Banking Confidence Monitor 2015

advertisement

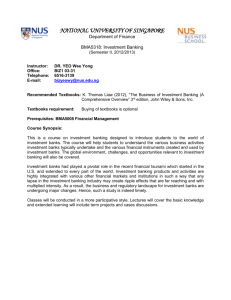

Banking Confidence Monitor 2015 5 2 1 0 Contents Foreword Foreword 3 Introduction 5 About the Banking Confidence Monitor • Survey design • Supervision of the survey • Further development 6 Confidence & Perceptions 9 • Almost a quarter of Dutch consumers have low confidence in banks • The Dutch have higher confidence in their own banks Product & Advice 11 • Service provision for payments and savings has high scores • Service provision relating to mortgages has the lowest scores Service & Use 13 • Many clients use online services • Clients frequently have contacts with their bank • One in three clients with a complaint feels that they are not taken seriously • Experienced availability is lower than actual availability Recommendations of the Advisory Board 14 • Devote attention to the personal side of client relationships • Improve handling of complaints • Carefully examine the processes relating to investment and mortgages • Further develop the Banking Confidence Monitor Opportunities for improvement 16 • Clients contacts • Assistance with financial setbacks • Handling of complaints Appendix Appendix Appendix Appendix 1 2 3 4 Design of the Banking Confidence Monitor Results per bank 24 The Advisory Board 26 GfK market survey questions 28 This is the first Banking Confidence Monitor: a new way for the banks to measure confidence in and customer opinions about the sector, their own banks and the various parts of our services. By obtaining feedback in society, we want to discover which buttons we need to push in order to strengthen confidence and improve our services. For the first time, we are also publishing the individual scores of banks, including the Client Interest dashboard scores of our supervisory authority, the Netherlands Authority for the Financial Markets (AFM). The Banking Confidence Monitor shows that consumer confidence in banks remains low. Public debates on e.g. remuneration at some banks and current interest rates show that it is more important than ever to enter into a dialogue with consumers and other stakeholders. Confidence builds slowly and can disappear in a flash. The improvement actions that we will take in response to the Banking Confidence Monitor are not enough to restore confidence on their own. The issue is too complex for that. We will have to show what we do with the feedback from consumers and other stakeholders. All banks must jointly take responsibility for restoring consumer confidence in banks. If you want to restore confidence, you must show initiative yourself. With the Banking Confidence Monitor, we are taking a new step with this. It was started up and is implemented by banks themselves, with an independent Advisory Board keeping us focused on the approach and outcomes of the survey. This initiative shows that banks are intrinsically motivated to improve their services. It is a matter requiring patience. That is why we will publish the Banking Confidence Monitor annually from now on, so that we can continue to see whether we are on the right track. 20 Banking Confidence Monitor 2015 3 Back to contents The results show that consumers and the supervisory authority are positive about our services and the progress we are making in some areas. But there are certainly points for improvement. The Banking Confidence Monitor clearly shows where. That is informative, motivating and stimulating. It also requires action. The ball is in the banks’ court. Chris Buijink Chairman, Dutch Banking Association (NVB) Introduction Consumer confidence in banks has fallen since the start of the financial crisis. As a sector, we are working hard to restore that. We have already taken various steps, but want to improve still further. For some years now, the AFM has conducted studies of the extent to which banks put their clients’ interests first. On the basis of the Client Interests dashboard, it assesses how well banks perform their services, such as savings, mortgages and investments. For the first time, we are publishing the scores per bank, to fulfil a wish of the Minister of Finance, the Consumers Association, the Dutch Shareholders’ Association (VEB) and the Association of (Prospective) Homeowners. However, we want to add something more: this is why we have had a survey conducted to assess how much confidence consumers have in banks and how satisfied they are with the services of banks. The Banking Confidence Monitor describes the outcomes from both sources of information. We therefore know where the main opportunities for improvement lie and can implement the concrete improvement actions that help to further restore that confidence. The Banking Confidence Monitor will appear annually in future. In this way, everyone can track the progress and effects of the actions for improvement. We will continue to communicate with consumers and other stakeholders. We will use the feedback we receive to further improve our services. We will also use the feedback to adjust our surveys where necessary in order to obtain a still better insight. The Banking Confidence Monitor also forms a good basis for opening a dialogue on social themes that influence consumer