The Financial Blogger | The Tax-Free Savings Account (TFSA) – A Cre...

1 of 5

http://www.thefinancialblogger.com/the-tax-free-savings-account-tfsa-...

The Financial Blogger

Blog about personal finances, investments and much more.

Home

About TFB

Disclaimer

Advertise

Search This Blog

The Tax-Free Savings Account (TFSA) – A Creative Financial Approach

February 28, 2008 By: The Financial Blogger Category: Personal Finance

The Canadian Government deposited their 2008

budget this February 26th. So at the same time

that the Montreal Canadiens were showing their

inability to be creative enough to bring Marian

Hossa (!) in our team, the Canadian Government

were including a nice innovation called the

Tax-Free Savings Account (TFSA) in their 2008

budget. This measure will take effect as of

January 1st 2009.

What is the TFSA?

The TFSA is an account where you can put money (up to $5,000 per year per person) and all gains (interest income,

dividend and capital gains) are non taxable. Even better, you can withdraw the money from your account at any time

under no restriction and without being taxed on the amount of the withdrawal.

You can save up to $5,000 per year and unused TFSA contributions room can be carried forward to future years. You can

also contribute to your spouse and benefit from income splitting strategies.

As previously mentioned, you can withdraw money at any time from your TFSA and this does not affect your contribution

room. You always have the possibility to put back the money into the Tax-Free Savings Account at any time without any

penalties.

Comparison between an RRSP and a TFSA

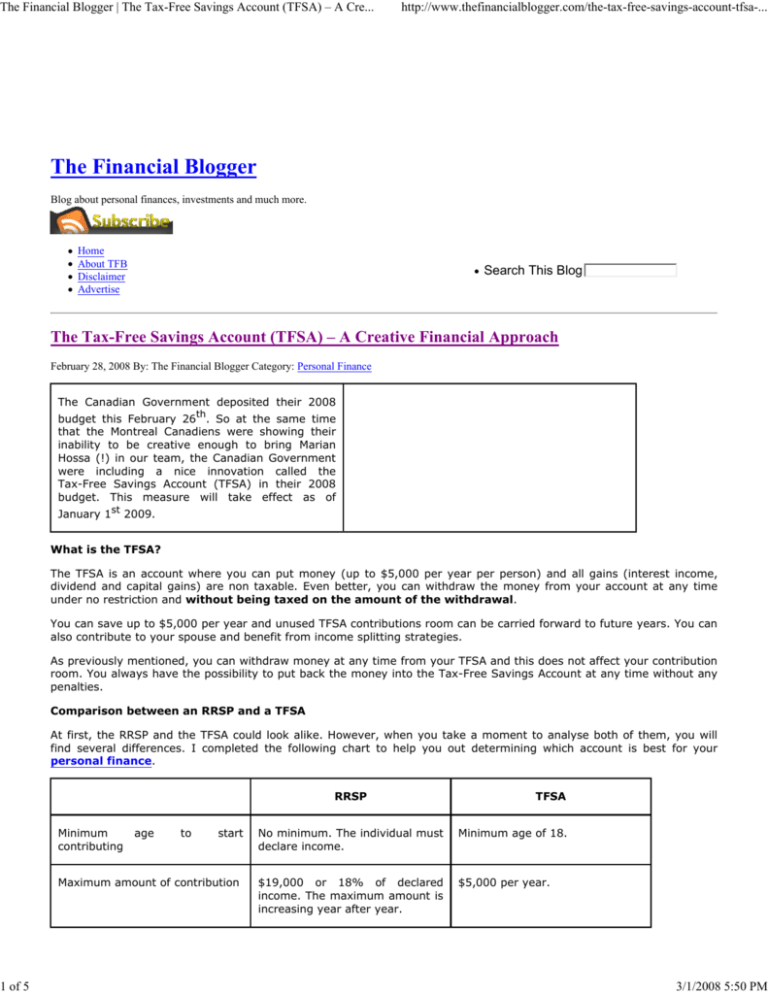

At first, the RRSP and the TFSA could look alike. However, when you take a moment to analyse both of them, you will

find several differences. I completed the following chart to help you out determining which account is best for your

personal finance.

