DINNER AND DRINKS: BC COURT OF APPEAL CONFIRMS

advertisement

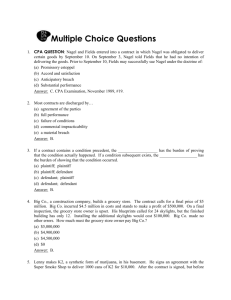

DINNER AND DRINKS: BC COURT OF APPEAL CONFIRMS NIGHTCLUB ACCIDENT NOT WITHIN SCOPE OF PROFESSIONAL INSURANCE November 2012 Number 743 Quantum of Damages . . . . . . . . . . . — Andrew Aguilar of McMillan LLP. © McMillan LLP. Reproduced with permission. 2 Recent Cases Motions Judge Erred in Dismissing Property Damage Claim From Cargo Damaged in Auto Accident . . . . . . . . . . . . 3 Although Breach of Trusts Fell Within Coverage, Exclusions Excluded the Loss . . . . . . . . . . . . 5 No Implied Consent To Drive Could Be Found From Fathers Failure To Press Theft Charges . . . . . . 6 In what may be the final chapter of a very long and protracted legal proceeding, the British Columbia Court of Appeal recently issued its decision in Poole v Lombard General Insurance.1 This is a case that has captured the attention of the legal community across Canada both for the nature of the claim — an articling student suing an associate at her law firm for injuries suffered as a result of a fall at a night club after a firm sponsored dinner — and for the quantum of damages awarded — almost six million dollars in future wage loss. While the facts of this case should serve as a warning to employers that they need to be aware of potential liability for the acts of employees at non-traditional work functions, the appeal should also be of some comfort to insurers providing professional insurance to employers. In Poole v Lombard, the appellate court held that any connection, however tenuous, between the event where the act occurred and the employment, was not sufficient to engage coverage under the law firm’s insurance policy. The policy, which was more broadly worded than many, did not extend to acts by an employee while out for impromptu drinks with co-workers after a employer sponsored dinner. The accident on which this case is based, occurred over ten years ago on April 6, 2001, when an articling student struck her head on the floor after being knocked over by an associate of the firm while dancing at a local nightclub. At the time, the student and the associate were both part of a group of co-workers who had gone out for drinks after a dinner, sponsored by their law firm employer. The hearing of this matter was split into two separate trials. The first trial dealt with the accident itself, and the second trial dealt with insurance coverage. The appeal in Poole v Lambard, was in relation to this second trial. Defendants Not Permitted To Reopen Trial To Address Contributory Negligence . . . . . . . . . 7 Plaintiffs Permitted To Amend Originating Notice Despite Previous Dismissal . . . . . . . . . . . At the first trial, the British Columbia Supreme Court found that the student had suffered a mild traumatic brain injury as a result of the accident on the dance floor and that she could no longer pursue her career as a lawyer. The court further held that the accident was caused solely by the negligence of the associate and awarded damages against the associate personally in the amount of $5,913,783.54. Notwithstanding this significant damage award, the associate had previously reached a settlement agreement with the student on the basis that he would pay $1,050,000, the limits on his home owners insurance policy, and agree to continue to pursue the action against his law firm’s insurer. The student could therefore only collect the full amount of the judgment if it was held that the accident fell within the coverage of the law firm’s professional insurance policy. 8 This set the stage for the second trial, which focused on the issue of whether the 1 2 CANADIAN INSURANCE LAW REPORTER associate was entitled to coverage from the law firm’s “professional package” insurance policy provided by Lombard General Insurance. This trial turned on whether the associate fell within the scope of one of two clauses in the contract of insurance. The first clause dealing with acts within the “scope of” or “course of” employment and the second clause dealing with acts with “respect to” employment. At trial,2 the court held that the two clauses needed to be read together, and that when read together, only the clause relating to the “scope of” or “course of” employment could apply. The court went on to consider whether the associate’s actions fell within the “scope of” or “course of” his employment and found that they did not, noting that while there were some business reasons to sponsor the dinner, the events at the nightclub had “a far more tenuous connection” with employment, and that the evidence did not support any residual benefit to the employer from the attendance of its employees at the nightclub. Considering only the first more narrow clause, the court found that the associate did not fall within the scope of the law firm’s insurance policy. On appeal, the associate conceded that his actions in causing the accident were not