Alec Barnett - Orange Value Fund

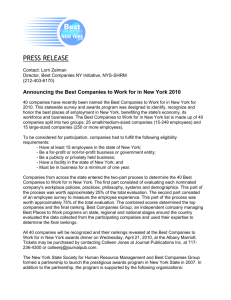

advertisement

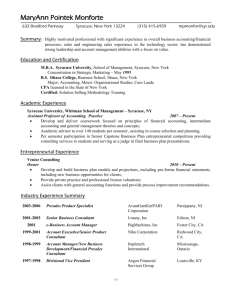

Alec Barnett 68 East 86th Street New York, NY 10028 (917) 855-1807 alexander.barnett@orangevaluefund.com EDUCATION Syracuse University Syracuse, New York Martin J. Whitman School of Management and S.I. Newhouse School of Public Communications Bachelor of Science in Finance/Public Relations; Minor in Economics; Expected 2014 • GPA: 3.67/4.00; Dean’s List: All semesters • Selected coursework: Financial Modeling for Investment Banking, Value Investing, Distressed Investing, Financial Accounting WORK EXPERIENCE Senior Analyst, The Orange Value Fund, LLC, August 2012 – Present Syracuse, New York The Orange Value Fund is a two-year money management and investment banking program, where students are trained to become both investment analysts and money managers while managing a $1.5 million portfolio using a deep value investment methodology similar in nature to Martin J. Whitman’s “safe and cheap” approach. • Create quarterly and annual financial reports for the Fund • Perform in-depth research and write investment reports on at least two portfolio companies and two new investment ideas • Track periodic developments for at least two portfolio companies by reading company press release, SEC filings, listening in to quarterly conference calls, and update research reports accordingly • Propose at least two new investment ideas to the Fund and participate in the creation of a “watch list” • Mentor junior Orange Value Fund analysts • Mentor a group of junior students in the Value Investing course • Complete the Advanced Financial Modeling for Investment Banking course module • Built a standalone operating model and discounted cash flow analysis for GameStop and Herbalife Investment Banking Summer Analyst, J.P. Morgan, Summer 2013 New York, New York • Worked in the Consumer / Retail coverage group • Prepared a valuation and strategic analysis on Elizabeth Arden, Inc. that was presented to senior bankers and group staffers o Spread relevant trading and transaction comparables for the lifestyle and beauty sector o Built a full three-statement standalone model that was complemented with discounted cash flow, leveraged buyout and cost of capital analyses o Offered strategic alternatives for the company, including potential acquisition targets • Created presentations and pitch materials for client meetings • Developed materials in response to client requests for various analyses and research o Built an aggregated transaction comparables database that include relevant multiples for over 800 transactions globally in the Consumer / Retail sectors • Prepared trading and transaction comparable analysis, along with extensive peer benchmarking analyses, for inclusion in presentation materials Investment Banking Summer Analyst, J.P. Morgan, Summer 2012 New York, New York • Worked in the Equity Capital Markets division o Spent four weeks with the Consumer / Retail team and four weeks with the Healthcare team • Performed investor targeting and shareholder evolution analysis for inclusion in client presentations and pitch presentations • Performed buy-side investor research that allowed clients to target investors that were most likely to participate in their equity offering • Summarized and created weekly market conditions slides for inclusion in client presentations • Drafted a weekly market and sector conditions update email that was sent out to over 200 Consumer / Retail clients • Selected transaction experience: o Worked on Idenix Pharmaceuticals $191mm follow-on offering § Built an analysis detailing new vs. existing investors and their participation in the offering § Built a stock price performance model for Idenix and its trading peers and distributed it to the deal team on an hourly basis over the two-day transaction § Participated in all calls related to the transaction including calls with management and targeted investors, allocation calls with management and the deal team, and the final pricing call § Took notes on all calls and distributed them to deal team members LEADERSHIP • Board Member, Syracuse University Inter-Fraternity Council Judicial Review Board, Spring 2012 • Vice President, Delta Kappa Epsilon Fraternity, Spring 2012 • Head of the Judicial Board, Delta Kappa Epsilon Fraternity, Fall 2011 Alexander “Alec” Barnett Alec’s passion for business, and in particular finance, has come from many sources. Alec was born and raised in the financial capital of the world, New York City. His father has had a long career in the financial industry, first working as an investment banker and then transitioning on to private equity. In high school, Alec was vice president of a student-run apparel business, which drove him to learn about the many different aspects of a business: sales, marketing/advertising, finance, and managing employees. After arriving at Syracuse as a public relations student in the Newhouse School of Public Communications, Alec soon realized that he wanted to further pursue his passion for business and finance and thus applied for a dual major in conjunction with the Whitman School of Management. Alec has completed several different finance and business related internships over the past few summers. His initial introduction to the world of finance came during an internship with Lenox Advisors, a wealth advisory firm serving high net worth and ultra-high net worth individuals. At Lenox, Alec interned with the Business Excellence and Private Wealth Management divisions, and learned about and developed an appreciation for asset management and