Flyer re ABC Investment Option

advertisement

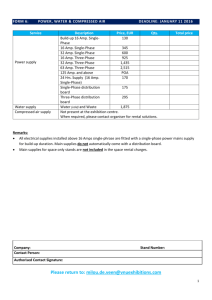

Specialist Property and Infrastructure Fund Quarterly Investment Option Update 30 September 2015 Aim and Strategy Aim and strategy: To provide total returns (income and capital growth) after costs and before tax, above the return of 20% of the S&P/ASX200 A-REIT Accumulation, 35% FTSE EPRA NAREIT Developed Net Total Return (Hedged to AUD), 30% Dow Jones Brookfield Global Infrastructure Net Accumulation (Hedged to AUD) and 15% Mercer / IPD Australian Pooled Property strategy indices on a rolling 3 year basis. The strategy provides exposure to a diversified portfolio of direct property, listed property and infrastructure securities, both in Australia and around the world. The portfolio may also invest in direct infrastructure and up to 10% in cash. The strategy diversifies manager risk across a range of both active and passive investment managers by using a multi-manager approach. Active exposures are to active managers who demonstrate competitive advantages within the various investment styles that are used when investing in the Australian and international property and infrastructure markets. Investment Option Performance To view the latest investment performances please visit www.amp.com.au Availability Product name APIR MultiFund Flexible Income Plan AMP0987AU Asset Allocation Benchmark Range (%) Australian Property 35 0-70 Global Property 35 15-55 Global Listed Infrastructure 30 10-50 Cash 0 0-10 Signature Super AMP0954AU SignatureSuper Allocated Pension AMP1161AU Custom Super AMP0861AU Flexible Lifetime - Allocated Pension AMP0877AU Flexible Lifetime – Investments AMP1007AU Flexible Lifetime – Investments (Series 2) AMP1423AU Top Ten Securities Exposure AMP Flexible Lifetime Super AMP0861AU Westfield Corp 4.41 AMP Capital Wholesale Office Fund 4.11 Scentre Group 4.06 GPT Wholesale Office Fund 3.41 Lend Lease Group 3.20 AMP SHOPPING CENTRE FUND 3.17 Simon Property Group Inc 2.56 Stockland 2.36 Mirvac Group 2.21 AMERICAN TOWER CORP 2.17 AMP Flexible Super - Retirement AMP1359AU AMP Flexible Super - Super AMP1488AU Flexible Lifetime - Term Pension AMP0931AU AMP Growth Bond AMP1192AU Investment Option Overview Investment category Property Suggested investment 5 - 7 years timeframe Relative risk rating Medium - High Investment style Multi - Manager AMP Life Limited 84 079 300 379 % Region % Australasia 38.49 North America 35.60 Europe ex UK 9.62 United Kingdom 6.30 Japan 6.13 Cash 3.15 Asia ex Japan 0.71 Others 0.00 Portfolio Summary Listed property was broadly flat over the quarter, while listed infrastructure declined. Direct property significantly outperformed listed real assets over the period. Investment Option Commentary The global listed property and infrastructure sectors posted markedly different performances in the third quarter, amid growing fears over China’s economic slowdown and uncertainty surrounding US monetary policy. While global REITs were broadly flat during the period, outperforming global equities, infrastructure securities declined. The global listed property allocation, managed by AMP Capital, generated a positive return during the quarter and additionally outperformed its benchmark. Key drivers of outperformance included stock selection in Asia Pacific and North America. At the stock level, the biggest relative contributors included an underweight position in Sun Hung Kai Properties, as well as overweights in Extra Space Storage and Equity LifeStyle Properties. The biggest detractor, versus the benchmark, was an overweight in La Quinta Holdings. Underperformance of the AMP Capital Global Infrastructure Securities Fund was mostly driven by stock selection in oil, gas storage & transportation, as continued low commodity prices negatively affected sentiment on the sector. At the stock level, the biggest detractors included overweight positions in SemGroup, Veresen and Targa Resources, while the biggest contributor was an underweight in Kinder Morgan. Direct property significantly outperformed listed real assets over the period, supported by strong prices in the transaction market. Notable deals included the A$2.45 billion acquisition by China Investment Corporation (CIC) of Investa Property Group’s office portfolio – the largest direct real estate transaction in Australia’s history. Two core holdings – GPT Wholesale Office Fund and AMP Capital Wholesale Office Fund – revalued their office assets and reported strong capital growth. Market commentary The September quarter saw significant volatility in listed markets, as expectations for the path of US monetary policy changed substantially. At the start of the period, consensus suggested a rate hike in September. However, by August, growing fears over the outlook