within the “scope of” or “course of” his employment, but sought a finding that the second clause could apply and did provide coverage as his actions were with “respect to” his employment. The court held that the trial judge had erred in law in determining that the two clauses should be read in conjunction. The appellate court confirmed that “the primary interpretive principle” set out by the Supreme Court of Canada in Progressive Homes Ltd. v Lombard General Insurance Company of Canada,3 was that “when the language of the policy is unambiguous, the court should give effect to clear language, reading the contract as whole.” While there was overlap between the two clauses, the wording was unambiguous, and the trial judge was incorrect in interpreting the clauses together rather than as stand-alone clauses. The court then examined the meaning of the phrase with “with respect to” employment and held that it has a wider meaning than “in the course of” or “within the scope of” employment. The court rejected prior American4 and UK5 case law, which took a more stringent view of the connection to employment implied by the wording “with respect to”, and took a more practical view, that: [T]he phrase requires that a line be drawn on a commercially reasonable basis between what is essentially firm functions and what are essentially social functions — notwithstanding some weak connection between the latter and an insured’s employment.6 The court went on to hold that contextual factors such as who was in attendance, where the incident took place, whether business was being discussed, time and place, and the likelihood of benefit to the employer were all relevant in this determination. While not legally binding, the court suggested that the dinner likely would have fallen within the scope of coverage, but that going to the night club did not as this had crossed the line into a purely social function. At the end of the day, whether an insurer providing professional insurance to an employer will be liable for the acts of employees at a non-traditional work event will be a fact specific determination and differ depending on the policy and the event, but Poole v Lambard makes it clear that liability will not extend indefinitely and courts will likely take a practical commercially reasonable approach in determining whether the event is sufficiently connected to the employment relationship to engage coverage. Notes: 1 2012 BCCA 434 [Poole v Lombard]. 2 2011 BCSC 65. 3 2010 SCC 33. 4 Rayburn v MSI Insurance Company, 624 NW 2d 878 (Wis CA 2000). 5 Tesco Stores Limited v Constable & Ors, [2008] EWCA Civ 362. 6 Supra note 1 at para 49. QUANTUM OF DAMAGES Injury Non-Pecuniary Total Paragraph Brain $250,000 $1,685,000 ¶M-2634 Brain $300,000 $638,675 ¶M-2631 3 CANADIAN INSURANCE LAW REPORTER RECENT CASES Full-Text Decisions Motions Judge Erred in Dismissing Property Damage Claim From Cargo Damaged in Auto Accident Ontario Court of Appeal, September 10, 2012 The appellant rented a truck from Ryder Canada (“Ryder”) to transport a food-packaging machine used in its business. The machine was damaged when another vehicle hit the truck. The appellant sought compensation from Ryder’s insurer, the respondent, for the damage to its machine, but the respondent denied coverage. On a motion brought by the appellant to determine three questions of law, the motions judge held: (1) the respondent was not the appellant’s “insurer” for the purpose of section 263(2) of the Insurance Act (the “Act”); (2) the terms and conditions in the rental agreement limited the appellant’s recovery; and (3) if the appellant misrepresented the type of cargo it was carrying, this would impact its recovery from the respondent pursuant to section 263(2). The claim was dismissed. The appellant submitted that the motions judge erred by failing to give effect to the Direct Compensation — Property Damage provisions in the Ontario Automobile policy, provisions authorized by section 263 of the Act. The appeal was allowed. Regarding the first question, the Court held that the respondent was the appellant’s insurer for the purpose of section 263(2) of the Act. The motions judge erred in holding that section 247(b) of the Act and section 3.5.1 of the policy applied to direct compensation for property damage; these sections applied to third-party liability coverage. The applicable statutory provision was section 263. That section and section 6.1 of the Automobile Policy would entitle Ryder to recover from the respondent, and the inclusion of an endorsement in the policy extended coverage to lessees. The Court concluded that the appellant was therefore an “insured” and the respondent was treated as its “insurer.” Turning to the second question, the Court stated that the respondent was not a party to the rental agreement and that the rental agreement was not part of the automobile insurance policy between Ryder and the respondent. No terms of the rental agreement could