complete case study

advertisement

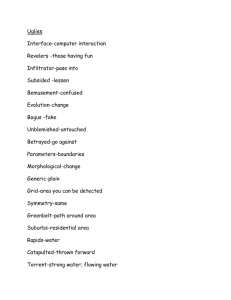

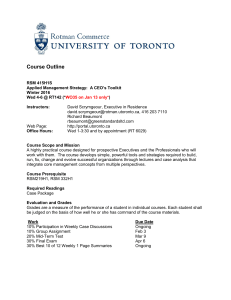

Re-balance your portfolio to respond to market shifts! The customer experience is the Marketing! Whirlpool Canada LP Strategic Growth Channel Strategy Exploration COMPANY SNAPSHOT Whirlpool Corporation is a dominant market leader in the home appliance industry, by various measures. Whirlpool enjoys worldwide revenue of $19 Billion, operates 66 manufacturing and technology research centres and employs 68,000 people around the world. In Canada, Whirlpool’s annual revenue exceeds $1 Billion, employs 500 people and has a commanding market share with 8 well known brands, including; Whirlpool, Maytag, KitchenAid, Jenn-Air, Amana, Inglis, Estate and Roper. THE QUESTION With the ‘Law of Large Numbers’ working against them, how can Whirlpool Canada sustain industry leading profitable growth? How can new channel initiatives achieve additional growth void of conflict and cannibalization of conventional channel partner success? Azure Corporation Phone: 905.939.9444 • Toll Free: 1.877.323.7906 | howcanwehelp@enablingideas.com | www.enablingideas.com Put an end to status quo Rotman Information Solutions Phone: 416.978.1912 | heather.wilson@rotman.utoronto.ca | www.rotman.utoronto.ca/bic/InfoSolutions/infoSolutions.htm In Canada, Whirlpool’s annual revenue exceeds $1 Billion, employs 500 people and has a commanding market share with 8 well known brands. FACTS AND FIGURES THE MARKET ECONOMICS: A large market with manufacturer sales in Canada estimated at $3 Billion (4.8 Million units), with an average gross margin of 29.5, translating to $4.25 Billion of revenue at retail. A mature, slow growth market (economic indicators predicting a near-term decline), new growth will not come from market trend but from micro-segment opportunities, winning competitive share through strategic advantage or new revenue streams from the creation of new complementary businesses. DISTRIBUTION CHANNEL / RETAIL MODEL PERFORMANCE: Industry distribution across all channels and regardless of which channel (i.e. national, regional, independent) is well saturated and largely undifferentiated. Although all channels are experiencing a performance decline due to cyclical economic factors, power shifts are taking place within the retail models, with Home Improvement wining share strength and conventional appliance retailers waining. Winning Channel Estimated Change Cause Nationals Regional Power Retailers -9% units decline - 10% units decline Gain in Home Improvement retailers Buying power, scale efficiencies, winning in Premium Dept Store Independents -11% units decline -11% units decline Dept store model losing consumers in general Cost/price disadvantaged, losing in all segments Winning Model Estimated Change Cause Home Improvement Natl Electronics Home Furnishings -4% units decline - 6% units decline -10% units decline Holding on to Mass, inroads in Premium Same winning success with Mass / Prem as HI High margin furn allow competitive pricing with appl -11% units decline -11% units decline -12% units decline Inability to hold mass segment sales, price compete Inability to hold mass segment sales, price compete Dept store model is losing consumers in general Losing Channel Losing Model Appliance Specialty Independents Dept Stores Azure Corporation Phone: 905.939.9444 • Toll Free: 1.877.323.7906 | howcanwehelp@enablingideas.com | www.enablingideas.com Put an end to status quo Rotman Information Solutions Phone: 416.978.1912 | heather.wilson@rotman.utoronto.ca | www.rotman.utoronto.ca/bic/InfoSolutions/infoSolutions.htm INSIGHT Our analysis uncovered an economic profit opportunity within Whirlpool’s existing distribution assets, requiring no additional capital investment. By restructuring current levels of investment from weakening channels / retail models to strengthening channels / retail models, Whirlpool would capture implicit growth resulting in an improved ROI. With largely undifferentiated distribution channels, further Implicit Economic Growth Investment Rebalance Relationship Advantage Marketing Redistribution untapped share growth is available by shifting channel spending to investing in the end-customer relationship (again an economic redistribution resulting in an improved ROI). THE SMART ANSWER Growth can come from only two places; (1) a growing market or (2) winning more from others. Our smart answer was in uncovering and capitalizing on the hidden opportunity for both. Investment Rebalance A distribution structure in economic terms is similar to an investment portfolio. Although you require diversification to have access to various markets and mitigate risk, as a business asset like any other financial asset, to maximize ROI it is necessary periodically and systematically to re-balance your portfolio to respond to market shifts. Our strategy validation analysis unearthed market shifts taking place that created an ROI lift opportunity by re-balancing Whirlpool’s distribution asset portfolio. Marketing Redistribution In an environment where the value chain power is disproportionally held by retailers due to a highly mature and well-saturated product market, manufacturer ROI is directly proportionate to a customer demand advantage versus competitive and substitute product choices. Re-framing the marketing model from channel push to demand pull we uncovered an ROI lift opportunity at the same spend level. Analysis of successful experience-based marketing models demonstrated that through an integrated strategy when “the customer experience is the Marketing”, demand advantage and in-turn value chain power and maximum ROI calibrates to the owner of the customer experience. SERVICES PROVIDED Senior Leadership Team workshop; Research framing; Facts and data search and assembly; Modelling and analysis; Financial validation; Business strategy and implementation plan; Marketing activity plan Azure Corporation Phone: 905.939.9444 • Toll Free: 1.877.323.7906 | howcanwehelp@enablingideas.com | www.enablingideas.com Put an end to status quo Rotman Information Solutions Phone: 416.978.1912 | heather.wilson@rotman.utoronto.ca | www.rotman.utoronto.ca/bic/InfoSolutions/infoSolutions.htm