confidence and enables us, as banks, to learn from each other more easily. Dutch Banking Association Banking Confidence Monitor 2015 5 Back to contents About the Banking Confidence Monitor The Banking Confidence Monitor was developed by the Dutch Banking Association (NVB) in cooperation with the market research agency GfK. The design was developed in consultation with the AFM. ABN AMRO, ASN Bank, ING, Rabobank, RegioBank, SNS and Triodos Bank took part in the GfK survey for the Banking Confidence Monitor. All banks publish their outcomes in this Confidence Monitor (Appendix 2) and on their own websites. The scores for the savings, mortgages, loans and investment products were taken over from the AFM’s Client Interests dashboard 2014/2015. The payment module was developed under the direction of the Dutch Payment Association (BVN). Confidence & Perceptions Product & Advice Confidence in banking sector * Payments *** Confidence in own bank * Savings ** Customer orientation * Mortgages ** Transparency * Loans ** Expertise * Investment ** Service & Use Online services * * Source GfK ** Source AFM ***Source BVN Client contacts * Design of the survey The Banking Confidence Monitor consists of three sections. Each section consists of different aspects and is structured as follows: Handling of complaints * Availability *** Confidence & Perception • The confidence of consumers in their own banks and in the sector; • How consumers perceive the transparency, customer orientation and expertise of their own banks. Product & Advice • The extent to which banks put the client’s interests first with: – Payment products; – Savings products; – Mortgage products; – Loan products; – Investment products Supervision of the survey An Advisory Board supervises the independence of the Banking Confidence Monitor. This Advisory Board has also advised on the measuring instrument and the presentation of the results. Each member has contributed to the development of the Banking Confidence Monitor on the basis of their own background and own viewpoints. Service & Use Further development The next Banking Confidence Monitor will appear in the autumn of 2016. The NVB aims to continually improve this tool further, in consultation with stakeholders. • • • • > Notes on the design of the survey and the data sources are presented in Appendix 1. > More information on the Advisory Board is provided in Appendix 3. 6 Satisfaction of consumers with the online service provision; Perceptions of client contacts; Perceptions of handling of complaints; The availability of online banking, mobile banking and iDeal. Dutch Banking Association Banking Confidence Monitor 2015 7 Back to contents Confidence & Perception Confidence in banking sector The first measurement of the Banking Confidence Monitor shows the general confidence in banks. On a scale of 1 (very low confidence) to 5 (very high confidence), the score for the sector as a whole is 2.8. The main outcomes of the client survey are presented below. 2,8 Confidence in own bank 3,2 Customer orientation Almost a quarter of Dutch consumers have low confidence in banks 5% have very low confidence in banks and 22% low confidence. More than half (56%) say that they have neither high or low confidence. 16% have high confidence in banks and 1% say they have very high confidence in banks. Young people aged between 18 and 34 have the highest confidence in banks in relative terms and confidence is lowest in the 50-to-64 age group. Increased costs and the remuneration policy are mentioned as reasons for low confidence. Consumers trust banks because there is a good guarantee that their money will be safe, they have a high regard for the quality of the supervisory authority and because they themselves have had positive experiences as clients. 3,3 Transparency 3,5 Expertise The Dutch have more confidence in their own banks Average confidence in the respondents’ own banks is considerably higher than the sector score: 3.2 versus 2.8. One third (33%) of Dutch consumers have high confidence and 3% have very high confidence in their own banks. Half (50%) of the consumers say they have neither high or low confidence in their own banks. 12% of consumers have little confidence and 3% have very little confidence in their own banks. The banks have somewhat higher scores for individual aspects that influence consumer confidence. Dutch consumers give their own banks an average score of 3.3 for customer orientation. On the level of transparency, the average score for own banks is 3.5. The banks’ clients rate their expertise relatively highly, with a score of 3.8. 3,8 > The results per bank are presented in Appendix 2. 