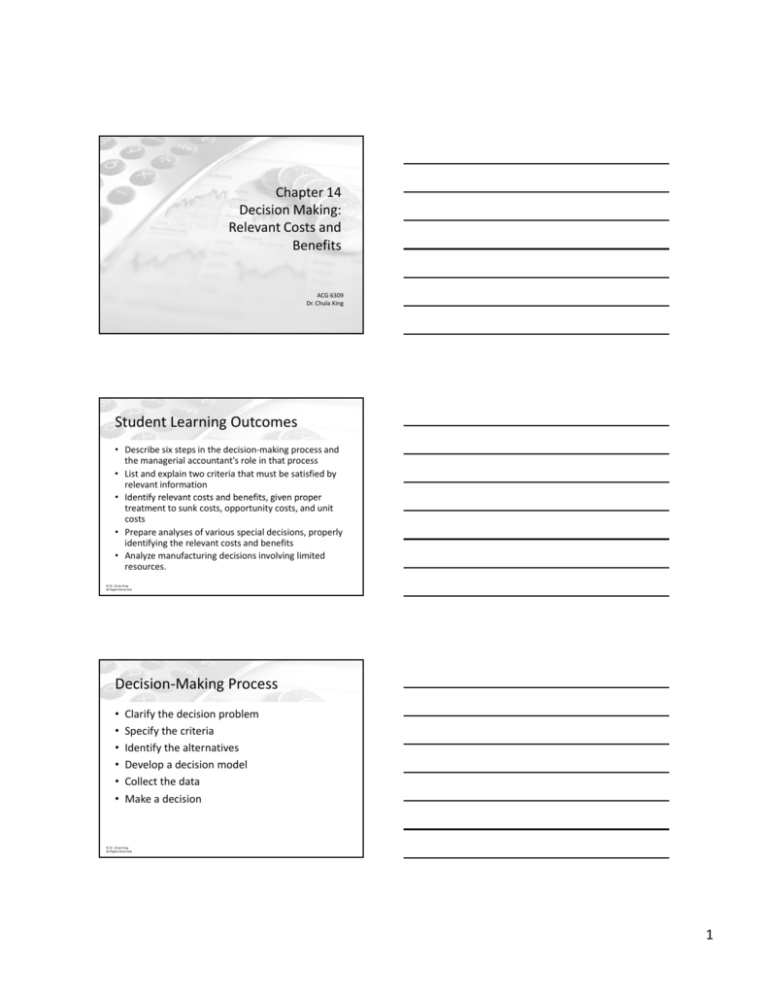

Chapter 14

Decision Making: Relevant Costs and Benefits

ACG 6309

Dr. Chula King

© Dr. Chula King

All Rights Reserved

Student Learning Outcomes

• Describe six steps in the decision‐making process and the managerial accountant's role in that process

• List and explain two criteria that must be satisfied by relevant information

• Identify relevant costs and benefits, given proper Identify relevant costs and benefits given proper

treatment to sunk costs, opportunity costs, and unit costs

• Prepare analyses of various special decisions, properly identifying the relevant costs and benefits

• Analyze manufacturing decisions involving limited resources. © Dr. Chula King

All Rights Reserved

Decision‐Making Process

•

•

•

•

•

•

Clarify the decision problem

Specify the criteria

Identify the alternatives

Develop a decision model

Collect the data

Make a decision

© Dr. Chula King

All Rights Reserved

1

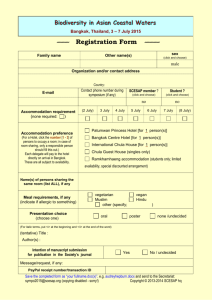

Relevant Information

• Information has a bearing on the future

• Information differs among competing alternatives

© Dr. Chula King

All Rights Reserved

Identifying Relevant Costs and Benefits

• Sunk Costs ‐ Costs that have already been incurred in the past

• Opportunity Costs – The potential benefit given up when the choice of one action

given up when the choice of one action precludes selection of a different action.

© Dr. Chula King

All Rights Reserved

Analysis of Special Decisions

• A travel agency offers Worldwide Airways $150,000 for a round‐trip flight from Hawaii to Japan on a jumbo jet.

• Worldwide usually gets $250,000 in revenue yg $

,

from this flight.

• The airline is not currently planning to add any new routes and has two planes that are idle and could be used to meet the needs of the agency.

© Dr. Chula King

All Rights Reserved

2

Accept or Reject Special Order

Typical Flight Between Japan and Hawaii

Revenue:

Passenger

Cargo

$250,000

30,000

Total

$280,000

Expenses:

Variable expenses

$90,000

Allocated fixed expenses

100,000

Total

190,000

Profit

$90,000

Worldwide would save around $5,000 in reservation and ticketing costs if the charter is accepted.

© Dr. Chula King

All Rights Reserved

Excess Capacity

Special price for charter

Variable cost/flight

Reservation cost savings

Variable cost of charter

Contribution from charter

$150,000

$90,000

(5,000)

85,000

$65,000

Since the charter will contribute to fixed costs and Worldwide has idle capacity, the company should accept the flight.

© Dr. Chula King

All Rights Reserved

No Excess Capacity

• What if Worldwide had no excess capacity?

• If Worldwide adds the charter, it will have to cut its least profitable route that currently contributes $80 000 to fixed costs and profit

contributes $80,000 to fixed costs and profit.

• Should Worldwide still accept the charter?

© Dr. Chula King

All Rights Reserved

3

No Excess Capacity

Special price for charter

Variable cost/flight

$150,000

$90,000

Reservation cost savings

(5,000)

Variable cost of charter

$85,000

Opportunity cost:

Lost contribution on route

80,000

Total

165,000

Loss

$(15,000)

Worldwide has no excess capacity, so it should reject the special charter.