alter the respondent’s obligation to the appellant under the policy. Finally, the Court held that even if the appellant misrepresented its cargo to Ryder, this would not affect its entitlement under the policy. Siena-Foods Ltd. v. Old Republic Insurance Co. of Canada, [2012] I.L.R. ¶I-5334 Foster Parents Who Were Terminated Were Not “Insureds” in Renewal Policies Ontario Superior Court of Justice, August 30, 2012 The respondent Frank Cowan Company (“Cowan”) issued insurance policies that required the Court’s interpretation. Briefly, both applications sought to determine the extent of available insurance coverage under the aggregate coverage provisions of the relevant policies. The Durham Children’s Aid Society (“DAS”) purchased four public entity casualty policies for the yearly periods beginning March 31, 2008, with the last policy ending March 31, 2012. Foster parents with the DAS were criminally charged in relation to the operation of their foster home. They were terminated as foster parents in October 2008. The foster parents retained counsel and were acquitted in June 2011. Legal expenses totalled approximately $750,000. There was no dispute that foster parents fell within the definition of insured, and Part I of the policies covered “legal expenses.” There was also no dispute that the policy in place for March 31, 2008 to March 31, 2009 had been triggered. In dispute was whether the subsequent policies were triggered. Each policy had a $500,000 aggregate limit. The applicants argued the $500,000 limit was not applicable where the legal expenses were incurred over successive policy periods. Cowan submitted the policies were “claims made” policies which only covered claims arising during the currency of the policy term. The applications were dismissed. Nowhere in the limit of liability was there any provision to the effect that the limit of the insurer’s liability should not be cumulative from year to year or period to period. If an ambiguity existed, the law was clear it was to be resolved in the insured’s favour. While it might seem to be an anomaly that the applicant should effectively be entitled to “stack” the aggregate limits from policy period to policy period, it would have been a simple drafting exercise for the insurer to have inserted words to remedy this result, but it did not do so. The Court concluded the aggregate coverage for legal costs was $2 million spanning all policy periods. However, the Court found that one issue remained: whether the applicants were entitled to this aggregate amount in excess of $500,000. The Court found they were not. Because the foster parents were terminated during the first policy period, they were not “insureds” for 4 CANADIAN INSURANCE LAW REPORTER the renewal policies from 2009 to 2011. Therefore, the applicants were limited to the aggregate limit of $500,000. David J. Gillespie Professional Corp. v. Frank Cowan Co. Ltd., [2012] I.L.R. ¶I-5335 Insurance Contract Not Binding on Non-Signatories Ontario Superior Court of Justice, September 12, 2012 In 1995, the applicant Fingold entered into an agreement with the respondent Metropolitan Toronto Condominium Corporation (“MTCC”) to allow his heritage property to become part of a condominium complex; the agreement allowed Fingold to develop it into three condominium units. Although Fingold’s property was part of the condominium complex, the property was a free-standing, non-attached structure. In 2009, a fire occurred at Fingold’s property; it had once been his residence, but at the time of the fire a portion of it was used as an office. A dispute arose between Fingold and MTCC 1100 with respect to which of them (and their respective insurers) should be entitled to direct and control the repair of the property. At the time, Fingold was insured by Chubb Insurance Company of Canada (“Chubb”), and MTCC 1100 was insured by Novex Insurance Company (“Novex”). Fingold sought a declaration that he was entitled to direct the repairs, as well as an injunction to prevent MTCC from making any repairs. MTCC argued its Novex policy provided coverage for the physical loss and damage, and that the adjustment of such loss was the exclusive right of MTCC 1100. Novex generally supported the relief sought by MTCC in relation to the repairs, and sought to have the application dismissed. Chubb took no position. The application was dismissed. The Court found that the parties were unable to rely on the provisions in their respective insurance policies to support their positions. Fingold and MTCC entered into insurance contracts with their own insurers, and neither party was a signatory with respect to the other’s insurance policy; therefore, the insuring agreements were not binding on the respective non-parties. After reviewing the relevant documentation and the nature of the condominium development as a whole, the Court concluded that MTCC had the obligation to repair after damage. However, the Court restricted this right to