1 2 8 Dutch Banking Association 3 4 5 Banking Confidence Monitor 2015 9 Back to contents Product & Advice Payments 4,4 Savings 4,4 Mortgages 2,8 Loans 3,3 Investments The figures for Product & Advice show the extent to which banks actually put their clients’ interests first, as assessed by the AFM or the BVN, on a scale of 1 to 5. The scores for payment and savings services are high For both savings and payments, the average score for the sector is 4.4. With regard to savings, banks increasingly provide a better insight into why interest rates differ between the various savings products. Websites are also increasingly accessible and more transparent and information on savings products has become clearer. In the field of payments, banks offer a broad product range and ensure that access to the services is simple. Through years of dialogue, banks are able to respond to current public requirements. The scores for service provision relating to mortgages are lowest. The sector scores lowest for services relating to mortgages, with a score of 2.8. Banks are often relatively late to understand the reasons for payment arrears and the client’s financial situation. This makes it more difficult to make a correct diagnosis and to offer an appropriate solution. The AFM finds that banks could do more to give clients that insight. 3,3 The score for loans is 3.3, which is determined partly by the way in which banks provide clients with an insight into the progress of the loan since it was contracted. Banks could make improvements in the way in which they design their client inventories. There is also still scope to optimise the match between the investment portfolio chosen and the client’s objectives. > The results per bank are presented in Appendix 2. > The scores for the AFM modules are not necessarily comparable from one year to the next, because the AFM pursues a ‘risk-driven policy’, as a result of which it may survey different subjects in a particular year than in the year before. We will record the progress with the improvement actions set up each year. 1 10 2 Dutch Banking Association 3 4 Banking Confidence Monitor 2015 11 Back to contents Service & Use Online services Customer contacts 3,6 Handling of complaints 1 2 3,2 3 4 5 Many clients use online services Online banking is popular. Clients find it convenient to arrange day-to-day banking affairs via online banking. Of the persons surveyed by GfK, 93% said that they banked online in the first quarter of 2015. 39% of the respondents said they had viewed information on the bank’s website. Clients frequently have contacts with their bank One in three Dutch consumers had contact with an employee of their bank in the first three months of 2015. A very large majority (86%) found it easy to make these contacts. Most clients were also satisfied with how these contacts proceeded. Some 85% felt that their queries or requests were handled well by the bank employee. One in three clients with a complaint feels that they are not taken seriously There are two important reasons for the low score for handling of complaints. The first is that many clients with a complaint (30%) do not find it easy to have their complaint processed. The second reason is that one in three clients with a complaint (35%) feel that the bank does not treat the complaint seriously enough. 99,75 Online banking 99,78 Mobile banking Perceived availability is lower than actual availability Measurements by the banks show that the availability of online banking during ‘prime time’ (on weekdays and Saturdays from 7.00 a.m. to 1.00 a.m. and on Sundays and public holidays from 8.00 a.m. to 1.00 a.m.) is high. Online banking is available 99.75% of the time, mobile banking 99.78% of the time and iDeal 99.49% of the time. However, this is not how clients perceive it. Only 91% of clients say that they can usually use online banking without disruptions. For mobile banking, the figure is 86%. These figures show that malfunctions carry considerable weight in the perceptions of clients. 99,49 iDeal > The results per bank are presented in Appendix 2. Availability in % 12 The figures for Service and Use show client perceptions of contacts with their banks and the use of online services. The scale runs from 1 to 5. 4,2 Dutch Banking Association Banking Confidence Monitor 2015 13 Back to contents Recommendations of the Advisory Board The Advisory Board advises the sector to work vigorously on improvements on the basis of the outcomes of the Banking Confidence Monitor. In the opinion of the Advisory Board, the most important outcomes are: • General confidence in the banking sector is low; • General confidence in consumers’ own banks is higher than confidence in the sector; • The main reason for the low confidence is a lack of customer orientation; • Because banks are experts and service providers, there is a good foundation for improvement; • Among the product modules, banks score higher for savings and payments and lower for mortgages, loans and investments; • Bank scores for handling of complaints are relatively low. Devote attention to the personal side of the client relationship The fact that consumer confidence is low is not because banks provide a mediocre service, have little expertise or unreliable systems. Banks in fact perform well for all these elements. A far more likely reason for the low confidence is that consumers see banks as insufficiently customer oriented. This explanation is also in line with earlier research conducted by Edelman 1). The Advisory Board advises the banks to take steps to improve their customer orientation. This primarily concerns the ‘soft’ side of service provision: being open and honest, giving advice in the interest of the client and helping clients to make financial choices. Examine the processes