portfolio allocation. The next summer, he took an intern role at Thomson Reuters, the world’s leading source of information for financial professionals. There he worked with the business development team that helped market Reuters Insider, an extensive multimedia project undertaken that sought to deliver information efficiently through video and audio to financial professionals. Hoping to gain some strong corporate finance experience, Alec leveraged his networking skills to earn a summer analyst position in J.P. Morgan’s investment bank for the summer of 2012. He proceeded to join the Equity Capital Markets group, where he worked with both the consumer/retail and healthcare teams. Alec believes that his experience within a fast-paced, markets-driven environment that promoted team work, communication, and accountability was a vital step forward in his future career in finance. He received an offer to return to J.P. Morgan for the summer of 2013, where he interned with the Consumer / Retail industry coverage team. His experience on the coverage side of investment banking sharpened his corporate finance skills, especially in the areas of accounting, valuation and financial modeling. Nicodemus Bownds 513 Walnut Ave #5, Syracuse, NY 13210 214-629-8174 | nicodemus.bownds@orangevaluefund.com EDUCATION Syracuse University Martin J. Whitman School of Management Syracuse, New York Bachelor of Science in Finance May 2014 • GPA: 3.75/4.00 • Honors: Dean’s list, Phi Theta Kappa Honor Society Scholarship, Syracuse University Dean’s Scholarship, Air Liquide Foundation Scholarship, Whitman School of Management Alumni Club Scholarship. WORK & LEADERSHIP EXPERIENCE The Orange Value Fund, LLC Syracuse, New York Senior Analyst August 2012-Present The Orange Value Fund is a two-year money management and investment banking program, where students are trained to become both investment analysts and money managers while managing a $1.5 M portfolio using a deep value investment methodology similar in nature to Martin J. Whitman's "safe and cheap" approach. • Create quarterly and annual financial reports for the Fund. • Perform in-depth research and write investment reports on at least two portfolio companies and two new investment ideas. • Track periodic developments for at least two portfolio companies by reading press releases, 8K filings, 10Q filings, DEF 14 and other SEC filings, listening in quarterly conference calls, media reports, and update research reports accordingly. • Participate in weekly investment meetings to discuss company and/or market developments that could affect portfolio holdings and/or create opportunities for new investments. • Propose at least two investment ideas to the Fund and participate in the creation of a "watch list". • Prepare presentations on new investment ideas to be presented to selected money managers in New York City. • Mentor Junior Orange Value Fund Analysts and supervise their work. • Mentor a group of junior students in the value investing class. • Complete the Advanced Financial Modeling for Investment Banking course module. GE Capital, Energy Financial Services Stamford, Connecticut Summer Analyst, Power Portfolio Team Summer 2013 • Performed quantitative and qualitative analysis on the EFS power portfolio to formulate strategies to increase EFS’s return on investment. • Visited a power plant with a senior portfolio manager to look at opportunities to optimizing the plants power production efficiency, reduce costs, and increase ROI. • Rebuilt the operating model for a 242MW power plant in Central Virginia. • Provided quantitative analysis for the strategy of a potential portfolio asset sell. BTIG, LLC Intern, Institutional Sales & Trading Division • Monitored equity markets and assisted in idea generation for potential trades. • Shadowed a managing director while developing a better understanding of the financial markets. Dallas, Texas Summer 2012 Syracuse University Investment Club Syracuse, New York President November 2012-Present • Manage the club’s equity account that contains holdings of $140,000 with a broker. • Organize and prepare materials for weekly meetings, arrange for guest speakers, and maintain relationships with alumni, industry professionals, and the Syracuse business community. Syracuse University Admissions Department Syracuse, New York Student Ambassador September 2012-Present • Research community colleges for possible transfer articulation agreements for the university’s individual colleges. • Participate in student panels for events, mentor incoming transfer students and answer email inquiries. • Work with the admission department’s senior leadership to improve the university’s admissions process. SKILLS, ACTIVITIES & INTERESTS • Bloomberg Certified (Equity, Fixed Income, Commodities, FX) • Wall Street Goes Orange Participant • SU Entrepreneurship Club • Hockey, football, basketball, hunting/fishing, kayaking, food, travel Nicodemus (Nico) Bownds Nicodemus Bownds is a senior majoring in finance at the Martin J. Whitman School of Management at Syracuse University and has made the Dean’s List each semester. Since arriving at Syracuse, Nico has been awarded Syracuse University’s Dean’s Scholarship, Phi Theta Kappa Scholarship, Air Liquide Foundation Award Scholarship, and the Whitman School of Management Alumni Club Scholarship through his hard work and performance in the classroom. Prior to coming to Syracuse, Nico played highly competitive ice hockey throughout the United States and Canada. From this experience, he transferred skills of hard work, dedication, leadership, and competitiveness from the rink to the classroom and