VALS - Bloomsbury

advertisement

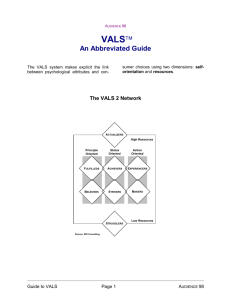

Strategic Business Insights Frequently Asked Questions August 2010 Issued by: VALS™ Strategic Business Insights 333 Ravenswood Avenue Menlo Park, California 94025 www.strategicbusinessinsights.com/vals What does VALSTM stand for? The first VALS framework was based on social values, and VALS was an acronym for Values and Lifestyles. The current VALS framework is based on psychology instead of social values, so we dropped Values and Lifestyles but retained the VALS brand. What is VALSTM used for? Marketers use VALS to understand why consumers make the choices they do. The more marketers know about their target consumers, the better they can design products and services and develop marketing strategies and communications that will appeal to the target. By using VALS to understand the motivations that stimulate consumer behavior (such as buying a product or participating in a loyalty program), marketers increase their chance of cutting through today’s advertising clutter. What are primary and secondary VALSTM types? An individual’s primary VALS type is the group with which the individual has the strongest affinity—the group with which the individual has the most characteristics in common. An individual’s secondary VALS type is the group the individual is next most like. Using both primary and secondary VALS types in combination expands the number of groups in the system and enables marketers to target smaller, more niche consumer groups. The VALSTM survey is so short. How do you know about product, service, and activity preferences by VALS group if you ask only these questions? The VALS survey on our Web site is our “VALS-location battery.” Its purpose is to identify a person’s VALS type. We gather consumer-product, -service, and -activity data by integrating the VALS questionnaire (survey) into larger custom or syndicated questionnaires. We integrate the VALS questionnaire into Consumer Financial Decisions’ MacroMonitor survey, giving us a source of detailed financial behavior by VALS types. We also integrate into various clientspecific surveys and GfK MRI’s Survey of American Consumers. How did the VALSTM questionnaire develop? The VALS questionnaire is based on a development effort and several large national surveys of consumer opinion that SRI International—a nonprofit research organization in Menlo Park, California—conducted between 1987 and 1992. These surveys allowed SRI to identify the specific attitudes that have had a strong correlation with a large range of consumer preferences in products and media. The current questionnaire is the third version based on this kind of extensive empirical research. Strategic Business Insights is a spin-off of SRI International. What is the idea behind the VALSTM questionnaire? The motivations and demographic characteristics that this questionnaire asks about are very strong predictors of a variety of consumer preferences in products, services, and media. The main advantage, therefore, is predictive power. To understand consumers’ individual preferences and likely reactions to new products and services, we ask this relatively short list of questions in place of a very long list of questions about current product activity and media choices. Some of the questions in the VALSTM questionnaire seem overly simplistic. Why? The questions measure very basic individual motivations with as little confusion as possible. Therefore, we refer to commonplace, concrete activities or interests, and we ask the questions in straightforward and simple terms. Why do many of the questions in the VALSTM questionnaire seem to ask the same thing? Asking repeatedly about an issue provides a more accurate measure about that issue. For instance, a single question permits an opinion to fall into only 1 of the 4 numbered response categories; with two questions, an opinion may fall into 1 of 16 categories (four times four). Asking about the same issue in different ways also reduces the possibility that respondents may misunderstand what we want to know. Are you aware that some of the questions in the VALSTM survey are politically incorrect? We are measuring how people think, not prescribing how they should think. If someone finds a question objectionable, he or she should register his or her disagreement by selecting the “mostly disagree” option. What good is the VALSTM questionnaire anyway? Using questionnaires such as the VALS questionnaire is one of the primary ways that businesses come to understand consumers’ individual preferences, needs, and interests. Imagine, for instance, that a company must design a new kind of software program, knowing only that most of its potential users are between 30 and 40 years old, with a college education. VALS adds the human side of the equation: preferences for control or freedom, tradition or novelty, information or stimulation, hands-on activity or intellectual abstractions. What are the weaknesses of the VALSTM questionnaire? People can always provide false answers to this kind of questionnaire out of malice or curiosity. The more accurate the responses, however, the more trustworthy the results. Added problems arise through misinterpretations or ambiguities inherent in the use of words. Because no conversation or interactivity exists to clear up possible misinterpretations or ambiguities, the VALS questionnaire asks more than one question about each topic. Finally, words themselves characterize only a small portion of human experience. Future tests may be more sensory and