relating to investments and mortgages with care The banks have lower scores in the Clients’ Interests dashboard in the field of mortgages, loans and investments. The Advisory Board advises the banks to improve the process design relating to these products. The improvements should be focused primarily on advice that perfectly matches a client’s needs. In the case of (impending) payment arrears, too, it is important to act and communicate more on the basis of the client’s situation. Further develop the Banking Confidence Monitor The Advisory Board regards the measurement instruments of the Banking Confidence Monitor and their outcomes as valid and reliable. The Advisory Board makes three recommendations for the further development of the Confidence Monitor: • Keep the Banking Confidence Monitor up to date. Make sure that the measurements always show as clearly as possible the extent to which banks provide for the current needs of clients; • Consider the addition of confidence figures from other sectors; • Investigate which sections have the greatest influence of the degree of confidence in banks. The Advisory Board also proposes adjusting the questions relating to transparency in the next Banking Confidence Monitor. The questions concerning openness and honesty should be split, which will provide more insight into this subject. The Advisory Board also proposes asking a question that measures the integrity of the bank. This will improve the quality of the measurement. Improve handling of complaints Consumers perceive that banks do not make it simple enough to submit complaints. A relatively large number of clients also feels that banks do not take complaints seriously enough and that complaints are not solved satisfactorily frequently enough. This result is in line with the outcomes of a survey by the Consumers Association 2). We advise the banks to take measures to improve handling of complaints. 1) Source: Edelman Trust Barometer 2015. 2) Source: Bank Monitor, May 2015. 14 Dutch Banking Association Banking Confidence Monitor 2015 15 Back to contents Opportunities for improvement The survey outcomes show that Dutch banks perform well in a number of areas and less well in others. However, overall the confidence of consumers in the banking sector is low. This calls for long-term and continual efforts by banks from the sector. The banks commit to this because they are not satisfied with the outcomes and want to improve. Assistance with financial setbacks Score of 2.8 for the ‘Mortgages’ section of the AFM Clients’ Interests dashboard. The sector scored 2.2 for this section in relation to payment arrears. In the GfK survey too, clients showed that they considered it important for their bank to contribute ideas on solutions if financial problems arise, such as payment problems. Action Banks explicitly state how they can assist clients with (potential) payment arrears for mortgages. Banks also search for appropriate solutions, together with the client. The survey results and the recommendations of the Advisory Board provide valuable insights into the improvement opportunities required. In the coming period, banks will focus on three improvement opportunities 3). Client contacts A score of 2.6 for the question ‘the bank actively notifies me that a change in my personal situation could influence which product is best for me’. In the eyes of clients, communication by banks is still not sufficiently geared to the personal situation of the client and is based too strongly on a legal point of view. Clients expect banks to help them to make the right financial choices. They also expect banks to show understanding and expertise, because they have experience with clients in similar situations. Handling of complaints Score of 2.8 for the questions ‘How satisfied or dissatisfied are you with the way in which your complaint was solved’. Clients state that they experience confusion in the process concerning handling of complaints. Action Banks must make it clear or clearer to clients how they can easily submit a complaint to the right person or department. Banks must also show that they take complaints seriously, both by keeping the client informed of progress during the handling of a complaint and by clearly explaining how a certain decision on a complaint is reached. Action Banks commit to giving advice or making suggestions in situations in which clients report that their personal situation has changed (or may change). The advice or suggestions must be tailored to the personal situation and the choices that the client can make. Banks must offer the client a clear insight into what the impact of the personal changes may be on the client’s financial situation and products. > The Advisory Board also recommends making improvements to the investment services. Banks and the AFM expect that the improvement measures already set in motion by banks will lead to better customer service. This is why we are not proposing any extra improvement measures at presen. 3) The banks will determine how the improvement opportunities and points for action are translated into concrete policy and actions on an individual basis. 