workplace. Nico first acquired his interest in finance after realizing the important role finance plays throughout the business world. This past summer, Nico worked as a summer analyst for GE Capital’s Energy Financial Services (EFS) Division working in their Domestic Power Portfolio Team. In this role, Nico worked with senior management of the portfolio’s assets to formulate strategies to increase EFF’s return on investment. Also, Nico performed qualitative and quantitative analysis on the portfolio’s investments and rebuilt an operating model for the budget of a 242MW power plant. As a junior analyst in the Orange Value Fund, Nico prepared a distressed debt research report on Caesars Entertainment Corporation with one of the senior analysts. Nico completed quantitative and qualitative research on Caesars properties, subsidiaries, management, and industry regulations and pitched the investment idea to industry professionals in New York City. On campus, Nico serves as the President of the Syracuse University Investment Club. Nico manages the club’s accounts containing $150,000 in cash and securities, organizes weekly meetings, and works with the Whitman Career Center to bring in guest speakers. Nico also works with the Office of Admissions as a Transfer Student Ambassador. Nico has Bloomberg certifications in equities, foreign exchange, commodities, and fixed income. Outside of the classroom, Nico loves playing sports, fishing, hunting, and being active. Nico strives to be a leader and looks forward to overcoming future challenges and achieving his lifelong goals. PAUL LESTER GOLDSMITH paul.goldsmith@orangevaluefund.com | 413-218-2422 | 104 Fairhill Dr.| Longmeadow, MA 01106 Education Syracuse University Martin J. Whitman School of Management, School of Information Studies Bachelor of Science in Finance and Information Management and Technology GPA: 3.71/4.00 Dean’s List: Fall 2010; Spring 2011; Fall 2011, Spring 2012, Fall 2012, Spring 2013 Syracuse, NY May 2014 Work Experience The Orange Value Fund, LLC Syracuse, NY Senior Analyst August 2012-Present The Orange Value Fund is a two-year money management and investment banking program, where students are trained to become both investment analysts and money managers while managing a $1.5 M portfolio using a deep value investment methodology similar in nature to Martin J. Whitman's "safe and cheap" approach. • Performed deep analysis of companies resulting in new investment ideas for the fund to consider • Prepared models on CREE, Inc. for the fund’s consideration following an approach similar to Martin J. Whitman’s “safe and cheap” approach • Prepared reports on current holdings with regards to the fund’s future position on the company, specifically reported on GT Advanced Technologies during the fall of 2012 AllianceBernstein New York, NY Bernstein Global Wealth Management Private Client Intern June 2013-August2013 • Assisted seven financial advisors and six associates to bring clients the premier investment management service • Performed Wealth Forecasting Analysis for prospective and current clients • Produced Global Analytics on the performance of clients’ portfolios based on their asset mix • Prepared client review books for monthly and annual financial advisor meetings with clients • Prepared a daily market overview for use by advisors and associates when answering client questions about market moving news • Analyzed the firm’s current social media marketing strategy and developed and presented to senior management a new strategy to better appeal to the younger demographic of high net-worth individuals NFP Sports Springfield, MA Sales Associate May 2012-January 2013 • Secured vendor participation for the fundraising program for 40+ high school sports teams in Massachusetts • Organized and implemented fundraising programs, collected funds and performed accounting services • Exceeded vendor participation goal for the 2012 program by securing new vendor participation in addition to resigning vendors from past years Marcus Printing Co. Holyoke, MA Sales Associate, Delivery Person, Bindery Operator 2006-Present • Serviced numerous accounts as a sales associate for company’s retail sign products • Implemented a new online sales system and marketing channel for the company’s Box Blossoms products • Performed collating, packing, and shipping functions • Delivered finished product to local customers Leadership Experience Syracuse University Investment Club Treasurer December 2012-Present • Responsible for maintaining the club’s financial stability by collecting dues and payments from over 40 members • Create and update accurate records of the club’s bank account • Ensure that appropriate agencies and brokers are aware of our club’s status as a non-profit entity for tax purposes • Participate in decision making process during weekly meetings and trading sessions Research Officer January 2012-Present • Responsible for researching transportation, healthcare, and emerging markets to help invest the club’s +$142,000 portfolio • Provide extensive research in transportation, healthcare, and emerging markets through diligence while analyzing market trends, news, and financial data • Present monthly reports on the above markets to the club utilizing business analysis and communication skills • Participate in decision making processes during weekly meetings and trading sessions Wall Street Goes Orange Participant January 2012 • Selected as a participant with a group of 30 Whitman Students to visit eight financial institutions over winter break, including; Ernst & Young, Morgan Stanley, Chartis, JP Morgan Chase, Credit Suisse, General