more interactive, much like a multimedia game. Why does changing just my income and education change my VALSTM type? VALS is optimized to identify the major consumer groups in the population. Think of each segment as a bull’s eye—the center ring represents individuals most true to type. If a person is on the edge of a segment, then small changes in demographics or attitudes can change the person’s VALS type. In such a case, however, the person’s assignment to a different VALS type would be to a segment with a similar attitude construct. We ask both attitude concepts and demographics because these measures are related but not redundant. Having both has more utility for marketers than have demographics or attitudes alone. What is GeoVALSTM? GeoVALS specifies the proportion of each of the eight primary VALS types in residential zip codes and block groups in the United States (including Alaska and Hawaii). GeoVALS data are available for standard geographic areas such as U.S. Census regions; U.S. Census divisions; or state, county, Metropolitan Statistical Area (MSA), or custom pieces of geography. GeoVALS is most typically in use for direct marketing, sales analysis, site location, merchandising mix, and media-plan development. Individuals can now purchase GeoVALS data directly on the Web by going to www.strategicbusinessinsights.com/vals/geovals . VALSTM focuses on the United States. How about other countries? The U.S.VALS Framework can also serve reliably in Canada. VALS frameworks are also in use in Japan and the Dominican Republic. Frameworks for more countries are under development. Every country has groups that have three primary motivations: Tradition (Ideals in U.S. VALS), Achievement, and Self-Expression. Each country is unique in terms of the distribution of types and the relative status of types in the country. The motivations may manifest in various ways and must sit in the context of each country. For example, some countries very much respect people with a traditional motivation. In other countries, the view of tradition will not be so important. Another important factor is the relative wealth of the society and the resources available. People with few resources cannot express a distinctive motivation and live very pragmatic lives. In each case, the country-specific VALS framework must take these distinctions into account. VALS™ is a lens for understanding consumer psychology. The VALS consulting and consumer-research services provide clients with tailored, real-time, marketing solutions for customer: • Targeting • Positioning • Communications. What Can U.S. VALS™ Do for You? • Provide a fresh perspective by “getting into the heads” of your customers. • Identify your best targets—the most profitable customers or to attract new consumers. • Create richly textured consumer profiles or personas of psychological traits, attitudes, behaviors, lifestyles, and demographics. • Increase communication effectiveness by knowing your target’s distinct communications styles, content preferences, and media-channel use. • Innovate new products and services for specific consumer targets. • Locate geographic concentrations of your target. Surveys and focus groups inform our work. Ongoing training and reports support ongoing learning and provide your team with a common language. Visit our Web site at www.strategicbusinessinsights.com/vals . About Strategic Business Insights Strategic Business Insights (SBI) works with clients to identify and map new opportunities based on emerging technology and market insights. We combine ongoing research with consulting services to create insights that affect customers, business, and technology. With our help, leading organizations identify coming changes faster, separate hype from reality, and create strategy with a greater awareness of what the future may bring. SBI stands apart from our competitors in our staff’s ability to integrate all pieces of the puzzle necessary to manage the future: the technology developments that will determine commercial opportunities, the forces that will define the business environment, and the shifts in consumer demand that will shape the marketplace. SBI is the former Business Intelligence division of SRI International that has worked with clients on opportunities and change since 1958. Headquartered in Silicon Valley—with offices in Japan, the United Kingdom, and New Jersey—we have a global reach and work across a wide range of government and business sectors, including electronics, health care, energy, and financial services. The standard in consumer financialservices research, strategy, and insight C F D CONSUMER FINANCIAL DECISIONS Continuous evaluation of opportunities in technology commercialization and applications TM Organizational radar to identify signals of change Consumer insights that drive market innovation An exploration of emerging technologies and applications Consulting Services Leveraging of our research expertise and proprietary methods • Scenario planning • Opportunity discovery • Strategic roadmapping • Customer targeting STRATEGIC BUSINESS INSIGHTS: 333 Ravenswood Avenue Menlo Park, California 94025 Telephone: +1 650 859 4600 Fax: +1 650 859 4544 P.O. Box 2410 Princeton, NJ 08543 Telephone: +1 609 378 5041 Fax: +1 650 859 4544 Knollys House 17 Addiscombe Road Croydon, Surrey CR0 6SR, England Telephone: +44 (0) 20 8686 5555 Fax: +44 (0) 20 8760 0635 Parkside House 3F. 2, Ichibancho, Chiyoda-ku Tokyo 102-0082, Japan Telephone: +81 3 3222 6501 Fax: +81 3 3222 6508 Visit our website at www.strategicbusinessinsights.com .