16 Dutch Banking Association Banking Confidence Monitor 2015 17 Back to contents Appendices 1 Design of the Banking Confidence Monitor 2 Results per bank 3 The Advisory Board 4 GfK market survey questions 18 Dutch Banking Association Banking Confidence Monitor 2015 19 Back to contents Appendix 1 Design of the Banking Confidence Monitor Development The Banking Confidence Monitor was developed on commission from the NVB. The development was in the hands of a working group consisting of representatives of ABN AMRO, ING, Rabobank, SNS, a representative of the ‘other banks’ 4) and the NVB. Requirements The NVB determined which conditions the measuring instrument must meet. These conditions are: • The instrument must speak for itself. This means that the structure and content of the instrument must be comprehensible to consumers; • The elements of the instrument must be and must remain measurable, so that follow-up measurements are possible; • The outcomes must provide an insight into the quality of service; • The instrument must offer transparency, with sufficient justification; • The instrument must consist of elements that relate to confidence; • The banks taking part must be able to define improvement measures on the basis of the outcomes; • The scores of the banks taking part must be comparable. Sections The Banking Confidence Monitor consists of three sections: Confidence & Perception, Product & Advice and Service & Use. Confidence & Perception Confidence & Perception concerns the elements in which consumers state the extent to which they have confidence in their own banks and in the sector (on a scale of 1 to 5). • The ‘transparent’ element concerns client perceptions of how open and honest their own banks are and the question of whether their own banks communicate in comprehensible language. The ‘transparent’ element also contains consumers’ views on the proactivity of their banks in the event of changes in the products and services used; • The ‘customer-oriented’ element concerns the extent to which consumers experience that their banks listen carefully to them, recommend products that are in their interest, support them in making financial choices, seek solutions together in the event of financial setbacks and meet their agreements; • The ‘expert’ element contains client experiences of the knowledge of banking affairs, the expertise of the bank employees and the insight that the bank provides into the consumer’s banking affairs. Product & Advice Product & Advice presents the results of a number of AFM modules. For the Banking Confidence Monitor, only the modules for the products that are most important to consumers were chosen: savings, mortgages, loans (consumer credit) and investment (quality of investment services). • The AFM conducted two surveys within the mortgages module: one into payment arrears and a self assessment. The scores for ‘mortgages’ in the Banking Confidence Monitor are an average of the outcomes of both surveys; • The scores for ‘investment’ are determined as an average of the scores for client inventories and fit with the investment portfolio; • Because there is no AFM module for Payments, the banks taking part developed this themselves, under the direction of the BVN. The module has the same design and calculation method as the AFM modules. 4) The other banks were represented by Achmea Bank. These are banks that are members of 20 the NVB and are not one of the four system banks (ABN AMRO, ING, Rabobank and SNS). Dutch Banking Association Banking Confidence Monitor 2015 21 Back to contents Service & Use Figures from AFM dashboard modules Service & Use consists of four elements: online service provision, client contacts, handling of complaints and availability. • The score for online service provision is based on consumer experiences with online banking and mobile banking in the past three months. Consumers were asked about the availability of online banking and mobile banking experienced, the convenience of these services and the accessibility of the information via the banks’ websites; • The score for client contacts is based on the experiences of clients who had personal contacts with their banks in the past three months. They were asked for their opinion of how easily they were able to make contact with the bank employee and how the bank handled their query; • The score for handling of complaints is based on the experiences of consumers who submitted a complaint in the past 12 months. They were asked how easy they found it to submit a complaint and how the bank dealt with this. • The availability percentages for online banking and mobile banking show the objective availability during prime time hours in the first six months of 2015. The figures included for iDeal were recorded between 1 February and 1 July 2015. The following time periods are regarded as prime times for online and mobile banking: on weekdays and Saturdays from 7.00 a.m. to 1.00 a.m. and on Sundays and public holidays from 8.00 a.m. to 1.00 a.m. The night-time hours are not included, as banks often perform system maintenance at those times. The standards set for the availability of iDeal are: – Standard prime time from 7.00 a.m. to 1.00 a.m.: 99.5% – Standard for non-prime time from 1.00 a.m. to 7.00 a.m.: 93.5% Each year, via the