Electric, Goldman Sachs, Citi • Attended networking and information sessions at each institution Certifications First Aid, Lifeguarding, CPR/AED for lifeguards Paul Goldsmith As a gift for his Bar Mitzvah in 2005, Paul was given money from his grandparents with the request that he invest the money into companies of his choice. With that gift, Paul was introduced to the field of finance, a field that he has continuously been fascinated by. The fast pace, high pressure environment that encompasses the financial markets was enticing to Paul after he had thrived in a similar environment on the football and baseball fields. At Syracuse University, Paul is majoring in both finance and information management and technology. He has continued to build his involvement in finance-related activities by taking on the positions of treasurer and research officer for Syracuse University Investment Club. As a research officer it is Paul’s responsibility to inform club members of developments on three major markets; Emerging Markets, Healthcare and Transportation. Paul gives monthly presentations on each market during which he discusses news, and performance of the market and provides some suggestions of potential investments the club should make. During the summer of 2012, Paul worked as an intern for NFP sports, a high school sports fundraising company. Paul worked on and negotiated the merchant license agreement forms to construct discount cards for each of the 40 towns in his region, each with 27 different merchants offering a discount. These cards were later sold by the teams as a fundraiser. This past summer, Paul interned at AllianceBernstein in their private client group, Bernstein Global Wealth Management. During his time with the firm, Paul assisted the financial advisors with various tasks including wealth forecasting analysis, global analytics of client portfolios, and the preparation of client review books. Paul also worked with his fellow interns at the firm on a marketing project which aimed to appeal to the younger demographic high net-worth individuals. Prem Hirubalan 229 Clarendon St, Syracuse, New York, 13210 Contact number: (315)560-1940 | Email: prem.hirubalan@orangevaluefund.com EDUCATION Syracuse University, Martin J. Whitman School of Management Bachelor of Science in Finance, Supply Chain & Economics (Minor) GPA: 3.7/4.0 Syracuse, New York Expected graduation - June 2014 WORK EXPERIENCE The Orange Value Fund, LLC Syracuse, New York Senior Analyst August 2012 - Present • Performed in-depth fundamental research, based on Marty Whitman’s “Safe & Cheap” philosophy on two new investment ideas for the fund • Participated in weekly investment meetings to discuss company and/or market developments that could affect portfolio holdings and/or create opportunities for new investments • Prepared presentations on new investment ideas and presented ideas to selected money managers in New York City Yield Capital New York, New York Summer Analyst July 2013 - August 2013 • Performed bottom-up, fundamental analysis on small and microcap equities in the Aerospace, Industrials and Oil & Gas Sectors and presented investment ideas to portfolio manager • Participated in the due diligence process by interviewing company management teams, analyzing financial filings, trade publications, sell-side research and other sources • Assisted senior analyst in creating and updating valuation models based on cash flows, capital structure and asset valuations OCBC Securities Pte Ltd Singapore Private Dealer, Equities Management April 2010 - August 2011 • Worked closely with clients on portfolio structuring by determining risk profile, expected returns, and investment knowledge • Utilized fundamental and technical analysis to determine equity investment recommendations • Acquired over 100 clients through cold calls, networking events, and referrals from existing clients • Underwent extensive product training, which included valuations for equities, fixed income, options and futures, various pricing models and sales training International Enterprise Singapore Singapore Senior Officer, Domestic Exports & Re-exports Group February 2008 - August 2009 • Developed relationships with multi-national companies in targeted industries through meeting with executives and promoting Singapore as an attractive option to base their trading operations • Developed strategy papers highlighting potential sectors in aerospace and heavy equipment which were presented to senior management and were implemented • Co-lead a project with DHL highlighting Singapore as the premier regional distribution center in the region. Created quantitative models, based on data flows and future expectations, for the project LEADERSHIP EXPERIENCE Syracuse University Rugby Football Club Syracuse, New York Captain September 2011 - Present • Elected by 80 current players to the post of captain • Assist coaches in developing players abilities and expanding their knowledge in the sport • Organize training programs for all 80 current members and motivate players during training and the games Singapore Armed Forces National Service • Graduated in the top 5% of the 2001 recruit class • 1of the 30 recruits selected for Officer Cadet School • Captain of the Singapore Armed Forces rugby team SKILLS & INTERESTS Technical Skills: Proficient in Bloomberg & Reuters terminals Languages: Conversational proficiency in Bahasa Indonesia and Tamil Singapore September 2001 - December 2007 Prem Hirubalan Prem Hirubalan hails from the island of Singapore, the financial capital of South East Asia. Prem is currently pursuing his degree in finance, supply chain and a minor in