the roof and the exterior of the property. This was a fair and equitable result, given the unique nature of the property and its overall importance to the condominium unit. In the alternative, the Court found that MTCC was entitled to make repairs to the exterior on the basis that Fingold had not carried out the necessary repairs within a reasonable time. The Court also ordered that any issues related to Novex’s expense with respect to ongoing maintenance could be dealt with by way of a further application to the court. Chubb Insurance Co. of Canada v. Novex Insurance, [2012] I.L.R. ¶I-5337 Garage Automobile Policy Insurer Required To Pay Defence Costs and Indemnity but Not Necessarily Exclusively Ontario Superior Court of Justice, September 20, 2012 The respondent owned and operated a tilting-bed tow truck that was insured by Lombard General Insurance Company of Canada (“Lombard”) under a garage automobile insurance policy. The respondent and Richard Spatola (“Spatola”) picked up some equipment for transport to the applicant’s house, which was insured by Co-operators General Insurance Company (“Co-operators”) under a home insurance policy. The applicant assisted with unloading the equipment from the truck. At some point, the respondent caused the bed to tilt, the equipment rolled, and Spatola was struck by it and injured. Spatola sued the respondent for damages, and the respondent commenced a third-party action against the applicant. The applicant referred the matter to Co-operators, which defended him and brought this application. Co-operators sought a declaration that Lombard was exclusively liable to pay the applicant’s defence costs and indemnity for damages assessed against the applicant in the action brought by Spatola. The application was allowed in part. There were two questions: (1) whether the applicant was an “occupant” of the truck within the meaning of the garage policy; and (2) whether the applicant fell within an exclusion in the home insurance policy. With respect to the first question, the Court was required to decided between two Court of Appeal decisions that reached opposite results on similar facts — Djepic v. Kuburovic, [2006] I.L.R. ¶I-4473, and AXA Insurance v. Dominion of Canada General Insurance, [2005] I.L.R. ¶I-4346. The Court concluded that the AXA decision was applicable. The vehicle was a truck with a special set of uses. It would be inconsistent with a purposive approach to construe a garage automobile policy to be categorical about the type of cargo a truck might ordinarily carry. The Court stated that the truck was built to carry “stuff” and it did so. As such, the Court concluded that Lombard was obliged to pay the applicant’s defence costs and indemnity for the damages assessed, but not necessarily exclusively. With respect to the second question, the Court held that because the precise cause of the accident and the applicant’s role in it 5 CANADIAN INSURANCE LAW REPORTER were not yet known (he had not been examined), the application was premature. The Court ordered that this remaining issue be tried immediately after the trial. Huestis v. Dahmer, [2012] I.L.R. ¶I-5339 Plaintiff Did Not Have Insurable Interest in Vehicle Ontario Superior Court of Justice, September 20, 2012 The plaintiff Wen was operating an Acura when she collided with a pedestrian. The pedestrian brought an action for damages for personal injuries against Wen and her common-law spouse, Shen; Unifund Assurance Company (“Unifund”) was a statutory third party, as it denied coverage to Wen and Shen in that action. The pedestrian’s insurer, State Farm Mutual Automobile Insurance Company (“State Farm”), was added as a party after this denial. Wen, Shen, and State Farm contended that Unifund was responsible for responding to the pedestrian’s claims. Unifund was the insurer of Shen’s two vehicles, and Shen called to add Wen’s Acura after the accident. Unifund alleged Shen and Wen contravened the insurance contract and/or committed a fraud by failing to disclose the accident and the proper owner of the vehicle. Wen and Shen argued that while Shen was not the registered owner of the Acura, he had an insurable interest in it. The action was dismissed. The Court applied the test set out by the Supreme Court of Canada in Kosmopoulos v. Constitution Insurance, [1987] I.L.R. ¶I-2147, and found that Shen did not have an insurable interest in the Acura. The evidence was clear he did not have a monetary interest in the vehicle, nor did he use it. The Court concluded that Wen never intended to sell the Acura to Shen; the story was fabricated to try to protect Wen from liability. In case it was incorrect in this regard, the Court proceeded to examine the second issue of whether Shen and Wen contravened the insurance contract and/or committed fraud. The Court concluded that the plaintiffs’ right to recover indemnity from Unifund was forfeited based on their actions. The Court found several instances of intentional