The Economy of Puerto Rico

advertisement

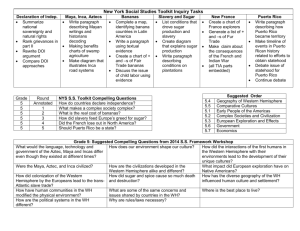

The Economy of Puerto Rico Presentation to the Puerto Rico Association for Financial Professionals Jim Orr Research and Statistics Group October 24, 2014 Puerto Rico Key features of the economy – – – – Bi-lingual, well-educated labor force Central location in the Caribbean Dollar economy with strong links to the U.S. mainland Host to numerous U.S. multinational corporations Figure 1. Real GNP Growth in Puerto Rico and the United States Percent Percent 10 10 8 8 Puerto Rico 6 6 United States 4 4 2 2 0 0 -2 -2 -4 -4 1981 1984 1987 1990 1993 1996 1999 2002 2005 2008 Sources: Puerto Rico Planning Board; U.S. Bureau of Economic Analysis. Note: Puerto Rico GNP is on a fiscal year basis; U.S. GNP is on an annual basis. 2011 2014 Figure 2. Real GNP Per Capita: Puerto Rico 2013 $U.S. thousands 25 20 15 10 1969 1973 1977 1981 1985 Source: Puerto Rico Planning Board. 1989 1993 1997 2001 2005 2009 2013 Figure 3. Economic Activity Index: Puerto Rico Index (Jan1980 = 100) 160 155 150 145 140 135 130 125 120 2001 2003 2005 2007 Source: Government Development Bank for Puerto Rico. 2009 2011 2013 Figure 4. Trends in Puerto Rico’s Payroll Employment Thousands Thousands 360 750 700 320 Private Employment 650 Government Employment 280 600 550 2002 240 2004 2006 Source: Bureau of Labor Statistics. Note: Data are seasonally adjusted. 2008 2010 2012 2014 Figure 5. Unemployment Rate in Puerto Rico and the United States Percent 30 25 20 Puerto Rico 15 10 5 United States 0 1976 1980 1984 1988 1992 1996 2000 2004 2008 2012 Source: Bureau of Labor Statistics. Notes: Data are seasonally adjusted; shading indicates periods designated recessions (mainland) by the National Bureau of Economic Research. Figure 6. Population of Puerto Rico Thousands 4000 3750 3500 3250 3000 2750 2500 1969 1973 1977 1981 Source: U.S. Census Bureau. 1985 1989 1993 1997 2001 2005 2009 2013 Figure 7. Debt-to-Income Ratio: Puerto Rico Debt/GNP (percent) 120 100 80 60 40 20 0 2000 2002 2004 2006 2008 2010 2012 Sources: Office of Management and Budget; Commonwealth’s Comprehensive Annual Financial Report; 2014 Series A Bond Prospectus. Note: Total government debt is shown as a percentage of annual GNP. Figure 8. Trends in Puerto Rico’s Government Balance1 $U.S. Billions FY 2000 FY 2005 FY 2010 FY 2011 FY 2012 10.8 10.8 13.7 13.6 15.2 15.2 15.5 15.5 15.8 15.8 9.7 9.2 0.5 16 15.3 0.7 17.6 16.3 1.3 17.4 15.8 1.6 19.1 17.4 1.7 Net interfund transfers 4 -1.6 0.5 0.3 0.2 0.2 Primary fiscal balance5 0 -1.2 -0.8 -0.1 -1.4 Fiscal balance6 -0.5 -1.9 -2.1 -1.7 -3.1 GNP7 41.4 54.9 64.3 65.7 68.7 Revenues 2 Non-interest revenues Total expenditures 3 Non-interest expenditures Interest expenditures Primary balance/GNP (%) 0.0 -2.2 -1.2 -0.2 Sources: Comprehensive Annual Financial Report (CAFR) 2011-2012, p. 286. GNP is from Economic Report to the Governor, 2013. -2.0 1 The scope of government shown here is the "primary government" as defined in the FY 2012 CAFR, which includes the central government and certain blended component units, notably including COFINA and the PBA, but excluding the public corporations like PREPA and PRASA. 2 Includes taxes, charges for services, intergovernmental revenues, interest and investment earnings, and other. Excludes proceeds from debt issues. 3 Includes current expenditures and capital outlays and excludes amortization payments. 4 Computed from "Transfers in” minus “Transfers out" on p. 286 of the CAFR; here it is treated as a net revenue item. 5 Non-interest 6 Primary revenues minus non-interest expenditures plus net interfund transfers. fiscal balance minus net interest expenditures. 7 Updated per Planning Board Revisions 2014. Figure 9. Composition of Puerto Rico’s Public-Sector Revenues 6,778 Intergovernmental revenue 10,082 General revenue from own sources Public enterprise revenue 9,650 Sources: Office of Management and Budget; Commonwealth’s Comprehensive Annual Financial Report; 2014 Series A Bond Prospectus. Note: Revenues are in millions of dollars. Figure 10. Revenues: Puerto Rico Compared with the States and Washington, D.C. Percentile of States and D.C. 25th 50th 75th Puerto Rico Puerto Rico rank (1) State Tax Revenues as Percentage of Aggregate Income 7.8 8.7 9.6 14.0 2/52 (2) Total State Revenues as Percentage of Aggregate Income 20.4 22.9 26.1 