economics at the Martin J Whitman School of Management. He has been on the Dean’s List every semester and has maintained a GPA of 3.7. From 2010 to 2011, Prem worked at OCBC Securities Singapore as a private dealer. He received extensive training, which included valuation of equities, options and bonds, portfolio management, fundamental and technical analysis utilization and sales training. Prem’s primary role was as an equity broker for high-net worth clients. He had S$10 million assets under management. Prem advised clients on how to structure their portfolio, taking into account their financial needs and risk adversity. He also suggested trading ideas to clients by determining which equities to invest in by using fundamental and technical analysis. In his role as a broker, Prem acquired clients through his own networking and cold calling. From 2008 to 2010, Prem worked at International Enterprise Singapore. There he was tasked with attracting foreign direct investment to start regional distribution centres in Singapore. Prem covered the aerospace, mining and oil & gas sectors. During his time, he held discussions with CEOs from the sectors he covered and gave presentations on the attractiveness of Singapore at trade shows. He worked closely with his senior management, presenting strategies on how projects could be implemented and these were approved by the management. Prem has been entrusted in leadership roles throughout his life. He was selected to Officer Cadet School when he was in the Singapore military and he was elected captain of the Syracuse University Rugby Football Club. Away from his studies, Prem spends his free time reading financial books, participating in various athletic events and the running of the rugby club. Prem plans to pursue a career in asset management in the United States upon his graduation from the Whitman School of Management. Current Address: 721 Lancaster Avenue Syracuse, NY 13210 Kevin Joseph Kettell Kevin.Kettell@orangevaluefund.com (201-956-4480) EDUCATION Syracuse University Overall GPA: 3.75 / 4.0 Dean’s List: Fall 2010, Spring 2011, Fall 2011, Spring 2012, Fall 2012, Spring 2013 Martin J. Whitman School of Management B.S. Finance School of Information Studies B.S. Information Technology Permanent Address: 42-14 Naugle Drive Fair Lawn, NY 07410 Expected May 2014 School of Information Studies Minor Global Enterprise Technology PROFESSIONAL EXPERIENCE Orange Value Fund, LLC, Senior Analyst Syracuse NY, August 2012 – Present The Orange Value Fund is a two-year money management and investment banking program, where students are trained to become both investment analysts and money managers while managing a $1.5 M portfolio using a deep value investment methodology similar in nature to Martin J. Whitman’s “safe and cheap” approach • Achieving Bloomberg certification in equity, fixed income, and FX • Completing the following course modules o Value investing, Introduction to Financial Modeling for Investment Banking, and Distress Investing • Perform in-depth research and write investment reports on at least two portfolio companies and two new investment ideas • Prepare presentations on new investment ideas to be presented to selected money managers in New York City • Mentor junior Orange Value Fund analysts and supervise their work BlackRock, Summer Analyst New York City, June 2013 – August 2013 • Worked on the risk and analytics team covering bank and agency clients • Modeled client’s balance sheets and fixed income investment portfolios using proprietary software to produce risk reports • Created firm wide documentation that provides market color and analytical overviews for several cash securities including cash repos, cash reverse repos, cash bond buying, cash collateral, and cash PCLG • Completed intensive three week boot camp which included several training sessions on investment management, market analytics, and attribution and return models JPMorgan Chase & Co., Summer Analyst New York City, June 2012 – August 2012 • Asset Management: JPMorgan Securities • Responsible for supporting client management systems and trading applications that identify investment opportunities • Worked alongside business analysts and application developers to identify requirements and implement new functionalities • Conducted quality assurance for these applications by testing new functionalities before release into production MeetingSprout.com, President/Founder Syracuse NY, October 2010 – February 2012 • Lead a team of six members in a start-up collaboration to create a web-based tool for scheduling • Derive company’s vision, analysis of internal/external environment, and strategy for implementation • Oversee product development including usability, interface design, and programming • Participate in pitch competitions to obtain financing necessary for operations SidearmSports, Technical Support Syracuse NY, September 2010 – Present • Conduct software diagnostics, server resets, and rectify bugs using basic HTML/CSS to develop and maintain websites • Manage client communication regarding project timelines, software malfunctions, and complaints • Train new clients how the SIDEARM software works via virtual training sessions to ensure customer satisfaction • Selected to attend NACDA conference in Orlando, Florida, marketing to potential clients Major League Baseball New York, March 2011 – May 2011 • Selected to design a website prototype for the Milwaukee Brewers to increase web traffic • Pitched prototype at MLB headquarters in New York City LEADERSHIP/ACCOMPLISHMENTS Nominated to Global Student Entrepreneur Awards June 2011 • For owning/managing a business