albania - AL

advertisement

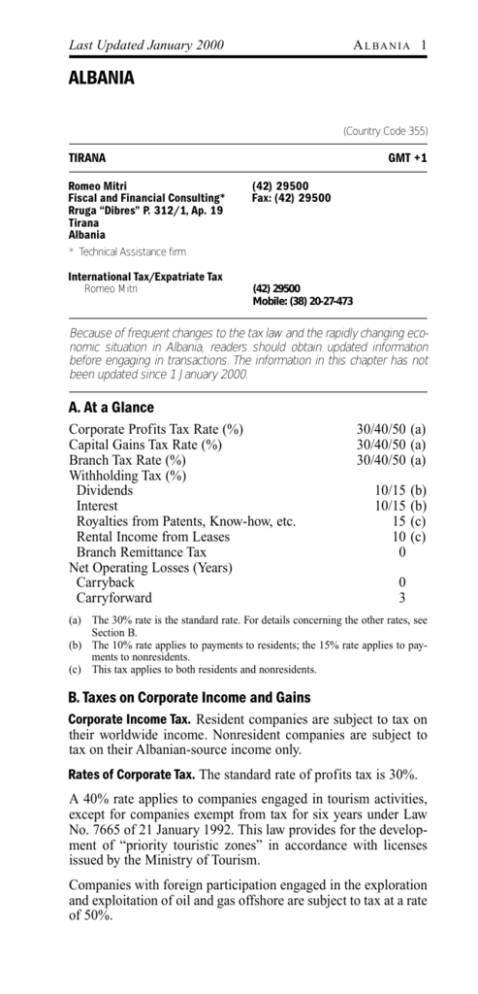

Last Updated January 2000 A L BA N I A 1 ALBANIA (Country Code 355) TIRANA Romeo Mitri Fiscal and Financial Consulting* Rruga “Dibres” P. 312/1, Ap. 19 Tirana Albania GMT +1 (42) 29500 Fax: (42) 29500 * Technical Assistance firm International Tax/Expatriate Tax Romeo Mitri (42) 29500 Mobile: (38) 20-27-473 Because of frequent changes to the tax law and the rapidly changing economic situation in Albania, readers should obtain updated information before engaging in transactions. The information in this chapter has not been updated since 1 January 2000. A. At a Glance Corporate Profits Tax Rate (%) Capital Gains Tax Rate (%) Branch Tax Rate (%) Withholding Tax (%) Dividends Interest Royalties from Patents, Know-how, etc. Rental Income from Leases Branch Remittance Tax Net Operating Losses (Years) Carryback Carryforward 30/40/50 (a) 30/40/50 (a) 30/40/50 (a) 10/15 10/15 15 10 0 (b) (b) (c) (c) 0 3 (a) The 30% rate is the standard rate. For details concerning the other rates, see Section B. (b) The 10% rate applies to payments to residents; the 15% rate applies to payments to nonresidents. (c) This tax applies to both residents and nonresidents. B. Taxes on Corporate Income and Gains Corporate Income Tax. Resident companies are subject to tax on their worldwide income. Nonresident companies are subject to tax on their Albanian-source income only. Rates of Corporate Tax. The standard rate of profits tax is 30%. A 40% rate applies to companies engaged in tourism activities, except for companies exempt from tax for six years under Law No. 7665 of 21 January 1992. This law provides for the development of “priority touristic zones” in accordance with licenses issued by the Ministry of Tourism. Companies with foreign participation engaged in the exploration and exploitation of oil and gas offshore are subject to tax at a rate of 50%. Last Updated January 2000 A L BA N I A 2 Capital Gains. Capital gains are included in the ordinary income of companies and are subject to profits tax at the regular rates. Administration. The tax year is the calendar year. An annual tax return must be filed by 31 March of the year follow-ing the tax year. Tax assessments with respect to irregularities or violations contained in the return are issued within 15 days after the filing of the return. Companies must pay profits tax in monthly installments during the tax year. The installments are due on the 15th day following the end of the month for which tax is due. Any balance of tax due shown on the annual tax return must be paid at the time of filing the tax return. Dividends. Dividends paid are subject to withholding tax at a rate of 10% for payments to residents and 15% for payments to nonresidents. Remittances of branch profits are not subject to withholding tax. Companies must include dividends received from Albanian and foreign companies in taxable income. Foreign Tax Relief. Under its tax treaties, Albania usually agrees to exempt foreign-source income from tax. Foreign taxes are creditable against Albanian tax only as provided in tax treaties. C. Determination of Trading Income General. Taxable income is based on the annual profit reported in financial statements prepared in accordance with the accounting law and regulations issued by the Minister of Finance. Taxable income does not necessarily equal the profit shown in the financial statements, however, because certain specified adjustments are required for tax purposes. All necessary and reasonable expenses incurred in carrying out business activities are deductible except for the following: • Costs of purchasing or improving land; • Costs of