Dear Tony Grant Thornton New Zealand Limited (Grant Thornton) is

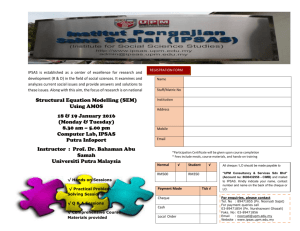

advertisement