Clients’ Interests dashboard, the AFM measures the extent to which banks and insurers put clients’ interests first in policies and in practice. The scores for savings, mortgages, loans and investments in this Banking Confidence Monitor are the latest scores assigned by the AFM. More information on the AFM Clients’ Interests dashboard is available at: www.afm.nl/nl­nl/over­afm/toezicht­thema/kbc/dashboard. Newly developed payment module Because the AFM does not have a payment module, this has been developed by the banks participating in the Banking Confidence Monitor. The figures have been validated by the BVN. The AFM was consulted on the structure of the payment module. The sections of the payment module focus on elements of payments concerning the clients’ interests and with which banks can distinguish themselves. This concerns the elements of accessibility, range, insight and control, service provision and communication. Measurements of banks The figures for the accessibility of online banking, mobile banking and iDeal are the outcomes of measurements performed by the banks themselves. These are data that the banks submit to the BVN as a standard procedure. The BVN has checked the figures. Data sources The outcomes of the Banking Confidence Monitor are based on the following sources: Client survey by GfK In this section, consumers were asked for their experiences of the banking sector and their perceptions of the service provision by their own banks. For the Confidence & Perception section, 4,243 consumers completed a questionnaire in the period from 16 January to 25 January 2015. For the Service & Use section 4,982 consumers completed a questionnaire in the period from 23 April to 3 May 2015. 22 Dutch Banking Association Banking Confidence Monitor 2015 23 Back to contents Appendix 2 Results per bank The review below presents the Confidence Monitor scores of the individual banks. If a participating bank does not offer a product or service, or if the size of the sample was too small to determine a reliable result, this is shown by ‘–’. The individual banks also publish the results, supplemented by their improvement measures, on their websites. ABN AMRO www.abnamro.nl/vertrouwensmonitor www.abnamro.com/nl/newsroom/nieuws/vertrouwensmonitor.html ASN Bank www.asnbank.nl/vertrouwensmonitor INGwww.ing.nl/vertrouwensmonitor Rabobankwww.rabobank.nl/vertrouwensmonitor RegioBankwww.regiobank.nl/vertrouwensmonitor SNS www.snsbank.nl/vertrouwensmonitor Triodos Bank www.triodos.nl/vertrouwensmonitor Section ING Sector ABN AMRO ASN Bank Rabobank RegioBank SNS Triodos Bank Confidence & Perception Confidence in banking sector 2,82,92,6 Confidence in own bank3,23,13,9 Customer orientation 3,33,23,7 Transparency 3,53,44,1 Expertise 3,8 3,7 4,0 2,82,9 2,82,82,5 3,23,2 3,73,24,1 3,23,4 4,03,33,9 3,53,5 4,13,64,3 3,7 3,8 4,1 3,8 4,3 Product & Advice Payments Savings Mortgages Loans Investment 4,44,44,4 4,4 4,3 3,9 2,83,1– 3,32,9– 3,33,0– 4,44,4 4,04,8– 6) 4,4 4,5 4,4 4,5 – 3,42,9 – 3,1– 3,93,5 – 3,2– 2,93,2 – – – 4,2 4,2 4,6 3,63,53,8 3,2 2,9 – 4,1 4,3 4,5 4,4 4,6 3,63,7 4,13,64,1 3,5 3,0 – 3,4 – 99,75 99,85 99,94 99,7899,8599,94 99,49 99,16 99,93 5) 99,64 99,75 99,69 99,94 99,95 99,6899,77 99,9499,9499,95 99,6299,63 99,9299,9399,85 Service & Use Online services Client contacts Handling of complaints Availability in % – Online banking – Mobile banking – iDeal 5) This concerns the availability in the period from 1 March 2015 to 1 July 2015. 24 Dutch Banking Association 6) At a late stage in the data gathering period, it became known that Triodos Bank had enough observations to be included in the Banking Confidence Monitor. For this reason, it was not able to perform the self assessment of the payment module. Banking Confidence Monitor 2015 25 Back to contents Appendix 3 The Advisory Board Membership The Advisory Board consists of four members: • Mr P.C. (Peter) Verhoef, Chairman Professor of Marketing, Faculty of Economics and Business, University of Groningen; • F. (Fred) Bronner Emeritus Professor of Media and Market Research, Faculty of Social and Behavioural Sciences, University of Amsterdam; • Ms I.D. (Ingrid) Thijssen member of the Alliander Board of Directors; • Ms M. (Mirjam) van Tiel head of agency De Argumentenfabriek. Selection criteria The members of the Advisory Board are selected on the basis of the following criteria: • Has the consumer’s point of view in mind; • Is an expert in the field of measurement, communication and putting the clients’ interests first; • Can make a substantive contribution to improvement measures; • Is available for the meetings of the Advisory Board; • Does not have a relationship in which the bank deploys the member directly for payment 7). Tasks of members The tasks of the members of the Advisory Board are: • To participate in Advisory Board meetings at least twice a year; • To assess the independence and effectiveness of the survey and the approach; • To make suggestions for improvement of the market research; • To provide advice, on request or otherwise, on the interpretation of the survey outcomes, measures for improvement and the presentation of the results. Tasks of the chairman The chairman of the Advisory Board initiates and