GST & FBT - Flinders University

advertisement

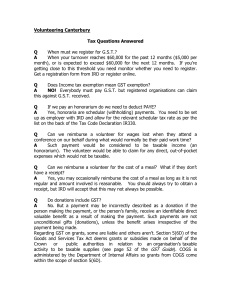

GST & FBT School of Medicine Agenda • GST – GST Basics – Receivables • Donations – Payables • Compliant Tax Invoices • Types of Transactions • FBT – Taxable Benefits – Entertainment 1 GST Basics • GST is a broad based consumption tax, generally charged at 10% on most goods and services consumed in Australia. • As an enterprise who is registered for GST, the University : – Collects GST on sales – Pays GST on purchases • Claim Input tax credits GST Basics • GST : 10% or 1/11th. • Zero Tax / GST Free : Non taxable supply. • NA : Out of scope – No supply or no consideration – Supplier not registered for GST • Export tax : (Receivables) Supplies not connected with Australia. • Input Taxed : Where GST is not charged but ITC can not be claimed. 2 Receivables & GST Cost Centre Revenue $20,000 Sales Customer : $22,000 Central GST Account $2,000 ATO Receivables & GST • GST (Tax Code : C) – Consulting services • GST Free (Tax Code : F) – – – – course fees for recognised courses course materials for recognised courses academic transcripts medical services • Out of scope (Tax Code : NA) – Government appropriations, donations & gifts – There is no supply (eg reimbursements) • Export Tax (Tax Code : E) – Supplies not connected with Australia 3 Donations & Gifts • What is a donation ? – Gifts, where no material benefit to the donor – Some grants, unless they are made for a return for services or an appropriation – Unconditional sponsorship • ITEC & DGR status Donations & Gifts Procedure • All donations are receipted to the Gift Fund in the first instance. 01.822.00429.0502 • Funds are then transferred to the CC/Project using account code ‘0991’. • Tax Code : N/A • The receipt issued from Cashiers should show the following: – Flinders University ABN – Words “TAX INVOICE” AND “Gift” – Date of receipt – Amount of receipt – Name of donor 4 Payables & GST Cost Centre Expense $500 Purchases Supplier : $550 Central GST Acct $50 ATO Payables & GST • Input Tax Credits (ITC) are claimed from ATO on acquisitions. – – – – Supplier must have ABN Supplier must be registered for GST Compliant Tax Invoice (purchases > $82.50 GST incl) Taxable Supply 5 Payables & GST • GST Free (Tax Code : Z) – GST Free supplies (eg. basic food, education, medical services) • Not applicable (Out of scope, Tax Code : NA) – Supplier is not registered for GST – Supplier doesn’t provide compliant Tax Invoice – International supply (eg. airfares) Payables & GST Spendvision BasWare Receivables GST GST Free 10% GST 0% GST C Z C F Out of Scope N/A NA NA GST Only Input Taxed Duty Tax Input Tax G I I - - E Export 6 Compliant Tax Invoice < $1,000 > $1,000 ABN of Supplier Y Y ‘Tax Invoice’ Y Y Date of Issue Y Y Supplier Name Y Y Description of goods/service Y Y ‘the total price includes GST’ or the GST amount Y Y Name of recipient Y Address or ABN of recipient Y Quantity of goods/services Y 7 • What documents do I need if the company is not registered for GST ? – Invoice – If a company is not registered for GST then it will not charge GST and should not provide Tax Invoice – The words ‘Not registered for GST’, if possible. – Tax Code : NA • What documents do I need if the supplier doesn’t have an ABN ? – – – – – – Supplier is not an enterprise (private capacity or hobby) Supplier is a non-resident Total payment less than $75 Supplier must not be employee Statement by supplier 46.5% must be withheld 8 Payables : Transactions • Deposits : If GST charged and a compliant tax invoice is supplied then we can claim ITC : Tax Code : C – Security Deposit • No supply (eg keys) • GST only applies if (and when) deposit is forfeited • Tax Code : N/A – Part-payment • Depends on method used by supplier • If part payment includes GST, then can claim ITC – Tax Code : C / 10% GST Payables : Transactions • Travel reimbursements – Mileage : no supply, so Tax Code : NA – Fuel : • If tax invoice submitted for payment & GST included. Tax Code : C / 10% GST • If no tax invoice, Tax Code : NA • Overseas transactions – Tax Code : NA – Only where supplier is registered for GST in Australia 9 Cheque • Used for reimbursing students or external requisition people. If supplier is registered for GST and provides Tax Invoice GST Free supplies (Z) or No Tax Invoice (NA) External Entities for GST • • • • • • CRH, AHURI, CGS Flinders Partners FRM FCCS FMC Flinders University Child Care Centre 10 GST Questions ? FBT Basics • Tax payable on a non-salary benefit provided to an employee. • Employee : current, former or future. • The FBT rate is 46.5% and is calculated on a grossed-up value of the benefit. – Eg. a benefit worth $1,100 (tax inclusive) = $1,100 x 2.0647 x 46.5% therefore FBT payable is $1,056. • Payroll tax is also calculated on any FBT paid (5%). • Some benefits are reportable benefits. 11 FBT • Is there a fringe benefit ? “Benefit” includes any right, privilege, service or facility. – – – – – – – Cars Entertainment Travel Gifts/Prizes Expense reimbursements Salary sacrifice arrangements Housing (Free or reduced-rate) • Is the benefit taxable ? – ‘Otherwise deductible’ • (Business use) Mobile Phones & ADSL • Education & Professional Development (not HECS) • Business travel – Minor & infrequent benefits exemption • < $300 • Doesn’t apply to entertainment for tax-exempt bodies • Gifts/Prizes – Property consumed on business premises • Books & Stationery – Exempt benefits • Some relocation costs 12 Taxable benefits • Personal use of mobile phones or ADSL : taxable • Work cars provided for personal use – Work-to-home travel : taxable – Fleet vehicles garaged at home : taxable • Personal travel – Incidental to business trip : non taxable • HECS : not ‘otherwise deductible’ thus taxable. • Entertainment Taxable Benefits • Entertainment – Tea & Coffee : not entertainment, non taxable – Light refreshments • Meeting/Business context : not entertainment, non taxable • In house, unless eligible seminar (Sage restaurant not considered in house – open to public) – Alcohol • Appearance of recreation : taxable • Incidental to provision to third party : non taxable • Gift (< $300) : non taxable – Meals while travelling (for travelling employee only) : non-taxable – Recreation eg golf day or theatre tickets : taxable 13 Entertainment • Meals and entertainment provided to staff/associates, subject to FBT should be coded to 2050 • Any FBT will then be calculated and charged to your project, against code 3608 Eg. Current balance in 500.12345.2050 = $56 1. Multiply by 10% for GST inclusive figure = 56 x 10% = $61.60 2. Multiply by Gross up rate (2.0647) & FBT rate (46.5%) = $61.60 x 2.0647 x 46.5% = $59.14 • Meals and entertainment for visitors/clients should be code to 2057, tax code ‘I’ [Input Tax] • Provision of food/drink is determined not to be entertainment should be coded to 2051, tax code ‘C’ [for employees & visitors] FBT Questions ? 14