COMPILATION AND REVIEW ENGAGEMENTS: NEW DIRECTIONS

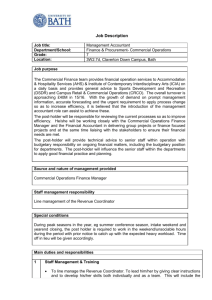

advertisement

COMPILATION AND REVIEW ENGAGEMENTS: NEW DIRECTIONS IN NON-AUDIT SERVICES Maria L. Bullen, Dominican University of California, maria.bullen@dominican.edu Gregory S. Kordecki, Clayton State University. gregkordecki@clayton.edu INTRODUCTION The American Institute of CPAs’ Accounting and Review Service Committee (ARSC) issued in 2012 two extensive exposure drafts—one on compilation services and one on review services-with far reaching implications for the compilation and review practices of external accountants’ association with the financial statements of clients. While the Committee is currently reviewing comment letters, the issues are likely to be hotly contested prior to the proposed effective date of December 15, 2014. The traditional distinctions between audits and various non-audit services may become blurred. This paper attempts to enumerate the key issues and suggest measures that would help the practicing profession, as well as preparers and users of financial statements for closely-held businesses. The paper describes the general thrust of both exposure drafts but focuses primarily on the earlier paper dealing with compilations, which carries a comment deadline of November 30, 2012. The review exposure draft is more recent with a comment deadline of April 30, 2013. Important trends in compilation engagements are described, including standard-setting, nuances of practice, and concerns of how the theme of compilation with no assurance varies from the other attest engagements of reviews and audits which carry some degree of assurance. The role of the attest function is questioned, and the need for independence of the external accountant from management, the entity, and its governance, challenged. The paper concludes with examples of practical implementation concerns. BACKGROUND In 2011, the Auditing Standards Board (ASB) of the AICPA achieved ability to redraft all of the auditing sections in Codification of Statements on Auditing Standards contained in the AICPA’s Professional Standards. In 2012 the Accounting and Review Services Committee (ARSC) of the AICPA reached out to the public with the issuance of two Exposure Drafts attempting to establish similar clarity in compilation and review engagements, and with an effective date for unaudited financial statements with which the accountant is associated of “on or after December 15, 2014” [ARSC 2012-C, 2012-R]. In addition to having the compilation and review standards easier to read, understand, and apply, the similar conventions of the auditing literature makes for more uniform standard setting [Glynn & Gloria, 2012]. The critical differences however between the ARSC and the ASB efforts were determined to be that governmental entities and smaller, less complex entities would not be receiving the specific application guidance by the ARSC. The ARSC established the following clarity drafting conventions: Objectives for each clarified AR section A definitions section, as relevant, for each clarified AR section Separating requirements from applicant and other explanatory material Numbering application and other explanatory material paragraphs using an A- prefix and presenting such is a separate section that follows the requirements section Bulleted lists and other formatting techniques to enhance readability [Editor’s Comments, 2012]. The first of the two exposure drafts proposes three new standards for compilation engagements: Association with Unaudited Financial Statements, Compilation of Financial Statements, and Compilation of Financial Statements—Special Considerations. Comments were originally due August 31, 2012, but extended to November 30, 2012. The second exposure draft proposes two new standards for review engagements: Review of Financial Statements, and Review of Financial Statements—Special Considerations. Comments on this second exposure draft are due April 26, 2013. SIGNIFICANT OVERALL CHANGES Adoption of the proposed standards for both compilation and review engagements would lead to some significant changes in approaches to viewing the external accountant’s work on the client’s financial statements, and also the various perspectives of not only the external CPA, but also the management preparer, and the financial statement user. The following areas of change would affect both compilation and review engagements. Professional Judgment—explicit statement is made that an accountant should exercise professional judgment; the extant call for judgment is only implicit. Signed Engagement Letter—requirements would begin that both parties to the engagement have signed written communication by (a) the accountant or the accountant’s firm and (b) management or, if applicable, those charged with governance. Accountant’s Compilation (or Review) Report—clarified headings throughout the report would be required to clearly distinguish each section of the accountant’s report. City and state of issuing office also must be included in the report Special Purpose Framework (SPF)—replaces other comprehensive bases of accounting (OCBOA), such as cash, tax, contractual, and regulatory bases, with SPF, and following requirements— Suitable financial statement titles and adequate description of how the SPF differs from GAAP. Any disclosures that would be required resulting from application of