 8 9 10 $100 40. Variable Cost Total Cost Average Fixed Cost Average Variable Cost Average Total Cost $110.50 Marginal Cost $2.00 $15 $18.10 $3.80 $126.40 $2.93 $13.19 Describe the difference between marginal cost and average total cost. Why are both of these costs important to a profit- maximizing firm? Answer: Marginal cost is the amount that total cost rises when the firm increases production by one unit of output. Average total cost is the total cost divided by the quantity of output. Marginal cost is used to determine the optimal production level and average total cost is used to determine the level of profits. 41. The table below reflects the production function of a firm that uses both capital and labour in its production process. The numbers on the interior of the table are levels of output associated with the usage of capital and labour in the respective margins. For example, when the firm employs 3 units of labour and 4 units of capital, output is 48 units. 7 1 2 Labour 3 4 5 a. b. c. d. e. 1 1 2 3 4 5 Capital 2 3 4 9 8 18 12 27 16 36 20 45 4 16 32 48 64 80 5 25 50 75 100 125 If two units of capital are used in production, what is the marginal product of the third unit of labour? If 4 units of labour are used in production, what is the marginal product of the second unit of capital? Does marginal product of labour ever decrease for this firm? Explain your answer. Does marginal product of capital ever decrease for this firm? Explain your answer. Assume that this firm is using 3 units of capital. If each unit of labour costs the firm $5, what is the marginal cost of output associated with increasing employment from 3 to 4 workers? Answer: a. 4 b. 12 c. No, marginal product of labour is constant for each level of capital. d. No e. 5/9 = 0.5555 42. Describe the difference between average revenue and marginal revenue. Why are both of these revenue measures important to a profit- maximizing firm Answer: Average revenue is total revenue divided by the amount of output. Marginal revenue is the change in total revenue from the sale of each additional unit of output. Marginal revenue is used to determine the profit- maximizing level of production and average total revenue is used to determine the level of profits. 43. Use a graph to demonstrate the circumstances that would prevail in a perfectly competitive market where firms are earning economic profits. Identify costs, revenue, and the economic profit earned on your graph. 8 Answer: 44. How do you find the profit- maximizing level of production for a competitive firm? 45. Firms in perfectly competitive markets are said to be price takers. Explain what is meant by this term and what it implies about the relationship between average revenue and marginal revenue. 46. Why would a firm in a perfectly competitive market choose not to set its price below the going price? If a firm did set its price below the going price, what effect would this have on the market? Answer: It could not sell any more of its product at the lower price than it could sell at the higher price. As a result, it would needlessly forgo revenue if it set a price below the going price. 47. Use a graph to demonstrate the circumstances that would prevail in a perfectly competitive market where firms are incurring economic losses. Identify costs, revenue, and the economic losses on your graph. On the basis of your graph, determine whether this firm will shut down in the short run, or choose to remain in the market. Explain your answer. 9 Answer: 48. Under what conditions would a firm choose to shut down and record its fixed costs as losses? When would it decide to exit the market? Answer: When price is below average variable cost. The exit decision is a longrun decision in which the firm has no prospect for being able to cover its cost of production. 49. In a perfectly competitive market with free entry and exit, discuss the process that induces firms to operate at efficient scale in the long run. Answer: If all firms in a competitive industry face the exact same cost structure, the exit and entry of firms will force every firm in the market to operate at the efficient scale of production. If it does not operate at efficient scale, it will be incurring economic losses. 50. If firms that remain in a perfectly competitive market over the long-term must make zero profit, why do firms choose to remain in the market? Answer: Because a normal rate of return on their investment is included as part of the opportunity cost of production. 51. Suppose at price $15 a firm’s range of production is from 1 to 19 units of output. (i) Over which range of output is average revenue equal to price? Answer: Over the whole range of output 10 (ii) Over what range of output is marginal revenue declining? Answer: None (iii) What is elasticity of demand when the firm sells 10 units? Answer: Perfectly elastic 52. Explain the condition at which a profit- maximizing producer always chooses to produce. 53. The Wheeler Wheat Farm has a long-term lease on 5000 hectares of land in Saskatchewan. The annual lease payment is $250,000. Prior to planting in the spring of 1996, the Wheeler Farm accountant predicted that the Farm would have $135,000 left after paying all of it s 1996 fixed and variable costs except the annual lease payment. (i) Calculate the farm accounting loss. Answer: $115,000 (ii) Should the Wheeler Wheat Farm continue to produce even at above cost? Explain your answer. 54. What is a firm’s short-run shutdown condition? Explain your answer. 55. In the long run all of a firm's costs are variable. What is a firm’s long-run shutdown condition? Explain your answer. 56. If a monopolist maximizes profit, society as a whole must benefit. Explain the validity of this statement. 57. Is it true that the fundamental cause of monopoly is barriers to entry? Explain your answer. 58. Explain the profit maximization of a monopoly. Do you think a monopoly has a supply curve? 59. Explain how a natural monopoly occurs. 60. Explain the key difference between a competitive firm and a monopoly firm. 61. What is typically the market demand curve for a monopolist. 11 62. What is typically the market demand curve for a firm operating in a competitive market. 63. What is the monopolist's profit under the following conditions: The price charged for goods produced is $16. The intersection of the marginal revenue and marginal cost curves occurs where output is 10 units and price is $8. Average cost for 10 units of output is $6. Answer: $100 64. The economic inefficiency of a monopolist can be measured by the deadweight loss. Explain very carefully this statement. Use graphs in your explanation. 65. Suppose in Manitoba, Black Box Cable has a monopoly in the provision of cable TV services in the town of Brandon. The diagram above represents the linear market demand curve that it faces for cable TV in Brandon. a. b. c. d. If Black Box has a constant marginal cost curve at $5, what is its profitmaximizing level of output? How much revenue will Black Box make from selling the profit- maximizing quantity of output? How much profit will Black Box make when it produces at the profitmaximizing level of output? Is there some scenario under which Black Box will have economic losses rather than economic profits? 12 Answer: a. Q = 192. (MR = 125 - .625 Q) b. TR = P * Q P = 125 - .3125 Q => P = 125 - .3125(192) = 65 TR = 65 * 192 = $12 480 c. We can't tell without more information about the cost structure of the firm. d. Yes, if the total cost of producing 192 units exceeds the revenue of $12,480, Black Box will have economic losses. This would be the case for capital intensive firms that sell in small markets. 66. Graphically depict the deadweight loss caused by a monopoly. How is this similar to the deadweight loss from taxation? 67. A profit- maximizing monopolist is often a target for some kind of government intervention. Describe why governments may choose to intervene in monopoly markets. List and describe the possible ways in which governments may choose to enhance the social efficiency of monopoly markets. Answer: Governments typically intervene in monopoly markets to either capture some monopoly profits for themselves or to move the market outcome to a more socially optimal level of output and price. Possible ways the government intervenes include legislation and enforcement of laws, regulation and public ownership. 68. Explain characteristics of both a duopoly and an oligopoly market. 69. Explain two possible outcomes of both a duopoly and an oligopoly market.