RRSP

Minimum

contributing

age

to

start

Maximum amount of contribution

TFSA

No minimum. The individual must

declare income.

Minimum age of 18.

$19,000 or 18% of declared

income. The maximum amount is

increasing year after year.

$5,000 per year.

3/1/2008 5:50 PM

The Financial Blogger | The Tax-Free Savings Account (TFSA) – A Cre...

2 of 5

http://www.thefinancialblogger.com/the-tax-free-savings-account-tfsa-...

Contribution is tax deductible

Yes.

No.

Investment

gains

(interest,

dividend and capital gains) are

not taxable

Yes.

Yes.

Spousal

permitted

Yes.

Yes.

Withdrawals from the account are

taxable.

Yes. They are not taxable in a

case of a Home Buyer Plan and to

go back to school (those 2

programs work under certain

restrictions).

No. Withdrawals from the TFSA

are not taxable.

Unused contribution room can be

carried forward.

Yes.

Yes.

You

can

“reimburse”

withdrawal in the account.

No. You can only reimburse

under the HBP and return to

school program under certain

restrictions.

Yes. You can reimburse your

withdrawals from the TFSA at

any time without penalties.

contribution

are

your

According to Million Dollar Journey the account would not serve the Smith Manoeuvre Strategy since the interest

paid on the borrowed amount would not be tax deductible. He took his information from The Financial Post. I will go

deeper into this as it would simply be amazing to combine the Tax-Free Savings Account to a Smith Manoeuvre

Strategy.

If you are looking for more information on the TFSA or the 2008 Canadian Budget, I suggest you read those articles:

Million Dollar Journey

Canadian Capitalist

The Globe and Mail

Fours Pillars

If you liked this article, you might want to sign up for my FULL RSS FEED. Then, you would get my daily post in your

email and can read it at any time. To subscribe, please click HERE.

Trackback URI | Comments RSS

7 Responses to “ The Tax-Free Savings Account (TFSA) – A Creative Financial Approach ”

1. # 1 MillionDollarJourney Says:

February 28th, 2008 at 8:27 am

Hey FB, thanks for the mention. It’s too bad that borrowed interest wont’ be tax deductible with this account, however, it’s still a great account

regardless. So many possibilities!

2. # 2 Tax Free Savings Account in Canada Says:

February 28th, 2008 at 8:36 am

[…] Capitalist Million Dollar Journey Canadian Dream Financial Jungle The Financial Blogger Canadian Mortgage […]

3. # 3 Canadian Capitalist Says:

February 28th, 2008 at 8:41 am

Thanks for the link FB. FT is right. The budget specifically mentions that borrowing to invest in the TFSA is not tax deductible.

4. # 4 Customers Revenge Says:

February 28th, 2008 at 10:44 am

Is the smith manouvre really that profitable? Doesn’t it just convert your mortgage into an investment loan so you can tax-deduct the interest?

Typically you can get a mortgage rate that is cheaper than the prevailing HELOC rates, so much of what you gain in a tax savings is lost to the

3/1/2008 5:50 PM

The Financial Blogger | The Tax-Free Savings Account (TFSA) – A Cre...

3 of 5

http://www.thefinancialblogger.com/the-tax-free-savings-account-tfsa-...

higher rate. The timing of when you lock into your mortgage might make a difference.

I did the calculations on converting my own mortgage in the past, and the amount of the return was very small. In general though, borrowing to

buy investments is way better than borrowing to buy consumption.

5. # 5 The Financial Blogger Says:

February 28th, 2008 at 8:20 pm

FT and CC;

That’s too bad for the SM! I guess I’ll have to wait and pray to have the tax exemption on the capital gain next year!!

CR;

I am a firm believer of leveraging based on the power of compounding interest. Many financial institution (including the National Bank starting

this April) allow you to combine a fixed mortgage with a HELOC. On the other side, it has been mathematically proven that if you take the

variable mortgage rate over 25 years, you will end up paying less interest than renewing a fixed rate every 5 years.

