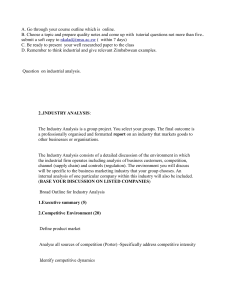

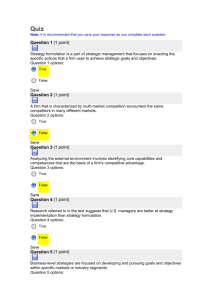

strategic management

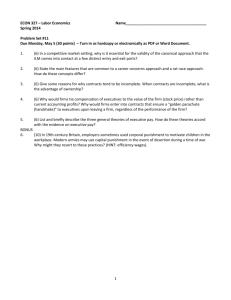

advertisement