International Federation of Accountants Tadashi Sekikawa IPSASB

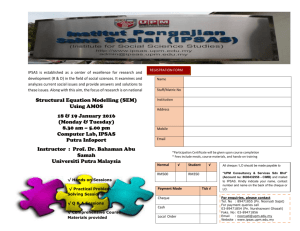

advertisement

International Federation of Accountants Overview of International Public Sector Accounting Standards Tadashi Sekikawa IPSASB Board Member Improving Public Sector Financial Management Seoul, Korea May 19, 2011 Disclaimer Views presented in this presentation are personal views of the speaker. They do not represent formal views of IPSASB or any other organizations with which the speaker is associated. Seoul, Korea (May 19, 2011) Overview of Session • • • • • • Scope and Authority of IPSASs Cash-basis IPSAS; at Present and its Review Accrual-basis IPSASs Accrual-basis IPSASs - PS Specific IFRS-based IPSASs – Major differences Q&A Seoul, Korea (May 19, 2011) Scope and Authority of IPSASs • The IPSASB develops IPSASs which apply to the accrual basis of accounting and IPSASs which apply to the cash basis of accounting • IPSASs set out recognition, measurement, presentation and disclosure requirements dealing with transactions and events in general purpose financial statements • The IPSASs are designed to apply to the general purpose financial statements of all public sector entities Seoul, Korea (May 19, 2011) Why IPSASB Develops Cash Basis? • IPSASB recognizes accrual basis financial reporting better serve the accountability and decision making purposes. • IPSASB also recognize that; 1) some countries have not been prepared to adopt full accrual based accounting; and 2) financial reporting need to be improved within the framework of cash basis accounting. Seoul, Korea (May 19, 2011) Cash-basis IPSAS • A comprehensive Cash Basis IPSAS that is specific to the public sector • It includes mandatory (Part 1) and encouraged (Part 2) disclosures sections • Financial Statement should be described as complying with the cash basis IPSAS only if they comply with all the requirements of mandatory disclosure section. Seoul, Korea (May 19, 2011) Review of Cash Basis IPSAS • A project is under way to: – Identify implementation issues in developing economies – Consider amendments to IPSAS & guidance in response • Task Force established in December 08 • • • • Lead data collection and make recommendations to IPSASB Questionnaire issued April 2009 – 46 responses received Follow-up discussions - Sept – Dec 2009 Progress report at Dec 2009 IPSASB meeting • Task Force Report to IPSASB for July 2010 meeting Seoul, Korea (May 19, 2011) Accrual-basis IPSASs IPSASB develops accrual basis IPSASs to address public sector financial reporting issues in two different ways: •Public Sector Specific IPSASs •IFRSs-based IPSASs Seoul, Korea (May 19, 2011) Accrual Basis IPSASs • IPSAS 1—Presentation of Financial Statements • IPSAS 2—Cash Flow Statements • IPSAS 3—Accounting Policies, Changes in Accounting Estimates and Errors • IPSAS 4—The Effects of Changes in Foreign Exchange Rates • IPSAS 5—Borrowing Costs • IPSAS 6—Consolidated and Separate Financial Statements • IPSAS 7—Investments in Associates • IPSAS 8—Interests in Joint Ventures • IPSAS 9—Revenue from Exchange Transactions • IPSAS 10—Financial Reporting in Hyperinflationary Economies • IPSAS 11—Construction Contracts • IPSAS 12—Inventories • IPSAS 13—Leases • IPSAS 14—Events After the Reporting Date • IPSAS 15—Financial Instruments: Disclosure and Presentation (to be withdrawn) • IPSAS 16—Investment Property • IPSAS 17—Property, Plant, and Equipment • IPSAS 18—Segment Reporting Seoul, Korea (May 19, 2011) Accrual Basis IPSASs (continued) • • • • • • • • • • • • • IPSAS 19—Provisions, Contingent Liabilities and Contingent Assets IPSAS 20—Related Party Disclosures IPSAS 21—Impairment of Non–Cash-Generating Assets IPSAS 22—Disclosure of Information about the General Government Sector IPSAS 23—Revenue from Non-Exchange Transactions (Taxes and Transfers) IPSAS 24—Presentation of Budget Information in Financial Statements IPSAS 25—Employee Benefits IPSAS 26—Impairment of Cash-Generating Assets IPSAS 27—Agriculture IPSAS 28—Financial Instruments: Presentation IPSAS 29—Financial Instruments: Recognition and Measurement IPSAS 30—Financial Instruments: Disclosures IPSAS 31—Intangible Assets IPSASs in white text are based on relevant IFRSs IPSASs in yellow text are public sector specific Seoul, Korea (May 19, 2011) Accrual Basis IPSASs – PS Specific Public Sector Specific IPSASs •By addressing public sector financial reporting issues: – that have not been comprehensively or appropriately dealt with in existing International Financial Reporting Standards (IFRSs) issued by the International Accounting Standards Board (IASB), or – for which there is no related IFRS; and Seoul, Korea (May 19, 2011) IPSAS 23 “Revenue from Non-exchange Transactions” • IPSAS 23 treats both taxes revenue and transfer revenue. • Main accounting issues on transfer inflow with “stipulations”, which are terms in laws or regulation, or a binding arrangement, imposed upon the use of a transferred asset by entities external to the reporting entity. Seoul, Korea (May 19, 2011) IPSAS 23 “Revenue from Non-exchange Transactions” (Continued) • Stipulations - Conditions : return obligation - Restrictions: without return