the SPF. Compilation (or review) report to state that management has choice of financial reporting frameworks, and if regulatory or contractual, then statement in the report, or reference to a note to the financial statements that contains such information. If the engagement is a compilation where management has omitted substantially all disclosures, then that must be described in the report. Inclusion in the accountant’s compilation (or review) report of an “emphasis-of-matter” paragraph under appropriate heading that the financials are prepared in accordance with the applicable financial reporting framework, reference to a note in the financials that describes the framework, and a statement that the SPF is a basis of accounting other than GAAP. Inclusion in the accountant’s compilation (or review) report of an “other-matter” paragraph under appropriate heading, any restrictive usage of the compilation (or review) report when under contractual or regulatory basis of accounting. Emphasis Paragraphs—extant standards do not require any emphasis paragraphs. New standards would require if SPF financial statements were prepared or when there have been management revisions to the financials for a subsequently discovered fact. If accountant expects to include an emphasis paragraph in the compilation (or review) report, the proposed standard for Special Considerations requires to accountant to communicate with management regarding the expectation and the wording of such paragraph. “Emphasis-of-matter paragraph” is report wording by the accountant to draw users’ attention to a matter appropriately presented or disclosed, while “other-matter” paragraph is used to communicate a matter that is not being adequately presented or disclosed. Required Supplementary Information (RSI)—is information that a designated accounting standard setter requires to accompany an entity’s basic financial statements but the information is not part of the basic finance financial statements, and that the account include an other-matter paragraph I the accountant’s compilation (or review) report and the extent of any compilation, review, audit, or other prescribed guidelines work performed. SPECIFIC PROPOSALS FOR COMPILATIONS AND REVIEWS With respect to compilations, the new standard would clarify the “submission” argument, in that the preparation of financial statements is specifically defined as a nonattest service. Preparation of financial statements is a responsibility of management and an essential part of an entity’s system of internal control. A compilation service would no longer include the preparation of financial statements which in whole or in part, would be a nonattest service. Compilation is an attest service, but not an assurance service. The compilation standards would go further on consideration of the effect of new or revised information. An explicit statement would require the accountant to consider the effect of such additional or revised information on the financial statements, including whether the financial statements are materially misstated. With respect to reviews, the new standards would clarify the broad scope of a review, still limited assurance, and short of an audit in the attest hierarchy, but with specific examples of information that the external accountant may report on. The scope would consider specified elements, accounts, or items of a financial statement, supplementary information, required supplementary information, and financial information included in a tax return, or other historical financial information for inclusion of information subject to a “review” in accordance with the SSARS. DISCUSSION ON PROPOSED COMPILATION STANDARDS The clear explanation of requirements relative to the accountant’s Association with Unaudited Financial Statements is long overdue. The suggested wording for inclusion in a report makes it clear that the service provided was not only not an audit, but also, was not a review, and was not a compilation. This delineation does much for definition of various practitioners’ work and elevates the notion in general that the work performed in a compilation to be truly an attest engagement. The proposed statement provides practitioners with guidance for performing services other than compilations, reviews, and audits, and further establishes the framework in a more logical fashion as to what type of work constitutes the various engagements, and yields an approach toward more clear differentiation between assurance, non-assurance, attestation, and non-attestation engagements [Landes, 2012]. Unfortunately, SSARS does not adequately address an important term, “prepare,” which is neither defined nor referenced to another standard where it is defined. This term should be defined in the proposed standard to prevent misinterpretation, such as questions regarding whether an accountant has ”prepared” financials when he or she has recorded necessary journal entries in a client’s accounting system during month-end bookkeeping work but has not actually printed the financial statements from the system. Inclusion of “preparation” as a formal term in the Definitions section may strengthen the overall document. The proposed statement on Compilation of Financial Statements clearly states that a compilation is not an assurance engagement, but is an attest engagement [Reinstein & Weirich, 2012]. In the Definitions section the term “assurance” is clearly identified, but not “attestation.” Footnote reference is provided to paragraph .01 of ET section 92, Definitions (AICPA Proposed Standards) of the AICPA Code of Professional Conduct for the definition of attest engagement—any engagement that requires independence—but if one is interested in clarity, why not apply the clarity conventions and include the term “attestation” in the formal Definitions sections of the SSARS literature? The common notion that attestation is a subset of assurance must be destroyed, if the spirit of the Exposure Draft is to prevail. As a considerable amount of the general literature outside of the AICPA is very much muddled on specifically what a compilation is, the Definitions section of the document should be expanded to include the sharp demarcations. The proposed statement goes further in treatment of special purpose frameworks, and the inclusion in the report of an “emphasis-of-a-matter” or “other-matter” paragraph will be of significant benefit to most users. The report drafting illustrations are good summaries of the preceding proposed requirements. Several illustrations, examples of cash basis and tax basis, stress such a basis not only in the introductory paragraph, but also in the management’s responsibility paragraph, and in an additional paragraph carrying the heading “Basis of Accounting.” With the current movement, including the AICPA’s outstanding ED on Proposed Financial Reporting Framework for Small- and Medium-Sized Entities, to transition away from OCBOA language toward reference of alternative reporting frameworks, the Committee may wish to revisit how specific language and wording is best applied in the accountant’s report. In Compilation of Financial Statements—Special Considerations, the extensive examples of how an “emphasis-of-a-matter” paragraph differs from an “other matter” paragraph are very helpful, and the report drafting illustrations will be a strong aid to the practitioner. Inclusion of the going concern bright time line of not exceeding one year is helpful guidance. An accountant should communicate with management regarding emphasis-of-matter and other-matter paragraphs, including proposed wording; however, ARSC does not provide guidance regarding actions the accountant should take if management has objections. The proposed standard also indicates that there are exceptions to the general rule prohibiting an accountant from issuing a compilation report when the accountant had been engaged to audit an entity’s financial statements but has been prohibited by the client from corresponding with the entity’s legal counsel. Clarification of “rare circumstances” needs to follow. The reporting language for inclusion of required supplementary information is clear and will help many preparers and users as well as the accountant. IMPLEMENTATION CONCERNS FOR REVISED STANDARDS Finally, the proposed compilation standards carry some helpful guidance for instances when the accountant is faced with reporting on going concern issues during a compilation of financial statements that omit substantially all disclosures. Since disclosures are frequently omitted in practice, this standard might address other instances where an emphasis-of-matter paragraph is necessary (e.g., extensive related party transactions, unresolved litigation) but considered inappropriate because the underlying disclosure has been omitted. Overriding concerns on the proposed statements include any additional burdens that would be placed on the accountant in compilation engagement work. While the clarity, organization, and exhibits are helpful, some dangling concepts such as thorough written documentation of the engagement via an engagement letter or some other written form could be expanded. Illustrations of those types of writing, including a single document covering scope of services requested for engaging in regular monthly work, would be helpful. If ARSC’s exposure draft on review engagement modifications is received with the clarity provided by the exposure draft on compilation engagement, management, the external accountant, and the financial statement user will all be well served. REFERENCES ARSC--Accounting and Review Services Committee of AICPA (2012-C). Exposure draft— Proposed statements on standards for accounting and review services: Association with unaudited financial statements, Compilation of financial statements, Compilation of financial statements—special considerations, June 29, 2012, comment deadline August 31, 2012, extended to November 30, 2012. ARSC--Accounting and Review Services Committee of AICPA (2012-R). Exposure draft— Proposed statements on standards for accounting and review services: Review of financial statements, Review of financial statements—special considerations, November 15, 2012, comment deadline April 26, 2013. Editor’s Comments (2012). News digest on accounting matters, Journal of Accountancy, Vol 214(5), November, 2012, pp. 17-21. Glynn, Mike, and Ellen Gloria (2012), Proposed revisions: Clarify responsibilities for preparers, Journal of Accountancy, Vol 214(2), August. 2012, pp. 50-53. Landes, Charles E. (2012). Preparation as a nonattest service: What does it mean and why should I care? AICPA Whitepaper, September, 2012. Reinstein, Alan, and Thomas R. Weirich (2012). New ethics guidance for CPAs in public practice and business, The CPA Journal, March, 2012, pp. 59-64.