6. # 6 Quentin DSouza Says:

February 29th, 2008 at 9:49 pm

I was thinking about this again. Please correct me if I’m wrong, but I think it might actually be useful for the Smith Manouvre Investments. Not on

the front end but on the back end.

It is difficult to say exactly until the TFSA comes into play but here is an idea, if transfers in kind are allowed. If we are able to do a “transfer in

kind” of non-registered funds into a TFSA closer to retirement in order to avoid taxation and wash non-registered funds like those of the Smith

Manouvre before we actually need it. Just say your a couple and want to retire in 10 years, so you together have 100,000 of TFSA room, you

transfer in kind from the non-registered funds of the SM - then withdraw funds from the TFSA to avoid taxation and create room again to do it

again the next year? That would mean that a couple who needed $100,000 before tax could now only need to save $70,0000 - since there would be

no tax on the money from the TFSA.

I also mentioned this over at Canadian Dream- http://blog.canadian-dream-free-at-45.com/?p=364#comment-3800 but haven’t got a response yet.

I’d appreciate some FPs opinions on this.

7. # 7 The Financial Blogger Says:

March 1st, 2008 at 5:50 pm

Quentin;

I guess it would work but you would lose your tax deductibility advantage at that point. I think it could be a could way to end-up the Smith

Manoeuvre when you are about to retire.

I would suggest we wait until next year and speak to an accountant

Leave a Reply

Name (required)

Mail (will not be published) (required)

Website

Submit Comment

← Why Using a HELOC as an Emergency Fund

3/1/2008 5:50 PM

The Financial Blogger | The Tax-Free Savings Account (TFSA) – A Cre...

4 of 5

http://www.thefinancialblogger.com/the-tax-free-savings-account-tfsa-...

Last Day For RRSP Contribution →

Financial Resources

Categories

Assets and Net Worth (7)

Banks and You (14)

Career (23)

Credit, Credit Rating and Credit Bureau (9)

Financial Cliché (8)

Financial Rambling (32)

Frugal (15)

Improve your credit score (3)

Insurance (4)

Investment, Market and Risk (17)

Leveraging Strategies (16)

Make Money Online (2)

MBA (4)

Miscellaneous Stuff about Finance (21)

Monthly Top Ten (6)

My Plan to Retirement (2)

Pay off your Debts (10)

Personal Finance (38)

Primerica Series (8)

Project $1500 (8)

Properties (8)

RESP (1)

Reviews (6)

RRSP (6)

Smith Manoeuvre (23)

Social Lending (1)

Trading (11)

Types of Financial Products (6)

Uncategorized (5)

Archives

March 2008

February 2008

January 2008

December 2007

November 2007

October 2007

September 2007

August 2007

July 2007

June 2007

May 2007

April 2007

March 2007

February 2007

January 2007

December 2006

November 2006

Recent Post

Financial Ramblings

Last Day For RRSP Contribution

The Tax-Free Savings Account (TFSA) – A Creative Financial Approach

Why Using a HELOC as an Emergency Fund

The Advantages of Contributing To Your RRSP With A Low Income

The Drawbacks Of Withdrawing From Your RRSP Before Retirement

3/1/2008 5:50 PM

The Financial Blogger | The Tax-Free Savings Account (TFSA) – A Cre...

5 of 5

http://www.thefinancialblogger.com/the-tax-free-savings-account-tfsa-...

Financial Ramblings

The Sad Truth About Investing

How Much Would Pay For A Visit At The Clinic?

3 Major Concerns For Retirees

Blogroll

Canadian Capitalist

Clever Dude

Dough Roller

Four Pillars

Genius Types

Give me back my 5 bucks

Lazyman and Money

Middle Class Milionaire

Million Dollar Journey

Money Smart Life

Money, Matter and More Musings

PF BLogs

Stock Trading To Go

The Digerati Life

The Dividend Guy Blog

The Financial Jungle

The Simple Dollar

Thicken My Wallet

Where Does All My Money Go

The Financial Blogger © 2007 All Rights Reserved. Using WordPress 2.3.1 Engine

Entries and Comments.

3/1/2008 5:50 PM