while attending college Winner/$5,000 Gran Recipient, Raymond von Dran IDEA Competition April 2011 • For exceptional start-up business pitch presentation Elected to Emerging Leaders Conference, Syracuse University January 2011 • Recognized for academic and extracurricular leadership 2nd Place $250,000 Maxwell Scholarship Competition April 2010 • Wrote/debated unique idea to better one’s local community TECHNICAL PROFICIENCIES • Bloomberg, Capital IQ, Excel, PowerPoint, Visio, UNIX, SQL, Server Management, FTP setup, and Computer Diagnostics Kevin J. Kettell Kevin Kettell launched his academic career with an intense passion for technology and entrepreneurship. For the past three years, Kevin has been working for SIDEARMsports, a well established, multi-million dollar internet company, where he is active in project management and software support. Kevin’s interest in finance developed as he started working on his own software company, MeetingSprout.com, which required capital to meet start-up and development needs as well as additional investment opportunities arising from being accepted into the Syracuse Technology Garden. To further merge his knowledge of technology with finance, Kevin spent the summer of 2012 interning for JP Morgan Chase in Asset Management. He gained valuable experience understanding the needs of financial analysts and brokers with respect to trading platforms and client management, including access to market data, sector research, and analytic tools to more readily identify investment opportunities and potential investors. During the summer of 2013, Kevin further pursued his passion for finance by interning with BlackRock, the worlds largest asset manager. While working on the risk and analytics team, Kevin gained full exposure to BlackRock’s bottom up approach to risk management, along with BlackRock’s overall investment approach. Kevin has a track record for effective public speaking, teamwork, and leadership. For example, at the Syracuse iSchool, Kevin and his team presented a website redesign proposal to Major League Baseball. He was also an integral member of the winning CAPSIM team, the 2012 business competition in which teams of students competed to create and manage the most profitable company. As president of MeetingSprout.com, he led his team to secure funding at the 2011 IDEA Competition and routinely pitched venture capilalist audiences. In 2010, Kevin placed second in the $250,000 Maxwell Scholarhsip Competition, which requires students to pitch solutions for locate community problems. Kevin was elected to the Emerging Leaders Conference and received the Global Student Entrepreneur Award. Kevin’s background offers a foundation for tech company valuation and related industry analysis. Further, he looks forward to applying the knowledge from his dual degree program in finance and information technology as well as his hands-on experience with brokers and analysts to expand his due diligence and modeling expertise. Upon graduation, Kevin looks forward to a career in the financial sector. MARK JOSEPH MEDICO MARK.MEDICO@ORANGEVALUEFUND.COM || (860) 335-6239 150 Henry Street, Syracuse, New York 13210 17 Litchfield Drive, Simsbury, Connecticut 06070 EDUCATION: Syracuse, New York Martin J. Whitman School of Management – BS Finance May 2014 Minor: Economics GPA: 3.79 / 4.00 HONORS & AWARDS: Beta Gamma Sigma | Golden Key International Honor Society | Renée Crown University Honors Program | D’Aniello Scholar | Whitman Alumni Scholar | National Society of Collegiate Scholars | Dean’s List SYRACUSE UNIVERSITY WORK EXPERIENCE: The Orange Value Fund, LLC Syracuse, New York Senior Analyst August 2012-Present The Orange Value Fund is a two-year money management and investment banking program, where students are trained to become both investment analysts and money managers while managing a $1.5 M portfolio using a deep value investment methodology similar in nature to Martin J. Whitman's "safe and cheap" approach. § Create quarterly and annual financial reports for the fund § Perform in-depth research and write investment reports on at least two portfolio companies and two new investment ideas § Track periodic developments for at least two portfolio companies by reading press releases, 8K filings, 10Q filings, DEF 14 and other SEC filings, listening in quarterly conference calls, media reports, and update research reports accordingly § Participate in weekly investment meetings to discuss company and/or market developments that could affect portfolio holdings and/or create opportunities for new investments § Prepare presentations on new investment ideas to be presented to selected money managers in New York City § Complete the Advanced Financial Modeling for Investment Banking course module JPMorgan Chase & Co. New York, New York Corporate Sector: Investor Relations June 2013-August 2013 Corporate Development Program (CDP) Financial Analyst § Created the firm’s quarterly earnings presentation and press release § Analyzed sell-side analysts’ JPM-specific EPS models and research to present to senior management § Collaborated with each line of business’ strategy and finance teams on analyses and presentations used by JPM’s senior management team for the firm’s annual Investor Day and select sell-side analyst conferences § Performed ad hoc competitor analysis upon the request of the firm’s CEO and/or CFO § Attended quarterly senior management meetings with investors and sell-side analysts JPMorgan Chase & Co. New York, New York Corporate Sector: Risk Reporting & Finance – Risk Regulatory Reporting June 2012-August 2012 Corporate Development Program (CDP) Financial