misrepresentation, and it did not find Shen or Wen’s evidence credible. The Court accepted that Unifund’s representative asked Shen questions as prompted by a computer, which would have prevented the representative from moving to the next question until an answer had been entered. The Court found Shen denied the vehicle had been in an accident and that there were other drivers in the household. The Court also agreed with Unifund that section 258(9) of the Insurance Act allows an insurer to rely on any misrepresentations or policy breaches for the portion of its policy limit above the minimum limit. Wen v. Unifund Assurance, [2012] I.L.R. ¶I-5340 Although Breach of Trusts Fell Within Coverage, Exclusions Excluded the Loss Ontario Superior Court of Justice, September 17, 2012 International Warranty Company Limited (“IW”) sold extended warranties to purchasers of certain automobiles. Central Guaranty Trust Company (“CGT”) received the premiums as trustee for the purchasers of the warranty. IW was placed in receivership. The plaintiff Ernst & Young Inc. (“E&Y”) was the receiver of IW. The defendant Chartis Insurance Company of Canada (“Chartis”) was the insurer of CGT. Because of allegations that trusts had been breached, E&Y sued CGT. E&Y received a judgment in its favour of approximately $10 million, and attempted to realize that judgment by relying on the insurance issued by Chartis to CGT. The parties agreed that there would be remaining issues for trial, and therefore this was a motion for partial summary judgment, which both parties sought in their favour. Chartis argued that E&Y did not have standing to bring the action, or in the alternative that the policy did not cover the loss. The motion was granted in favour of the defendant. The Court found that E&Y had standing to bring the action, and that a breach of trust that occurred as a result of the insured’s failure to properly carry out its function as a trustee under the trust agreements and that caused a loss to beneficiaries would be covered under the policy. In this case, CGT intended money taken from the trust to be used to purchase security for the loan made to IW and that money taken from another trust be passed on to IW. The reasons for judgment of an earlier action left little doubt that the trusts were intentionally breached. However, the reasons did not indicate that CGT’s acts were undertaken with the intention of causing harm to the trusts; CGT undertook the acts on the understanding there was a surplus in the trusts. The Court found that coverage would be available where the wrongful act was intended but the consequent damage was not. However, the Court held that exclusions in the policy applied to withdraw coverage. CGT’s actions, as decided in a previous judgment, were dishonest or provided an illegal advantage. CGT misappropriated funds for its own benefit. The exclusions operated such that E&Y could not rely on the policy to satisfy the judgment it obtained against CGT. Ernst & Young v. Chartis Insurance Co. of Canada, [2012] I.L.R. ¶I-5341 6 CANADIAN INSURANCE LAW REPORTER Other Insurance Decisions ● Limitation Issue Should Have Been Considered Before Consolidation Issue Gordyukova v. Certas Direct Insurance, [2012] I.L.R. ¶I-5332, Ontario Court of Appeal (August 30, 2012) ● Examiner’s Efforts Were Reasonable Even Though Proposed Dates Were Outside 30-Day Period Benc v. Parker, [2012] I.L.R. ¶I-5333, Court of Appeal of Alberta (August 30, 2012) ● Insurer’s Application for Severance of Coverage and Bad Faith Claims Allowed Shaffner v. Insurance Corp. of British Columbia, [2012] I.L.R. ¶I-5336, Supreme Court of British Columbia (August 24, 2012) ● Insurer Entitled To Recover Under Bond, as It Held Honest Belief as to Validity of Obligee’s Claim Travelers Guarantee Co. of Canada v. Farajollahi, [2012] I.L.R. ¶I-5338, Supreme Court of British Columbia (August 31, 2012) ● Plaintiff Failed To Establish Prima Facie Case That He Was Incapable of “Gainful Employment” Bain v. Great-West Life Assurance, [2012] I.L.R. ¶I-5342, Supreme Court of British Columbia (September 19, 2012) ● Section D Action Was a Direct Action Subject to Two-Year Limitation Period Tucker v. AXA General Insurance, [2012] I.L.R. ¶I-5343, Supreme Court of Newfoundland and Labrador, Trial Division (September 25, 2012) Torts — Motor Vehicle Plaintiff’s Injuries Were Severe and Permanent but $300,000 in General Damages Appropriate as She Did Not Require Constant Supervision Supreme Court of British Columbia, September 20, 2012 The plaintiff suffered a head injury, multiple bone fractures, and other serious injuries when her vehicle was struck by a vehicle owned by the defendant Key West Ford Sales Ltd. and leased to the defendant driver, who did not enter an appearance in the action or attend trial. The defendant and third-party insurer admitted that the driver had a blood alcohol content of .069 to .092 at the time of the accident; he was found guilty of dangerous