purchasing, improving, renewing or reconstructing fixed assets; • Depreciation or other expenses in excess of rates set by law or the Ministry of Finance (see Tax Depreciation below); • Fines and penalties paid for the violation of laws or contractual provisions; • Interest paid on loans in excess of the rates of the Bank of Albania; and • Interest paid on late payments to the government. Inventories. The inventory valuation rules provided in the accounting law also apply for tax purposes. Inventory is valued at historical cost, which is determined by using the weighted-average, first-in, first-out (FIFO) or other specified methods. The local tax authorities must approve a change in the adopted method. Provisions. Companies may not deduct provisions. Tax Depreciation. Depreciation of tangible and intangible assets must be computed using the straight-line method. The following are some of the applicable rates. Last Updated January 2000 A L BA N I A 3 Asset Buildings and structures Computers, information systems and software Other fixed assets Intangible assets Rate (%) 5 25 20 10 Assets that may not be depreciated include land, artistic works, jewelry and precious metals. Relief for Losses. Tax losses may be carried forward for three years. Loss carrybacks are not allowed. Groups of Companies. The tax law does not contain any clear provisions for filing consolidated returns or relieving losses within a group. As a result, consolidated returns are not allowed. D. Other Significant Taxes The following table summarizes other significant taxes. Nature of Tax Value-added tax; exempt supplies include leases of land and buildings and financial services Standard rate Exports, services rendered outside Albania for Albanian recipients by Albanian residents and supplies of goods and services relating to international transportation Excise duties on specified goods Tobacco Alcoholic drinks Soft drinks Benzene Super Oil Social security contributions, on monthly salary; paid by Employer Employee Rate (%) 20 0 60 50 5 90 50 34.2 11.7 E. Foreign-Exchange Controls The Albanian currency is the leke (no symbol is provided for the leke). In Albania, the currency market is a free market and the leke is fully convertible internally. Residents and nonresidents may open foreign-currency accounts in Albanian banks or foreign banks authorized to operate in Albania. Residents may open accounts in banks located abroad only if they obtain the prior approval of the Bank of Albania (the central bank). No limits are imposed on the amount of foreign currency that may be brought into Albania. Hard-currency earnings may be repatriated, and no tax is imposed on the repatriation of such earnings. F. Treaty Withholding Tax Rates The rates of withholding tax in Albania’s tax treaties are described in the following table. Last Updated January 2000 A L BA N I A 4 Dividends % Croatia (c) Czech Republic Greece (c) Hungary Italy Malaysia Malta (d) Poland Romania Russian Federation (c) Switzerland (d) Turkey (c) Nontreaty countries 10 5/15 5 5/10 10 5/15 5/15 5/10 10/15 10 5/15 5/15 15 (a) (a) (a) (a) (a) (a) (a) (a) Interest % Royalties % 10 5 5 0 5 (b) 10 5 10 10 (b) 10 5 10 (b) 15 10 10 5 5 5 10 5 5 15 10 5 10 15 (a) The lower rate applies if the beneficial owner of the dividends is a company that holds at least 25% of the capital of the payer; the higher rate applies to other dividends. (b) Interest on government and central bank loans is exempt from withholding tax. (c) These treaties have been ratified by the Albanian parliament but not by the parliaments of the other countries. (d) These treaties have been negotiated, but not signed. Albania is negotiating tax treaties with several other countries.