holds final responsibility for the realisation of adequate decision-making and advice. In that regard, the chairman ensures that: • The Advisory Board has a vision of the objective of the measuring instrument; • The Advisory Board determines its advice on the methodology, results and effectiveness of the instrument with due care and in a timely manner, and communicates this on a regular basis (in any event on a fixed date each year); • The Advisory Board or a representative if this is opportune (by agreement with the NVB) attends and acts as a spokesperson on behalf of the Advisory Board at relevant meetings. Remuneration The members of the Advisory Board can declare expenses for the time for meetings and the travelling costs incurred. The members receive reasonable remuneration for meetings, per half-day. 7) An exception is made for Ms. Van Tiel. She works for De Argumentenfabriek, a company that has provided services to various parties in the financial sector since 2009. 26 Dutch Banking Association Banking Confidence Monitor 2015 27 Back to contents Appendix 4 GfK market survey questions Confidence & Perception questions 1 2 3 4 5 6 7 8 28 How high is your confidence in banks? Can you explain why you have <answer to Question 1> in banks? At which bank or banks do you bank? Which bank do you regard as your main bank? How high is your confidence in your main bank? Can you explain why you have <answer to Question 5> in your main bank? To what extent do you agree or disagree with the following statements? ... is open and honest ... communicates in understandable language ... actively informs me of changes in products and services ... listens to clients ... advises on products that are in the interest of clients ... supports me in making financial choices ... searches for solutions with me in the case of financial setbacks ... has knowledge of banking affairs ... has expert personnel ... makes my banking affairs transparent ... meets agreements reached ... can easily be reached (online, by telephone, through branch) … is a financially solid bank Which of the following financial products have you placed with your bank? • Current account • Savings account • Investments • Mortgage • Credit/loan • Insurance • Other product Dutch Banking Association 9 Has one of the following changes occurred in your private life in the past 12 months, with an influence on your financial situation? • Birth of child • Marriage • Cohabiting • Divorce • Death in the family • Loss of job • Other job • Other • None of the above 10 To what extent do you agree or disagree with the following statement? My bank actively notifies me that a change in my private situation could influence which product is the best for me. Banking Confidence Monitor 2015 29 Back to contents Service & Use Questions Online service provision 1 In the past three months, have you made use of one of the following online services? • Made use of mobile banking on my smartphone/tablet • Made use of online banking by logging on to the website • Searched for information on the website • I have not made use of any of the above online services 2 To what extent do you agree or disagree with the following statements? • I can usually make use of online banking without disruptions app • I can usually make use of online banking without disruptions • I can easily arrange my day-to-day banking affairs via the mobile banking app • I can easily arrange my day-to-day banking affairs through online banking • I can easily find the required information on the website 3 Which of the following financial products have you placed at your bank? • Current account • Savings account • Investments • Mortgage • Credit/loan • Insurance • Other product Client contacts 1 30 How have you had contact in the past 3 months with an employee of your bank? • By telephone • E-mail • Visit to bank branch (personal meeting) • (Video) chat • Other, i.e. … • I have not had contact with an employee Dutch Banking Association 2 To what extent do you agree or disagree with the following statements? • I can easily contact an employee (if necessary) • My question was handled well in my last contact with an employee 3 Which of the following financial products have you placed at your bank? • Current account • Savings account • Investments • Mortgage • Credit/loan • Insurance • Other product Handling of complaints 1 2 3 4 5 Have you submitted a complaint to your bank in the past 12 months? • Yes, I have submitted a complaint to my bank • No. I did have a complaint, but did not submit this to my bank • No, I had no complaints Can you explain what your complaint was? To what extent do you agree or disagree with the following statements? • I found it easy to arrange for my complaint to be processed • The handling of my complaint was taken seriously How satisfied or dissatisfied are you with the way in which your complaint was solved? Which of the following financial products have you placed with your bank? • Current account • Savings account • Investments • Mortgage • Credit/loan • Insurance • Other product Banking Confidence Monitor 2015 31 © September 2015 Dutch Banking Association Gustav Mahlerplein 29-35 1082 MS Amsterdam The Netherlands +31 (0)20 550 28 88 www.nvb.nl