operation of a motor vehicle causing bodily harm. Although the defendant and insurer formally disputed liability in their pleadings, they did not seriously contest the issue at trial. Among other damages, the plaintiff sought the upper limit for non-pecuniary damages. The action was allowed. The defendant driver was wholly at fault for the accident on the basis that he failed to meet the standard of care required of a reasonably competent driver when he pulled into the plaintiff’s lane of travel to pass a car in front of him. Turning to the assessment of damages, the Court accepted the plaintiff’s injuries as presented. While the plaintiff was completely independent in relation to bathing and dressing, and managed to control her own finances, which was a better result than expected, she would have permanent cognitive impairments and physical pain. With respect to non-pecuniary damages, the parties agreed the limit, adjusted for inflation, was $342,500 at the time of trial. The Court held that $300,000 was an appropriate award in the plaintiff’s circumstances, noting that while her injuries were severe, life-threatening, and chronic, the plaintiff was distinguishable from plaintiffs in some of the authorities in that she did not require constant supervision for her own protection. She continued to enjoy a considerable degree of independence. Clost v. Relkie, [2012] I.L.R. ¶M-2631 No Implied Consent To Drive Could Be Found From Father’s Failure To Press Theft Charges Ontario Superior Court of Justice, September 11, 2012 The defendant L.B. moved for summary judgment dismissing the plaintiffs’ claims against him. His son, S.B., took his vehicle without his consent and was involved in an accident that injured the plaintiffs. S.B. was 17 years old and did not have a valid driver’s licence. He had been drinking. S.B. was charged with driving without a licence and impaired driving, but L.B. did not press charges for theft. L.B. sought dismissal of the action on the ground that he did not give his son consent to drive the car. The motion was allowed. There was no express consent given by L.B. to his son to drive the car. Based on the evidence, 7 CANADIAN INSURANCE LAW REPORTER the Court concluded that S.B. also did not have implied consent to drive the vehicle. He had no licence and had never operated a vehicle prior to this occasion. The evidence also indicated that he knew his father would not have given permission to drive the car until he had gotten his learner’s permit and taken driving lessons, as his older brother had done. The Court noted that S.B. had never previously taken the car. L.B.’s decision not to press charges for theft was not indicative of consent — it was a logical decision given the charges already laid against his son. Fyfe v. Bassett, [2012] I.L.R. ¶M-2632 Defendants Not Permitted To Reopen Trial To Address Contributory Negligence Supreme Court of British Columbia, September 19, 2012 The plaintiff sought damages for injuries sustained in a motor vehicle accident. The issues of liability and quantum were severed. The Court issued reasons for judgment on liability on April 23, 2012, after a three-day trial; liability was apportioned 90% to the defendant Fichten and 10% to the defendant Bahniwal. The order had not yet been entered when counsel for the defendants submitted that there had been an oversight and that the issue of contributory negligence should have been addressed at trial. In this regard, they produced evidence that at the plaintiff’s examination for discovery, she admitted that she had not been wearing a seat belt. The plaintiff did not testify at trial. The defendants’ application was dismissed. The reasons for judgment stated that there was no allegation of contributory negligence against the plaintiff, but Bahniwal did in fact allege in his pleadings that the plaintiff was contributorily negligent in failing to use her seat belt. The Court found that it had discretion, after the judgment but before an order was entered, to permit reopening a trial. However, the Court found that the defendants had their opportunity at trial to raise the defence of contributory negligence. They failed to show that there would be a miscarriage of justice if the trial was not reopened. Although the plaintiff had admitted she was not wearing her seat belt, there was no evidence regarding her injuries before the Court that could possibly change the result of the trial. The Court also found that it was likely the trial would have been conducted differently if the issue of contributory negligence had been pursued, and it would be unfair to the plaintiff to re-open the trial on liability at this point. The Court noted an additional complication: a different judge would have to hear the matter, as the judge had now retired from the court. Matheson v. Fichten, [2012] I.L.R. ¶M-2633 Court Permitted Extension of Time for Service Due to Erroneous Affidavit Court of Queen’s Bench of Alberta, September 