© Dr. Chula King

All Rights Reserved

Accept or Reject a Special Order

• With Excess Capacity: Relevant costs will usually be the variable costs associated with the special order

• Without Excess Capacity: Relevant costs will Without Excess Capacity: Relevant costs will

usually be both the variable costs associated with the special order, plus the opportunity costs of using the firm’s facilities for the special order.

© Dr. Chula King

All Rights Reserved

Outsouce a Product or Service

• Consider this: An Atlanta bakery has offered to supply the in‐flight desserts for Worldwide for $0.21 each.

Cost

Variable costs:

Variable

costs:

Direct material

$0.06

Direct labor

0.04

Variable overhead

0.04

Fixed costs:

Supervisory salaries 0.04

Equipment depreciation 0.07

Total cost/dessert

$0.25

Relevant

$0.06

0.04

0.04

0.01

‐0‐

$0.15

© Dr. Chula King

All Rights Reserved

4

Add or Drop a Service, Product or Department

• Consider this: Worldwide Airways offers its passengers the opportunity to join its World Express Club. Club membership entitles a traveler to use the club facilities in the Atlanta

traveler to use the club facilities in the Atlanta airport.

• Club privileges include a private lounge and restaurant, discounts on meals and beverages, and use of a small health spa.

© Dr. Chula King

All Rights Reserved

Add or Drop a Product

Keep Club Eliminate

Sales

$200,000

0

Food/Beverage

(70,000)

0

Personnel

(40,000)

0

Variable overhead

(25,000)

0

Contribution Margin 65,000

0

65 000

Depreciation

(30,000) (30,000)

Supervisor salary

(20,000)

0

Insurance

(10,000) (10,000)

Airport fees

( 5,000)

0

Allocated overhead (10,000) (10,000)

Loss

$ (10,000) $(50,000)

Differential

$200,000

(70,000)

(40,000)

(25,000)

65,000

65 000

0

(20,000)

0

( 5,000)

0

$ 40,000

© Dr. Chula King

All Rights Reserved

Add or Drop a Product ‐ Relevant

Keep Club Eliminate

Sales

$200,000

0

Food/Beverage

(70,000)

0

Personnel

(40,000)

0

Variable overhead

(25,000)

0

Contribution Margin 65,000

65 000

0

Avoidable fixed costs

Supervisor salary

(20,000)

0

Airport fees

( 5,000)

0

Profit/Loss

$ 40,000

Differential

$200,000

(70,000)

(40,000)

(25,000)

65 000

65,000

(20,000)

( 5,000)

$ 40,000

© Dr. Chula King

All Rights Reserved

5

Additional Analysis

Contribution margin from

general airline operations

that will be forgone if club

is eliminated . . . . . . . . . . . $ 60,000

Profit/Loss

fi /

$ 40,000

40 000

Monthly profit of

keeping the club open

–0–

–0–

0

$ 60,000

$ 40,000

40 000

$100,000

© Dr. Chula King

All Rights Reserved

Decisions Involving Limited Resources

• How should limited resources be used?

• Generally, fixed costs are not affected, so management can focus on maximizing total contribution margin

contribution margin.

© Dr. Chula King

All Rights Reserved

Consider This

Martin, Inc., produces two products. Selected data is shown below:

Products

Webs

Highs

Selling price/unit

$60

$50

Less: Variable expenses/unit

36

35

Contribution margin/unit

$24

$15

Current demand per week (units)

2,000

2,200

Contribution margin ratio

40%

30%

1.00 min.

0.50 min

Processing time required on the lathe/unit

The lathe is a scarce resource because there is excess capacity on other machines. The lathe is being used at 100% of its capacity, which is 2,400 minutes/week.

Should Martin focus its efforts on Webs or Highs?

© Dr. Chula King

All Rights Reserved

6

Contribution Margin/Minute

Products

Webs

Contribution margin/unit

Time required to produce one unit

Contribution margin/minute

Highs

$24

$15

÷ 1.00 min

÷ 0.50 min

$24/min

$30/min

Highs should be emphasized. It is the more valuable to use of the lathe which is a scarce resource. Highs yields a contribution margin of $30 per minute as opposed to $24 per minute for the Webs.

If there are no other considerations, the best plan would be to produce to meet the current demand for Highs and then use the remaining capacity, if any, to make Webs.

© Dr. Chula King

All Rights Reserved

Implementing the Plan

Weekly demand for Highs

Time required/unit

Time required to make Highs

Total lathe time available

Time available for Webs

Time required/unit

Production of Webs

2,200 units

x 0.50 minutes

1,100 minutes

2,400 minutes

1,300 minutes

x1.00 minute

1,300 units

© Dr. Chula King

All Rights Reserved

Limited Resources: Conclusion

Given the lathe capacity of 2,400 minutes, management should choose to make the current demand of 2,200 Highs per week, and 1,300 g p y

Webs with the remaining capacity.

Webs

Production and sales

1,300

Contribution margin/unit

x $24

Total contribution margin $31,200

Highs

2,200

x $15

$33,000

© Dr. Chula King

All Rights Reserved

7

Theory of Constraints

• Limit to a company’s profitability

• To relax constraints, managements could

– Outsource

– Work overtime

W k

i

– Retrain employees

– Reduce non‐value‐added activities

© Dr. Chula King

All Rights Reserved

Pitfalls to Avoid

•

•

•

•

Sunk costs

Opportunity costs

Allocated fixed costs

Unitized fixed costs

© Dr. Chula King

All Rights Reserved

The Next Step

• Exercises 14‐31, 14‐35, 14‐40

• Problems 14‐44, 14‐45, 14‐48, 14‐53, 14‐54

© Dr. Chula King

All Rights Reserved

8