Fundamentals Of Accounting Manual #2

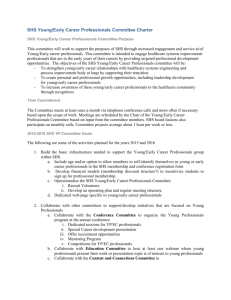

advertisement