27, 2012 The defendant Reimer was noted in default in two actions. The actions involved a motor vehicle accident that killed E. Sanderson and permanently injured the plaintiff Lowe. The accident allegedly occurred after some stunt and race driving involving two motor vehicles, one of which was driven by Reimer. The plaintiffs had relied on the erroneous affidavit of a process server who swore he had served Reimer with the statements of claim in both actions. It had since been determined that someone other than Reimer had been served. Reimer provided evidence that he had moved from the address of service several months before service, and he did not learn of the existence of the two claims until almost two years later. He brought this application to set aside the default and strike the statements of claim against him, or in the alternative grant him leave and extend the time to permit him to file statements of defence. The application was allowed in part. The Court noted that there was no suggestion Reimer was evading service or was unavailable to be served. There was also no suggestion of bad faith on the plaintiffs’ behalf. Various issues were raised. The statement of claim had expired, but the Court determined that it had the discretion to renew it. Regarding the Praecipe to Note in Default, the Court found it should be set aside, as it was entered without proper service being effected. Finally, the Court analyzed whether it should exercise its discretion in the circumstances before it. The Court found that there was no general equitable or discretionary power to bypass the rules and permit the renewal of a statement of claim when the statutory provisions were not met, but there remained the general exception in Rule 3.27(1)(c). The Court concluded that it would exercise its discretion to permit an extension of time for service of the statements of claim for a period of 30 days from the date of entry of this judgment, and Reimer would have a further 30 days to file a defence. Sanderson Estate v. Potter, [2012] I.L.R. ¶M-2635 8 CANADIAN INSURANCE LAW REPORTER Other Motor Vehicle Tort Decisions ● Plaintiff Did Not Establish There Was Reasonable Belief That Claim Would Be Resolved by Agreement Gildart v. Minhas, [2012] I.L.R. ¶M-2628, New Brunswick Court of Queen’s Bench, Trial Division (September 17, 2012) ● Plaintiff Required To Litigate in Jurisdiction Where Accident Occurred Misyura v. Walton, [2012] I.L.R. ¶M-2629, Ontario Superior Court of Justice (September 25, 2012) ● Vehicle Owner Not Vicariously Liable as Public Park Was Not a “Highway” Persaud v. Suedat, [2012] I.L.R. ¶M-2630, Ontario Superior Court of Justice (September 17, 2012) ● Plaintiff Did Not Have Reasonable Quality of Life; Court Awarded $250,000 in General Damages Yick v. Johnson, [2012] I.L.R. ¶M-2634, Supreme Court of British Columbia (October 9, 2012) ● Plaintiff Was Permitted To Add City as Defendant Outside Limitation Period Middelaer v. Berner, [2012] I.L.R. ¶M-2636, Supreme Court of British Columbia (October 4, 2012) Torts — General Minor Permitted To Proceed Anonymously in Pursuit of Cyberbully; Lower Courts Erred in Failing To Consider Objectively Discernable Harm Supreme Court of Canada, September 27, 2012 A 15-year-old girl appealed the decision of the Nova Scotia Court of Appeal upholding the denial of her request for permission to anonymously seek the identity of the creator of a Facebook profile that posted her picture and made unflattering commentary about her. The profile also listed other particulars that identified her and made sexually explicit references. The girl sought the information to identify potential defendants in an action for defamation and also sought a publication ban on the content of the profile. The lower court granted the order requiring the Internet service provider to disclose the information about the publisher of the fake profile, but denied the request for anonymity and the publication ban. That decision was upheld by the Court of Appeal. The girl appealed again. The appeal was allowed in part. The Court held that both lower courts erred in failing to consider the objectively discernible harm to the girl. Although evidence of direct, harmful consequence to an individual is relevant, the courts can also determine that there is an objectively discernible harm. The Court found that the girl should be entitled to proceed anonymously, but once her identity had been protected, there was no reason for a further publication ban preventing the publication of the non-identifying content on the fake Facebook profile. The girl’s privacy interests were tied both to her age and to the nature of the victimization she sought protection from. This was not simply a question of her privacy but of her privacy from the “relentlessly intrusive humiliation of sexualized online bullying.” The recognition of the inherent vulnerability of children has consistent and deep roots in Canadian law. In the