for China, and the potential knock-on impact on global economic growth, had led many commentators to forecast a later start to monetary tightening. This shift in expectations was vindicated in September, as the US Federal Reserve declined to hike rates at its monthly meeting. It was a mixed picture in US REITs, as the sector rose in July, declined in August, and rebounded in September. Self-storage and manufactured housing performed strongly in relative terms, while the lodging segment underperformed. Continental European REITs were less affected by the market volatility and were boosted by positive economic news from Spain, although this effect was offset by the emergence of the Volkswagen emissions scandal. UK REITs continued to benefit from an environment of rising rents and falling vacancies, as investment demand remained strong. The Australian market was dominated by company news – in addition to the CIC acquisition, developments included a subsequent attempt by Morgan Stanley to offload its stake in Investa Property Group, and the replacement of Federation Centres’ CEO and CFO with their former Novion Property Group counterparts. In Asia, Singapore and Hong Kong REITs were negatively affected by fears surrounding the China slowdown – notably the impact of a weaker renminbi. However, it was a more positive picture in Japan, where Prime Minister Abe announced the latest stage of his economic reform programme. In listed infrastructure, it was a challenging period for the North American energy sector, as sentiment remained negative amid continued low commodity prices. While long-term contracts support near-term cash flows for oil, gas storage & transportation stocks, the sector de-rated owing to fears regarding longer-term growth and the attractiveness of future projects. Outlook In listed property markets, we continue to be most positive on the UK and US, and we are also positive on Japan. In infrastructure, current market conditions continue to support our defensive growth strategy, focusing on long-term fundamentals and sustainable growth opportunities while avoiding short-term market noise. We continue to initiate or add to positions in quality infrastructure companies where market conditions present attractive entry points. AMP Life Limited 84 079 300 379 Contact Us Web: www.amp.com.au Email: askamp@amp.com.au Phone: 131 267 (Mon. to Fri. 8:30am to 6:00pm AEST) What you need to know This publication has been prepared by AMP Life Limited ABN 84 079 300 379, AFSL No. 233671 (AMP Life). The information contained in this publication has been derived from sources believe to accurate and reliable as at the date of this document. Information provided in this investment option update are views of the underlying Investment Manager only and not necessarily the views of the AMP Group. No representation is given in relation to the accuracy or completeness of any statement contained in it. Whilst care has been taken in the preparation of this publication, to the extent permitted by law, no liability is accepted for any loss or damage as a result of reliance on this information. AMP Life is part of the AMP Group. In providing the general advice, AMP Life and AMP Group receives fees and charges and their employees and directors receive salaries, bonuses and other benefits. The information in this document is of a general nature only and does not take into account your financial situation, objectives and needs. Before you make any investment decision based on the information contained in this document you should consider how it applies to your personal objectives, financial situation and needs, or speak to a financial planner. The investment option referred to in this publication is available through products issued by AMP Superannuation Limited ABN 31 008 414 104, AFSL No. 233060 (ASL) and/or AMP Life. Before deciding to invest or make a decision about the investment options, you should read the current Product Disclosure Statement for the relevant product, available from ASL, AMP Life or your financial planner. Any references to the “Fund”, strategies, asset allocations or exposures are references to the underlying managed fund that the investment option either directly or indirectly invests in (underlying fund). The investment option’s aim and strategy mirrors the objective and investment approach of the underlying fund. An investment in the investment option is not a direct investment in the underlying fund. Neither AMP Life, ASL, any other company in the AMP Group nor underlying fund manager guarantees the repayment of capital or the performance of any product or particular rate of return referred to in this document. Past performance is not a reliable indicator of future performance. AMP Life Limited 84 079 300 379