38.6 1/52 Sources: Government Development Bank for Puerto Rico; Commonwealth’s 2012 Comprehensive Annual Financial Report; Census of Governments, 2012; U.S. Bureau of Economic Analysis. Note: Gross national product is used for Puerto Rico and gross state product is used for the states and Washington, D.C. Figure 11. Composition of Puerto Rico’s Outstanding Debt Puerto Rico: General Government Debt1 As of December 2013 $U.S. Billions Percent of Total General obligation and/or full faith and credit debt 2 15.8 22.0 COFINA Municipalities and other 15.6 13.2 21.7 18.4 Tax revenue anticipation notes Public corporations and agencies 1.1 26.2 1.5 36.4 Total 71.9 100.0 Sources: March 2014 Series A Prospectus, p. 33; public corporation debt is sourced from Quarterly Report dated February 18, 2014, p. 36. 1 In March 2014, Puerto Rico issued $3.5 billion of debt securities. After refinancings and deductions, total debt rose to $72.8 billion. Debt payable from revenues from “internal sources,” that is, income taxes, is guaranteed by the Puerto Rican constitution. 2 Figure 12. 2012 Debt: Puerto Rico Compared with the States and Washington, D.C. Percentile of States and D.C. 25th 50th 75th Puerto Rico total debt Puerto Rico rank (1) Total State/Local Debt as Percentage of Aggregate Income 13.7 16.8 19.5 100.7 1/52 (2) Federal and State/Local Debt as Percentage of Aggregate Income 83.9 94.1 100.9 100.7 14/52 Sources: Government Development Bank for Puerto Rico; Commonwealth’s 2012 Comprehensive Annual Financial Report; Census of Governments, 2012; U.S. Bureau of Economic Analysis. Note: Gross national product is used for Puerto Rico and gross state product for the states and Washington, D.C. Figure 13. 2012 Revenues: Puerto Rico and Other Economies Percentile of 30 Nations 25th 50th 75th Puerto Rico Puerto Rico rank (1) Total Revenue as Percentage of GDP, Advanced Economies 34.6 40.8 46.8 38.6 19/31 (2) Total Revenue as Percentage of GDP, Emerging Economies 22.1 26.3 35.6 38.6 5/30 Sources: Government Development Bank for Puerto Rico; Commonwealth’s 2012 Comprehensive Annual Financial Report; International Monetary Fund. Note: Gross national product is used for Puerto Rico and gross domestic product for the others. Figure 14. 2012 Expenditures: Puerto Rico and Other Economies Percentile of 30 Nations 25th 50th 75th Puerto Rico Puerto Rico rank (1) Total Expenditure as Percentage of GDP, Advanced Economies 40.8 44.0 47.2 50.1 6/31 (2) Total Expenditure as Percentage of GDP, Emerging Economies 24.3 30.5 38.2 50.1 1/30 Sources: Government Development Bank for Puerto Rico; Commonwealth’s 2012 Comprehensive Annual Financial Report; International Monetary Fund. Note: Gross national product is used for Puerto Rico and gross domestic product for the others. Figure 15. Debt Burdens in Advanced Economies Including Puerto Rico 250 Percent of Annual GDP 200 150 100 50 0 Sources: Government Development Bank for Puerto Rico; Commonwealth’s 2012 Comprehensive Annual Financial Report; International Monetary Fund. Note: Gross national product is used for Puerto Rico and gross domestic product for the others. Figure 16. Debt Burdens in Emerging-Market Economies Including Puerto Rico 120 Percent of Annual GDP 100 80 60 40 20 0 Sources: Government Development Bank for Puerto Rico; Commonwealth’s 2012 Comprehensive Annual Financial Report; International Monetary Fund. Note: Gross national product is used for Puerto Rico and gross domestic product for the others. Figure 17. Municipal Single-State GO Spreads to U.S. Treasury Basis points Basis points 800 300 PR GO 10yr 700 200 600 IL GO 10yr 500 100 MI GO 10yr 400 0 300 AAA GO 10yr 200 Aug-12 Feb-13 Source: Thomson Reuters. Note: GO is general obligation. -100 Aug-13 Feb-14 Steps to improve fiscal outcomes and restore access to low-cost credit Step 1: Reinvigorate efforts to raise economic growth Step 2: Reform the Commonwealth’s tax system Step 3: Improve the Commonwealth’s financial reporting Steps to improve fiscal outcomes and restore access to low-cost credit Step 4: Strengthen performance and harden budget constraints for public-sector corporations Step 5: Adopt a capital budget and binding balancedbudget rule for the central government Step 6: Adopt a legislative framework requiring multiyear budgeting, specific fiscal targets, and monitoring mechanisms to help ensure those targets are met