context of sexual assault, the courts have already recognized that protecting a victim’s privacy encourages reporting by victims. It was not a great analytical leap to conclude that a child would be more likely to protect himself or herself from bullying if the protection could be sought anonymously. Therefore, if the right of children to protect themselves from bullying is valued, the appellant’s anonymous pursuit for the identity of her cyberbully should be allowed. However, there was little justification for a publication ban on the non-identifying content of the profile; not including these elements in the publication ban would permit the public’s right to open courts and press freedom to prevail. A.B. v. Bragg Communications Inc., [2012] I.L.R. ¶G-2470 Plaintiffs Permitted To Amend Originating Notice Despite Previous Dismissal Court of Queen’s Bench of Alberta, September 17, 2012 The plaintiffs were a minor and his mother who pursued the defendants in a medical malpractice action. In April 2008, the plaintiffs sought registration of a Montana judgment in Alberta, pursuant to the Reciprocal Enforcement of Judgments Act. The Court heard the application in April 2009 and dismissed it in September 2009. The decision was not appealed. The plaintiffs then pursued a debt action that was ultimately decided in the defendant’s favour. The plaintiffs now sought to amend the originating notice filed in April 2008 to add the debt claim. They submitted that the Limitations Act clearly indicates that the defendant could not object on the basis of passage of limitation periods when an otherwise statute-barred claim is added to a proceeding that was commenced within the applicable limitation period, so long as the claim is related to the conduct, transaction, or events described in the original pleading in the 9 CANADIAN INSURANCE LAW REPORTER proceeding. The application was allowed. The Court noted that the plaintiffs’ claims against the defendant had never been adjudicated: the plaintiffs obtained a default judgment in Montana, and the 2009 Alberta proceedings dealt with the issue of whether the defendant had a substantial connection to Montana when the proceedings against her in Montana were commenced. In addition, the dismissed debt action dealt with the limitation period for suing on the debt. As a result, the main action was “alive.” It was commenced in 2008, and at that time the applicable period for dismissal for delay was five years. The Court concluded that, considering the actual wording in the originating notice, it could not be said that everything contemplated by the originating notice had been litigated. There was therefore no technical reason pursuant to the Rules of Court to bar the plaintiffs’ claim for “further relief” pursuant to their originating notice. The Court also stated that the plaintiffs were not seeking to re-open the judgment, nor were they attempting to circumvent an appeal. Res judicata, issue estoppel, and cause of action estoppel were not, according to the Court, affected by or applicable to this decision. Finally, the Court found that the defendant was not prejudiced by the application. Laasch v. Turenne, [2012] I.L.R. ¶G-2471 Other General Tort Decisions ● Preservation Order Granted for Life Insurance Proceeds That Were Subject of Forfeiture Action Ontario (Attorney General) v. $51,000.00 In Canadian Currency (In Rem), [2012] I.L.R. ¶G-2472, Ontario Superior Court of Justice (September 14, 2012) ● Defendant Not Entitled To Avoid Settlement Agreement Lahti v. Pitka, [2012] I.L.R. ¶G-2473, Queen’s Bench for Saskatchewan (September 26, 2012) ● Nothing Escaped From Defendant’s Parking Lot To Cause Plaintiff’s Slip and Fall on Adjacent Sidewalk Shane v. 3104854 Nova Scotia Ltd., [2012] I.L.R. ¶G-2474, Supreme Court of Nova Scotia (September 17, 2012) CANADIAN INSURANCE LAW REPORTER 10 CANADIAN INSURANCE LAW REPORTER 11 12 CANADIAN INSURANCE LAW REPORTER CANADIAN INSURANCE LAW REPORTER Published monthly as the newsletter complement to the Canadian Insurance Law Reporter by CCH Canadian Limited. For subscription information, contact your CCH Account Manager or call 1-800-268-4522 or 416-224-2248 (Toronto). For CCH Canadian Limited Brenna Wong, BA, Editorial Team Leader Legal and Business Markets (416) 224-2224, ext. 6227 email: Brenna.Wong@wolterskluwer.com Allison Lau, Marketing Manager Legal and Business Markets (416) 224-2224, ext. 6153 email: Allison.Lau@wolterskluwer.com Rita Mason, LLB, Director of Editorial Legal and Business Markets (416) 228-6128 email: Rita.Mason@wolterskluwer.com Editorial Board Katja Kim, LLB, Contributor © 2012, CCH Canadian Limited Notice: This material does not constitute legal advice. Readers are urged to consult their professional advisers prior to acting on the basis of material in this newsletter. CCH Canadian Limited 300-90 Sheppard Avenue East Toronto ON M2N 6X1 416 224 2248 1 800 268 4522 tel 416 224 2243 1 800 461 4131 fax www.cch.ca ● ● CILL