Analyst § Responsible for calculating capital requirements under Basel 1, 2 and 3 methodologies for senior management and investment banking controllers § Assisted in projects that involved the strategic data capture for monthly and quarterly Securitization Risk-Weighted Asset (RWA) reporting § Completed a variety of deliverables including a Basel 2.5 Investment Bank Covered Positions variance analysis, a Basel 2 Securitization 2Q12 consolidation analysis of RWA results for senior management presentation and a Basel 3 client financial structure check on asset balance threshold § Created a more efficient document for the infrastructure release, which provides enhancements to the automated Basel calculators, while also determining the steps required to effectively test each change for the upcoming release JPMorgan Chase & Co. Syracuse, New York Treasury & Security Services (TSS) – Information Risk Management Team June 2011-June 2012 Corporate Development Program (CDP) Technology Analyst § Third Party Oversight (TPO) – Managed the oversight of all key TSS Third Party service providers in accordance with the firm’s TPO and Application Security Assessment (ASA) Standards LEADERSHIP EXPERIENCE: The Stock Market Game, JPMorgan Chase & Co. Participant/Winner § Achieved the highest return of 17.5% over the S&P 500 surpassing approximately 900 competing JPMC interns Syracuse, New York July 2011 Wall Street Prep Technical Finance Seminar Syracuse, New York Member November 2011 § Participated in a workshop with elite finance professionals, which illustrated the industry skill set, as well as valuation and modeling techniques SKILLS, COMMUNITY SERVICE & ACTIVITIES: Certifications & Training: Bloomberg certification in equity, fixed income, commodities, and FX, S&P Capital IQ, Thompson ONE, PitchPRO & DocPRO and Microsoft Office Suite Community Service: Project REACH, HARC Walkathon, March of Dimes, CL&P Special Olympics, HopePrint tutoring and Hillside Renovation Activities: JPMC Ambassador, Wall Street Goes Orange, SU Baseball Team, Whitman Peer Facilitator, SU Student Leadership Conference and GE Leadership at Work Program Mark J. Medico Mark Medico is majoring in finance at the Martin J. Whitman School of Management at Syracuse University with a minor in economics. When deciding which institution to spend the next four years of his life, the intrigue and promise of the Ballentine Investment Institute set Syracuse University apart from all other universities. Mark’s strong interpersonal skills and unparalleled work ethic have not only enabled him to thrive in the classroom but allowed him to maintain business relationships and seamlessly dive into various corporate roles which make him well qualified for a career in finance. In the summer of 2012, Mark completed his third internship with JPMorgan Chase & Co. (JPMC) within the Credit Risk RWA (Risk-Weighted Asset) team. As a part of this team, Mark was responsible for calculating capital requirements under Basel 1, 2, and 3 methodologies for banking products such as traditional credit products, securitization products, available for sale products, and repurchase agreements. The value extracted from this role was his experience with new capital requirements regulation and the underlying risk associated with the bank’s assets. This summer, Mark will continue interning for JPMC in their Investor Relations team, where he will create the firm’s quarterly earnings presentation and press release, collaborate with each line of business’ strategy and finance teams for analyses and presentations, perform ad hoc competitor analysis upon the request of the firm’s CEO and/or CFO, and analyze sell-side analysts’ EPS models on JPMC and present findings to senior management. At school, Mark has demonstrated his work ethic and academic success. This past semester, Mark was inducted into Beta Gamma Sigma, which is the highest form of academic recognition a business student can receive and will hold a position on their executive board during his senior year. Recently, he was selected as a Whitman Scholar by some of the business school’s most distinguished alumni. He is also a member of the Golden Key International Honor Society, National Society of Collegiate Scholars, and has spent two years in Syracuse University’s Renee Crown University Honor’s Program. Overall, Mark’s experience and work ethic make him a valuable asset to any financial firm. As an aspiring business professional, Mark has already proven that he is well suited for a career in investment banking. GARRETT H. STEVES garrett.steves@orangevaluefund.com (585) 576-3151 Permanent Address School Address 50 Scarborough Park 300 University Ave., #150 Rochester, NY 14625 Syracuse, NY 13210 EDUCATION Syracuse University: Martin J. Whitman School of Management Syracuse, NY Bachelor of Science May 2014 Majors: Finance & Managerial Accounting Cumulative GPA: 3.4/4.0 Dean’s List, Fall 2011, Spring 2012 EXPERIENCE The Orange Value Fund, LLC Syracuse, NY Senior Analyst August 2012-Present The Orange Value Fund is a two-year money management and investment banking program, where students are trained to become both investment analysts and money managers while managing a $1.5 M portfolio using a deep value investment methodology similar in nature to Martin J. Whitman's "safe and cheap" approach. • Create quarterly and annual financial reports for the Fund • Perform in-depth research and write investment reports on at least two portfolio companies and two new investment ideas • Track periodic developments for at least two portfolio companies by reading press releases, 8K filings, 10Q filings, DEF 14 