AMP Capital Global Property Securities Fund

AMP Capital Global Property

Securities

Quarterly Investment Option Update

30 September 2015

Aim and Strategy

To provide total returns (income and capital growth), after costs and before tax, higher than the return from the UBS

Global Real Estate Investors Index (net dividends reinvested, hedged back to Australian dollars) on a rolling 3 year basis by investing in property securities listed on share markets around the world. Securities in which the portfolio invests are diversified across a range of asset classes, property sectors and geographic regions. The portfolio includes investments in Real Estate Investment Trusts and property securities companies across North America,

Europe and Asia Pacific. The portfolio is managed by an investment team made up of on-the-ground regional investment specialists based in Sydney, Chicago, London and Hong Kong,implementing a research driven process which integrates a macroeconomic (top-down) approach to regional and country allocation, with a stock specific

(bottom-up) selection process.

Investment Option Performance

To view the latest investment performances please visit www.amp.com.au

Availability

Product name

AMP Flexible Lifetime Super

APIR

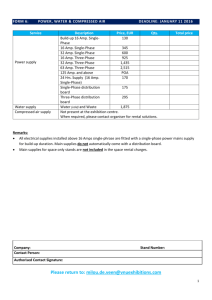

AMP1596AU Top 10 Securities Exposure %

AMP Flexible Super - Retirement account AMP1620AU

Simon Property Group Inc 8.64

Equity Residential 5.28

AMP Flexible Super - Super account AMP1611AU

CUSTOM SUPER AMP1596AU

Klepierre

Prologis Inc

3.90

3.84

Flexible Lifetime - Allocated Pension AMP1632AU

Flexible Lifetime Investment (Series 2) AMP2043AU

Empire State Realty Trust Inc

UDR Inc

3.53

3.52

METCASH SUPERANNUATION PLAN AMP1596AU

SignatureSuper

SignatureSuper Allocated Pension

Investment Option Overview

Investment category Property

Suggested investment timeframe

Relative risk rating

Investment style

Asset Allocation

5 years

AMP1602AU

AMP1626AU

Medium - High

Growth

Benchmark Range (%)

Equity LifeStyle Properties In

Extra Space Storage Inc

Essex Property Trust Inc

Paramount Group Inc

Regional Exposure

North America

Europe

Asia

Australasia

Cash

3.12

3.11

3.04

2.87

%

59.25

21.76

9.83

5.98

3.18

Global Property 100 90-100

Cash 0 0-10

AMP Life Limited

84 079 300 379

Portfolio Summary

Global REITS were up for the quarter and outperformed global equities.

The Fund outperformed during the quarter, driven primarily by strong stock selection within North America.

We continue to be most positive on both the UK and US markets. We are also positive on Japan. We continue to monitor China and the concerns over growth. We will also closely monitor commentary by the US Federal

Reserve in regards to interest rates with December now the most likely timing for a rate rise.

Investment Option Commentary

The Fund outperformed during the quarter, driven primarily by strong stock selection within North America.

At a stock-specific level, the main contributors to performance were overweight positions in Extra Space Storage and

Equity LifeStyle Properties, and an underweight in Host Hotels & Resorts. The key stock detractors were overweight positions in La Quinta Holdings and Hilton Worldwide Holdings, and an underweight position in Public Storage.

Market commentary

Global REITS were up for the quarter and outperformed global equities.

US REITs endured a bumpy ride in the third quarter – rising in July, falling in August, and rebounding in September – reflecting a period of heightened volatility for global equity markets. Expectations for the path of US Federal Reserve monetary policy changed markedly during the third quarter of 2015. At the start of the period, consensus suggested a rate hike in September. However, by August, growing fears over the outlook for China, and the potential knock-on impact on global economic growth, had led many commentators to forecast a later start to monetary tightening. This shift in expectations was vindicated in September, as the US Federal Reserve declined to hike rates at its monthly meeting.

In Europe, the big piece of news early in the quarter was the ‘resolution’ of the Greek drama and the market reacted positively to this. Later in the quarter, concerns focused on China’s devaluation of its currency, and while this saw volatility flow into share markets and European REITs did weaken, Europe didn’t feel this impact as heavily as other regions. Eurozone Q2 2015 GDP data was released and showed a slowdown across Europe, particularly in the major markets of France, Germany and Italy. In the UK, macroeconomic data was better than expected with strong

Q2 2015 GDP numbers, but this was countered by Bank of England Governor Carney raising the possibility of a rate rise later this year. We saw some great results from UK names which continue to exceed expectations. We continue to see the UK deliver on an operational level (i.e. rents going up and vacancies coming down) while investment demand continues to be extremely strong. We also saw a new record high rent for London’s Southbank from The

Shard which managed to secure a £90 per square foot deal, which is impressive for that area of London.

Australian REITs saw significant developments at the company level – notably the A$2.45 billion acquisition by

China Investment Corporation of Investa Property Group’s direct office portfolio, the largest direct real estate transa ction in Australia’s history. The reporting season in August was strong, particularly for residential REITs, with most companies meeting or exceeding expectations.

Portfolio positioning and outlook

We continue to be most positive on both the UK and US markets. We are also positive on Japan. We continue to monitor China and the concerns over growth. We will also closely monitor commentary by the US Federal Reserve in regards to interest rates with December now the most likely timing for a rate rise. The large discrepancy between prices in the private and listed markets continues to benefit REITs and we expect large transactions to occur in the direct market globally, particularly the US and Europe (including the UK), as we continue to see strong demand from investors around the world.

AMP Life Limited

84 079 300 379

Contact Us

Web: www.amp.com.au

Email: askamp@amp.com.au

Phone: 131 267 (Mon. to Fri. 8:30am to 6:00pm AEST)

What you need to know

This publication has been prepared by AMP Life Limited ABN 84 079 300 379, AFSL No. 233671 (AMP Life). The information contained in this publication has been derived from sources believe to accurate and reliable as at the date of this document. Information provided in this investment option update are views of the underlying

Investment Manager only and not necessarily the views of the AMP Group. No representation is given in relation to the accuracy or completeness of any statement contained in it. Whilst care has been taken in the preparation of this publication, to the extent permitted by law, no liability is accepted for any loss or damage as a result of reliance on this information. AMP Life is part of the AMP Group. In providing the general advice, AMP Life and AMP Group receives fees and charges and their employees and directors receive salaries, bonuses and other benefits.

The information in this document is of a general nature only and does not take into account your financial situation, objectives and needs. Before you make any investment decision based on the information contained in this document you should consider how it applies to your personal objectives, financial situation and needs, or speak to a financial planner.

The investment option referred to in this publication is available through products issued by AMP Superannuation Limited ABN 31 008 414 104, AFSL No. 233060

(ASL) and/or AMP Life. Before deciding to invest or make a decision about the investment options, you should read the current Product Disclosure Statement for the relevant product, available from ASL, AMP Life or your financial planner.

Any references to the “Fund”, strategies, asset allocations or exposures are references to the underlying managed fund that the investment option either directly or indirectly invests in (underlying fund). The investment option’s aim and strategy mirrors the objective and investment approach of the underlying fund. An investment in the investment option is not a direct investment in the underlying fund.

Neither AMP Life, ASL, any other company in the AMP Group nor underlying fund manager guarantees the repayment of capital or the performance of any product or particular rate of return referred to in this document. Past performance is not a reliable indicator of future performance.

AMP Life Limited

84 079 300 379