obligation • Conditions on transferred assets are stipulations that specify that the future economic benefits or service potential embodied in the asset is required to be consumed by the recipient as specified or future economic benefits or service potential must be returned to the transferor. • Transfers without “conditions” are directly recognized as income • Transfers with “conditions” are recognized as income when conditions are fulfilled. Seoul, Korea (May 19, 2011) Social Benefit - History • November 2003 - ITC Accounting for Social Policies of Government approved. • March 2008: A package of documents comprising; 1)ED 34, Social Benefits: Disclosure of Cash Transfers to Individuals or Households, 2)Consultation Paper, Social Benefits: Key Issues in Recognition and Measurement ; and 3)A Project Brief on Long-Term Fiscal Sustainability Reporting published Seoul, Korea (May 19, 2011) Social Benefit – Current Status • • • IPSASB decided not to develop ED 34 into an IPSAS. IPSASB agreed that the general purpose financial statements cannot convey sufficient information about the financial condition of governmental programs providing social benefits. Start “Long-term fiscal sustainability” Project IPSASB decided that proposals for recognition and measurement should now be closely linked to work in Phase II of the Conceptual Framework project dealing with elements, particularly the definition of a liability. Seoul, Korea (May 19, 2011) Public Sector Specific Projects - ongoing Work is under way on the following: 1) Conceptual Framework – Paramount 2) Projects within Financial Statements – Service concession arrangements (SCAs) – Entity combinations 3) Projects outside FS but within Financial Report –Long-term fiscal sustainability –Service performance reporting –Narrative Reporting Seoul, Korea (May 19, 2011) Accrual Basis IPSASs – IFRS Based IFRS-based IPSASs • By developing IPSASs that are based on IFRSs by adapting them to the public sector context • IPSASB has committed continuous alignment of IFRS-based IPSASs with IFRSs Seoul, Korea (May 19, 2011) Alignment with IFRS • IFRS-based Standard Setting completed by 2009: – Financial instruments (IPSAS 28, 29 & 30, reflecting IAS 32, IAS 39 & IFRS 7) – Intangible assets (IPSAS 31) – Agriculture (IPSAS 27) • Renewed focus on regular liaison with IASB (Chair, Vice-Chair) • Maintaining IFRS-based IPSASs aligned with IFRS – Major improvements project to be done every 2 years after 2010 Seoul, Korea (May 19, 2011) Major Difference between IFRS-based IPSASs and IFRSs • Most IFRS-based IPSASs do not have major differences with corresponding IFRSs. (terms, examples, etc) • Process for reviewing and Modifying IASB Document (October 2008) 1) Whether identified PS issues warrant departures from IASB document 2) IPSASB will use professional judgment Seoul, Korea (May 19, 2011) Major Difference between IFRS - based IPSASs and IFRSs – IPSAS 1 IPSAS 1 “Presentation of Financial Statements” IPSAS does not incorporate concept of “comprehensive income” • IPSAS 1 was developed based on IAS 1 (revised in 2003) • IASB revised IAS 1 in 2007 to incorporate a concept “comprehensive income” • IPSASB have not yet considered this issue (IASB’s continuous development, IPSASB’s conceptual framework) Seoul, Korea (May 19, 2011) Major Difference between IFRS - based IPSASs and IFRSs – IPSAS 5 IPSAS 5 “Borrowing Cost” IAS 23 requires capitalized borrowing cost for qualifying assets. IPSAS 5 remain option of all expensing borrowing cost. • IPSAS 5 was developed based on IAS 23 (revised in 1993). • IASB revised IAS23 in 2007 to delete an expensing option. • IPSASB have discussed possible revision of IPSAS 5 and issued ED 35, but based on the responses to ED 35, IPSASB decided to consider the issue further using the preliminary views developed in the Measurement phase of its Conceptual Framework project. Seoul, Korea (May 19, 2011) Major Difference between IFRS - based IPSASs and IFRSs – IPSAS 18 IPSAS 18 “Segment Reporting” IPSAS 18 do not use “Management Approach”. • • • IPSAS 18 was developed based on IAS 14 (revised in 1997). IASB issued IFRS 8 in 2006, replacing IAS 14, to introduce “Management Approach”. The IPSASB considered possible revision of IPSAS 18, but the IPSASB is concerned about whether the underlying basis of IFRS 8 is readily transferable to the public sector. Possible implications for the Conceptual Framework project may also need consideration. The IPSASB decided that existing IPSAS 18 be retained unchanged. Seoul, Korea (May 19, 2011) Potential Impact of IASB's Major Project • IFRS 9 “Financial Instruments – Recognition and Measurement" • Revenue Recognition • Lease The IPSASB closely monitored activities of IASB and would consider necessary revisions to corresponding IPSASs. Seoul, Korea (May 19, 2011) Keep up to date on IPSASB projects • IPSASB Project Pages – All IPSASB projects http://www.ifac.org/PublicSector/ • IFAC eNews – Free electronic newsletter Enroll at www.ifac.org • IPSASB Publications - Downloadable free of charge at: http://www.ifac.org/Store/Category.tmpl?Category=Public%20Sector%20Accounting Seoul, Korea (May 19, 2011) Questions? Seoul, Korea (May 19, 2011)