and other SEC filings, listening in quarterly conference calls, media reports, and update research reports accordingly • Participate in weekly investment meetings to discuss company and/or market developments that could affect portfolio holdings and/or create opportunities for new investments • Propose at least two investment ideas to the Fund and participate in the creation of a "watch list" • Prepare presentations on new investment ideas to be presented to selected money managers in New York City • Mentor a Junior Orange Value Fund Analyst and supervise his work • Mentor a group of junior students in the value investing class • Complete the Advanced Financial Modeling for Investment Banking course module Yield Capital Partners (Y/CAP Management, LLC) New York, NY Summer Analyst July-August 2013 • Performed due diligence analysis on select portfolio holdings and participated on quarterly earnings calls • Met directly with executives from investment target companies to discuss business environment & industry trends • Completed Valuation & Financial Modeling Analysis for select securities • Discovered accounting incongruities and a pyramid control-structure in a specific security, which led to the conclusion that Book-Value per Share does not necessarily guarantee shareholder value LEADERSHIP LVW Advisors, Shadow Experience July-August 2012 • Shadowed executives at wealth management firm in order to gain valuable exposure to the financial services industry • Participated in investment meetings with Bridgewater Wealth Management to discuss capital markets Sage Rutty & Company, Shadow Experience August 2011 • Discussed financial planning sales strategies with executives and learned the need for different approaches based on client needs Syracuse University Investment Club Chief Research Officer, Former Executive Board Member (Jan. –Dec. 2012) Sept. 2011-Present • Appointed and directed sector research analysts • Help manage a portfolio of roughly $140,000 by making strategic investments • Successfully pitched Gran Tierra Energy, a small-cap oil & gas company to the club for investment SU Study Abroad, Madrid, Spain May-July 2012 • Studied management in Spain and developed a global perspective of business strategies as well as a greater appreciation for Spanish culture by living with a host family • Gained a unique perspective on the state of the Spanish economy and greater insight into the European Debt Crisis • Developed fluency in the Spanish language SKILLS, ACTIVITIES, & INTERESTS Technical Skills: Proficient in Excel, Word, PowerPoint, Bloomberg Software Certification, Credit Suisse HOLT Lens, & Capital IQ Activities: National Society of Collegiate Scholars Member, Habitat-for-Humanity Volunteer, Intramural Ice-Hockey Interests: Travel, Golf, Jazz Trumpet, Ice-hockey Garrett H. Steves Garrett is a senior majoring in finance and managerial accounting in the Martin J. Whitman School of Management at Syracuse University with career interests in the financial services industry. His competitive drive to be successful has its roots in high school where he excelled as a student, fundraising volunteer, and as a hockey, tennis, and trumpet player. His enthusiasm has carried over to college where he has excelled both in the classroom and in extracurricular activities. As a student seeking opportunities beyond the classroom, Garrett took the advice of a business school administrator and joined the Syracuse University Investment Club during his first semester. After participating as an energy industry analyst and achieving early success in recommending investments for the $140,000 portfolio, Garrett was appointed to the Executive Board as the Chief Research Officer for the second semester and also served for the first semester of his junior year. In this leadership role, Garrett developed valuable organization, management, and teamwork skills that will serve him well in any future endeavor. He also participates in the Habitat for Humanity organization, in which he has learned invaluable teamwork skills and an appreciation for those who are less fortunate. As a result of his determination and passion for investing, he earned Bloomberg certification during his sophomore year and successfully completed the Credit Suisse HOLT Challenge during his junior year. As a junior analyst for the Orange Value Fund last year, he worked with a senior analyst to develop a distressed debt investment recommendation for JCPenney. In addition to working at a full-time summer job after his freshman year, Garrett took the initiative to shadow executives at Sage Rutty & Company in Rochester, NY in order to gain exposure to the financial services industry. Following a six-week study abroad experience in the summer of 2012, during which he studied global business management in Madrid, Spain, Garrett had the opportunity to shadow executives at LVW Advisors, a Rochester-based financial services firm for high net worth individuals and institutions. He participated in client management as well as in investment strategy activities. During his internship in the summer of 2013 at Yield Capital Partners, he learned to apply his value investing analyst skills to investment opportunities in this NYC hedge fund. Overall, Garrett’s leadership, organization skills, and strong work ethic will make him a valuable asset to any firm within the financial services industry. As an aspiring business professional, he plans to pursue a career in asset management and eventually obtain the prestigious CFA designation. In his spare time, he enjoys golfing, playing jazz trumpet, and participating in ice hockey intramurals at Syracuse.